“The most important quality for an investor is temperament, not intellect.”

— Warren Buffett

Dear Investors,

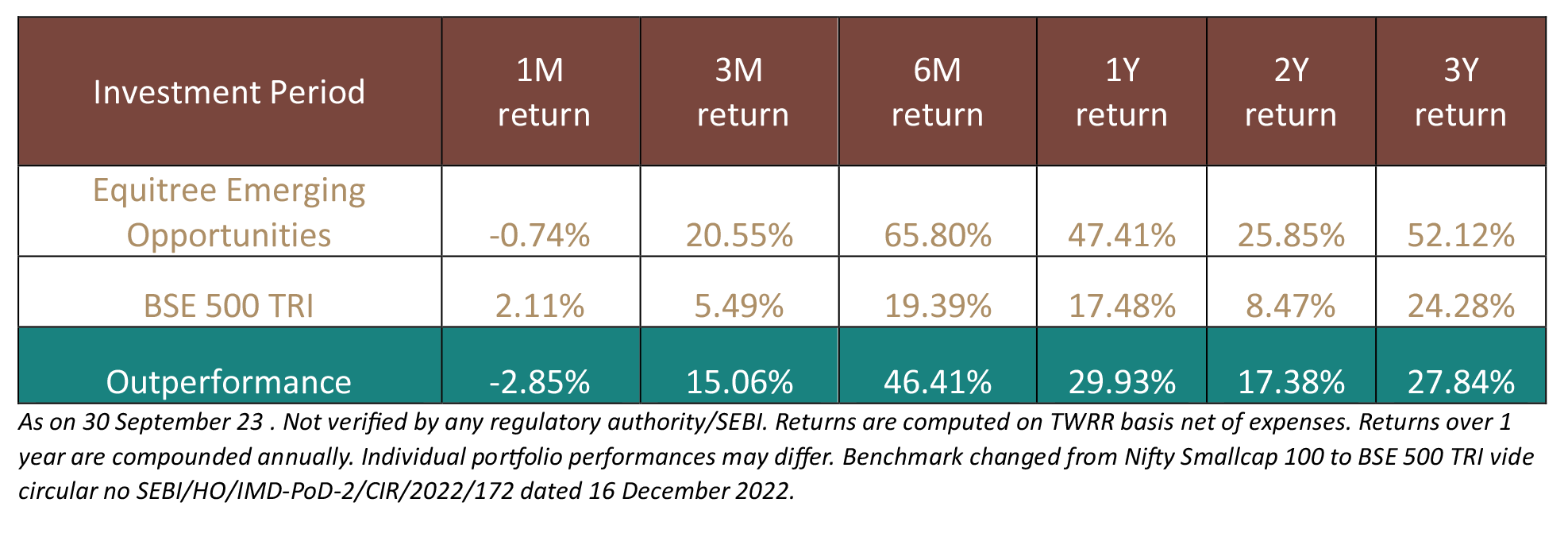

Our reckoning, “This market has still much more steam left – still time to build cautiously rather than thinking exit” that we had mentioned in our Q1 FY24 newsletter played out perfectly. After a super performance in Q1 FY24, our portfolio saw a continued outperformance during Q2 delivering 20.55% return as against a mere 5.49% return from the benchmark index. We summarize our performance hereunder:

Last month some of the companies in our portfolio saw a bit of consolidation after a significant run up post Q1, resulting in marginal underperformance on a monthly basis. However, we consistently outperformed the benchmark across all time period overs the last 3 years and have emerged as 5th best performing PMS across all strategies (source: PMS Bazaar).

Despite this out performance, valuation of our portfolio companies continues to be in a very comfortable zone trading at ~ 16x FY25 PAT (please refer to the Q1 FY24 Operating Performance Update shared earlier) which still leaves enough room for further upside and gives us comfort and conviction to not only hold on to the portfolio but also add more even at these levels!

Brace up for some volatility ahead

While we believe that the portfolio still has significant upside, we are also cognizant of the upcoming volatility that may hit the markets on account of profit booking as Q2 earnings come about as well as the ongoing global issues like Israel-Gaza war, Ukraine-Russia conflict, rising Dollar index, increasing bond yields, expected longer regime of higher interest rates et al which would keep rocking the boat and accordingly have been extremely cautious in deploying funds. As of now we are sitting on ~ 12% in cash on an overall basis – waiting to leverage the opportunities which the expected volatility may throw up.

For e.g. we grabbed the recent fall in the market which gave us a brief window of opportunity to deploy capital at ~ 10% lower prices and deployed nearly 25% of the cash that we were holding! We are sure we would get more such opportunities to judiciously deploy capital in our chosen businesses.

Some of these global events have been around for a while and have been discounted in the prices too – nevertheless this would keep bringing in intermittent volatility. In our opinion the mother of volatility from Indian market perspective would be the national elections coming up early next year. We use this opportunity to share our views on the same hereunder.

Upcoming elections – will ensure a short-term rollercoaster ride but neutral from long term!

From investors to traders, from retail to institutions and everyone alike has been discussing in murmurs about the upcoming general elections and the potential impact that it may have on the Indian markets. Morgan Stanley’s recent report on the subject summed it up well presenting 4 different scenarios of election outcome and giving a range of +5% to -40% impact on the market depending on the outcome! So even in the best-case scenario they are talking only about a 5% positive impact on the market and open for downside up to 40% in case of a weak coalition government.

We are not crystal gazers to predict the outcome of the elections but take a much more pragmatic view of this based on the on-ground assessment of the business environment.

Undoubtedly a weaker coalition / head of government will impact India’s positioning in the global rankings and the power and strength that it has started to wield over the last few years, however, we believe that the strong macro fundamentals and policies already implemented over the last couple of years will continue to steer India’s growth irrespective of the outcome as it cannot be undone even by a weak coalition.

We enumerate some of these important policies / actions which have been implemented over the last couple of years and have laid a strong foundation for India’s economic growth:

- Banking Clean-up: Post the IL&FS fiasco in 2018, the government went on a spree to clean up the long drawn NPAs in the books of the financial institutions to avoid any crippling of the economy & create a healthier financial industry. Resultantly, gross NPAs have declined from the peak of 14.6% in March’18 to 5.53% in December’22 and at the same time, resilience has increased with provision coverage ratio of PSB’s rising from 46% to 89.9%. Banks are the backbone of any economy, and a healthier balance sheet of Banks will ensure and provide the stimulus required for consistent growth in near future.

-

Digitization of economy:

Right from demonetization carried out in 2016, the government has introduced various schemes to digitize the economy. Today most government benefits / subsidies like PMJDY, PMJJBY, APY and other such schemes are directly transferred to the end beneficiaries reducing the red tapism in between. A look at some of the numbers will help in better understanding of the impact:

- Since the first year of the scheme 17.90 crore PMJDY accounts were opened. PMJDY accounts have grown three-fold (3.4) from 14.72 crore in March 2015 to 50.09 crore as of August 16, 2023. Total deposit balances under PMJDY Accounts stand at Rs 2,03,505 crore.

- Since implementation of Direct Benefit Transfer, the government has saved over a whopping Rs. 50,000 crores in FY22alone under various welfare schemes & subsidies.

- PLI / Make in India: PLI Schemes have transformed India’s exports basket from traditional commodities to high value- added products such as electronics & telecommunication goods, processed food products etc. 176 MSMEs are among the PLI beneficiaries in sectors such as Bulk Drugs, Medical Devices, Pharma, Telecom, White Goods, Food Processing, Textiles & Drones. Actual investment of Rs. 62,500 Crore has been realized till March 2023 which has resulted in incremental production/ sales over Rs. 6.75 Lakh Crore and employment generation of around 3,25,000. Exports were boosted by Rs. 2.56 Lakh Crore till FY 2022-23. As of date, 733 applications have been approved in 14 Sectors with expected investment of Rs.3.65 Lakh Crore over the next couple of years.

- GST Implementation: India’s taxation structure was complex indirect tax regime, with states levying a range of diverse taxes on goods and services. Since the implementation of Goods & Services Tax in 2017 we saw the rise of ‘One country One Tax’ regime bringing in uniformity across the country. This has not only brought ease of multi-state operations, but tighter enforcement has also brought a lot of unorganized “cash economy” in the mainstream. The impact of all this is evident in the GST collection which stood at a staggering Rs. 1,62,712 crores in Sept’23 – highest GST collection ever in a month.

- Free Trade Agreements (FTAs): With a view to strengthen India’s role in global trade, the government has been on a spree to sign FTAs with global majors. India has already signed FTAs with countries like Japan, Australia, Chile, Singapore, Sri Lanka etc. and is in advanced stage of negotiations to sign its first FTA with one of the top 5 economies of the world – UK. It is estimated that these FTAs contribute roughly about 30% to India’s merchandise exports and is expected to rise only further

If history rhymes, one doesn’t need to be much worried about:

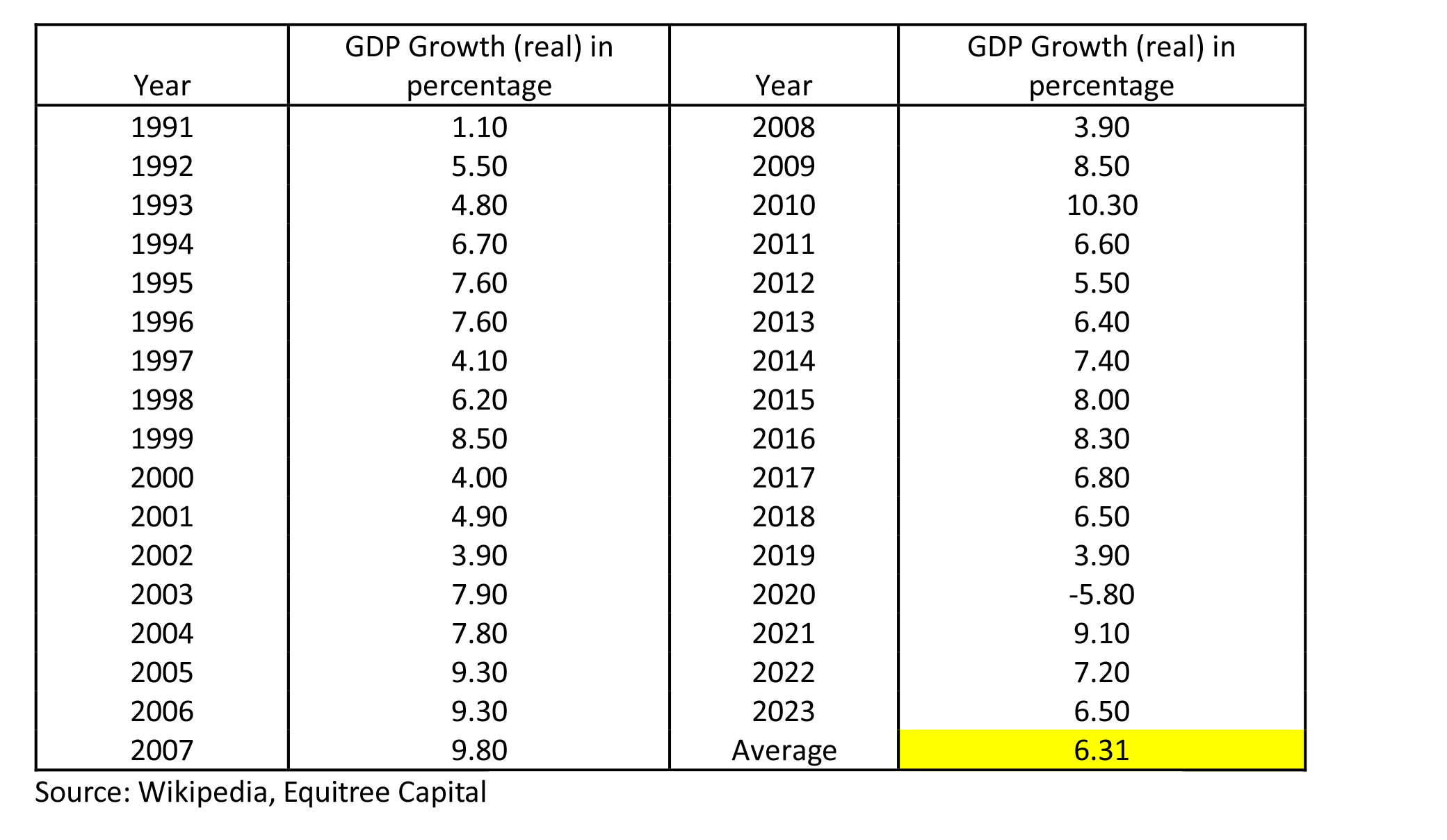

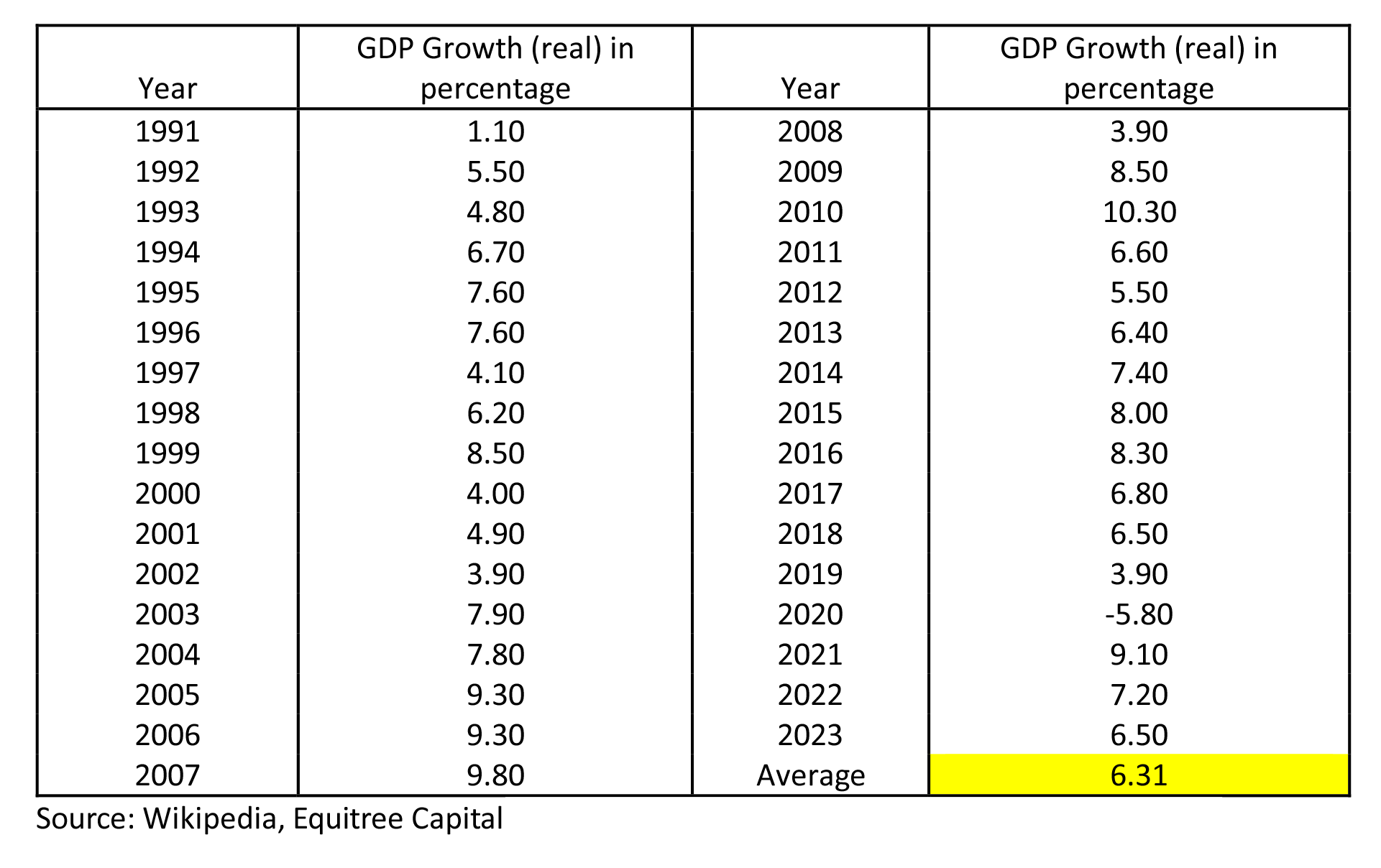

We looked at how Indian economy has fared over the years during different regimes, and it is heartening to note that economy at large has taken its own stride despite multiple swings at the power center in Delhi:

As can be seen from above over the last 32 years, Indian economy has grown at an average of 6.31% despite all challenges irrespective of which party was in power and whether we had a majority or coalition government in place. In fact, even during the weakest coalition government phase of 1996-1998 where India saw 3 Prime Ministers in the 2-year regime, the economy managed to still grow at an average of 5.15%

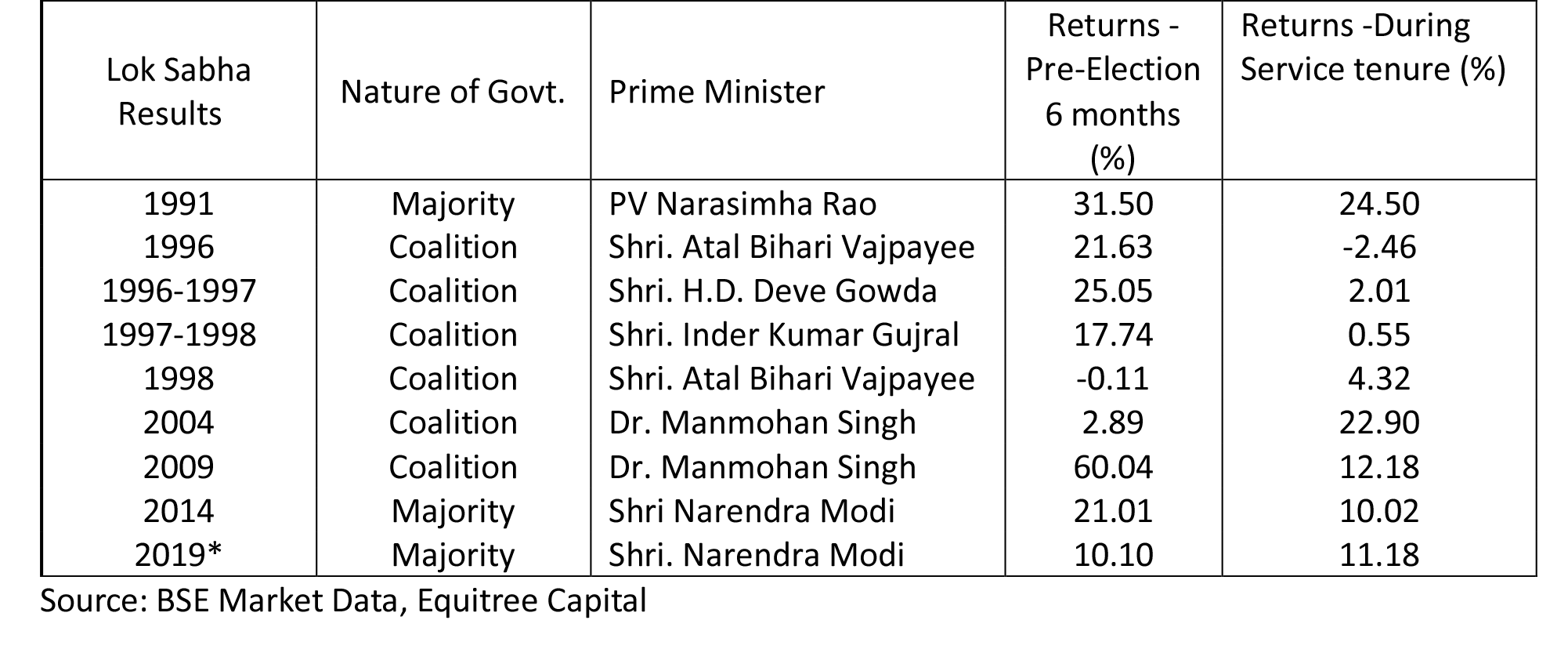

Likewise, we looked at the market returns as well during the same period. It is interesting to note that over the last 32 years, the headline index has given a CAGR return of 13.46% despite all challenges and volatility in the market. Even during the weakest coalition government of 1996-98 the index was flattish at best:

Given that we have had a decent run up getting into the elections, expecting a sharp volatility may not be out of context, however, looking at the strong economic set up and going by the history we believe that if such a volatility indeed comes about it may just be short lived and present a significant wealth creation opportunity from long term perspective.

“Market Fluctuations are your friend, not your enemy.” – Warren Buffett

How are we preparing to play this out:

As investors in businesses, we have our eyes set on the ground in terms of assessing the visibility of growth for our portfolio companies. Equally we have our “value” lens on to focus on booking profits where valuations seem to be getting stretched – we have indeed booked profits in some of our holdings and redeployed cash in other interesting opportunities.

Like a polar bear who doesn’t spend too much effort in fishing every now and then but rather waits for his opportunity to grab his big pound of catch, we keep judiciously looking for the right opportunity to deploy capital. Our strategy of building up the portfolio in a staggered manner helps us in maneuvering the volatility and use it to our advantage and has been a cornerstone in our outperformance over the last 3 years.

We firmly believe that India is on a strong footing for a multi-year growth and continue to keep looking for good businesses that are available at reasonable valuations. One just needs to be ready with the investible corpus to leverage these opportunities rather than getting caught in the clutter of noise every now and then!

We also take this opportunity to wish all of you a very Happy Diwali and a Prosperous New Year ahead.

Please feel free to reach out to us at pawan.b@equitreecapital.com / skabra@equitreecapital.com with your comments/ suggestions/ feedback etc.

Warm regards.

TEAM EQUITREE