ETMarkets PMS Talk: How this Rs 200 cr fund manager turns Rs 1 cr to nearly 2 cr in FY24 and nearly Rs 6 cr in 4 years

Pawan Bharaddia's Equitree fund focuses on high-growth businesses with strong moats. Despite the market corrections, the fund consistently outperformed, delivering 55.33% TWRR. Expecting a bullish market in FY25 with sector rotations and wealth creation through stock picking. Baraddia says "we believe that FY25 will be a year of ground-up stock picking for wealth creation and not a broad-based rally in the markets.

Read More

MC Interview: Negative surprise in any of these 4 factors may bring huge market volatility during the year, says this market expert

Our Md and CIO with Moneycontrol where he spoke about massive wealth creation opportunity over the next 4-5 years and leveraging the upcoming volatility, if any, to build up the portfolios.

Read More

Upcoming Elections: A short-term rollercoaster ride with a neutral long-term outlook

Elections have been a topic of intense discussion, with investors, traders, retail players, and institutions alike weighing in on the potential impact the upcoming elections may have on the Indian markets.

Authored an article in ET Markets on the upcoming national elections, its potential impact on the markets and how to play this around. Hope you enjoy reading this.

Read More

ETMarkets LIVE Video: Watch ET Markets PMS Talk LIVE Stream video on ETMarkets LIVE.

Equitree was featured on ET Markets PMS Talk. Had an opportunity to do a live interview with Kshitij Anand, Senior Editor of ET Markets and share insights on Equitree's investment philosophy and thoughts on current market. Do see the interview here:

Watch Live

ETMarkets Fund Manager Talk: Despite a strong rally, this asset manager continues to see opportunities in smallcap space

"Equity as an asset class is only gaining more acceptability with domestic investors which is visible from the continuously increasing SIPs with mutual funds. Even at this, it still makes up to about a mere 4.8% of Indian household savings – which is substantially lower than its global peers. As the GenZ comes into the mainstream, we expect this number to only get better, leading to a much stronger and continued domestic flows."

Read More

This small-cap PMS scheme delivered over 56% returns in just 6 months. Here’s how

In an interaction with Business Today, Pawan Bharadia, MD of Equitree Capital Advisors, says as a deep value investor, his firm strategically invests in under-researched companies with strong fundamentals.

Was featured in Business Today...hope you guys enjoy reading it!

Read MorePMS Tracker: Multi-cap, smallcap funds outshine in October with up to 9% return

A glittering start with Diwali - glad to share that Equitree emerged as the 2nd BEST PERFORMING PMS for the month of Oct'23!! We have consistently amongst the top 3% best performing PMS over the last 4 years.

Wish all of you a very Happy Diwali and a Prosperous New Year ahead!

Read More

Why small caps are most attractive and exciting space in capital market

Smallcaps are indeed the most attractive and exciting space in the capital markets and have been known to create the biggest wealth compounders over the years – provided one practices enough due diligence, patience, and discipline while investing in this segment.

Historically small caps have been known to deliver superior returns over large caps. Over the last 20 years since these indices were constituted, the Nifty has given an absolute return of 911%, while the NSE SmallCap100 has given an absolute return of 1012%.

Read More

MC Interview | This investment advisor sees pockets of opportunity in infrastructure, engineering, ancillary segments despite run-up

"We believe in the India story and are seeing a revival of the capex cycle in a big way," Pawan Bharadia, Managing Director of Equitree Capital Advisors, says in an interview to Moneycontrol.

While the intrastructure segment has seen a decent run-up, he is still seeing pockets of opportunity in the infrastructure, engineering, and ancillary segments which are well-geared for growth and still valued reasonably.

Read MoreStrong rally in smallcaps still likely, under-invested companies could be moneymakers: Pawan Bharadia of Equitree Capital Advisors

Spoke to Moneycontrol today evening on our investment philosophy and my thoughts on the current market. Hope you enjoy reading!

Read MoreEquitree emerged as the BEST performing PMS for the quarter ending Jun'23 delivering 38% returns during the quarter!

A couple of portfolio managers delivered robust alpha to their high-net-worth clients in the June quarter, when the broader markets outperformed the benchmark equity indices. Data showed that Equitree Capital Advisors’ small-cap PMS strategy Emerging Opportunities topped the chart with a return of 37.53 per cent for the quarter ended June 30, 2023.

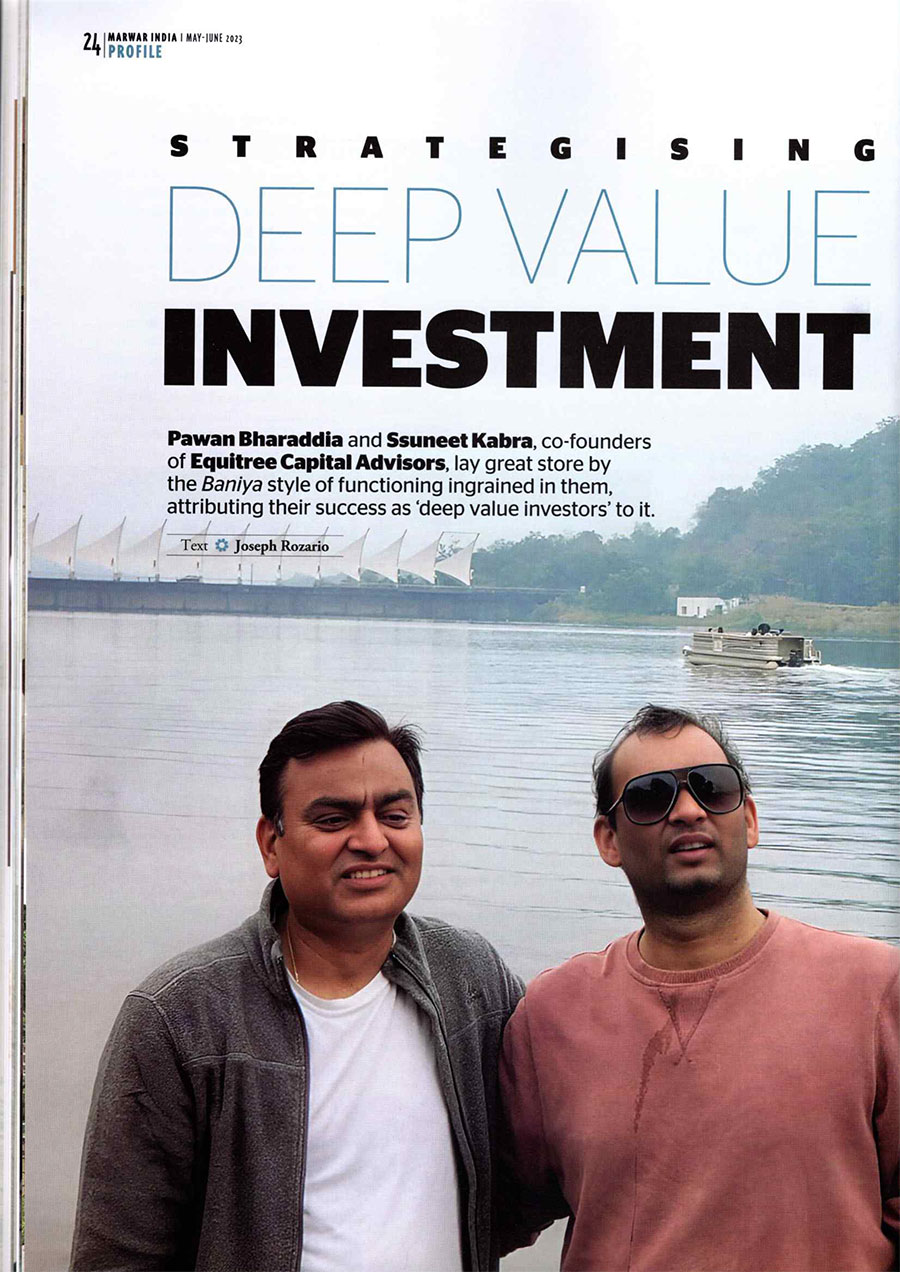

Read MoreEquitree Profiled - Marwar India, May-June'23 edition

Happy to be featured in Marwar India, an elite community-based magazine in their latest edition!

Read More

ET Market Moghuls: The market paradox: Has the cheese moved?

"Apart from this, FIIs had stayed away from the Indian markets for some time. Their re-entry into the Indian markets, especially banks have led to the performance of the index. In November the FIIs' net purchases were worth Rs 22,500 crore, which was visible in the index."

The current market paradox has got a lot of investors wondering, ‘who moved my cheese?’

Read More

ETMarkets Fund Manager Talk: This Marwari money manager like these 5 sectors; explains why he is sitting on 8% cash

"Staggered investing and booking profits in overvalued stocks has been the cornerstone of our investing in the past one year. We generally invest in companies with 3-5 years horizon, however, being deep value investors at the heart we have been booking profits in some of our ideas where the valuations were getting rich and have reinvested the same into other deep value opportunities."

Read More

Pawan Bharaddia's interaction with ET Markets - Talking about markets in general and nuances of investing in small / micro caps in particular

"We expect the market to be volatile in the short run as it keeps reacting to the global news flows but creates substantial wealth over the next 2-5 years. While India might not be fully insulated from the pandemonium globally, but we believe that structurally, India is in a sweet spot. It is all set to deliver multi-year growth. In our opinion, one should look at short-term volatility and corrections as an opportunity to build positions in strong companies."

Read More

ETMarkets Smart Talk: FOMO among investors is further keeping markets buoyant: Pawan Bharaddia

The RBI took its third rate hike to bring the repo-rate to 5.4%; however, it sounded a little less hawkish. With the softening of commodity prices and crude more specifically, we believe peak inflation might just be behind us.

“Availability of liquidity and a sharp rise in the market, there is an increasing sense of FOMO amongst investors which is further keeping the markets buoyant,” says Pawan Bharaddia is co-founder and CIO of Equitree Capital.

Read More

ETMarkets Smart Talk: FIIs may not be able to stay away for long as India is in a sweet spot: Pawan Bharaddia

It is heartening to see that Indian domestic investors are finally rising to the idea of equity allocations. This is evident by the fact that as of March 2022, 4.8% of the total Indian household assets were invested in equities, up from 2.7% in 2020. However, India still has a long way to go compared to the ~25% levels in the US. As the Indian domestic investors get more educated and experienced with the equity markets, we hope to continue seeing increased allocations for equity as an asset class.

Read More

Daily Voice | FIIs may not be able to stay away for long, says Pawan Bharaddia of Equitree Capital

India is sweetly positioned as one of the fastest growing economies in the current uncertain global environment and given the correction in valuations which makes India attractive again, we believe that FIIs may not be able to stay away for long.

Read More

Equitree Capital suggests these 4 investment philosophies for growth and value creation – know details

Amid the massive volatility and weakness in the market, a small and micro-cap investment firm Equitree Capital has laid out the top four investment philosophies, which they follow and also believe that systematic investments ensure pragmatic growth and value creation.

Read MoreInteraction with Finnovate, a wealth advisory firm

Topic: What is the road map to spot winners in small and micro cap companies?

Date: Jun 24, 2022

Play

PMS minnows continue their outperformance over the likes of Mukherjea, Samir Arora

Saurabh Mukherjea-founded Marcellus’ Little Champs strategy returned 3.44 per cent during the month. Sunil Singhania’s Abakkus Emerging Opportunities delivered 2.7 per cent returns. However, these two were outliers as most other strategies by celebrity fund managers were either flat or delivered negative returns.

Read More

Why auto stocks may be the best bet for next 2-3 years

Currently auto sector is contributing just about 5% of the total market cap, which is in line with its long-term averages. However, we have seen in the past that as the economic growth comes about, the sector has a tendency to go up to 9% of the total market cap.

Read More

Top PMS Strategies 2021

Our PMS Equitree Capital ranked 12th in top few PMSs in India for FY 21 by Business Today!

Read More

Equitree Capital Advisors

A Historical Legacy Bringing a Blend of Rich Entrepreneurial and Investing Experience.

Read More

Pawan Bharadia's interview in Navbharat newspaper

Read More

Equitree Capital Advisors – Earning Alpha Returns for Investors through Emerging Companies

In the last couple of years, the Indian market has given extraordinary returns. With that, a lot of portfolio and wealth managers have mushroomed in recent times leaving investors confused as to how and whom to rely on for quality advice.

Read More"Equitree Capital Advisors Private Limited - Konexio Nivesh Guru" on YouTube

Konexio Nivesh Guru is a show where we are discussing success story of the Fund managers & their unique style of investing.

We are discussing how we invented these stock ideas and invested along with overall investment strategy.

.jpg)