“ The contrary investor is every human when he resigns momentarily from the herd and thinks for himself. ”

— Archibald MacLeish

The Market: A Game of Snakes & Ladders?

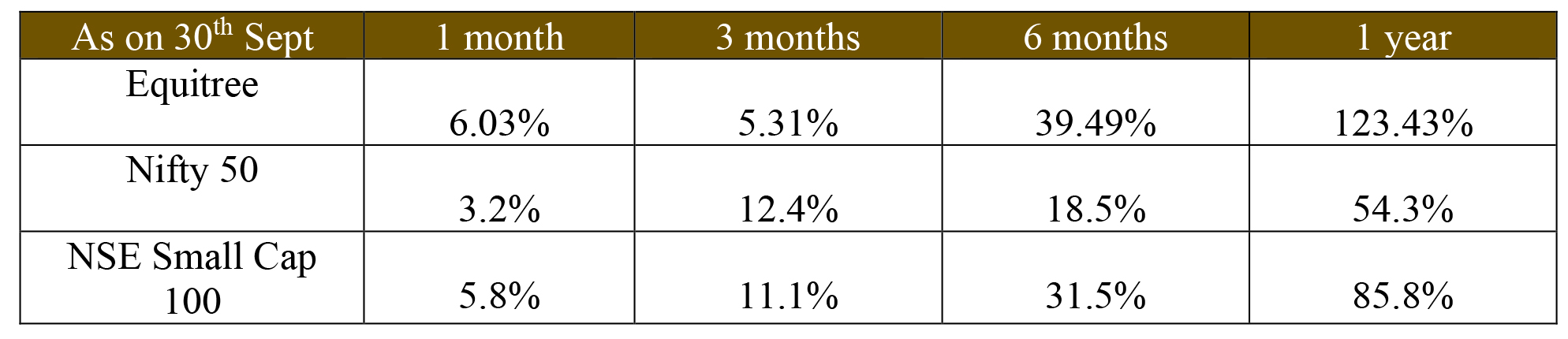

In our last quarterly update we spoke about expecting a normal correction of 5-7% as the markets were making new high. From there, markets have only inched higher making newer all time high of ~ 18600 (at least for now!) giving about 12% return over the last quarter! We share our performance during the quarter hereunder:

We still maintain our cautious approach in the near term as the market seems to be in an overbought zone. Since achieving peak of 18600, market has seen a swift correction of ~ 5% already and is finding its base now. While the index has been holding on because of sector rotations, however, some of “growth” stocks trading at extremely high valuations have seen very sharp corrections (~ 30%+) recently. Likewise, a number of individual stocks have seen a good 15-20% correction from their recent highs.

This is what we call the classic “Snakes & Ladders” – some positive and some negatives will always be there in the market place at all point in times and in the short run which way will the market play out is extremely difficult to fathom.

Early corporate results for Q2 have been quite encouraging thus far and endorse the Indian opportunity – the “ladders” that we have discussed in detail in our earlier newsletters.

Likewise there is never a dearth of “snakes” i.e. negative which may pull the markets down. We discussed some of these as well in our Jun’21 quarter newsletter (please read here). The list may keep changing with new additions like the Evergrande issue in China, a faster tapering et al.

We re-iterate that despite many uncertainties that exist in the short term, the Indian domestic and export story continues to be strong. It is noteworthy that India exported a record amount of $35.43 of goods in July.

Any correction will provide us with a good opportunity to buy strong companies. While we do expect a healthy correction to take place, we don’t see the markets being gripped by panic. Long term investors should look at corrections as an opportunity to build their portfolios.

Smart Money Doesn’t Move With Market Momentum

“ Beware of the investment activity that produces applause; the great moves are usually greeted by yawns. ” – Warren Buffet

Investing in such bull markets is always a difficult task. One needs to be precise and disciplined. We share some of our own commandments that we swear by :

-

Focus on the Business

Investing in these kind of bull markets could be tricky. It is important to find good businesses rather than market tips. Investing in a stock and the return it generates is dependent on more than just macro factors and market forces. Every stock has an underlying business, it’s pertinent to know what that business is doing and how it is going to be performing. -

Staggered Buying in Reasonably Valued Companies

Turbulent markets like the ones we are witnessing right now, require staggered buying in companies that are into good businesses and that are valued reasonably. Portfolios need to be built carefully over a period of time as the markets keep giving opportunities to enter interesting businesses. -

Reasonable debt

We generally look for companies where debt/equity ratio is less than 0.5x. A lower leveraging ensure sustainability of businesses even in bad times as well as generally leave enough profits for the equity shareholders – which is what eventually gets valued. A good business where major part of the profits ends up in debt servicing only generally does not get equity investors attention. -

In Investing, Laziness Is Good

While the lack of flux in our portfolio might suggest inactivity, we are hyper-active and aware about the various businesses we invest in and the on-the-ground activity of our companies. Momentum based investing will make you a quick-buck, company specific long term investing creates wealth. -

Don’t Try to Time the Market

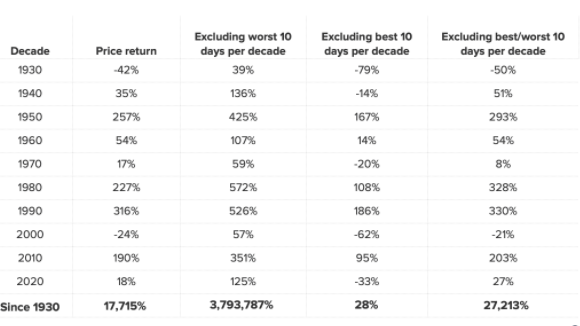

Timing the markets is a game at which the probability of losing is much larger than the probability to win. It is a game of chance and guessing. Even the most seasoned investors cannot predict when and by how much the markets will rise or correct, as the markets move on many factors, all of which are impossible to know and consider. Here’s some data on trying to time the market. Bank of America looked at the impact of missing the market’s best and worst days each decade:

If an investor missed the S&P 500’s best 10 days each decade, the total return would be 28%. In the meanwhile if the investor held steady through the ups and downs, the return would be 17,715%. Staying invested in the right businesses generates more returns than actively trading or trying to time the markets!

The price of any stock depends on its own performance as well as market forces. Markets are sentimental and to an extent unpredictable. We prefer buying stocks based on their performance, outlook and industry opportunities.

How We Invest

“ Successful investing is about managing risks, not avoiding it. ” – Benjamin Graham

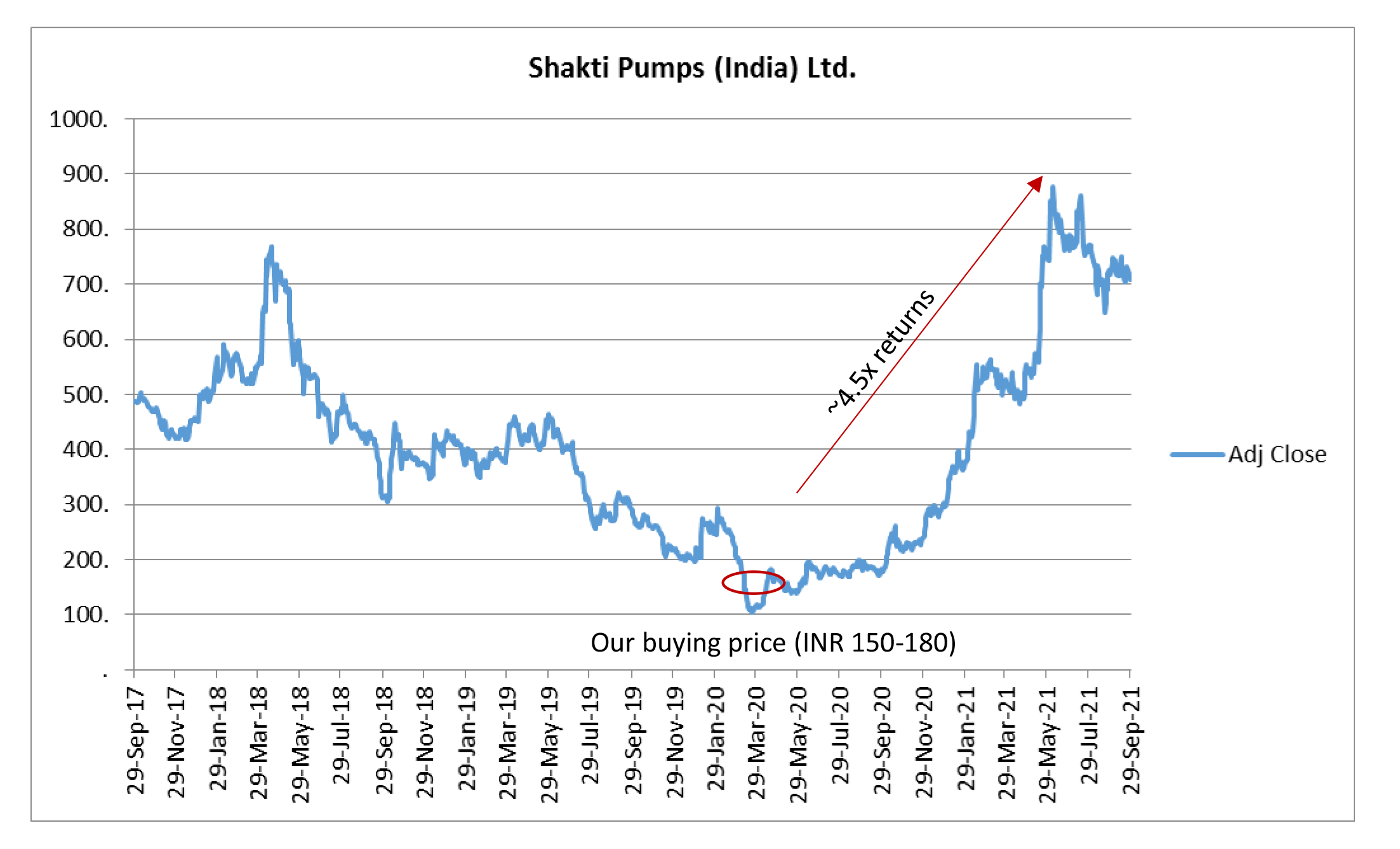

We use an example of seeing through the volatility and reaping benefits from one of our own portfolio company :

The Story: A High Conviction Idea

We’ve invested in a company that makes agri-equipment.

- The industry size is USD 3.8bn, and the specific product that this company makes is expected to grow at a cagr of 27%.

- The government is also expected to provide financial support of INR 34,422 cr under specific schemes to boost this industry.

- Apart from this there is a vast opportunity in the export market too.

- The company currently has a market share of almost 50% domestically and is looking to increase its share domestically as well as enter new markets out of India.

The vast opportunity, superior product and macro opportunity give us the comfort to hold the company’s stock through highs and low.

The Story In A Chart

Why We Didn’t Sell

The company’s stock price took a large beating of ~50% from our purchase price due to macro factors and the impact of March 2020 both of which were not in the company’s control. While there was a delay in execution of business, we believed the company would benefit from the large opportunity sooner or later. We remained convinced in the company’s business and the story, in-spite of the massive correction and slowing down of the business.

We benefited from keeping our eyes and ears close to the ground as when the price was at rock-bottom, we saw the business beginning to gain momentum and we doubled up our position. We have seen ~4.5x returns from those levels.

We believe high conviction ideas are those which you can continue to hold in-spite of temporary draw downs. Stock prices change, businesses are more stable.

The Secret To The Market: Know What You Own.

“ Know what you own, and know why you own it. ” – Peter Lynch

We are lazy investors, and feel no urge to constantly keep churning our portfolio. We prefer to have our eyes and ears close to the ground and know exactly what is happening in the businesses we own. We believe many of the businesses that we continue to hold in our portfolio today can generate similar returns to the high conviction stock idea we’ve spoke about above.

We are expecting our portfolio’s earning’s growth to be north of 20% for Q2-22 and our current average portfolio PE is 17x, which we believe to be rather reasonable and are very comfortable with.

Having said that, we are selectively booking profits in some of our investments where valuations have run up a bit as also investing in to new opportunities where we see a long term sustainable growth and reasonable valuations.

We are in midst of making our next investment – a company engaged in exports of knitwear mainly for the kids segment. With a clean management, superior quality products and a large opportunity, we believe this business is placed sweetly. It is a company with a topline of ~INR 700 cr that currently trades at 9x FY23E numbers and is expected to grow at 20-25% for the next few years.

We are neither eternal bulls, nor bears. We are realists who believe in the strength of the businesses we hold.

Please feel free to reach out to us at pawan.b@equitreecapital.com / skabra@equitreecapital.com with your comments / suggestions / queries etc.

Warm regards.

TEAM EQUITREE