“ You don't need to predict how everything will play out. Just master the next step and continue moving in the right direction. ”

— James Clear

Dear Investors,

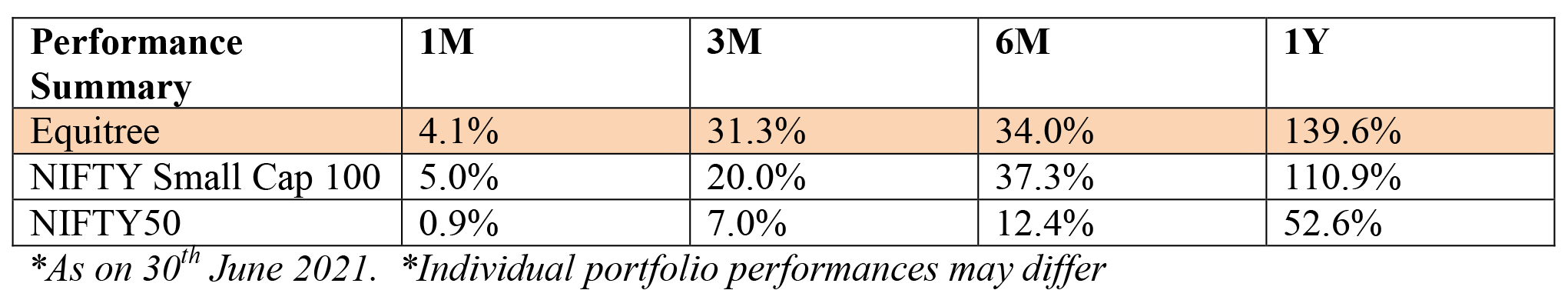

Buoyancy in the markets continued during the June quarter as well despite the 2nd covid wave hitting hard and the intermittent lockdowns etc. Interestingly, Nifty delivered 7% return during the June quarter despite FIIs selling to the tune of Rs. 18,700cr during the quarter! Small cap index did even better during the previous quarter registering 20% return. We summarize the broad performance matrices hereunder :

After a stupendous performance by the headline indices and the broader markets as well during the last year, it is important for one to step back and recalibrate expectations going forward. One needs to understand that these extraordinary returns are on the backdrop of an unusual event which took the markets to nadir and hence the future returns are likely to be more in line with long term averages (20-25% IRR) as the base itself will be higher. Nevertheless, we strongly believe that we are in a bullish market for the next couple of years and that equity returns will continue to far outshine returns from all other asset classes, intermittent corrections notwithstanding.

In this newsletter, we attempt to explain our point hereunder.

MARKET SCALES NEW PEAKS – SOME CORRECTION IMMINENT BUT UNDERLYING TONE REMAINS BULLISH

Markets have scaled new peaks with Nifty 50 peaking at 15962 (within whisking distance of the psychological 16000 barrier!) and have corrected ~ 2% since then. We believe that given the spectacular run up seen in the market during last year, it may not be out of context to expect another 3-5% correction as traders look to book some profits. On an overall basis, we believe a healthy correction of 5-7% would be good to attract fresh capital in the market as a lot of investors have been waiting on sidelines for a meaningful correction to enter the markets afresh.

Having said that, we strongly believe that we continue to be in a bull run (at least for the next couple of years!) and reiterate that any such correction should be used to build a long term portfolio of good quality businesses. Our optimism stems from the following –

-

The third wave may be inevitable but it is expected to be less lethal

The second wave of Covid-19 in India came as a shock to the government which led to severe lockdown and hospitalizations and impacted economic activity. However, the government is well prepared for the third wave in terms of the medical infrastructure and the companies are also well adapted and adjusted to the new-normal. With the pace of vaccination picking up and herd immunity being achieved, the third wave is expected to be far less lethal. -

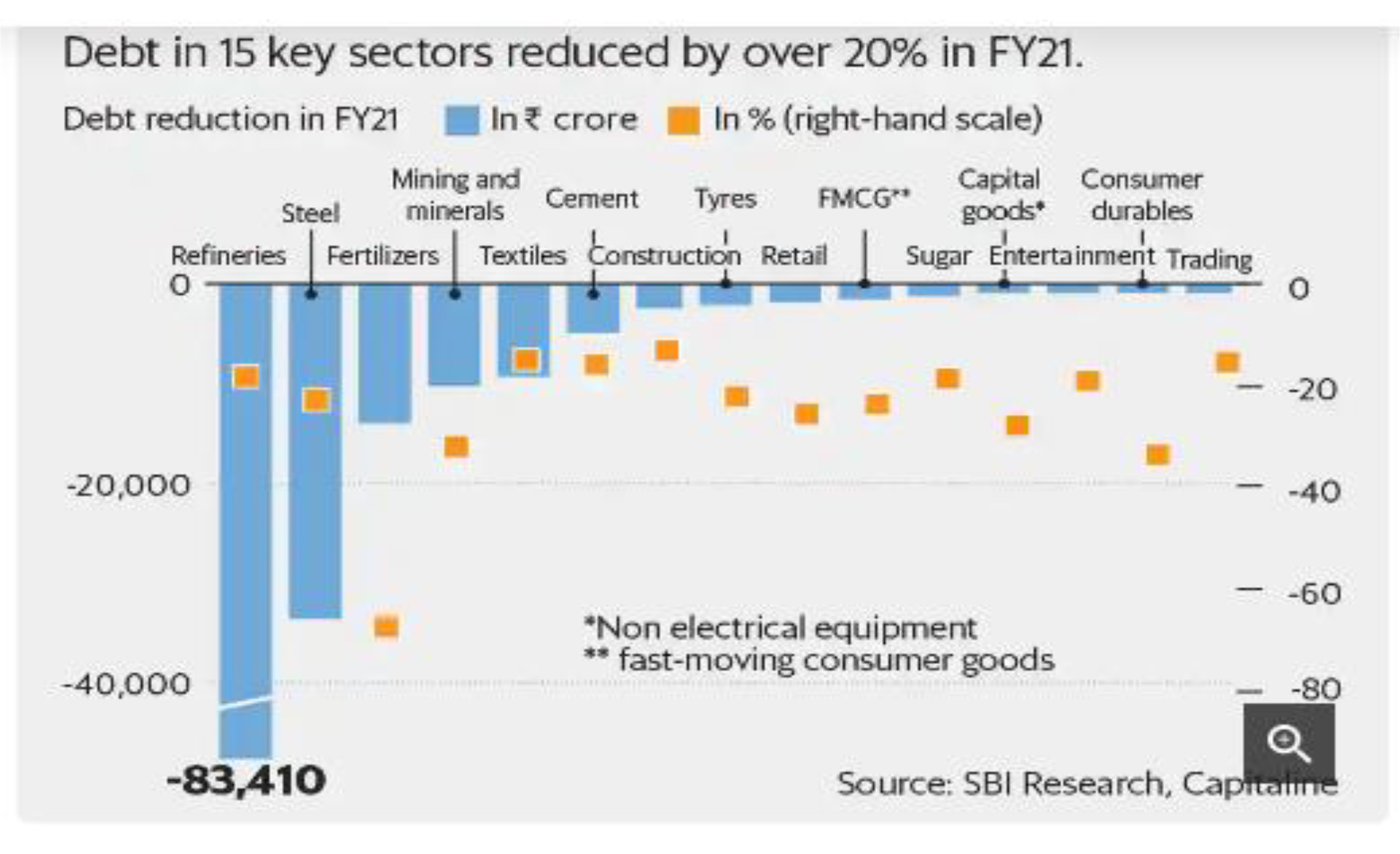

Substantial deleveraging over the last couple of years – India Inc. standing on much more agile balance sheets to take advantage of growth

opportunities (as discussed in our Dec’20 quarterly newsletter. Pls read here)

According to a research report by SBI, the top 15 sectors, from more than 1,000 listed entities, reported a debt reduction of Rs 1.7 lakh crores during FY21.Indian corporates have never cut debt so drastically ever before. For instance, Tata Steel has reduced debt by a whopping ~ Rs 30,000 crs in FY21 and SAIL has reduced debt by ~ Rs 16,150 crs in Q4FY21. These are the kind of numbers that the companies would have achieved in 4-5 years.

The same phenomenon is seen across our portfolio companies as well; where on an aggregate basis the portfolio companies have reduced debt from Rs 6,646 crs in 2018 to Rs 4,015 crs in 2021 – a whopping 40% reduction in debt.

This is expected to reduce interest costs and improve margins as well as return ratios which are likely to get reflected in the stock prices even further. -

India on the cusp of huge capex cycle

Indian companies have drawn up extensive capex plans as plants are running at near-full capacities and on the back of improving economic outlook.- ONGC has earmarked a massive Rs 30,000 crs towards capex for FY22 to increase its crude oil output.

- Tata Steel unveiled plans to invest Rs 50,000-60,000 crs over the next five years to enhance capacities.

According to a report by Spark, capex over the ensuing three years in core sectors ̶cement, metals, oil refining and power should be about Rs. 5tn. This would not only be the highest in a decade but is also likely to be >2x the capex over the previous three years.

Moreover, the government’s production linked incentives (PLI) – led capex is likely to see investments of over ~Rs. 1.4tn in the chosen sectors as announced by the government.

The capex in the sugar industry is also expected to pick up pace on the back of government’s vision of 20% ethanol blending target by 2025. -

Shift of business from unorganized to organized

The much spoken and awaited shift of businesses from unorganized to organized sector finally seems to be playing out. From our discussions with business owners – both listed companies as well as private – a clear trend of shifting of business from unorganized to organized sector seem to be very evident. This shift has largely been on two accounts :- Aggressive implementation of E-way bills – further to the GST implementation, making E-way bills mandatory has made it extremely difficult for the unorganized sector to do any business outside the tax net and has taken away the cost advantage which they used to enjoy. With the cost advantage fading away, its only natural for the business to move to organized players.

- Covid related issues – availability of labour and organizing their mobility, higher logistics costs, online presence, frequent and erratic lockdowns have hit the unorganized players much harder, paving way for the business to move to organized players.

-

Increased Export opportunities

As highlighted in our previous newsletter on the opportunities getting unfolded due to the China+1 strategy, we are already seeing a lot of companies benefitting from import restrictions and higher export inquiries. It is noteworthy that India’s merchandise export reached an all-time quarterly high of $95billion in three months ended June contributed by non-rice cereals, iron ore, gems & jewellery, petroleum products, engineering goods and organic and inorganic chemicals. - While we remain optimistic about the markets on back of business fundamentals, nevertheless, we also have our sight on potential irritants which can impact the markets beyond a normal 5-7% correction. Some of these include :

THINGS TO BE WATCHFUL FOR

-

Inflation & rising interest rates

The headline inflation has been increasing due to a sharp surge in commodity prices and crude. Petrol and diesel prices have increased dramatically causing further pressure on retail prices. While it is expected that as the second wave and lockdowns are rolled back, the sharp rise in CPI inflation will moderate, however any delay in this will start putting pressure on RBI to look at increasing interest rates and thereby impacting liquidity. Similar phenomena is playing out in the American markets and while the FED has indicated of no interest rate hikes till end of FY 22 and continued bond purchasing program, however, higher inflation may force them to change direction earlier than expected causing a jerk in the global easy liquidity scenario which has been fueling the equity markets globally. -

Continuous FII selling – do they know something that the market yet has to discover?

FII activity has generally been a trend setter in the market. If one were to go by that, the continuous selling by FIIs in cash market since April’21 should be a cause of concern. It is noteworthy that in the month of July alone, FIIs have sold to the tune of ~ Rs. 16,204cr – cumulatively from April’21, this number now stands at over Rs. 34,000cr. Despite such large selling by FIIs, markets have shown a lot of resilience – on the contrary, headline Nifty has posted a positive ~ 5% returns since April till date! This sustenance has been primarily driven by domestic DIIs, retail and HNI investors. One needs to wait and watch for the final jury to be out on this one. For sure, this is not something to be ignored. -

Valuations expensive; factoring high growth – any disappointment in this may lead to disproportionate reaction

The headline Nifty currently trades at 22x FY22 and 20x FY23 projected EPS for Nifty. These valuation numbers are factoring in 40% growth in EPS for FY22 and 14% growth for FY23. While these growth estimates look achievable on bank of lower base as well as changing business dynamics, however, any slowdowns / delays in achieving this is likely to result in a disproportionate reaction from the markets. -

New variants of covid / 3rd wave

The overarching fear of newer covid variants / 3rd wave leading to more lockdowns etc. may also have an impact on the buoyancy in the market. However, given the experience of the 2nd wave where business disruption was kept to the minimum possible extent we believe that both economy and markets are more tuned in to with this aspect of risk and not likely to cause major disruption.

OUR PORTFOLIO

We are happy to share that our portfolio companies have done exceedingly well despite the covid impact. On an overall basis our portfolio companies have registered 8% y-o-y growth in FY 21 and 52% q-o-q growth in Q4 FY 21. We strongly believe that this growth trajectory for our portfolio companies is likely to continue in FY 22 and are building ~ 28% growth in PAT on an aggregate basis for our portfolio companies.

It would also be interesting to share that on an aggregate basis, debt / equity ratio of our universe stands at a mere 0.2x – endorsing agility and financial strength of our universe to leverage the unfolding opportunities across different segments.

On the valuation front as well, our universe stands at a comfortable PE of ~16x FY22. While most brokers have started marketing companies at 15-16x FY 23 numbers as “reasonable” valuations, we are quite comfortable holding the portfolio based on the current valuations on FY 22 numbers and strongly believe that there is enough upside still to be unlocked in our universe.

WHAT ARE WE DOING CURRENTLY

We have been cautiously adding more of our own portfolio companies as the business visibility gets stronger and as the valuations are still comforting.

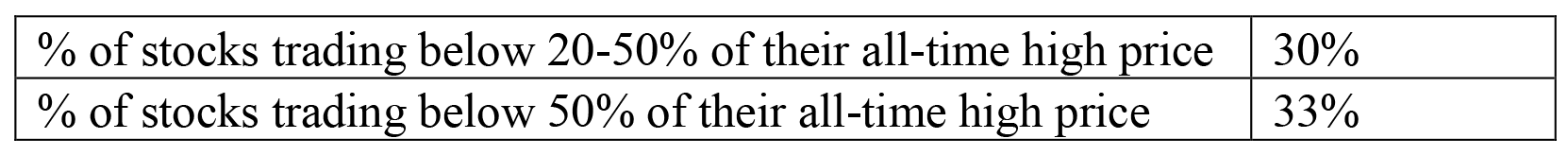

We are also working on new investment opportunities and are seeing some interesting ideas within our chosen areas. It may be worthwhile to mention here that despite the fact that the headline index seem to be trading closer to all time high and valuations look expensive, however, on the other hand there are enough opportunities available in the market to tap as a good number of stocks are still trading substantially lower from their all-time high prices when the market was at its earlier peak :

Having said that, as always, we prefer to make staggered investments and build a portfolio instead of allocating the entire capital at once, as we believe the market will keep throwing opportunities to enter and as the story we invested for gradually unfolds; giving us confidence to allocate a higher sum eventually.

Please feel free to reach out to us at pawan.b@equitreecapital.com / skabra@equitreecapital.com with your comments / suggestions / queries etc.

Warm regards.

TEAM EQUITREE