“The India Way, especially now, would be more of a shaper or decider rather than just be an abstainer.”

— S. Jaishankar, Minister of External Affairs

Dear Investors,

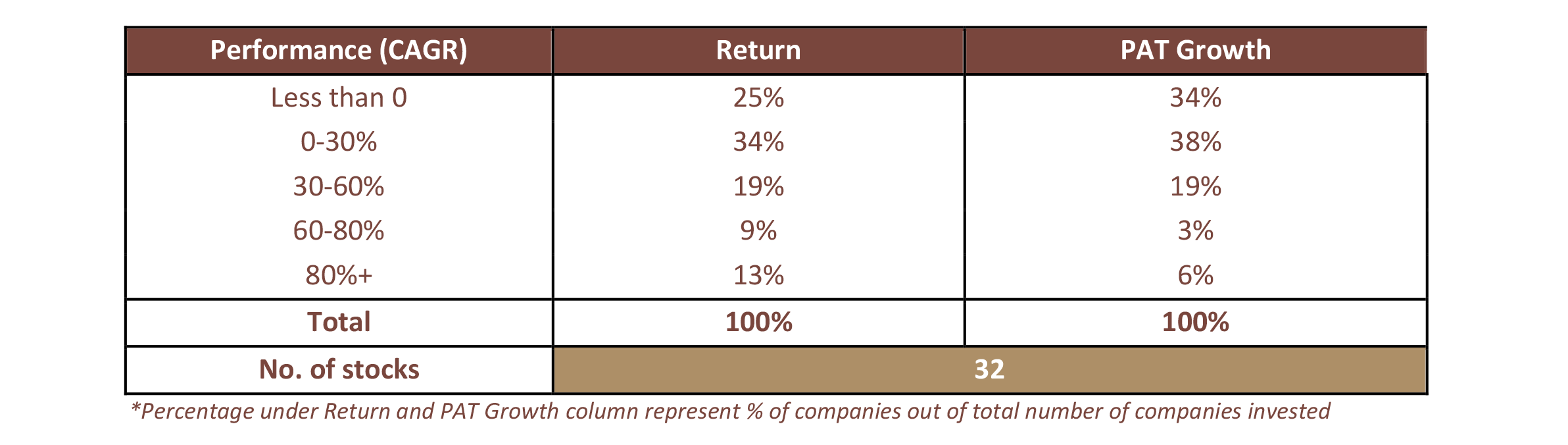

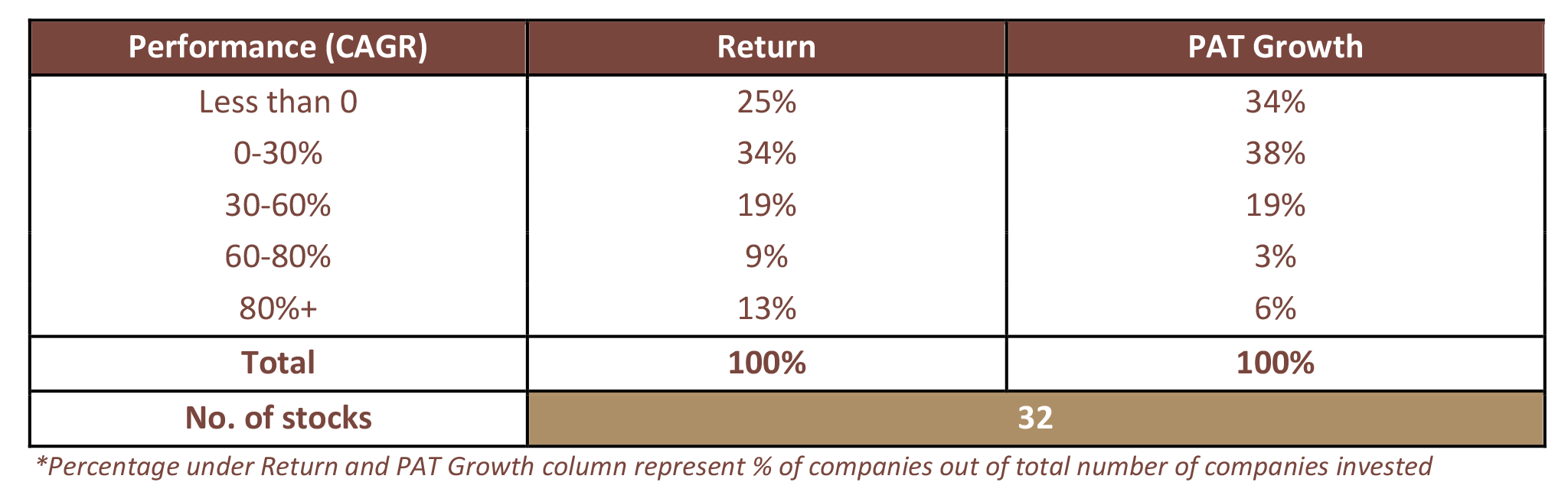

This festive season, Equitree completes 10 years of its investing journey! Since 2012, we have invested in 32 stocks with our proprietary private equity approach.

Of these 32 stocks, 75% of the time we have got our investment call right with a median return of 2.5x (CAGR of about 37% over our investment period).

This is even more staggering in the context that over the last 10 years only 10% of the NSE Small Cap index has given returns over 30%.

In a high risk genre of small and micro cap investing where it is extremely difficult to find winners, to be right 75% of the time since inception is very comforting, boosting confidence in Equitree’s process, analysis and conviction.

At Equitree, “Picking winners is a process not an event"

Our Performance update :

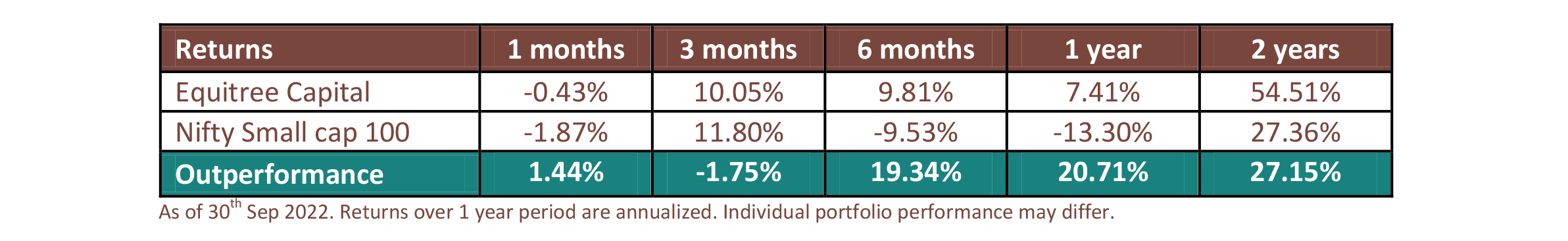

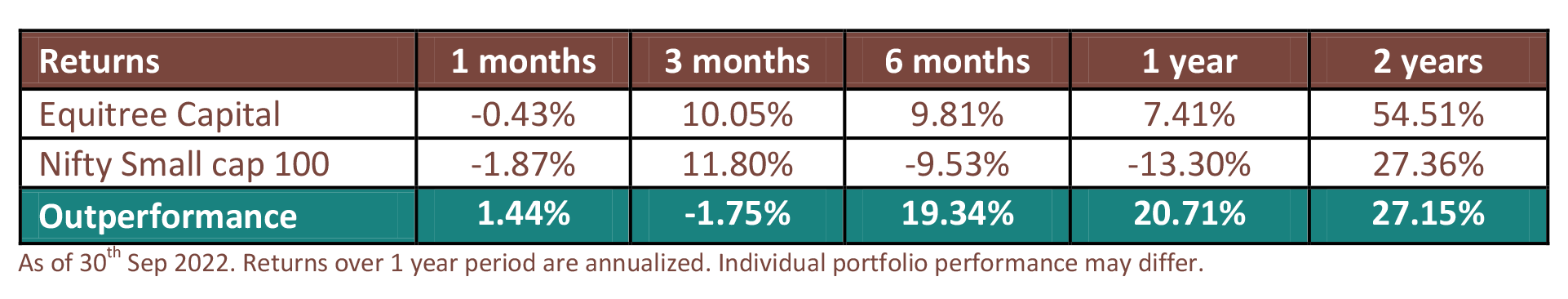

Over the last 6 months Nifty Small Cap 100 index has corrected by ~10%, however, the broader base of the index has seen a different picture with about 50% of its constituents seeing a drawdown ranging between -11% to -66%

Amidst this kind of sell off in the broader market, our portfolio continues to show strong resilience beating the benchmark by ~20%!

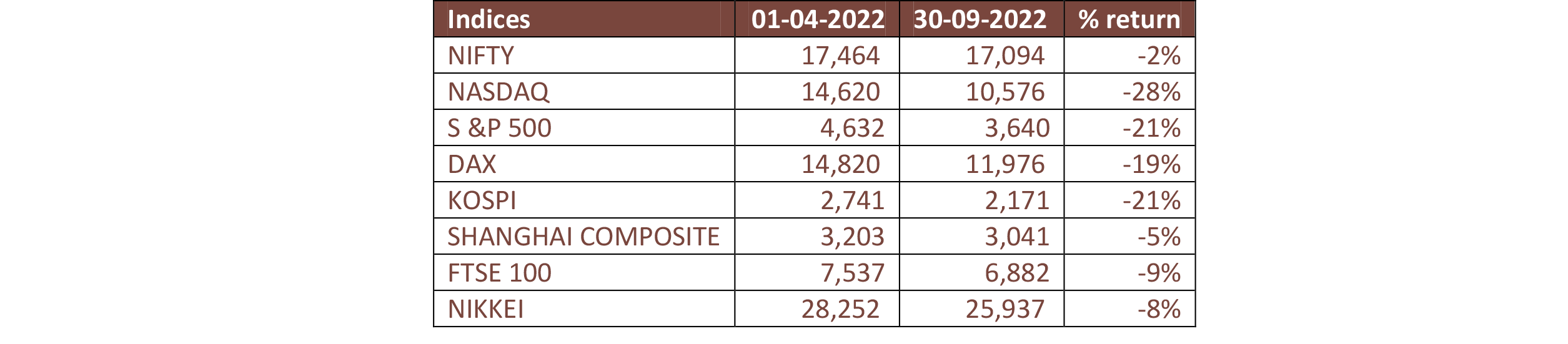

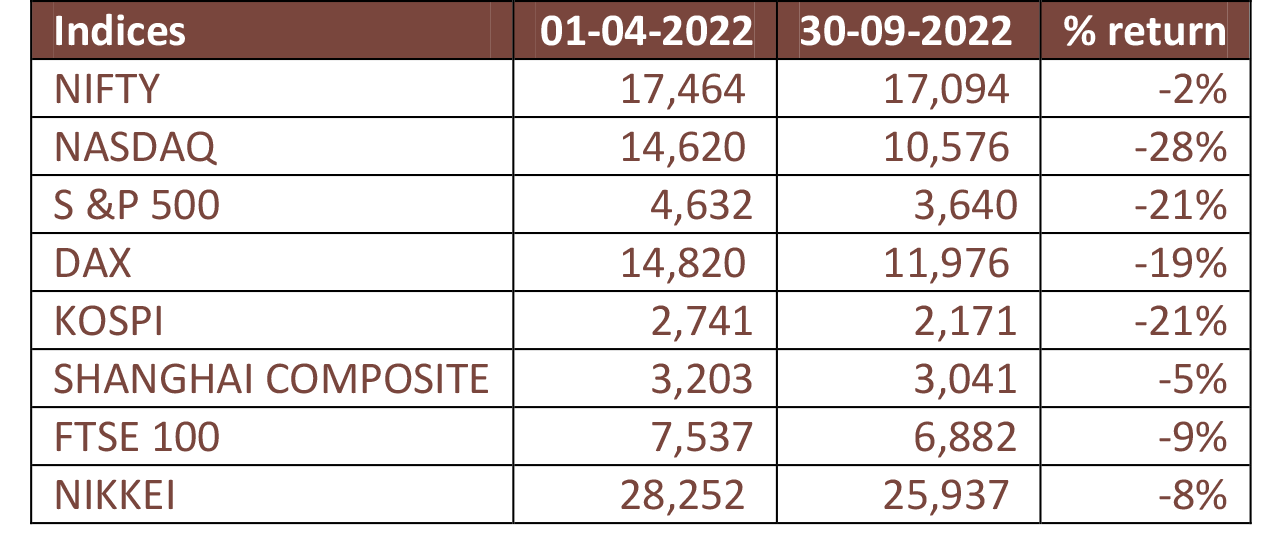

Despite the broad underperformance, the headline Nifty 50 index shows a completely different picture with the index correcting by merely 2% over the last 6 months. This performance stands out even more in the backdrop of global indices losing anywhere between -5% to -28%.

This outperformance of Nifty has led to emergence of the catch phrase “India decoupling” – once again! We take this opportunity to share our two cents on this topic and give our perspective on decoupling in this newsletter.

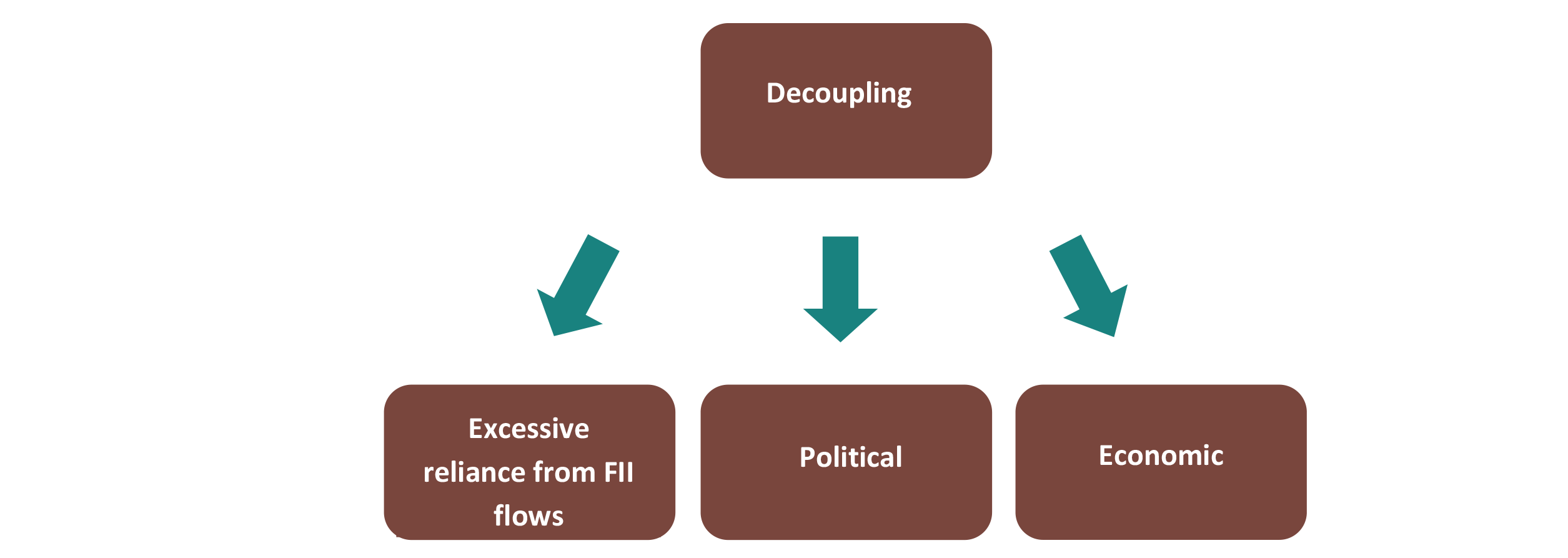

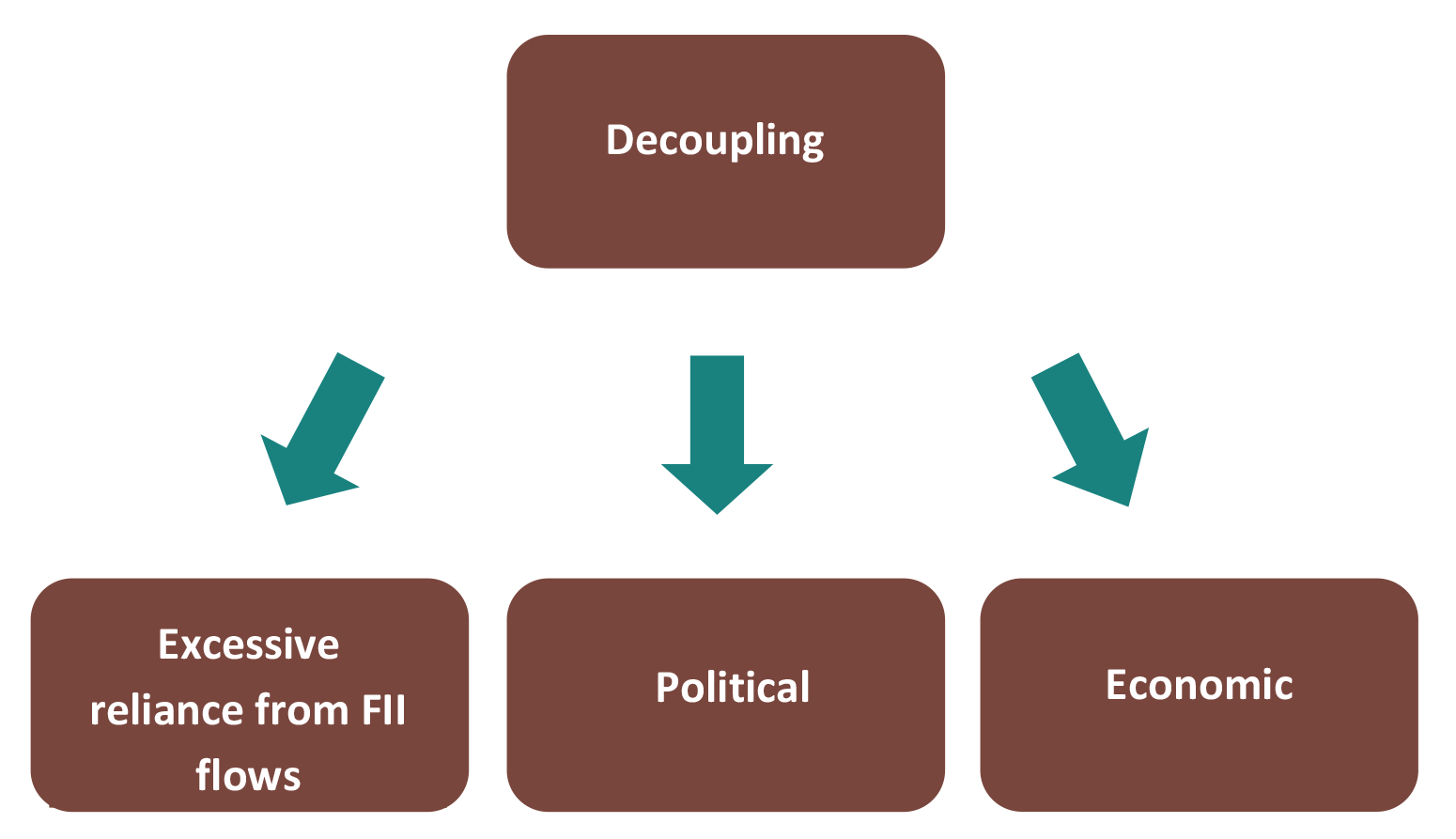

Is India decoupling?– Yes, Indeed. But from its own older self rather than from the world.

India seems to be going through a transformational change from its own old self – more particularly in three macro areas:

-

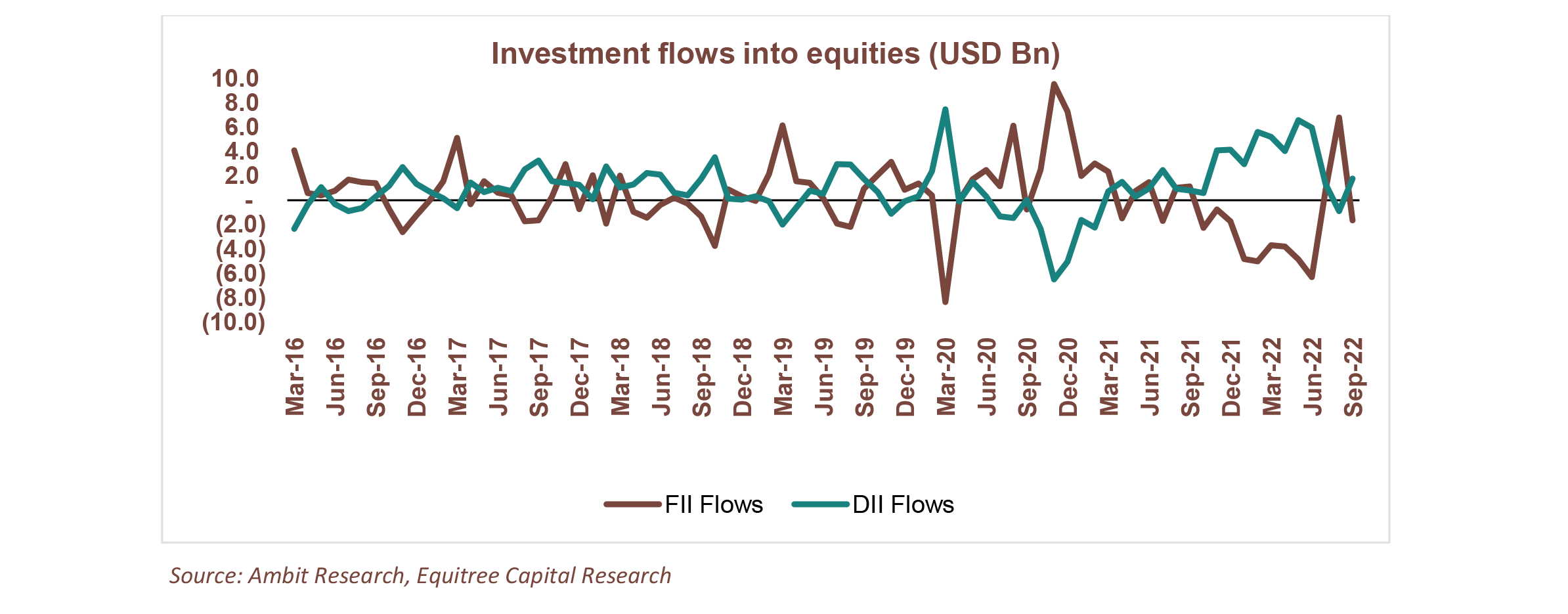

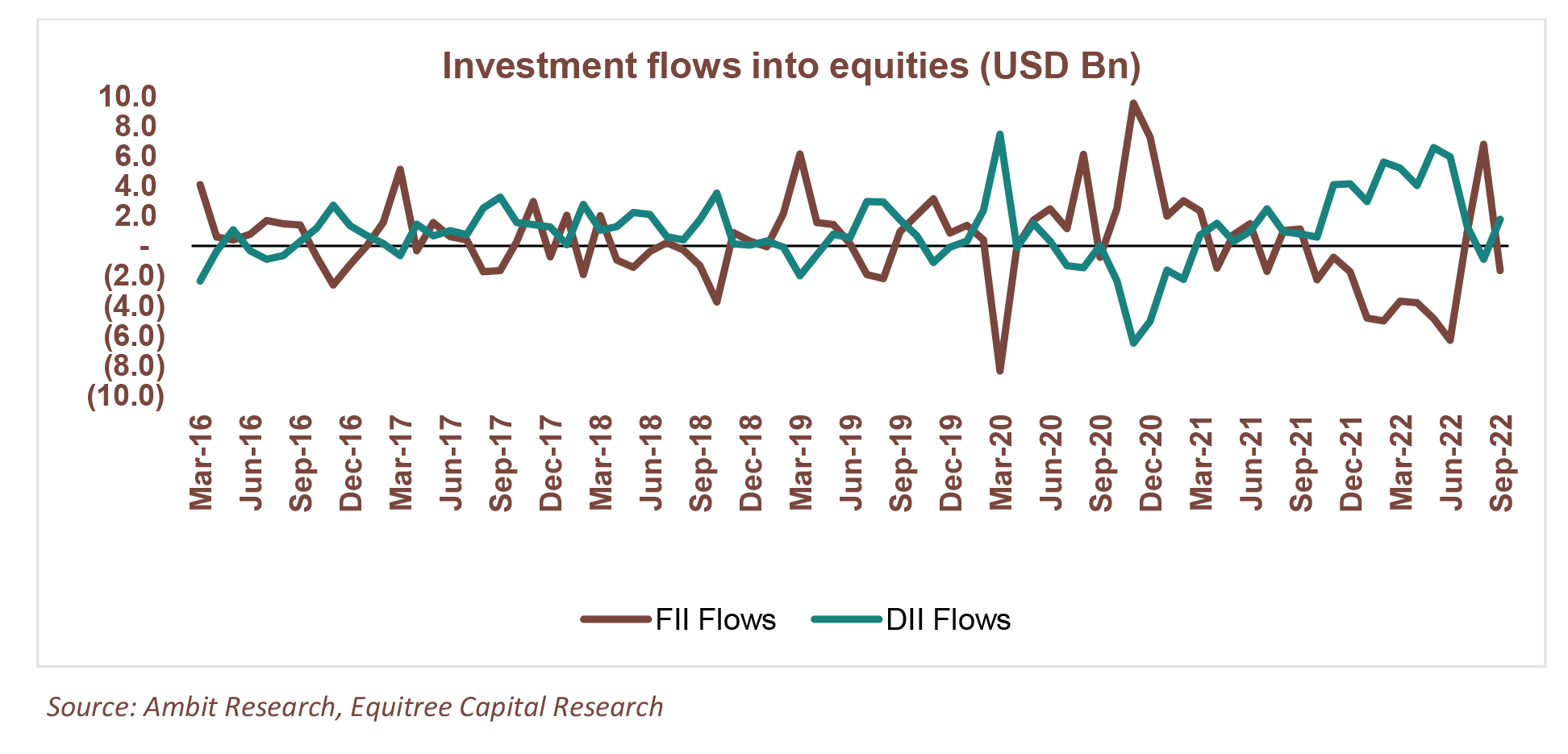

Stock Market Liquidity - Decoupling from excessive reliance on FII flows

FIIs have been on a selling spree, having sold a whopping ~ 27.4 USD bn worth of Indian stocks since Oct 21. The last time India witnessed this kind of a sell off was back in 2008 where the FIIs sold ~14.4 USD bn worth of stocks from Jan 2008 to Feb 2009, which led the market to crash by ~55%. However, this time around, despite the FIIs selling almost twice the amount sold in 2008 (of course one needs to adjust for the currency depreciation etc. but the absolute amount still continues to be large enough), the markets have barely corrected by 3% as the DIIs have infused more than ~ 41 USD bn into the Indian stock market. Had this been the old India, the stock market would have corrected by a much higher percentage. This is a substantial deviation from erstwhile India where the markets were heavily dependent on FII inflows for direction in the markets and could sway easily based on FIIs mood swings. So what has changed in India for reducing this reliance on FII flows? Some structural changes have happened to lead this which includes factors like:- The domestic equity cult has been growing over the years with allocations in equity as an asset class increasing from 2.7% in 2020 to 4.8% of India’s household savings assets. One needs to understand that even at this number Decoupling Political Economic Excessive reliance from FII flows India lags behind substantially from developed markets where equity allocations are as high as ~ 15-20% of household savings – so India has a long way to catch up.

-

The growing equity culture in domestic market has also been evident from:

- The total number of demat accounts have increased from 40.9 million in March 2020, right before the Covid-19 outbreak, to a massive 100+ million accounts for the first time in August 2022 and have more than tripled in the last three years.

- The SIP AUM has grown at 30% annually in the past five years and inflows through SIPs have been growing have remained above INR 12,000 crs since May 2022.

-

In addition, ~INR 25,000-30,000 crs is being invested into equities by the EPFO (Employees’ Provident Fund Organisation). It is currently allocating ~15% to equities market and the government is proposing to increase it to 20% gradually, which would further increase the flows into the equity markets.

-

Politicalstability and growing dominance in world politics – Decoupling from the weak political system plaguing India

Over the last 30 years, “coalition government” had become quite an acceptable norm. However, these coalition governments have always been plagued of putting political agendas ahead of national interest, in turn leaving a weaker government which always lacked in resolve to push significant reforms and / or present a strong “India image” on global platforms. This changed dramatically with BJP winning the 2019 elections on its own which has given them significant room to push through political and economic reforms like implementation of GST, RERA, IBC, PLI Schemes, Direct Benefit Transfer, revocation of Article 370, etc with reduced parliamentary barriers, transforming the image of Indian politics. Likewise, over the last couple of years India has emerged as a stable political leadership on global front as well significantly improving its relationships with other nations and gaining position of strength at global platforms. Whether it was giving befitting military responses to neighbors’ or putting strong resistance for economic decisions which were unfavorable for the country, India has now been taking bold steps and making itself count and heard. For e.g. in 2019, India took a bold step and exited from the 16-country RCEP as it was a target of cheap imports from the member countries and posing a threat to India’s competitiveness. Since then it has been on an FTA signing spree and has recently completed one FTA with UAE and FTAs with UK, EU, Canada and Australia are under negotiations. India’s handling of both human lives and economic situation during the Covid pandemic has now become global discussion point and a matter of appreciation. Emerging as the torch bearer vaccine / medicine supplier to the world has further strengthened India’s political relationships with countries globally. Even during the on-going Russia-Ukraine war, despite all global pressures India has maintained its hard stand and continues to source discounted priced oil from Russia against wishes of Western economies, defying all calls for sanctions and yet emerging as the most sought after partner where the most prominent dignitarieswere queuing up to meet the Indian leadership. Things like promoting the start-up culture, extending the clarion call of “Jai Jawan Jai Kisan” to “Jai Jawan Jai Kisan Jai Vigyaan and now Jai Anusandhan”, attracting the best of manufacturing talent and scale under the “Make in India” initiatives etc. have opened unheard opportunities for the “new India”. All these initiatives have led India to increase opportunities for itself and enjoy a position like never before – in turn infusing a great sense of pride and optimism, fueling confidence and turbocharging the entrepreneurial spirit in the countrymen – decoupling from its own older self and making India truly Atmanirbhar. -

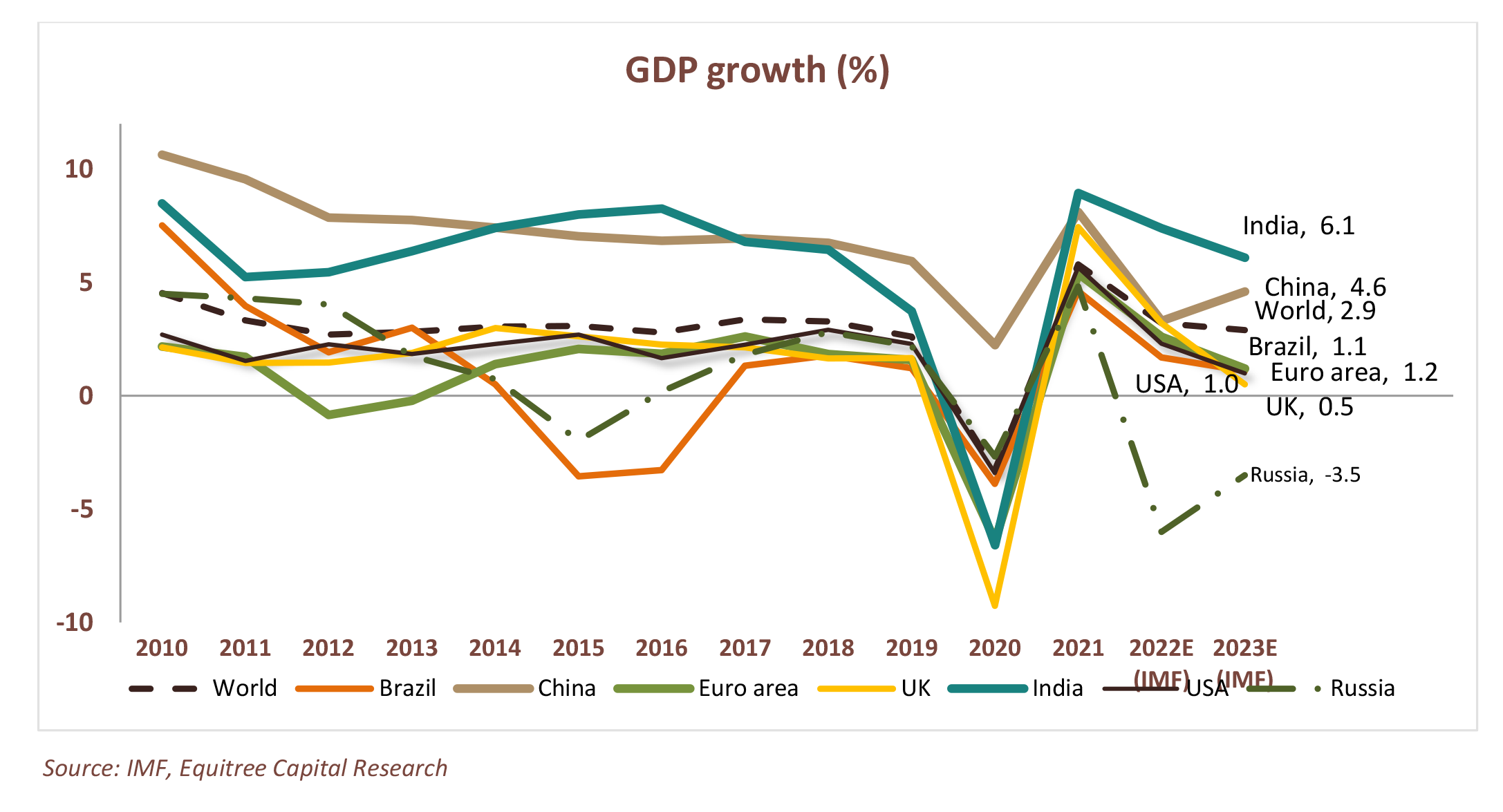

Gaining economic strength – Decoupling from an “under developed” nation

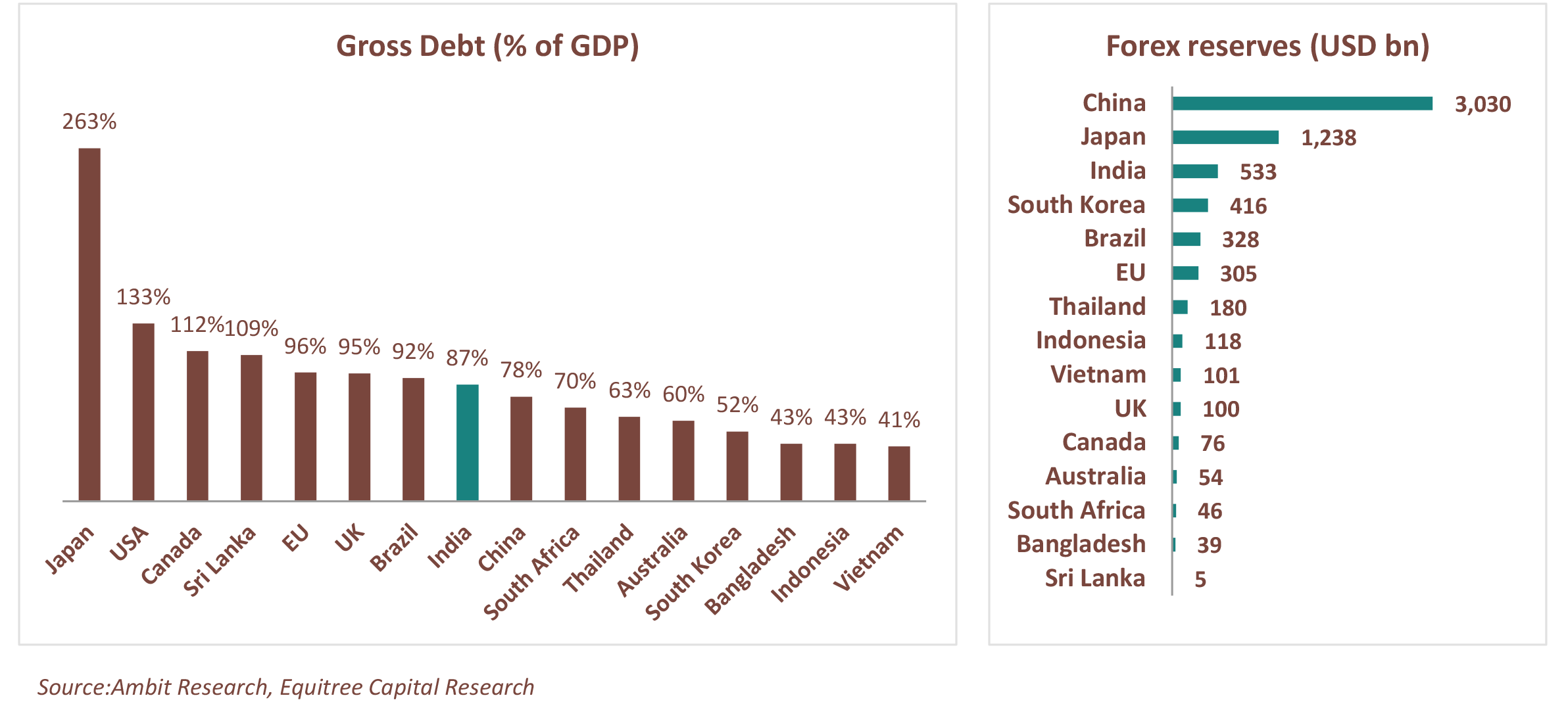

In a growth-starved world, India is projected to be the fastest growing economy in 2022 (7.4%) and 2023 (6.1%), even as other global economies slow, overtaking UK to become the fifth-largest economy in the world.While the debt levels of leading economies have ballooned and currencies have depreciated, India’s position fares far better as the world stares at turbulent times:

- Gross debt to GDP and forex reserves stand at a comfortable level.

Moreover, India’s short term debt is ~20% of its total debt and the ratio of forex to total reserve stands at ~98%, which suggest there are no alarming immediate liabilities and it has enough reserves to cover a good part of the debt in case of a liquidity squeeze.

- India’s GST collections have been buoyant and remained above INR 1.4 lakh crore for the seventh straight month. And direct tax collections have surged 24% to ~INR 9 lakh crs from April 1 to Oct 8, 2022, making up 52.46% of the total budgeted estimate for FY 22-23. This shows the resilience and self-reliance of the Indian economy while the world is struggling to keep the demand steady.

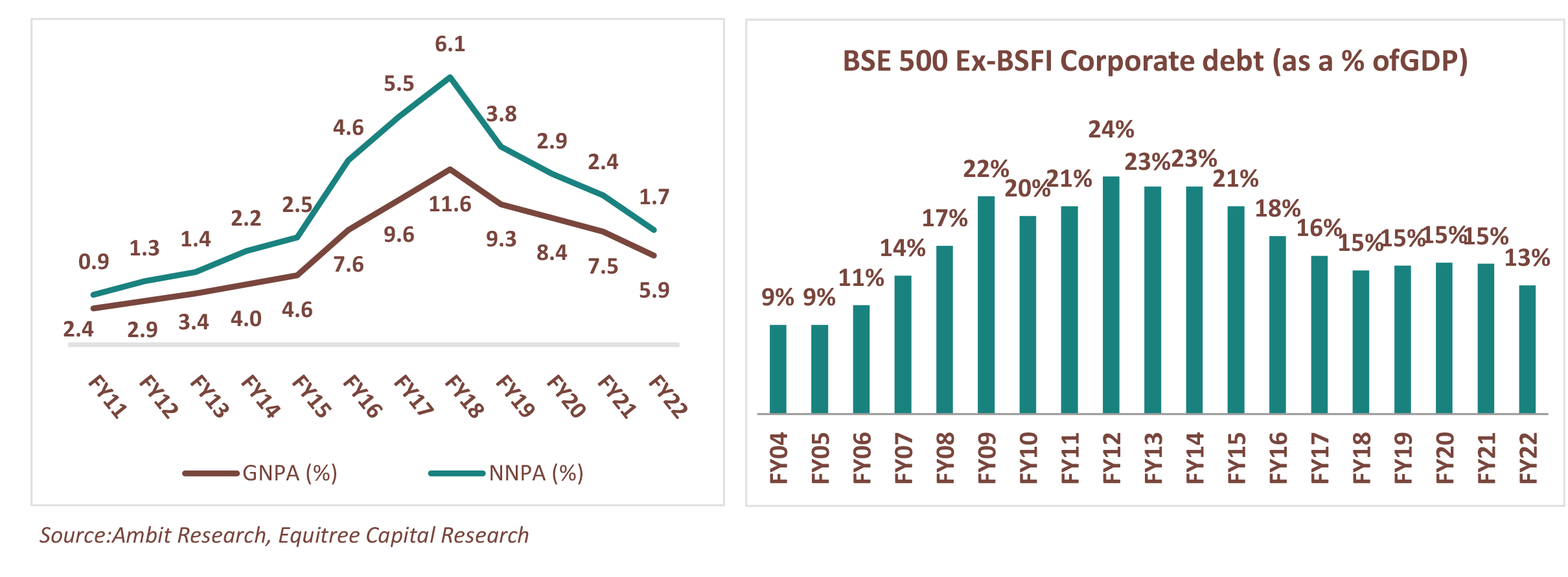

- Corporate India has also been improving itsbalance sheets with NPA ratios declining substantially and corporate debt to GDP coming down to its lowest in over 15 years.

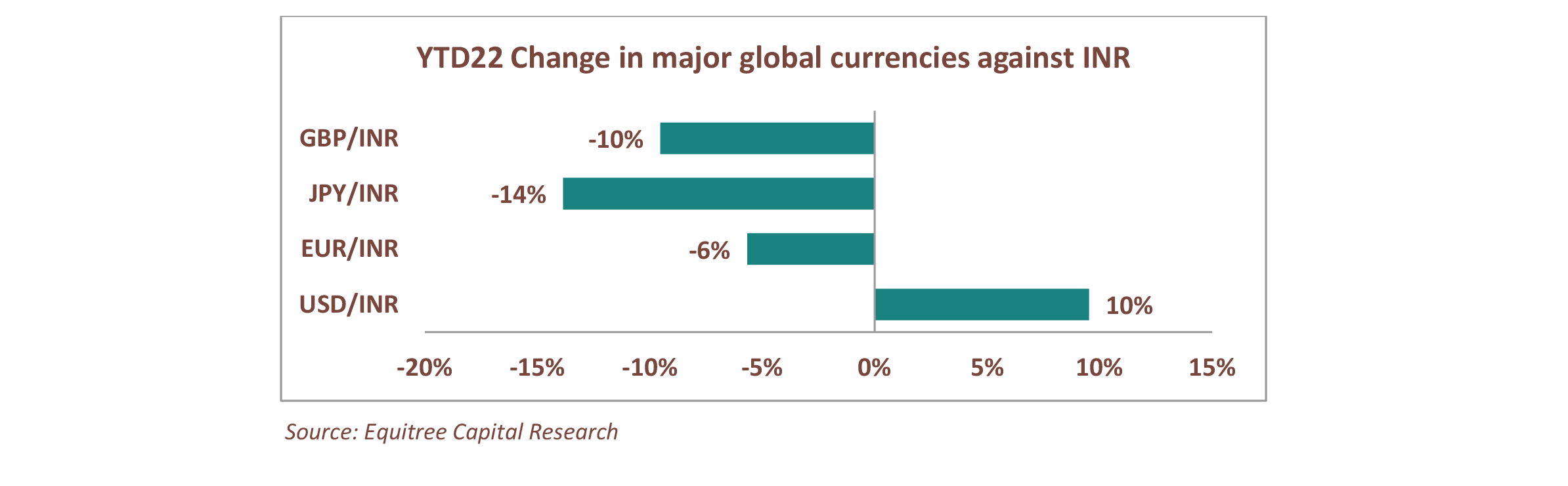

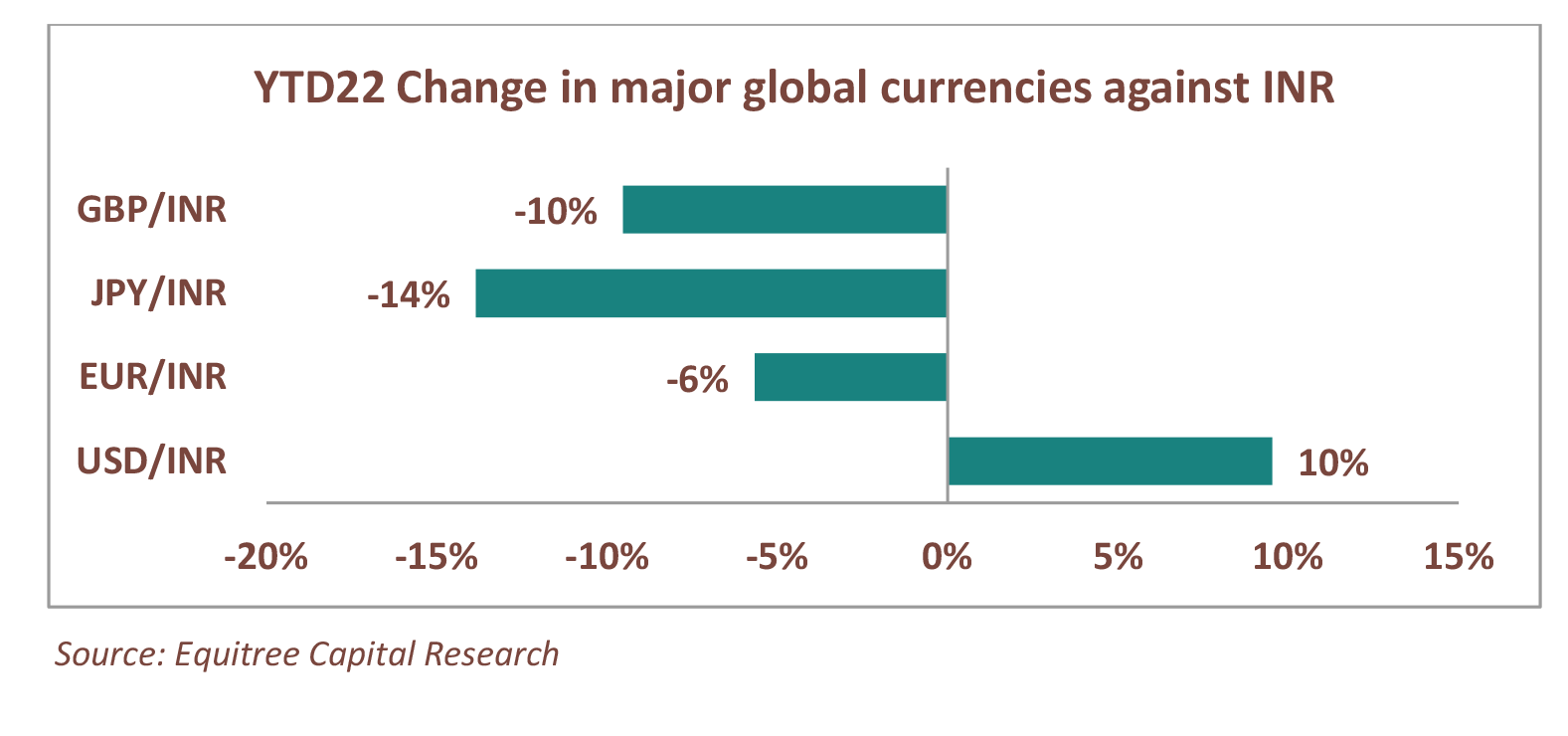

- Strengthening domestic currency led by economic strength

The only major currency against which Indian rupee is depreciated is the USD which has gained strength against all currencies due to the volatile global markets. Even at that, Indian rupee has corrected ~8.2% against USD as against most currencies correcting between 6% to 30%. All these factors put together has catapulted India as the 5th largest economy in the world and is being touted to achieve the top 3 status in about five years - a massive decoupling from its older self from being looked upon as a “poor and developing nation”

The only major currency against which Indian rupee is depreciated is the USD which has gained strength against all currencies due to the volatile global markets. Even at that, Indian rupee has corrected ~8.2% against USD as against most currencies correcting between 6% to 30%. All these factors put together has catapulted India as the 5th largest economy in the world and is being touted to achieve the top 3 status in about five years - a massive decoupling from its older self from being looked upon as a “poor and developing nation”

Can the impending global slow down impact growth story of this “decoupled” India?

-

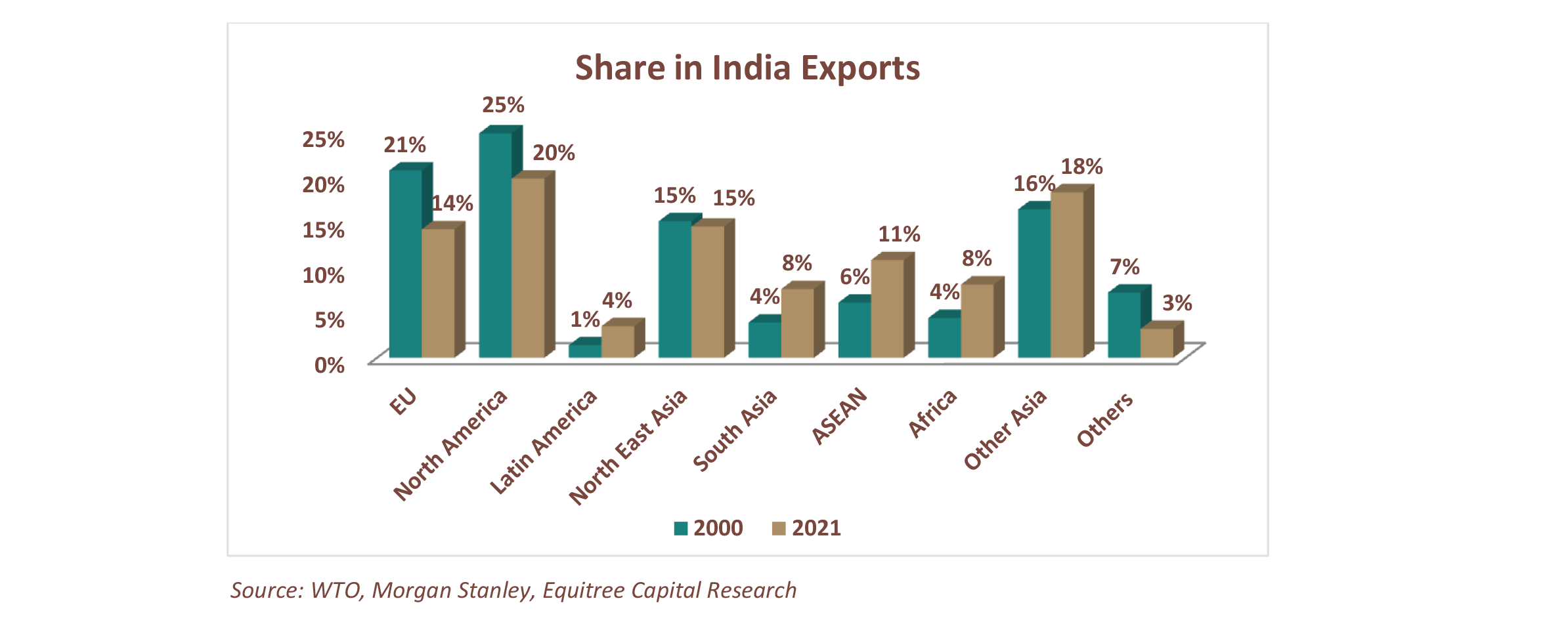

Exports likely to be a mixed bag – win some, lose some

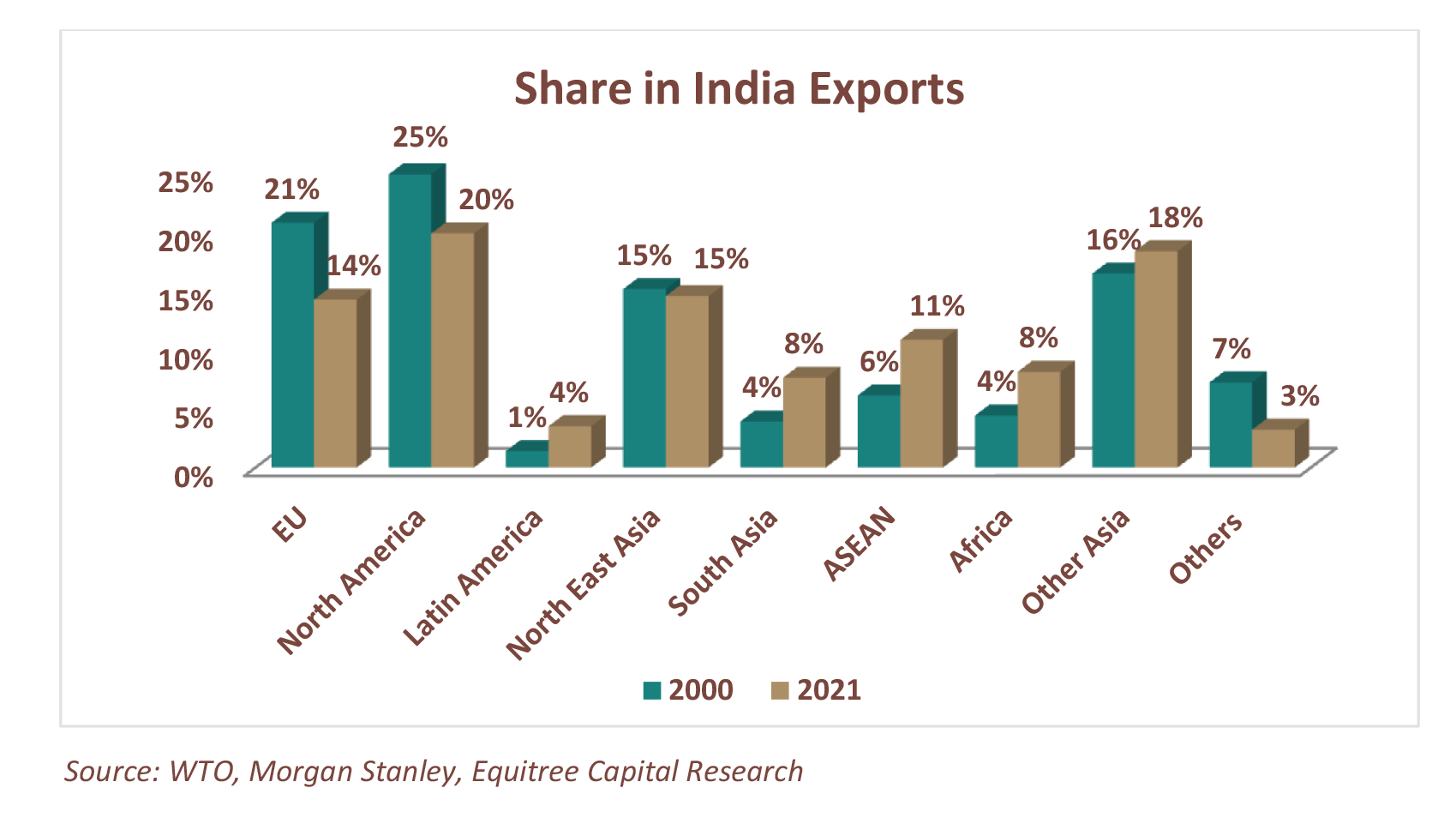

Even after posting a record $400bn in merchandise exports in FY22, India still contributes barely 1.8% of the global merchandise exports – and has largely been there for over a decade! In its quest for gaining market share, India has set an ambitious target of reaching $1 trillion in merchandise exports. Given this ambitious target, an impending slowdown in global markets will indeed impact India’s export growth story to some extent, however, given our small base we believe the impact may not be as deep – we may see a dip in the growth, but growth will happen indeed. We tried looking at India’s export destinations and realize that India’s export contribution to developed countries has dwindled from ~49% in 2000 to ~36% in 2021 and that of developing economies has accelerated from 28.4% in 2000 to 38.9% in 2021 as shown hereunder: Furthermore, the GDP of developing economies is expected to see faster recovery in 2023 as against further slowdown in advanced economies, providing some cushion to the demand from India’s perspective:

Furthermore, the GDP of developing economies is expected to see faster recovery in 2023 as against further slowdown in advanced economies, providing some cushion to the demand from India’s perspective:

We believe that factors like China+1 and now Europe+1 (something that we have spoken about in length in our earlier newsletters) should also help in opening up opportunities for Indian merchandise exports. The impact of slowdown could be to the extent that as global customers may look to consolidate vendors, these opportunities may not be available to completely new players but may get restricted to the ones who already have foot in the door in these geographies and have established themselves as credible partners in the supply chain curve. While the low base opportunity may stand true for the sectors where India has a negligible presence, the narrative of the slowdown impact could be different for the sectors where India has a leading position in the supply chain. For e.g. export of services (IT) where India enjoys a credible place in global market share, home textiles– where India enjoys about 25% market share, gems & jewellery etc. Impact of a global slowdown will be more felt in these segments as the space for growth will be challenged given already higher contribution.

We believe that factors like China+1 and now Europe+1 (something that we have spoken about in length in our earlier newsletters) should also help in opening up opportunities for Indian merchandise exports. The impact of slowdown could be to the extent that as global customers may look to consolidate vendors, these opportunities may not be available to completely new players but may get restricted to the ones who already have foot in the door in these geographies and have established themselves as credible partners in the supply chain curve. While the low base opportunity may stand true for the sectors where India has a negligible presence, the narrative of the slowdown impact could be different for the sectors where India has a leading position in the supply chain. For e.g. export of services (IT) where India enjoys a credible place in global market share, home textiles– where India enjoys about 25% market share, gems & jewellery etc. Impact of a global slowdown will be more felt in these segments as the space for growth will be challenged given already higher contribution.

-

Domestic story continues to buoyant – providing a large cushion against global slowdown

India by itself has been a strong domestic marketas the domestic consumption accounts for ~60% of its GDP. Governments continued thrust on infrastructure spending as well as other policies for encouraging domestic manufacturing augurs well for Indian corporate. We are particularly enthused to look at segments like:-

Infrastructure:

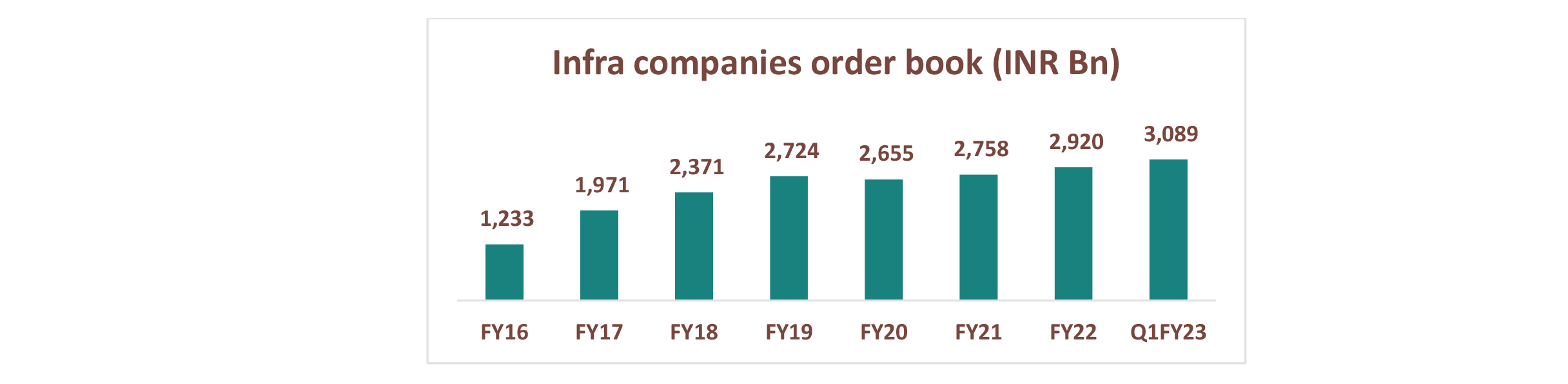

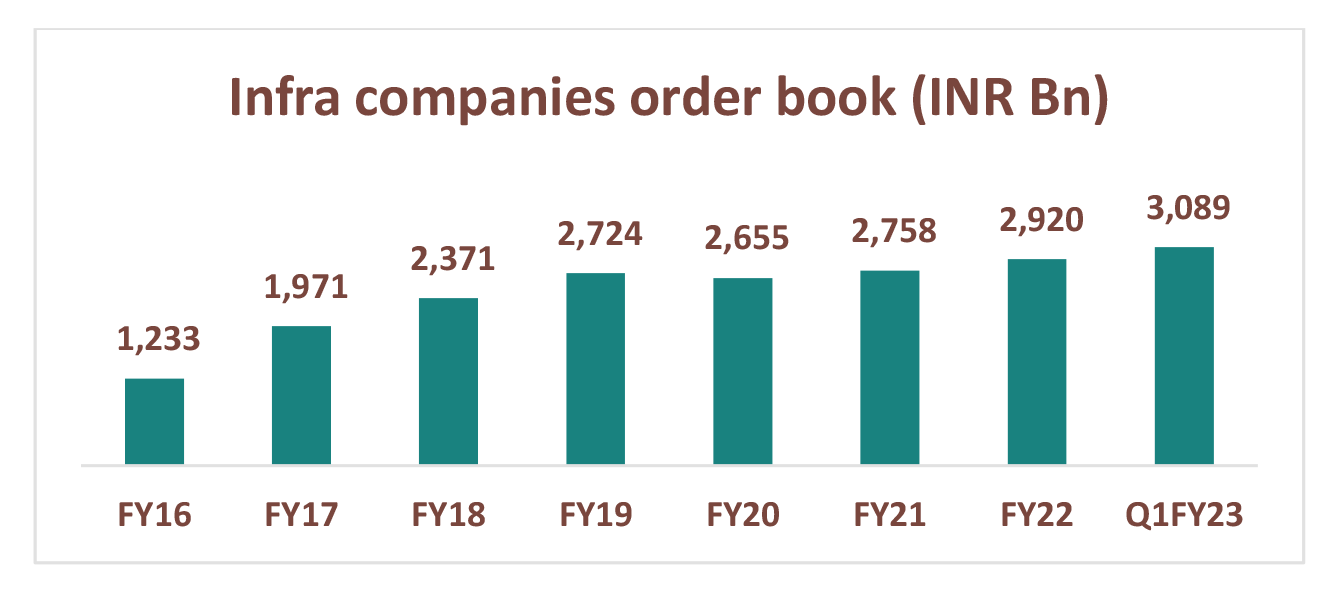

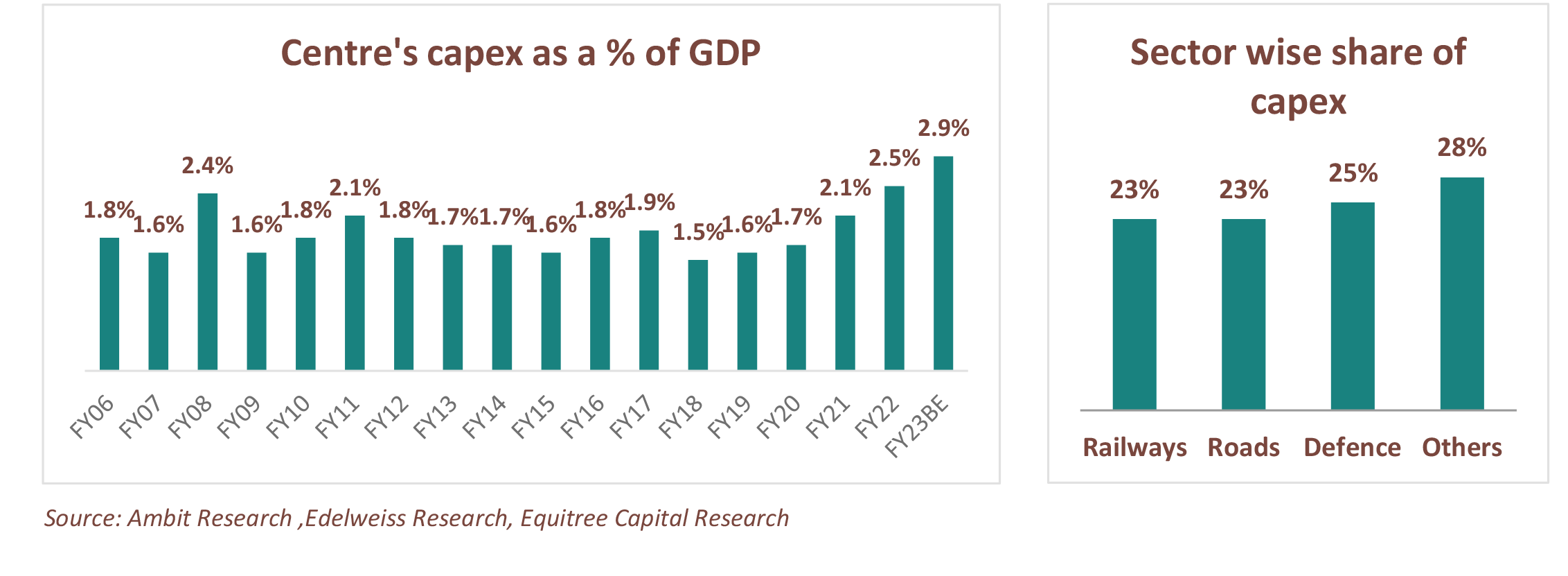

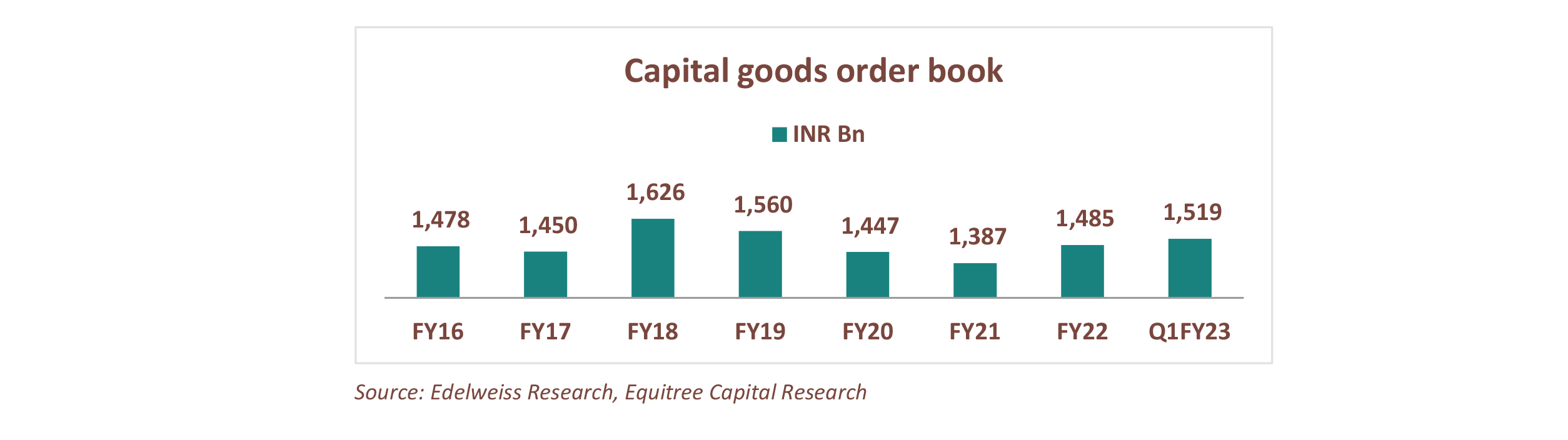

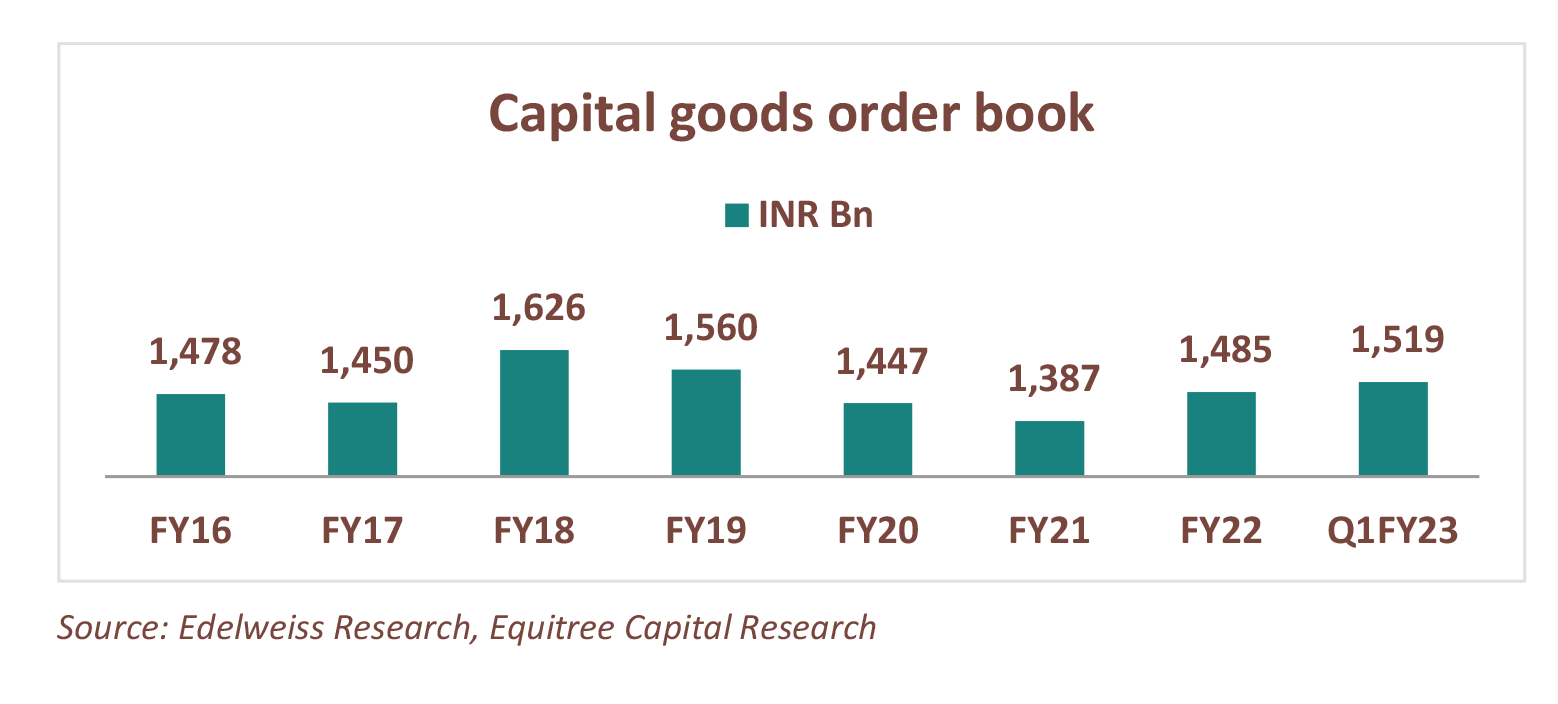

Government has allocated ~INR 7.5 lakh crores in capital expenditurefor financial year 2022-23. Centre’s capex as a % of GDP is expected to hit an all-time high which has a higher multiplier effect compared to revenue expenditure. Order book of infra companies are at a multi-year high:

-

Engineering & Manufacturing

Private capex cycle is picking up in a big way with a wide range of companies undergoing expansions. India hasn’t seen this kind of capexcycle in the last 6-7 years.

Large scale manufacturing projects announced by global majors like Foxconn and Apple is likely to open up opportunities for companies in the entire supply chain. Various policy initiatives taken by the government like reducing the corporate tax rate for new manufacturing units, introduction of schemes like PLI and PM Gati Shakti, which have helped India improve its ranking in the ease of doing business from 142 in 2014 to 63 in 2022 should also all assist in boosting manufacturing in India.

Large scale manufacturing projects announced by global majors like Foxconn and Apple is likely to open up opportunities for companies in the entire supply chain. Various policy initiatives taken by the government like reducing the corporate tax rate for new manufacturing units, introduction of schemes like PLI and PM Gati Shakti, which have helped India improve its ranking in the ease of doing business from 142 in 2014 to 63 in 2022 should also all assist in boosting manufacturing in India.

-

Chemicals & Fertilizers:

Chemical companies have seen a decent correction in their stock prices bringing down the valuations to reasonable levels now. A lot of these companies enjoy global leadership positions and have been moving up the value chain. The correction in their valuations have rendered a lot of them attractive as they consolidate their position. European Chemical players had the advantage of low gas price, which led to setting up of large-scale capacities of bulk chemicals that also helped it in scaling up of specialty chemicals value chain.Now with the ongoing energy crisis, many European plants have cut production of key chemicals upto 50%, providing a Europe+1 opportunity. The China+1 strategy and a prolonged crisis (elevated gas price) would compel European companies to start collaborating (technology transfer), to shift energy-/electricity-intensive chemicals, and consequently, specialty chemicals out of Europe and/or outsource more. Indian Chemical companies should benefit from such initiatives in the medium to long term as they are poised to emerge as a credible and a primary/alternative supplier to the world. -

Defense:

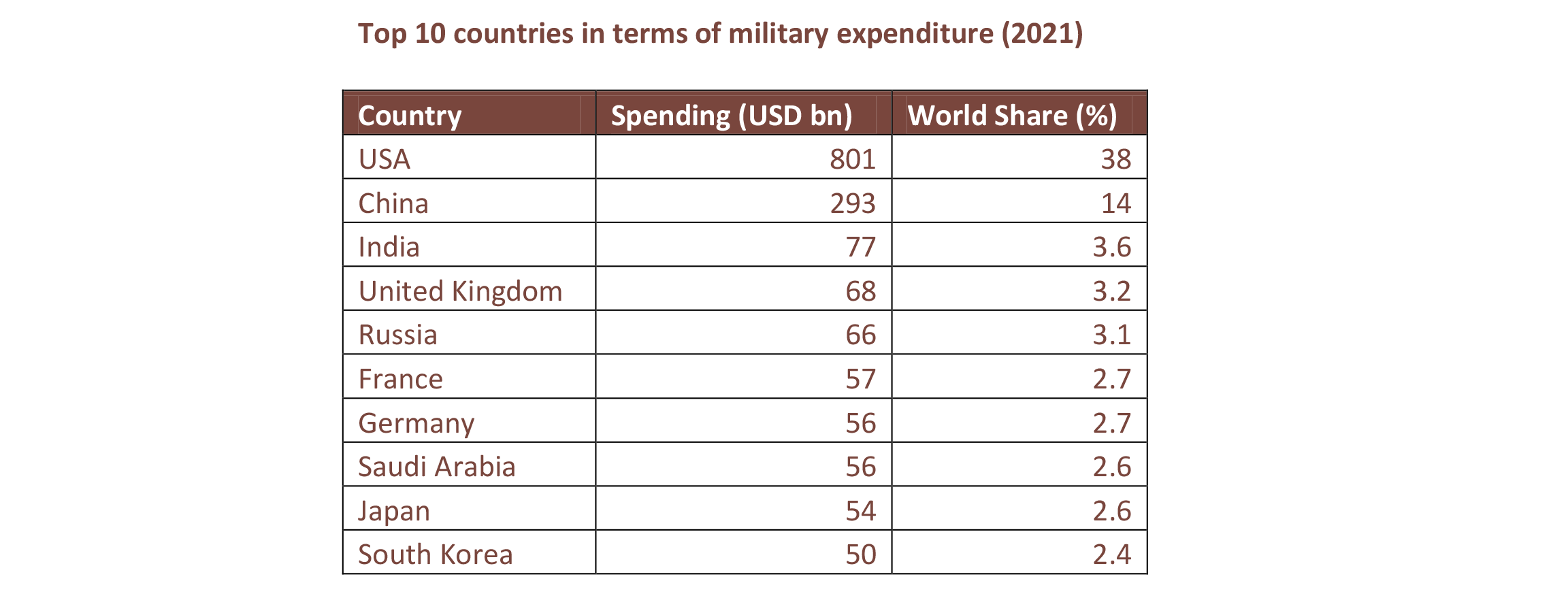

India is the largest importer of arms in the world and accounts for 11% of the global arms sold. To increase indigenization and reduce dependence on imports, the government has mandated between 30 per cent to 60 per cent of home-made components, depending on the nature of the military purchase or where it’s purchased from. India is the third highest military spender in the world and has set a defense budget of ~INR 4 lakh crore excluding the component of defence pension. The sector is buzzing on the back of a strong order book, orders from the government, technological advancements and requirements in keeping with the geopolitical environment and export orders The defence sector is set to evolve as a strategically important sector. India has set a target of turnover of Rs 1.75 lakh crore in defence manufacturing by 2025, noting that boosting domestic production of military equipment is a major focus of the government. This target is now further being scaled to placing orders of Rs. 8 lakh crore over the next 8 years providing a multi year opportunity for the industry.

The sector is buzzing on the back of a strong order book, orders from the government, technological advancements and requirements in keeping with the geopolitical environment and export orders The defence sector is set to evolve as a strategically important sector. India has set a target of turnover of Rs 1.75 lakh crore in defence manufacturing by 2025, noting that boosting domestic production of military equipment is a major focus of the government. This target is now further being scaled to placing orders of Rs. 8 lakh crore over the next 8 years providing a multi year opportunity for the industry.

-

Agriculture:

Amid the ongoing Russia-Ukriane war, the world is grappling with food shortage. During such testing times, the Indian government is rightly focused on ensuring food security for the domestic economy and has imposed ban on certain commodities like rice and wheat. India commands the world’s second largest population and its own consumption is much more than the surplus available for export, which explains its miniscule share in global food and agriculture trade and agriculture trade at 2-3% vs EU’s 50% and US’ 10%. It spends a huge sum on food, power and fertilizer subsidy to boost the farmer’s income. As the country is faced with multiple issues of declining arable land, erratic rainfall and rising population, increasing the yield per hectare is the only solution available to the government. Hence, we believe, sectors like fertilizers, agro chemicals, piping and irrigation systems, solar panels and pumps, etc, that will help to adopt advance technology, improve the agriculture infrastructure and productivity of the land and reduce the burden of subsidy will tend to benefit remarkably.

-

Infrastructure:

How is our portfolio positioned?

Our portfolio is exactly walking the talk and the opportunities that we are looking at are focused on identifying sectors/companies that are expected to defy the gloomy global economic outlook.

Q1 performance of our portfolio companies has been in line with our expectations given the volatile commodity environment and unstable geo-political scenario.

Our portfolio companies (excluding financials) have posted a median Sales and PBT growth of 30% YoY. However, the median PAT growth of our companies has been at 19% YoY due to a higher tax incidence in Q1 of current year.

We expect some volatility in margins in Q2 for some of our companies given the volatile raw material and currency fluctuations. However, we believe H2 of FY23 will be better as commodity prices are expected to stabilize, which would make the demand much more sustainable.

Overall, the valuation of our universe stands at ~11x FY23E EPS, which we believe is extremely reasonable and expect some of our companies to generate a CAGR of more than 25% over the next 2-3 years. We continue to use the market volatility to build up on our portfolio as well as look for newer opportunities that fits in to our investment philosophy.

Lastly, we wish all our investors and well wishers a very Happy Diwali and a Prosperous New Year!

Please feel free to reach out to us at pawan.b@equitreecapital.com / skabra@equitreecapital.com with your comments/ suggestions/ feedback etc.

Warm regards.

TEAM EQUITREE