“ The less prudence with which others conduct their affairs, the greater the prudence with which, we should conduct our own affairs ”

— Howard Marks

Dear Investors,

As the COVID numbers show some signs of stagnating, increasing number of people seem to be getting back to work. The green shoots that we spoke about in our last quarterly update has found some more support on back of resumption of economy and all of this put together has also kept the market momentum going during the last quarter with the headline Sensex gaining ~ 6%. Our portfolio has also kept up the pace gaining ~ 15% during the last quarter. We are happy to report that since the March lows, our portfolio is now up ~ 44% from April till date (kindly note that individual performances may differ).

Despite this momentum, a few questions still linger in most minds – Is this bull-run sustainable or a bubble? Why is there, if at all, such a chasm between the market and the economy? Is this the right time to build up a portfolio?

While we are not star gazers nevertheless, we will try and address some of these questions to the best of our understanding and based on the analysis of certain facts.

IS THIS BULL RUN SUSTAINABLE OR A BUBBLE?

“The big money is not in the buying or selling, but in the waiting” – Charlie Munger

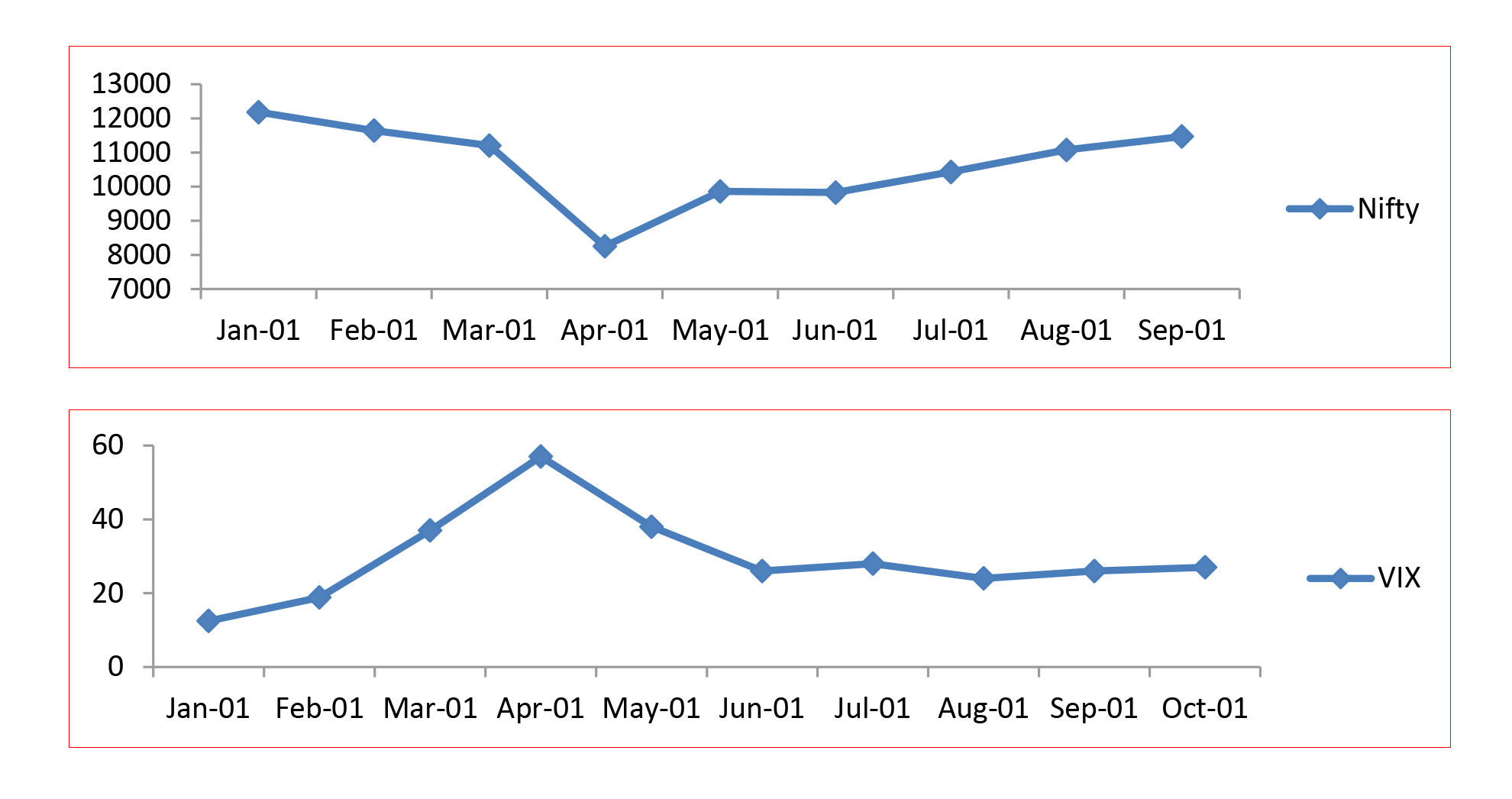

Over the past 6 months, the Nifty Index has seen a sharp V shaped recovery and even the India VIX (the fear index) has cooled off substantially. The markets have mainly rallied in reaction to the extreme sell-off in March, abundant global liquidity, hopes of a vaccine being available earlier than originally expected and leniency showed by certain SEBI norms.

We analyse some of the reasons for this hereunder :

- Green shoots find more support, as the economy opens up

- In our last update, we had mentioned about some green shoots being visible. During the last quarter, these

green shoots have held up more strongly showing signs of a recovery much faster than expected :

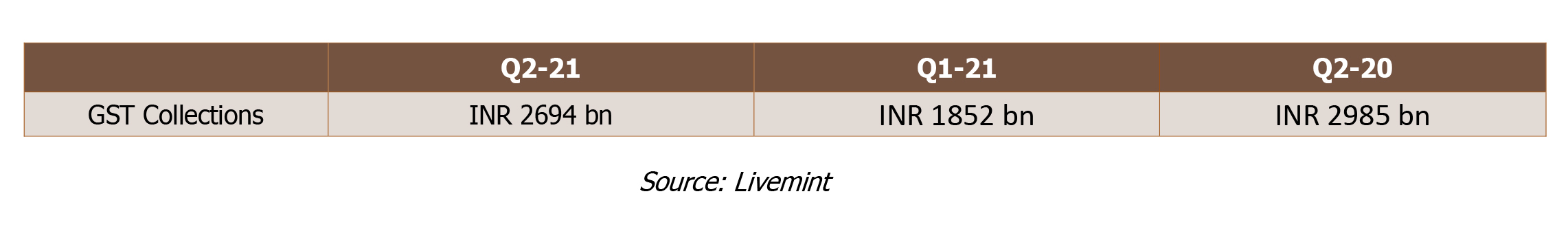

- Improvement in GST Collections

-

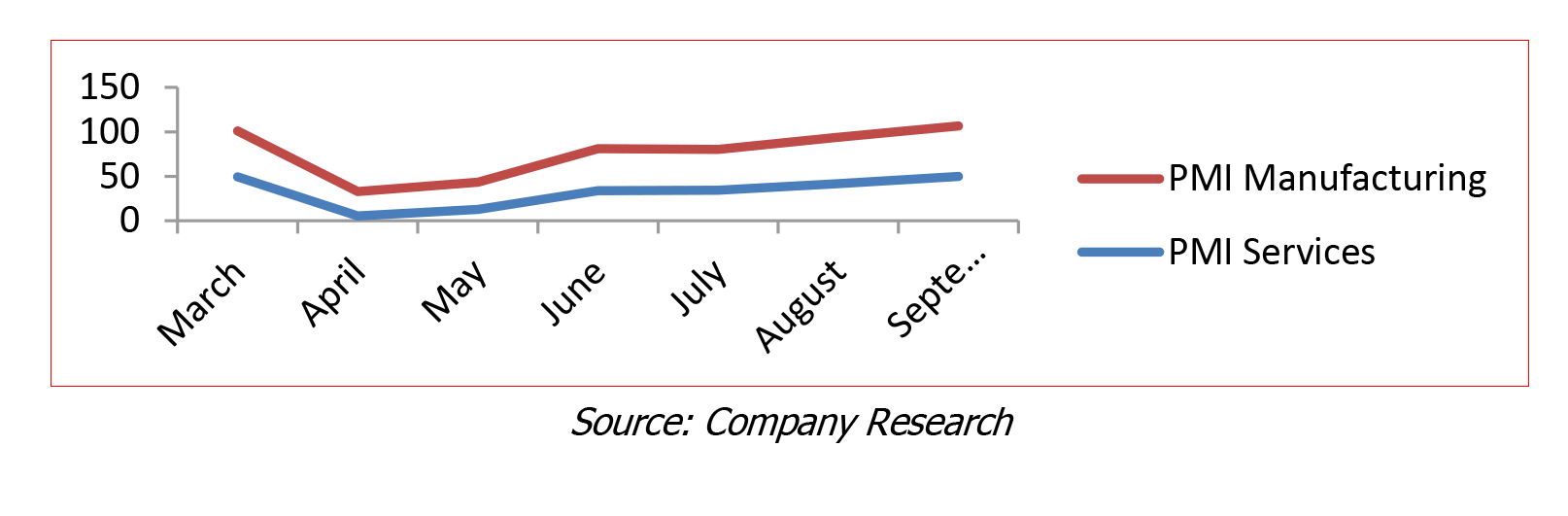

PMI Data showing signs of significant recovery

-

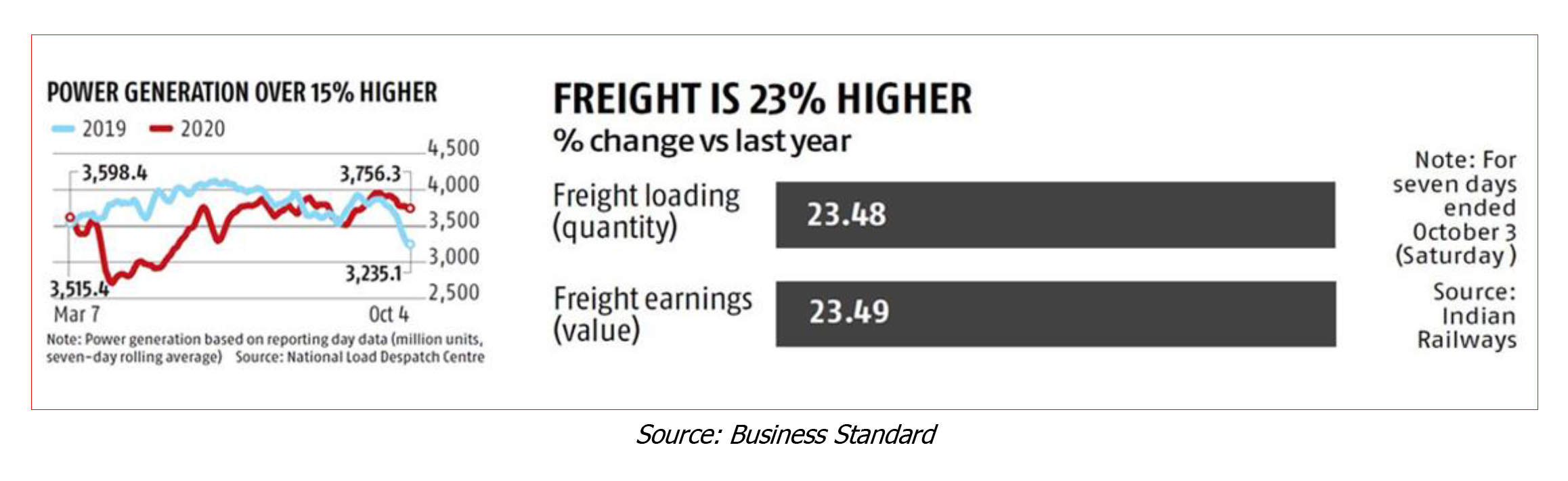

Pick Up in Power Generation & Freight

-

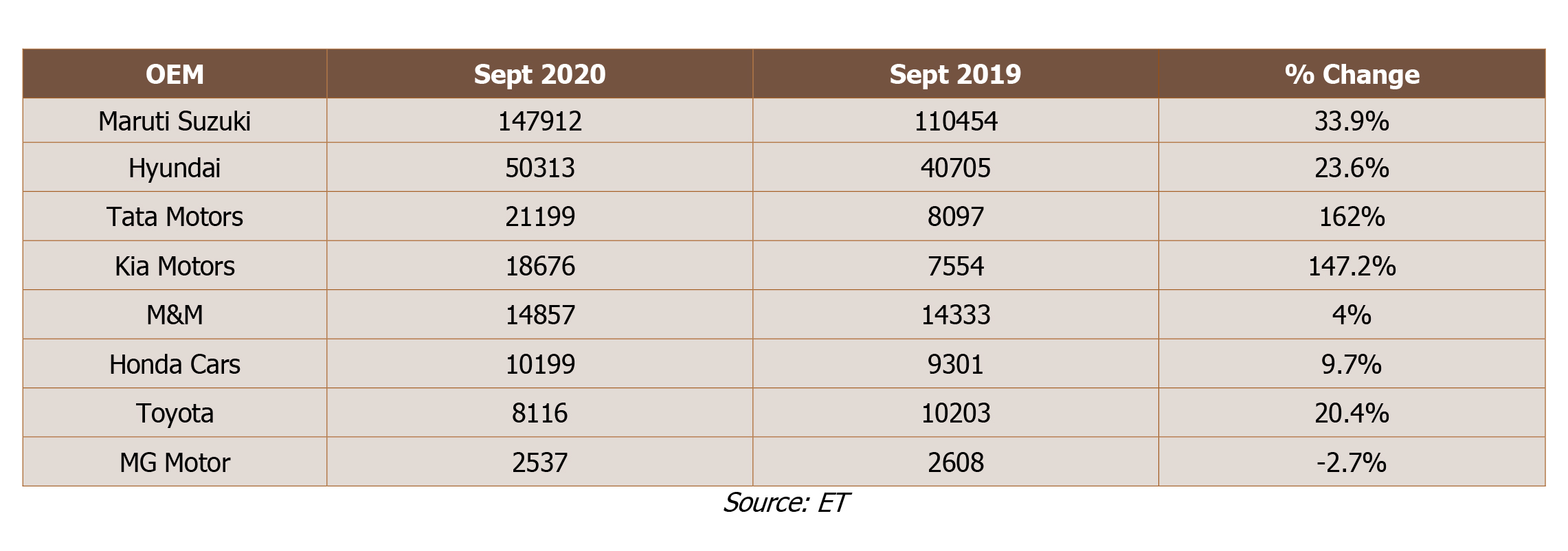

Pick Up in Auto Sales

- Improvement in GST Collections

- Visibility of a vaccine getting stronger

- Currently nine vaccines are in the pipe line at various stages of trials and there is a strong expectation of a couple of these being commercially available by the end of this year. Plans are already being drawn for distribution of the vaccine – both in India and globally too. Investors are budgeting for a further pick up in economy as the vaccines is made available and normalcy returns back globally.

- We believe the markets have already valued in some amount of positivity with respect to the vaccine, any negative developments may lead to corrections.

- SEBI Making way for Small / Mid cap investing

-

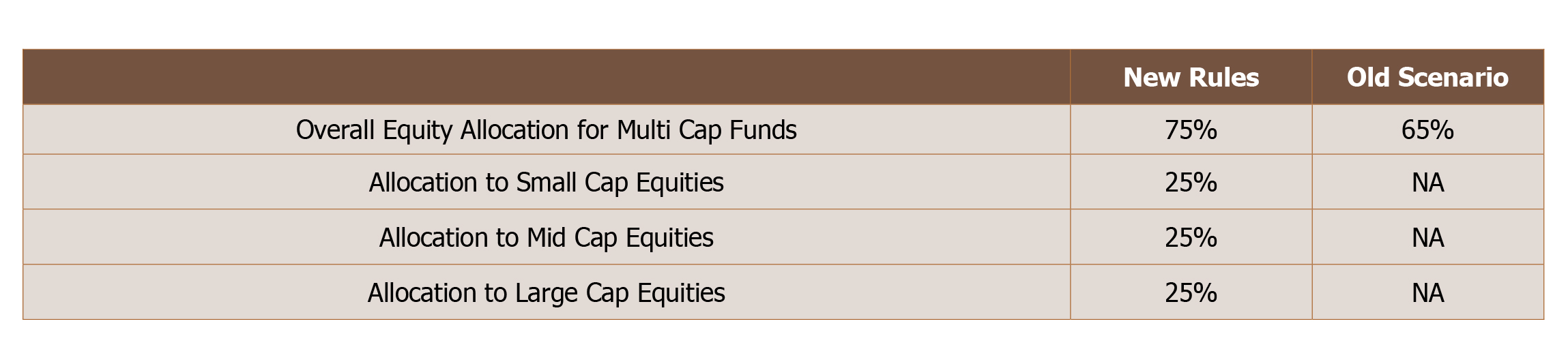

SEBI has tweaked the portfolio allocation rules for multi-cap funds making it mandatory for these multicap

funds to have specific allocation earmarked for Small and Mid-caps (as defined by SEBI) as under :

- As on 31st August assets under management for multi cap funds was ~INR 1.46 lakh crores which paved the way for a large chunk to be invested in small and mid-caps. Nevertheless, SEBI quickly came up with clarification allowing these funds to convert themselves in to Large Cap funds or change the nomenclature of the funds accordingly. SEBI has given a timeline till Feb’21 to these Multicap funds to fall in line with the revised regulation.

- We believe that a large chunk of these Multicap funds will indeed get converted in to Large Cap funds and / or will change their nomenclature to side line this SEBI notification. However, even a small chunk of liquidity coming from the total INR 1.46 lakh crore in to Small and Mid-Caps can be sufficient to fuel a rally in this category of stocks. Given the attractive valuation of a lot of companies in this segment, we do believe that some trickle effect should be seen in this space. Pre-empting the same, quite a few stocks have seen increased action from HNIs / PMSs alike which has further helped in keeping the markets buoyant.

While the markets have rallied substantially since March 2020, we believe certain buckets remain to be interesting and investible. We don’t expect the markets to witness an extreme sell-off of 25-35%, as that would imply a wipe- out of 3-4 years earnings, which doesn’t seem to be the case.

The Federal Reserve Bank’s Chairman, Jerome Powell has maintained that they will allow inflation to rise, in order to support the labour market and the economy; implying low interest rates are going to stay in the US economy for a long time. Even the RBI governor, Shaktikanta Das has suggested that from a liquidity point of view, the RBI will do all it must to maintain adequate liquidity.

While we believe that the current scenario is not a bubble, we are cautiously treading and expect the markets to witness healthy corrections, from time to time, giving long term investors opportunity to build up portfolios.

THE CHASM BETWEEN THE ECONOMY AND THE STOCK MARKET – REALLY?

“If I heard economists all my life, I would have never made any money” – Rakesh Jhunjhunwala

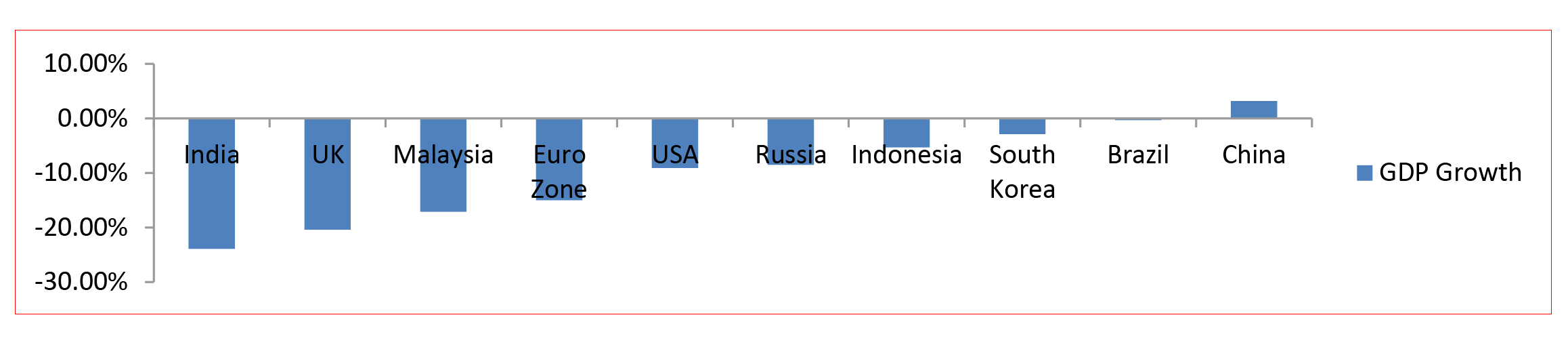

In Q1-21, India witnessed a sharp contraction in GDP of 23.9%, which was lower than most estimates. India’s GDP contraction was sharper than all its EM peers, attributable to stringent lockdowns, the in-ability of the government to spend large amounts as stimulus packages and the fact that the Indian economy was already losing steam, before being hit by Covid-19. Despite all this, Nifty grew by almost 26% during this period. This naturally fuels thoughts on the chasm between the economy and stock market and has left a lot of people confused. We share our thoughts on the same hereunder :

- Markets are forward looking

-

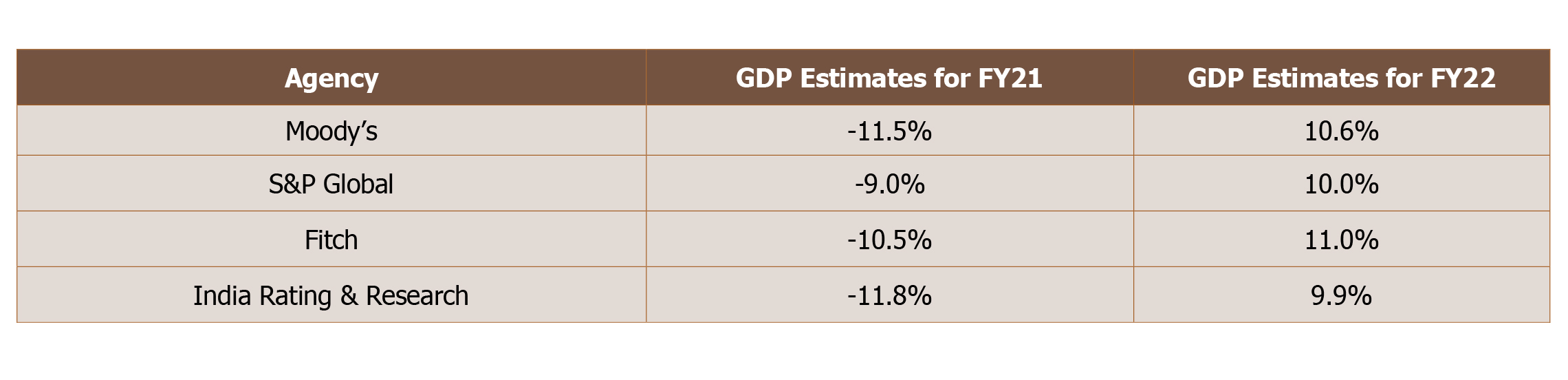

The headline number of a 23.9% contraction in the GDP, holds true to the locked down economy of Q1-21,

however since then the situation on the ground seems a lot more inspiring today. Given the current

momentum, we expect the second half of FY21, to be even stronger in terms of economic activity. Most

economist and rating agencies have also predicted for a much stronger comeback in 2H FY21 bringing the

overall fall to much reasonable levels in FY 21 and a strong growth in FY 22.

- Despite the run up in the last couple of months Nifty is still 9.5% lower than January levels, which broadly seems in line with GDP estimates. Apart from this, markets represent the formal and stronger portion of the economy, which will bounce back faster and will not suffer as much as the informal sector.

- It is this comfort on the forward growth that has kept the investors’ confidence in the market

- A languishing Indian economy need not mean majority of the companies listed on the stock market will languish either

-

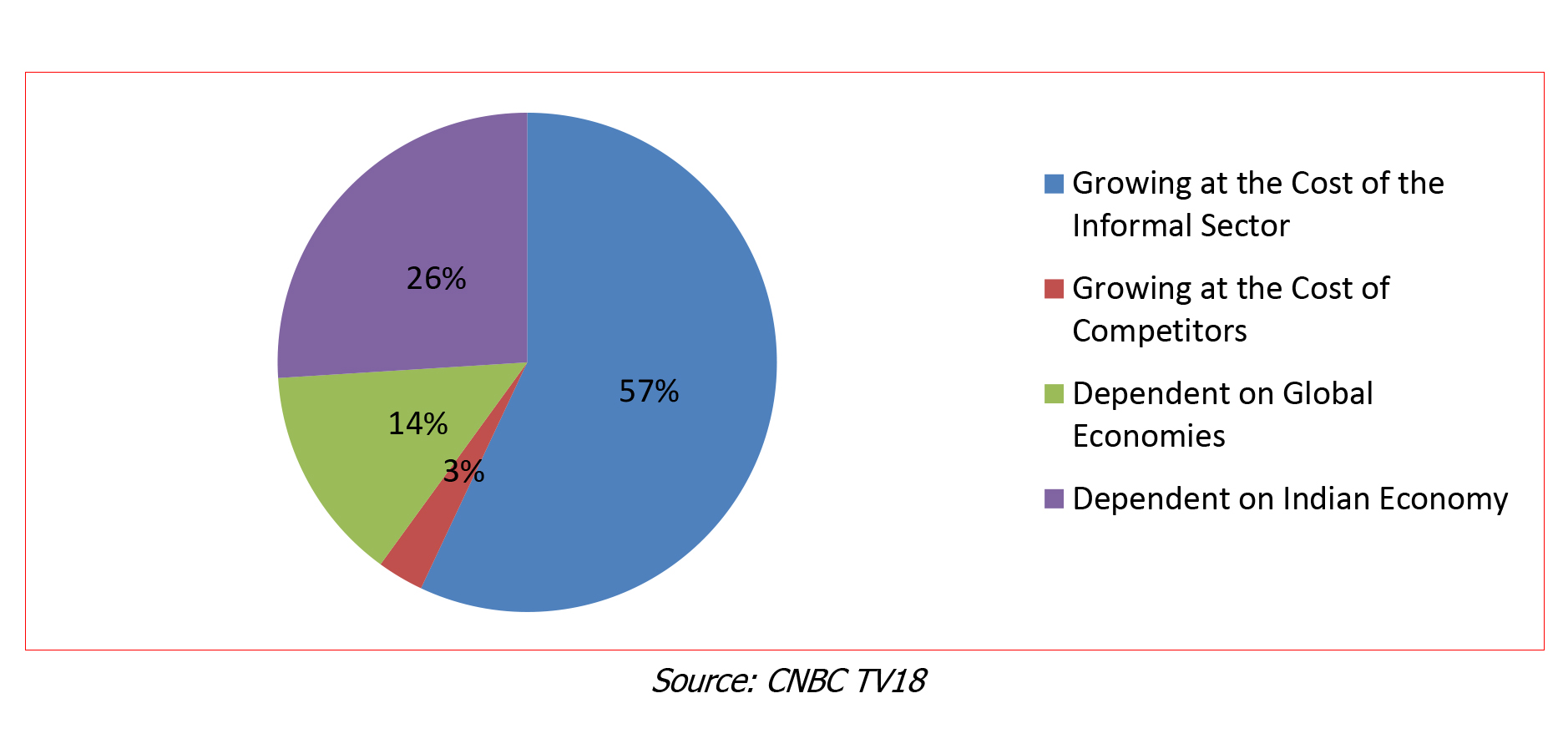

CNBC did an interesting study on what drives growth for the companies in the listed space which is worth sharing here :

- 57% of all listed companies are expected to grow by gaining market share from the informal sector (textile, sanitary ware, tiles, packaging etc)

- 3% of all listed companies grow by gaining market share of their competitors (telecom)

- 14% of the companies grow due to foreign economies (IT, large exporters etc)

- This leaves only 26% of listed companies which grow based on GDP growth (BFSI, FMCG).

- This kind of got reflected in the 1Q earnings and is getting more prominent in 2Q earnings being reported by listed companies. Companies which have shown sustainability / growth in earnings have clearly stood out and attracted investor interests and continue to do so.

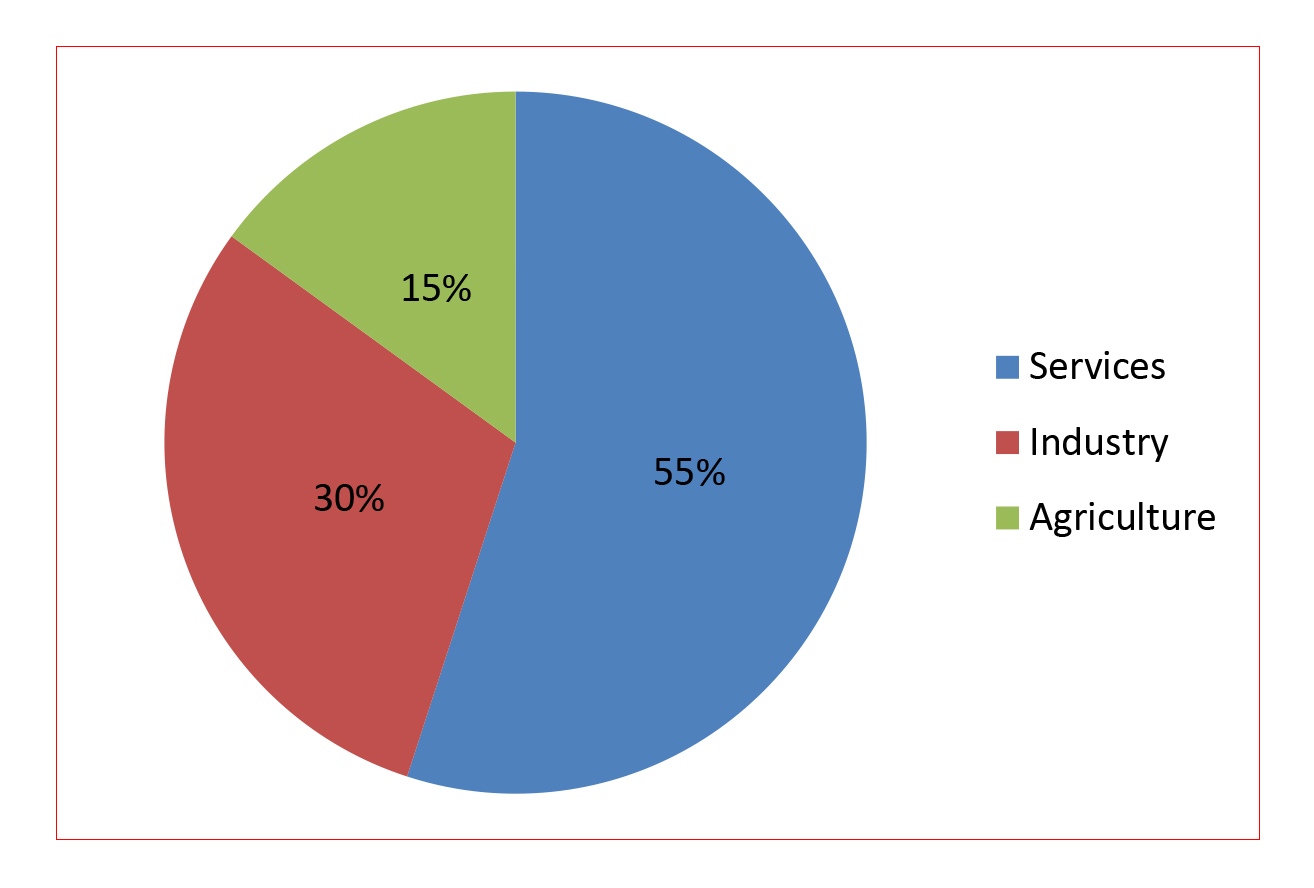

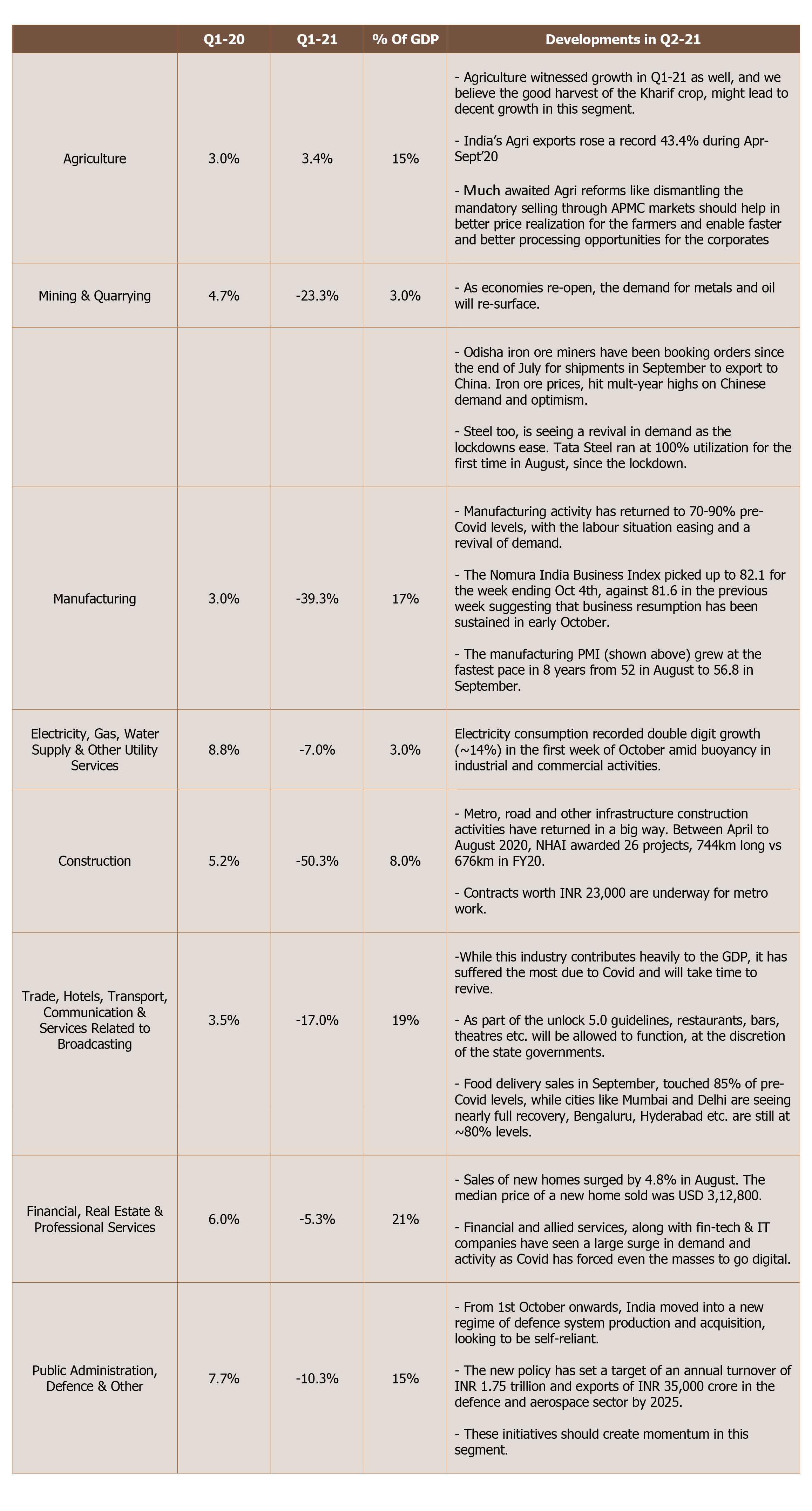

- Different segments of the GDP showing a strong come back

-

We tried analysing different segments of the GDP and the Covid impact on the same along with their path to recovery and are happy to share our thoughts hereunder :

- Break Up of the Q1-21 Contraction

All this explains the optimism in the markets and rightfully so – one need to remember that the intrinsic value of companies is not washed out by an aberration of one year, and that is what the rally in the markets currently represents

IS THIS THE RIGHT TIME TO BUILD A PORTFOLIO? INDEED YES – TIME TO LOOK FOR MICROs THAN FOR MACROS

“Wall Street makes its money on activity; you make money on inactivity” – Warren Buffett

We believe, even though the markets have surged since March, there are several buckets of opportunities from investment perspective (kindly refer our last update for our comments on the seemingly expensive valuations at the headline index level). It is time to focus on the micros instead of the macro. Several factors, like the rise in domestic infrastructure spends, Make-in-India initiative, opportunities created by the China backlash in the global markets are likely to have a positive impact on many companies.

- No time to generalize opportunities / challenges at macro level – need to dig deeper at specifics

- Under the current business environment, it may not be prudent to size up any industry / segment with a universal brush, rather it is extremely important to do a ground up analysis of a particular company and analyse its business prospect.

- To explain this point better we use Textile industry as an example – a general perception about the textile industry is that the industry is reeling under huge stress and has been completely out of flavour. However, as we dig deeper we realize that there were certain island of opportunities which are doing extremely well even during these stressful times – more particularly while the synthetic (man-made) textile is reeling under tremendous pressure due to low demand and cheap imports, cotton textile is doing reasonably well due to bumper cotton produce reducing the raw material cost and a tilt in procurement from China to India. Even within this segment bedsheets and knitwear apparel manufacturers are doing extremely well as against other segments – so much so that some of the players that we spoke to were completely booked for the next 3 months!

- Intermittent irritants will continue – time to have a buying list ready and buy on dips

- At no point in time do the markets behave in a linear manner – and we are indeed looking up to certain global issues which may test the markets and create volatility in near term. Some of these include :

- US Election – given the stretched valuations in the US markets, the outcome of US election will most likely have a short tem impact on global markets, irrespective of the outcome. However, long term impact will seek guidance from the new government’s policies – something that one needs to wait and watch

- Delay in Covid vaccine – the world is now awaiting a vaccine over the next 3-4 months and is hoping for restoration of normalcy sooner than later. Any delay in this would further hurt the sentiments and may impact the markets negatively

- Re-imposition of lockdowns on second wave of covid – pending the vaccine, any re-imposition of lockdowns because of a second wave of covid would also further accentuate negative sentiments and bring volatility

- Probability of an Indo-Chinese military skirmish due to the ongoing border issue –the built up on either side of the border has kept everyone guessing. Any significant flare-up in the situation has the potential to throw all exuberance of the market out of window

- Our approach

- At Equitree, we are keeping a close tab on the opportunities and challenges as enumerated above. We are cognizant of the volatility which each of these challenges can bring about; however in our opinion probability of most of these is very low – except for the US election outcome overbearing the global markets for a while.

- We are taking a cue from the persistent low interest regime globally which should continue to drive liquidity in to equity as an asset class. Further, vaccine or no vaccine – we are seeing people raring to get back to work as fatigue of being at home is setting in. Increased awareness and high recovery rates coupled with drying up finances – both at personal as well as at government’s level are also driving people back to work and adapting the “new normal”. Central government has been pushing the state governments to further implement unlocking measures with due precautions and open up the economy as soon as possible.

- We have been spending a lot of our time in relentlessly searching for companies that have a strong visibility of growth and have a buying list ready across diverse range of industries like auto ancillary, power industry, infrastructure space, packaging industry and many more, where we are continuing to see on the ground growth. We continue to patiently wait for drops in the market, to build up our portfolio.

Please feel free to reach out to us at pawan.b@equitreecapital.com / skabra@equitreecapital.com with your comments / suggestions / queries etc.

Best wishes for the upcoming festival season. Stay safe. Stay healthy.

Warm regards.

TEAM EQUITREE