“ The most contrarian thing of all is not to oppose the crowd but to think for yourself. ”

— Peter Thiel

Dear Investors,

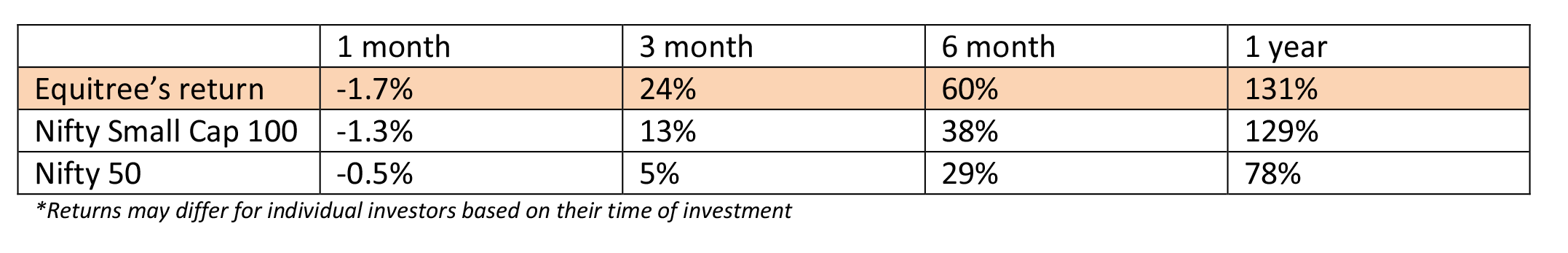

It gives us immense pleasure to share that Equitree has been one of the best performing PMS for FY20. We summarize our performance hereunder :

As we write this newsletter we are again in tight grip of covid’s 2nd wave and a more severe one at that. We share our thoughts hereunder on the current situation from the markets perspective and our strategy on how we are aligning ourselves with this.

2021: a feeling of Déjà vu….will this extend to the markets too!

FY 20 started with covid related lockdowns and economic uncertainty around that. After the uncertainty came back a huge economic rebound. We seem to have come full circle now – with the 2nd wave of Covid hitting hard and another round of lockdowns being imposed, albeit less harsh economically this time. Of course the markets have reacted with far more resilience this time around – primarily for a couple of reasons :

- Last years’ experience is still fresh in mind – so the expectation is this wave of covid should subside sooner than later and businesses should catch up with full vigour as the current wave subsides.

- Availability of vaccine and more informed medically – with multiple vaccines in place, the rush now is to get as many people vaccinated and as fast as it can be done. BMC Commissioner recently mentioned that he is hoping to get entire Mumbai vaccinated by end of July’21. Medically also people are far more aware in terms of handling the virus and resorting to early medication which is also reducing the no. of deaths.

- Lesser impact on manufacturing / infrastructure / construction – despite local lockdowns announced by different states, this time around manufacturing, infrastructure and construction activities have largely been allowed to be operational with adequate care and safety norms to be followed. This has helped in keeping the economic issues at bay unlike last time around – except for the directly impacted segments like travel, leisure & entertainment and a few consumer discretionary segments; most other parts of the economy have been largely functional. The recent statement by RBI also echoed that the impact of lockdowns is far lesser on construction activities. For a more detailed view on impact of covid on different segments please read our September’ 20 update here

- Having said all of this, the human loss and the anxiety that people are going through for want of oxygen and basic medical facilities has been very excruciating and we sincerely hope that all the firefighting efforts going on – both domestically and international help pouring in – to quickly ramp up supplies help to soothe the situation at the earliest.

- While there is a complete congruence on the fact that India is in for extremely good times ahead as economic recovery sets in thanks to all the policy decisions including PLI Scheme, Make in India, focus on infrastructure spending, China +1 strategy however we would see some bouts of uncertainty with people’s sentiments yo-yoing between getting emotionally drained out for want of basic medical facilities on one side and the improving business prospects on the other.

- We believe that these fickle sentiments may see some downside in the market in the intermittent before it finds an upward direction towards a better and stable economy. We strongly recommend using any such downward opportunities to build up the portfolio and participate in the wealth creation opportunity as India emerges as one of the fastest growing economies in the world.

What Do We Look At While Investing?

“ No wise pilot, no matter how great his talent and experience, fails to use his checklist. ” – Charlie Munger

Our deep rooted process of analysing businesses helps us navigate through the universe of over 5000 listed companies and eliminate more easily. With the markets being uncertain and volatile, we prefer to stick to the basics and parameters that we understand well. While, each business we invest into requires specialised investigations, the core parameters across all the businesses remain similar and these include :

-

Business models with strong cash flows and moats

We look for business models which are simple and easy to understand. Our focus is more on the cash flows of the company and not just the profitability to ensure that the profits earned are converting in to positive cash flows and not just remain paper profits.

We prefer businesses that are market leaders and/or have robust moats. Businesses with serious moats give superior returns, margins and grow faster and more consistently. -

Strong earnings growth & macro visibility

We prefer companies that are looking at a large addressable market as that ensures consistent growth over long periods of time. These companies are rewarded with superior valuations for consistent growth. We track the macro environment and on-ground opportunities closely to find these kinds of businesses. -

Reasonable debt

We generally look for companies where debt/equity ratio is less than 0.5x. A lower leveraging ensure sustainability of businesses even in bad times as well as generally leave enough profits for the equity shareholders – which is what eventually gets valued. A good business where major part of the profits ends up in debt servicing only generally does not get equity investors attention. -

Strong return ratios

We look for consistently strong return ratios like ROEs, ROCEs, Asset Turnover etc. The average cost of capital for most companies in the country would be between 8-12%, if a company can consistently generate ROCEs north of 15%, we believe they would make lucrative investment options. -

Reliable promoters & managements

The promoters and managements are the most important part of any business – an average business also if executed efficiently can result in higher profits and valuations then a complex business with a mediocre management. We thoroughly go through the balance sheets (related party transactions, management remuneration etc.) of company to get an idea of the reporting and management quality. Apart from this we interact closely with the managements via quarterly con-calls and meetings over longer periods of time to understand the management’s thought process and sincerity. -

Capital allocation

Poor capital allocation can make or break a company and lead to heavy balance sheets. Strong cash flows are of vital importance, but what the company does with that cash and external capital is more important. Are long term loans being raised to service short term liabilities, is the other income via free cash a large part of the company’s PAT, is the company’s cash lying idle? -

Valuations

After having found the business and all the other attributes spoken about above interesting, we finally come to the valuations. We normally look for companies trading at a discount to their 15-year average valuations or companies that are likely to get re-rated. While looking at valuations we consider PE multiples, PEG and EV/EBITDA.

What Are We Currently Looking At?

“ It is far better to buy a wonderful company at a fair price, than to buy a fair company at a wonderful price. ” – Warren Buffet

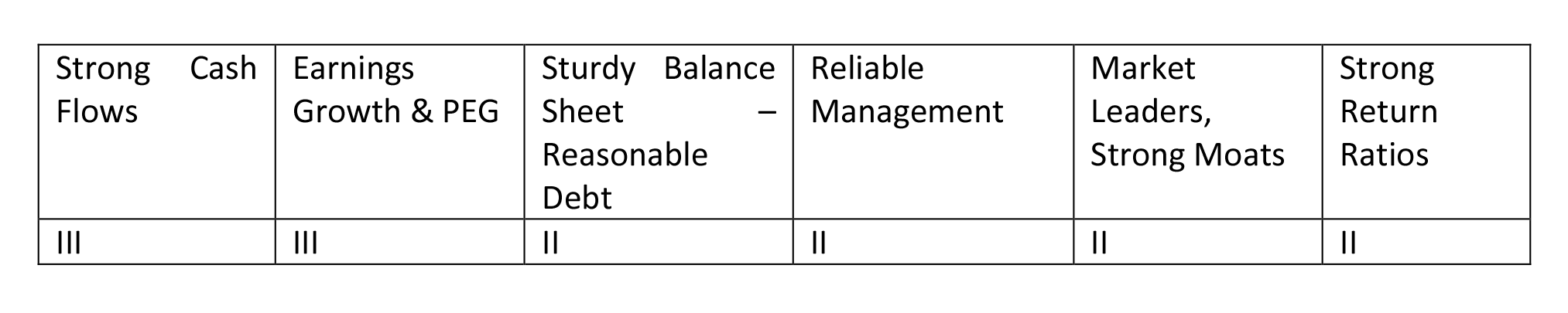

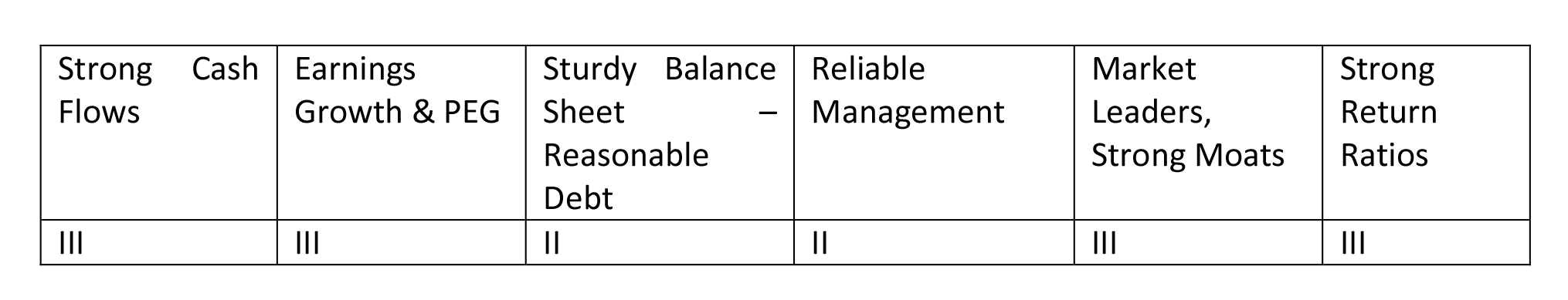

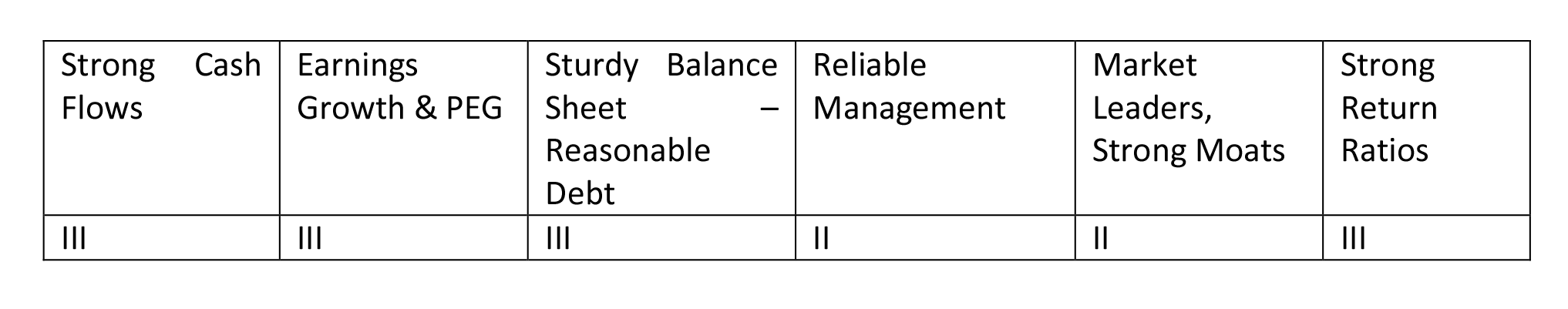

We are always working towards new ideas and looking for companies that fit into our investment thesis. We grade our investment opportunities on a scale of III (three) on various parameters enlisted above. Our current buying list includes businesses like :

-

A company that is a strong player in the inner wear space, with 14-15% market share. The company

has great brand recall, with 55% of their sales coming from the mid-premium segment and 15% from

the premium segment. The company has a pan-india presence with over 1200 dealers and over

1,25,000 retail touch points. The company is exploring the athleisure, women and kids segments,

which are expected to have substantial growth over the next few years.

-

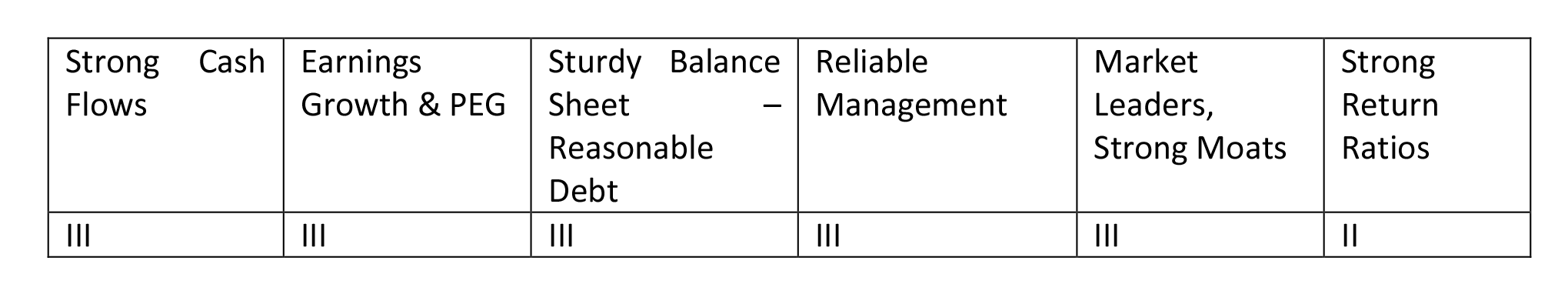

An engineering firm that provides services in the field of bio-based technologies, engineering and

HiPurity solutions. The company has established a global leadership in ethanol technology where it

commands ~70% market share and enjoys a debt-free status. The recent advancement of 20%

Ethanol blending target from 2030 to 2025 by the government has opened up a visible opportunity

of ~ Rs 10,000-15,000 crs for the company for the next 4-5 years.

-

An NBFC, this company extends housing and mortgage loans to salaried and non-salaried individuals.

The Housing Finance Companies (HFCs) are expected to see good momentum due to low interest

rates which is incentivizing borrowers to purchase homes and in turn prop up demand. In the recent

quarterly result of Q3FY21 the company has indicated that it has reached a collection efficiency of 97% and has a proforma GNPA of 4.3% including restructured loan of 0.3% which is commendable.

We believe the company is on the right track and the asset quality is set to improve hereon. The

P/BV of 1 seems extremely attractive.

-

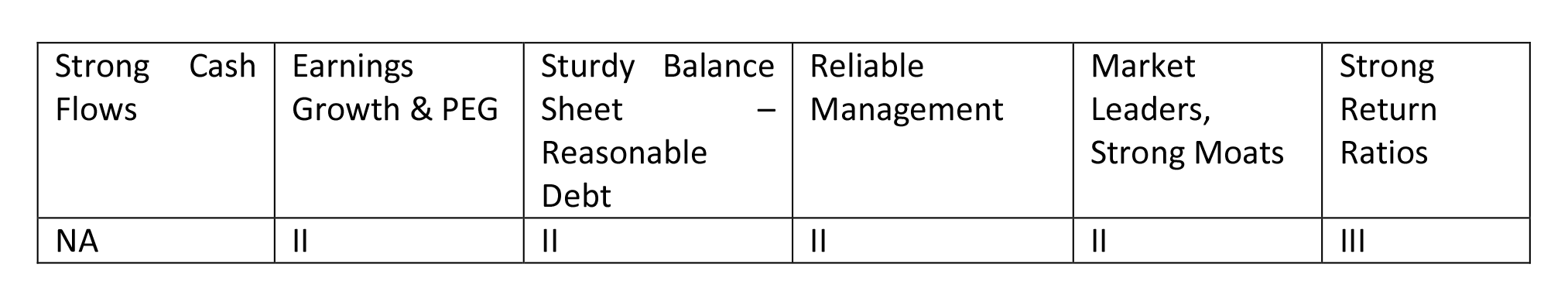

A well-established rice company with a strong brand in India (27% market share), USA (50%+ market

share), Middle East (10% market share) and expanding in Europe. The company is also expanding

into new products and looking to establish itself as an FMCG player. The company is consistently

working towards improving its working capital cycle and hence its cash flows, which in turn will

improve its balance sheet.

-

A cement company with a strong hold in the North East markets and an aim to move to Eastern

markets at well, trading well below its replacement cost with close to no debt on its books. The

company also has upcoming capacity expansions which will lead to earnings growth and is working

towards premiumisation.

Financial Performance of Our Portfolio & Valuations

“ Although it’s easy to forget sometimes, a share is not a lottery ticket, it’s part-ownership of a business. ” – Peter Lynch

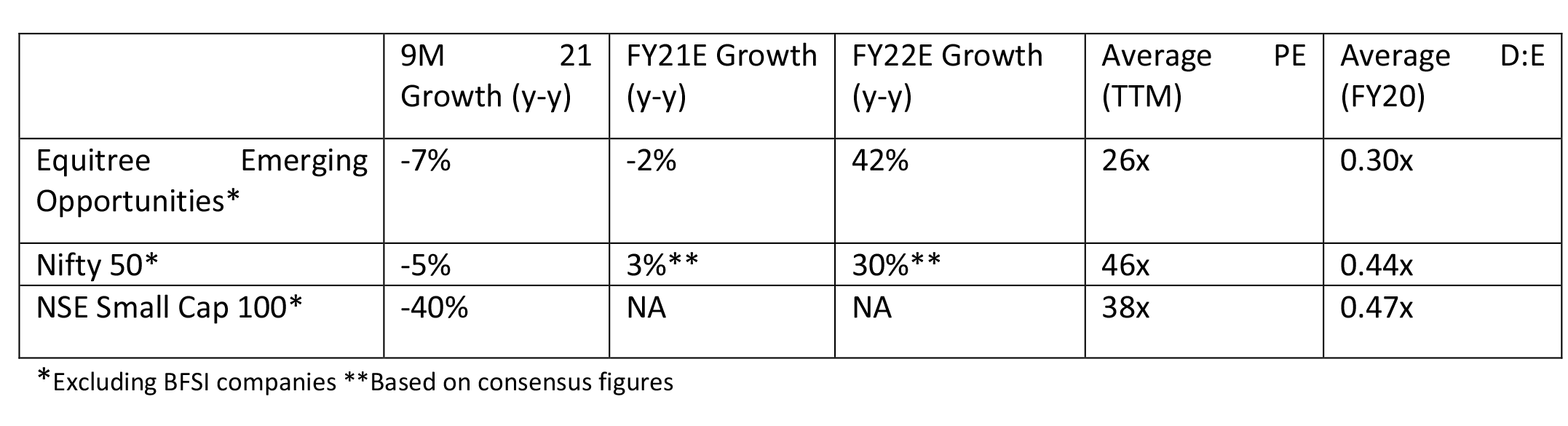

In-spite of a weak first half, most of our companies are looking at either a flat FY21 or slight growth. We are expecting a strong FY22. As discussed in our March 2020 update, most of our companies are 20-30 year old brands, are well-known and have dependable managements. Our portfolio is currently valued at a PE of 26x (TTM) and 11x on FY22E numbers.

Is The Market As Rational As The Intelligent Investor?

“ Markets can remain irrational longer than you can remain solvent. ” – John Maynard Keynes

The markets are irrational and emotional, always capable of luring investors into traps. In March 2020, the markets witnessed irrational bouts on the bear side and as the pandemic saw some respite, the markets started behaving irrationally on the bull side. In the midst of this bear and bull fight, stands the intelligent, rational investor. Who doesn’t get deterred by bears or ecstatic around bulls? Our investment strategy and the kind of businesses we get excited by did not change during the bear phase of March 2020, was the same when the markets were touching all-time highs and remains the same as Covid makes the markets volatile.

Even in the current market environment, we are dedicated towards finding interesting businesses, available at reasonable valuations. We remain focused on businesses and the softer factors therein, instead of getting distracted by volatile markets. For volatility and activity is what excites the markets, but understanding businesses coupled with long stretches of inactivity is what generates wealth.

Please feel free to reach out to us at pawan.b@equitreecapital.com / skabra@equitreecapital.com with your comments / suggestions / queries etc.

We wish for everyone’s good health and safe being.

Warm regards.

TEAM EQUITREE