“Volatility is the price of admission. The prize inside are superior long-term returns. You have to pay the price to get the returns.”

— Morgan Housel

Dear Investors,

Experiencing once in a lifetime things seem to be the new normal since beginning of 2020 – starting with pandemic to seeing crude oil trading at -$20 and inching back to all-time highs of $135 to being a witness to such a long drawn military aggression (unheard of in recent times) to seeing commodity prices flying through the roof and followed by an equally sharp decline to adapting from a decade of near zero interest rates to as much as 5% in a year…..phew! In a lighter vein after this rollercoaster ride, one thing that comes to mind is a well-known dialogue from a hindi movie “Babaji ab bas, aur nahi, ab meri zindagi boring bano do”

As an investor one can factor in “normal” economic cycles, however maneuvering this kind of extreme volatility is never easy – aptly reflected in the markets as well where we saw new highs being made at the end of 2021 and since then experienced a broad-based drawdown where ~2 out of 3 stock are down by an average of ~ 33% (explained more on that hereunder).

Our Performance :

In this backdrop, we are glad to share that on a 3-year basis (Apr’20 – Mar’23) Equitree has emerged as one of the best performing portfolio manager with annualized compounded return of 45.37%!

We did see our share of corrections, more particularly over the last 3 months(post Q3 results) as some of our core holdings reported a margin-hit due to raw material inflation as well as lower inventory stocking due to volatility in the input prices. Despite this, we closed FY23 with a marginal draw down of 2.36% against -13.81% return of our benchmark index Nifty Small Cap 100 – outperforming the benchmark by a good 11.45%

With the raw material prices cooling down, our sense is that the worst is behind us so far as the margin impact is concerned and we should see better Q4 nos vis-à-vis Q3.

FY23 – a year of extraordinary events

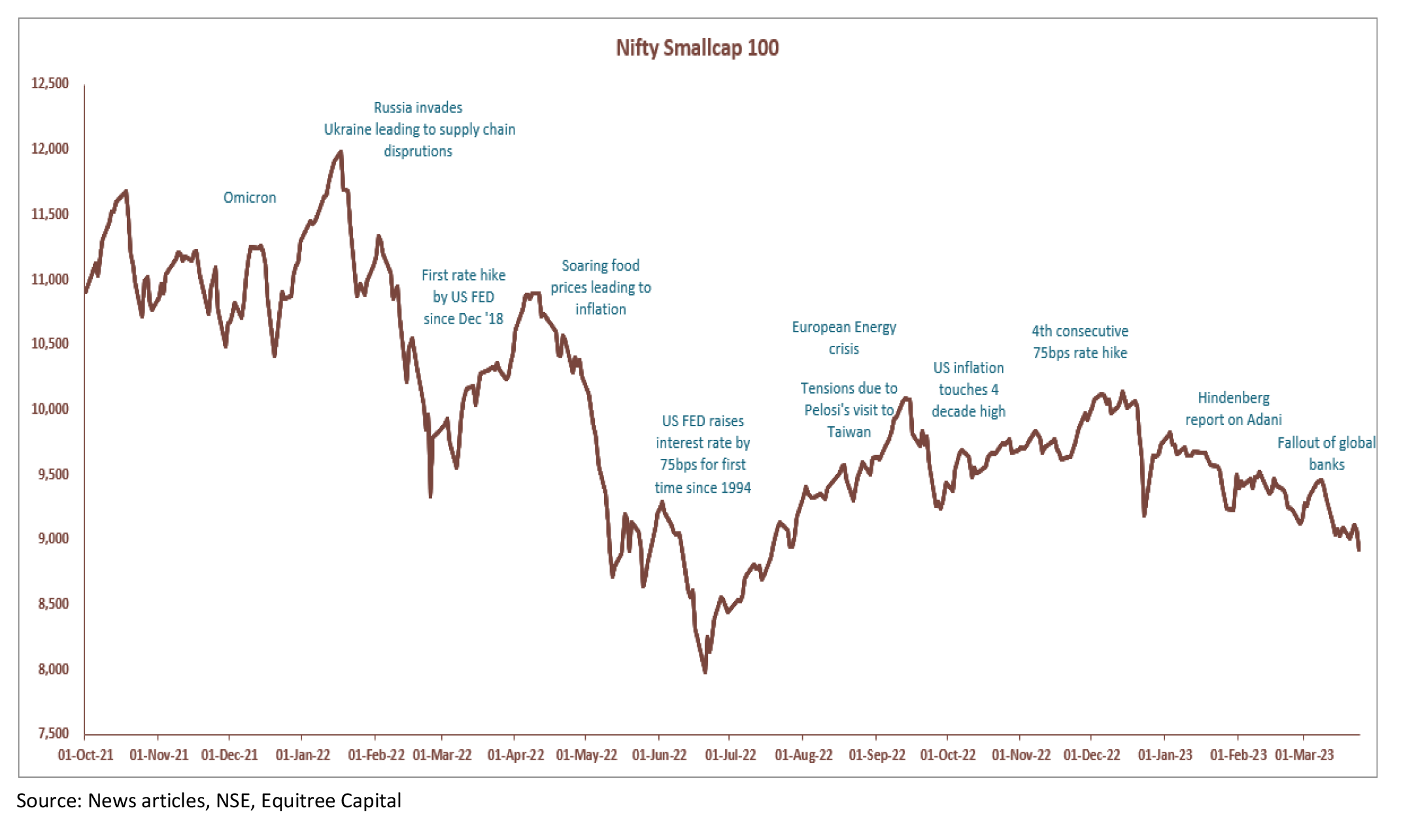

We have discussed various events that took place during FY23 in our earlier newsletters. We present hereunder a timeline of all the key events during the past year that have left a deep mark on the markets:

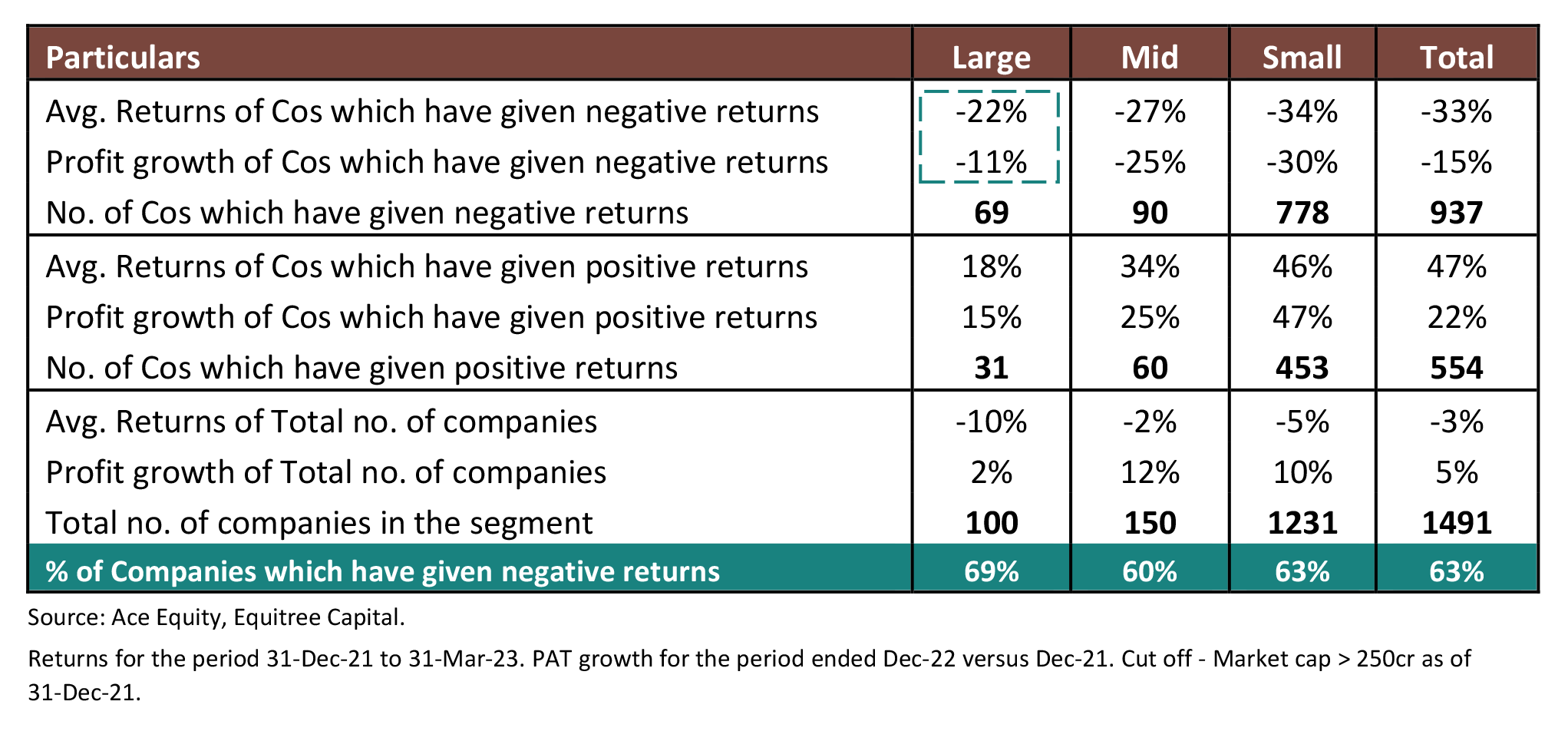

Despite all the volatility, the headline indices of Nifty 50 and Nifty Midcap 100 have delivered 0.03% and -1.34% returns respectively over the 15-month period which may make someone believe that everything is hunky dory. But as they say – the devil is in the detail – a detailed analysis shows us that ~2/3 of the total stocks have given a negative return of 33% on an average! We share the statistics hereunder:

Some interesting observations from the above data :

- Large cap companies with high PE ratios have seen a contraction in their PEs, whereas the Mid and Small Cap companies have seen a correction which is in line with the drop in their reported earnings.

- Across all segments, the smaller number of companies which have done well on the bourses have done extraordinarily well, significantly improving the returns on an overall basis.

- We find ourselves also in a similar structure where 57% of our portfolio companies have delivered significant outperformance with 49% return over the last 15 months whereas the balance showing a drawdown of 26% on average.

- Booking profits, taking cash calls, and following a staggered approach to building up the portfolio has also helped us to contain the damage as against the deep correction in the market.

So how should one tread in these kinds of markets?

“ We think short-term volatility should often be viewed as an opportunity to the long-term investor who seeks enduring businesses at reasonable prices.” – Christopher Begg

Volatility is inevitable….and life moves on!

- Volatility does test an investor’s conviction all the time, but it can also be an investor’s friend provided the investor has done his due diligence well enough.

- Businesses go through their cycles and as investors in businesses (not stocks) it’s best to remain invested as long as the underlying structural story is intact (irrespective of short-term blips).

-

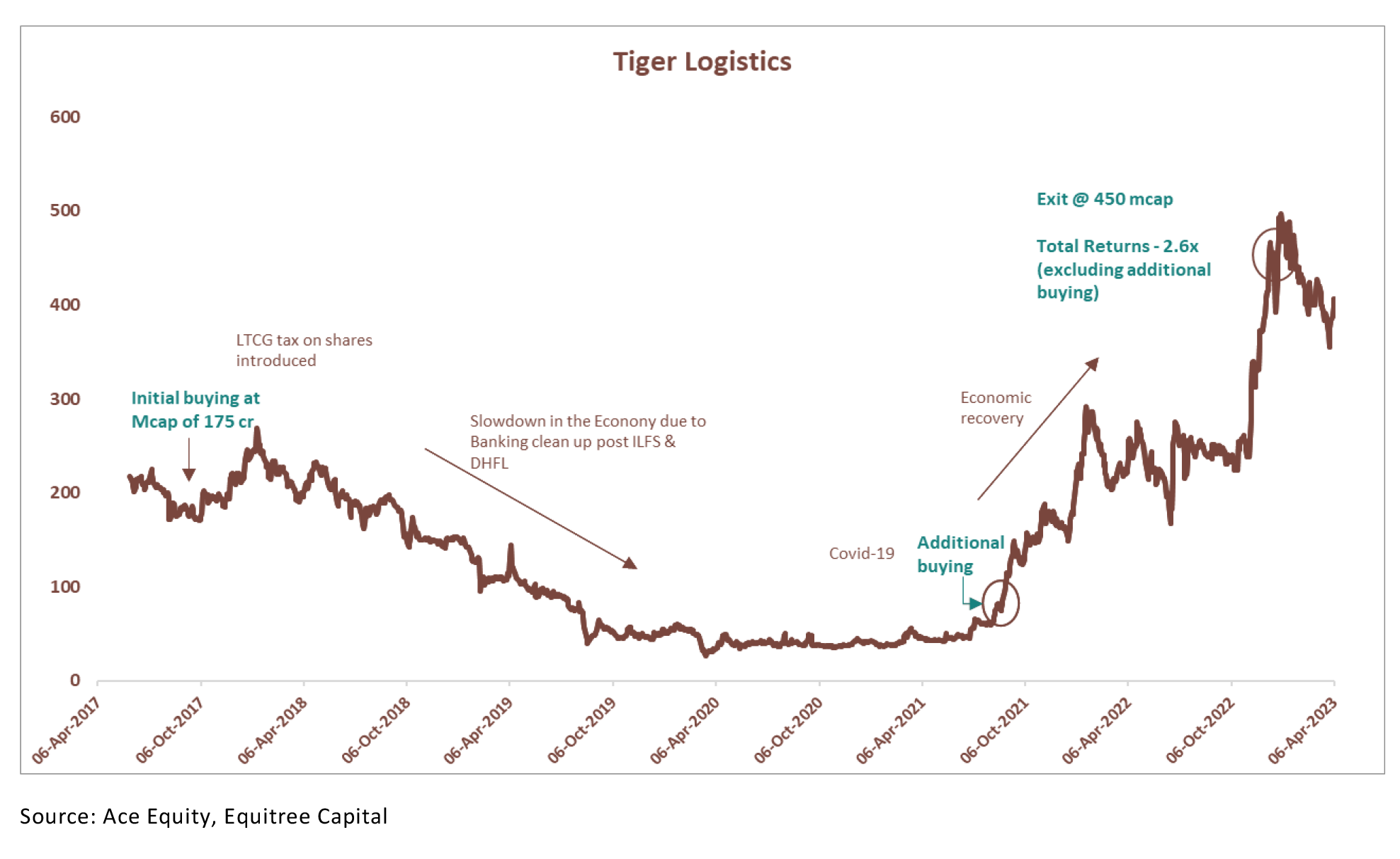

We explain this by an example of one of our portfolio company – Tiger Logistics

- Being a logistics company, its fortunes were impacted due to the slowdown in the economy. From reporting annual profit of Rs. 10cr in FY17, the company reported a loss of Rs. 15cr in Q4FY21. From being debt free, the company had to take on debt to manage the downturn.

- During this phase, we were constantly monitoring this business, doing our own due diligence as well as talking to the promoter of the company to get a sense of the business trajectory.

- As soon as we got comfort that the business was improving, we started adding more towards the end of 2021.

- Our close monitoring of the business and continuous reassurance of the promoter’s pedigree gave us the conviction to hold on to the stock despite a significant drawdown in the absolute stock price.

- As the economic situation improved so did the company’s fortunes – today the company is churning out quarterly profit of Rs.8cr+ and has become debt free again – in turn creating significant value for shareholders.

- The stock has become a multibagger for us giving 2.6x returns from our initial buying price over our holding period (assuming that we did not build up more at lower prices). At our blended price of acquisition, the returns are over 4.5x in 5 years.1

- This is what we call “private equity approach to public market investing”.

End of volatility may be in sight!

We spoke about pause of burning issues of 2022 in our Dec’22 newsletter. Going by the recent developments we believe that we could be closer towards the end of the tunnel. We share our thoughts hereunder that makes us believe so:

- The banking crisis looks to be largely contained both in the US and Europe thanks to the Central banks’ swift action in preventing contagion. Further the one-year long funding program by the US FED suggests that the rate hikes may soon reverse which will help the banks recover the mark to market loss on their bond portfolio.

- There are increasing talks by leading economists / US FED members battling for max one more rate hike before FED hits the pivot. We have recently seen the RBI as well as the Australia’s central bank pausing rate hikes as they assess the impact of past increases.

- US CPI data has also been showing signs of cooling off with the latest reading coming down to 5% from 6% reported earlier. The drop in employment data also suggests that the FED may not take a very aggressive stand so far as interest rate hikes are concerned.

- While Europe (particularly UK) is still glaring into a possible recession coming up, US economy has shown far more strength with the IMF latest projection showing a modest growth of 1.6% rather than a recession for the US economy.

-

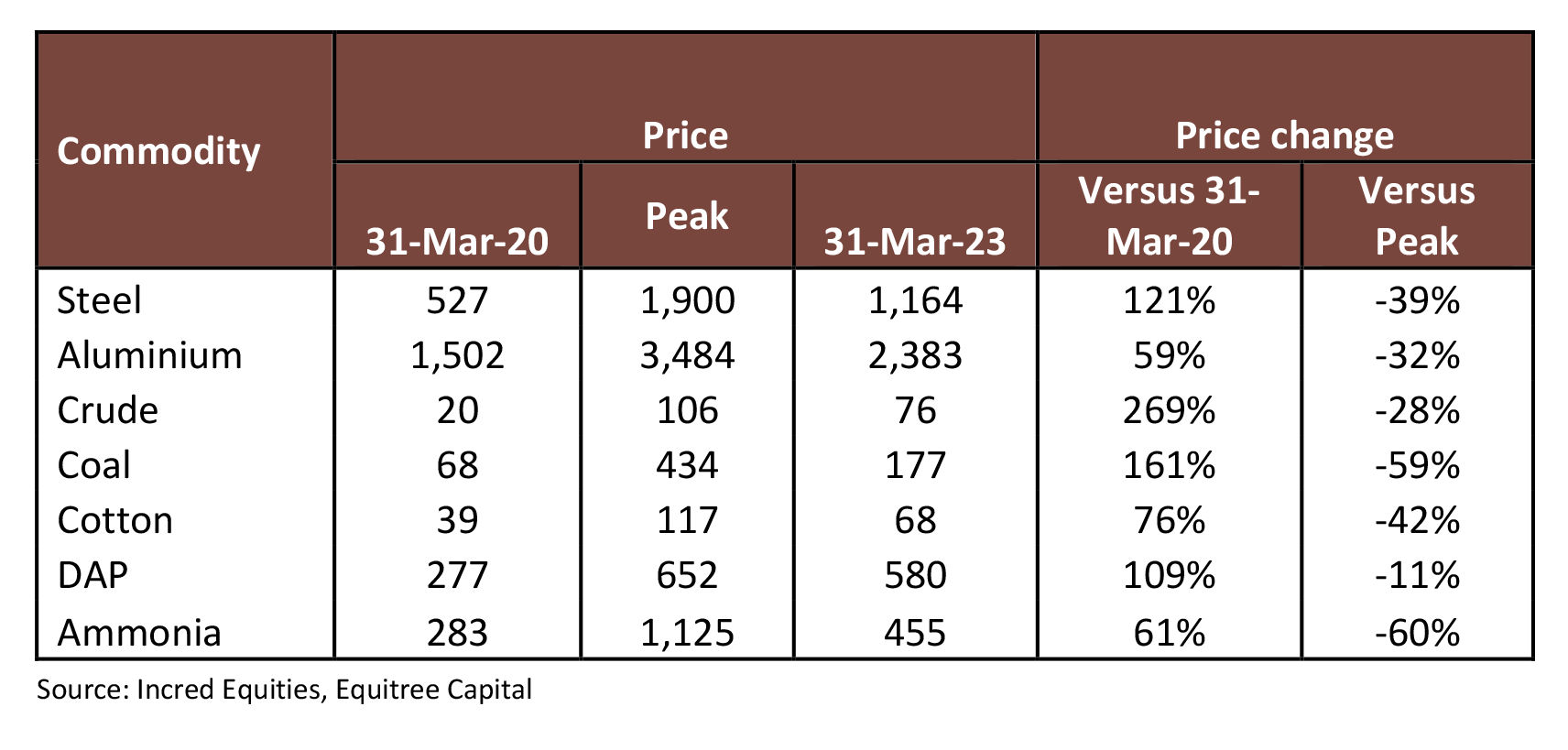

Commodity prices, even though not back to pre-covid levels, are off from their peaks and are stabilizing. This would help business recoup lost margins as well as increase demand as channel partners look to re-stock the inventory given the stability in prices.

-

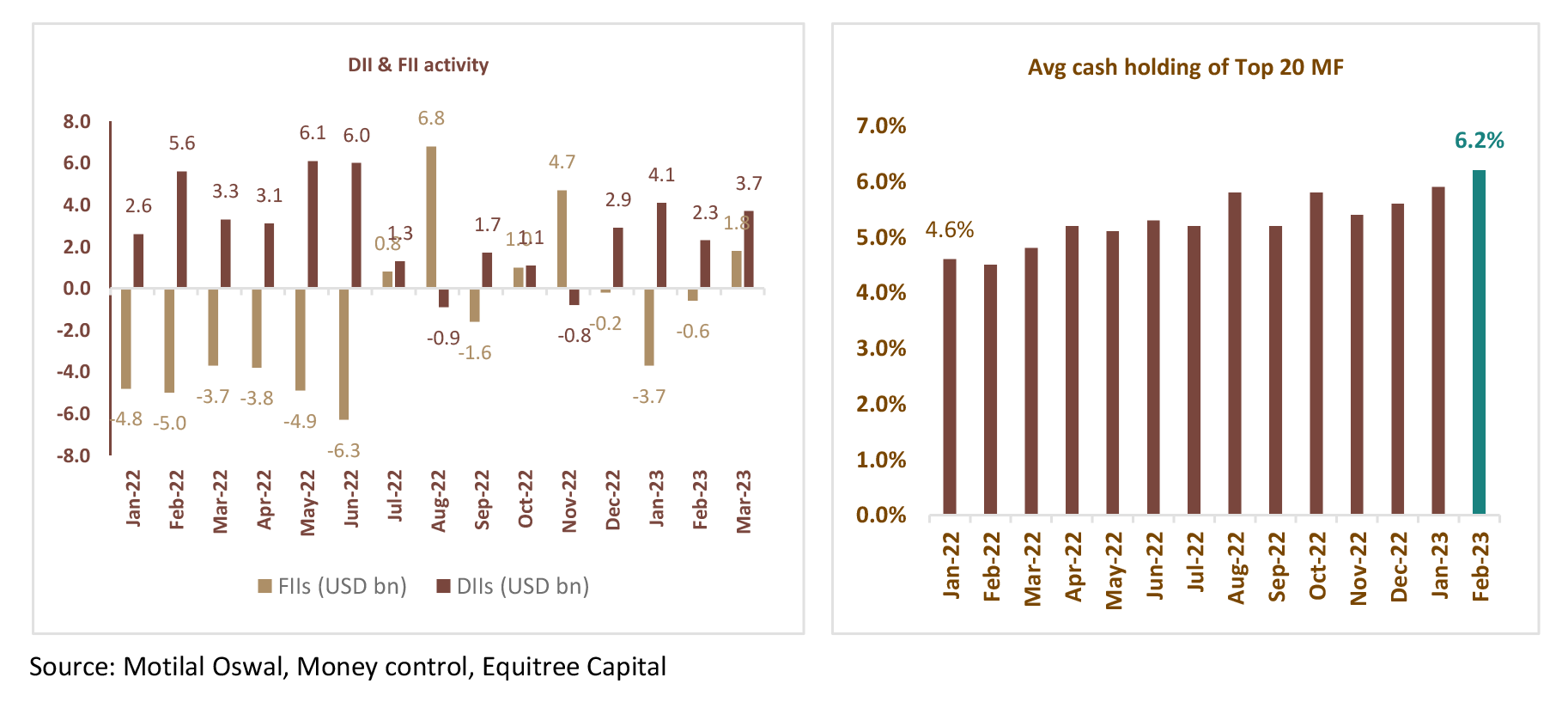

FIIs have been net sellers in the last 10 out of 15 months. DII activity has also been subdued off late. Mutual funds were sitting on INR 63,000 cr of cash as of February end. With India continuing to emerge as one of the fastest growing economy, we strongly believe that a lot of this money will be start getting deployed as soon as some green shoots are seen at the macro situation.

On ground endorsement of our focus investment sectors

With so much of global gloom and doom theories questioning India’s manufacturing / industrials driven growth, we decided to talk to some of our focus industries on the ground to get a first-hand assessment of business impact / visibility. We quote hereunder some of the interactions to showcase the kind of stuff that we are seeing:

-

An auto ancillary promoter - import substitution playing out:

“A leading 2-wheeler manufacturer has contacted us for localization of parts for high end bikes as they are finding it difficult to import from Japan. A total of 14 parts are under discussion. Earlier we refrained from supplying to that particular OEM as we didn’t get enough margins, but now they have agreed to work as per our terms.” -

An industrial battery manufacturer – Europe+1 playing out:

“Russia is looking for alternate suppliers as Europe has stopped supplying. Russia’s railway market is an entirely new market for us. Russian market is huge, and it can pave way for long term supply contracts. Russians visited our factory and have taken sample batteries with them for testing.” -

Another auto ancillary promoter – product and geography expansion playing out:

“We are increasing our exports by adding new customers, entering new geographies, and increasing wallet share with existing customers. On the domestic side, we are adding capacities specifically for a leading OEM for their EV offering.” -

A kid’s apparel exporter – vendor consolidation playing out:

“Due to the inflationary situation, smaller suppliers are finding it difficult to supply to the larger clients. Customers are increasing their sourcing from larger suppliers like us as they want stability in supplies. One of our customers has asked to us to manufacture men’s apparel as well as they want to consolidate their vendors.” -

An Infra EPC player – strong and sustained order book playing out:

“Order book to touch INR 20,000 cr by FY27 from INR 11,209 cr in FY22. Metro projects to be the major contributor to revenue and order book.”

Despite all the noise on export slowdown etc. that we have been reading, the latest data on this subject shows that India’s total exports have grown to a record $770 billion in 2022-23 as against $676 billion in 2021-22 registering a growth of 14% on y-o-y basis. Of this, goods exports have been reported to grow at 6% while services exports have grown at 27%!

We understand that challenges are indeed going to be there, and one cannot paint everything with the same brush – the global uncertainties will continue to plague certain businesses and will create opportunities for some other. The crux for us is to be able to do a ground up analysis of businesses which can emerge stronger and leverage the opportunities as the dust settles down.

Outlook for FY24

While the last couple of quarters got impacted due to the extreme volatility in commodity prices, this in no way has impacted the long term structural story of our companies.

We expect Q4 to be better than Q3 and lead in to a much better FY24.

As normalization sets in, we are looking at a significantly better FY24. One also needs to keep in mind that FY24 performance would have a low base of FY23 for comparison which may amplify the growth nos for FY24 – given this, we expect PAT of our portfolio companies to grow by 30% y-o-y, on a conservative basis!

Risks

We believe that the markets may continue to be volatile over the next 3-4 months as news flow keeps coming in on interest rate hikes from Fed / RBI and other global issues.

As mentioned earlier in the newsletter, our expectation is that these issues should settle down over the next couple of months and stability should come back to the markets.

On the business side – with commodity prices cooling off, the only risk that pertains is more than expected slowdown in the global markets.

Valuation

We strongly believe that the recent correction in the stock price of some of our portfolio companies caused by the damp FY23 nos should be used by investors as an opportunity to build up on the portfolio from the next 18-24 months perspective.

Currently, our portfolio is trading at a PE multiple of mere ~12x FY24E PAT, and we strongly believe that given the growth prospects of our portfolio, we should see significant alpha generation over the next 18-24 months.

Time and again we come across investors trying to time the market, however in our kind of investing it may be futile to keep waiting for everything to be clear on the table before one decides to jump in – one it actually never happens that way and two – it doesn’t take too long for the market sentiments to change. Case in point being a swift and sharp recovery of ~5% in the first two weeks of April itself! Nothing much has changed in the underlying businesses since March to April to have driven this kind of recovery in the portfolio.

We strongly recommend investors to make good use to this opportunity and increase allocations to equities at this point in time.

Please feel free to reach out to us at pawan.b@equitreecapital.com / skabra@equitreecapital.com with your comments/ suggestions/ feedback etc.

Warm regards.

TEAM EQUITREE