“ Widespread fear is your friend as an investor because it serves up bargain purchases. ”

— Warren Buffet

Dear Investors,

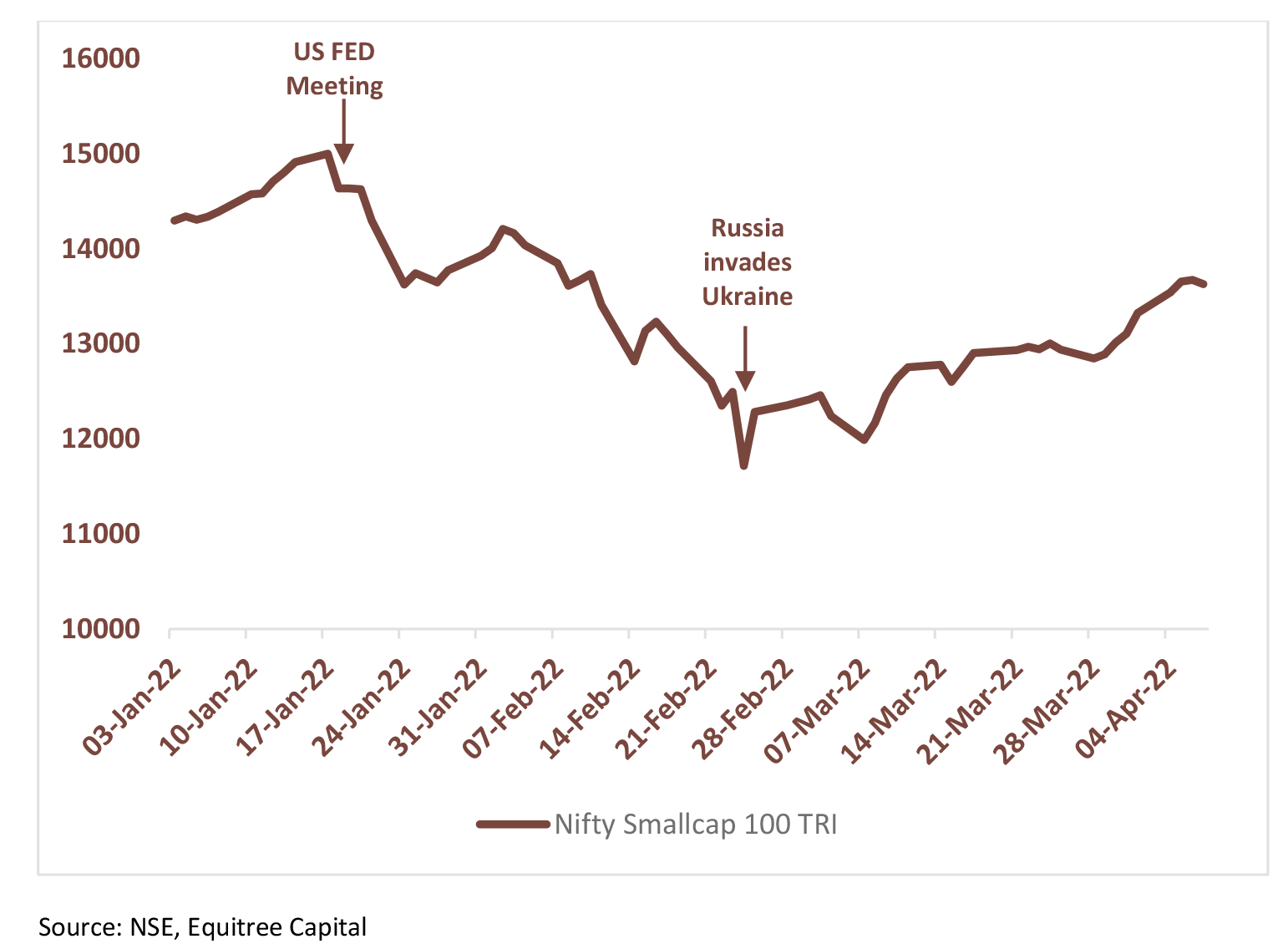

Since our last newsletter, we have seen significant volatility in the broader market owing to variety of factors such as Russia-Ukraine crisis, rising inflation globally, impending interest rate hikes, strengthening of bond yields etc. – all of which has kept the markets on tenterhooks during the last quarter oscillating like a yo-yo.

As can be seen from the chart above, Nifty Small cap index saw a correction of 28% from the high and has since recovered 13% from the bottom, but still continues to be 13% below the high it created before the volatility started.

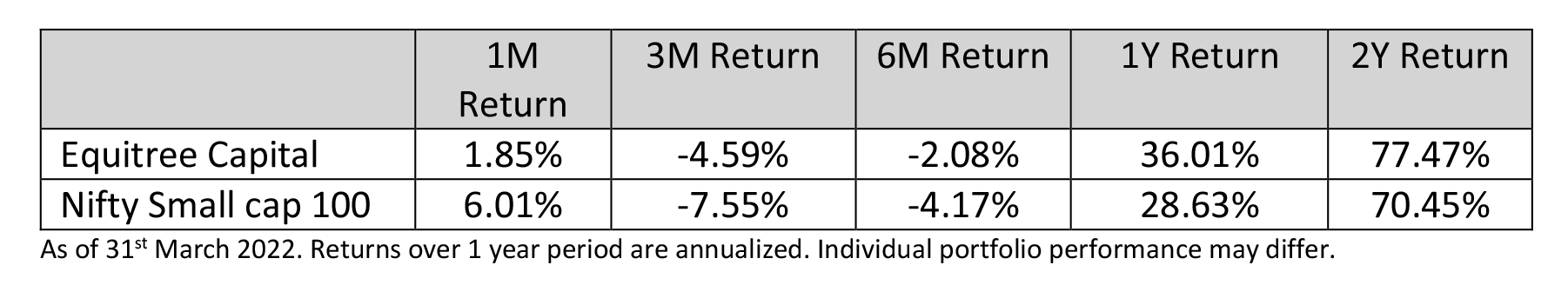

This volatility led to over 70% of the Portfolio Managers struggling to even match up the benchmark returns. We are happy to share that despite all this volatility, we have been able to keep our head up delivering ~ 36% return in FY22, putting us in the top quartile performer – second time in a row consecutively!

FROM BISCUITS TO FUEL, THE WAR IS DRIVING UP PRCIES OF ALMOST EVERYTHING

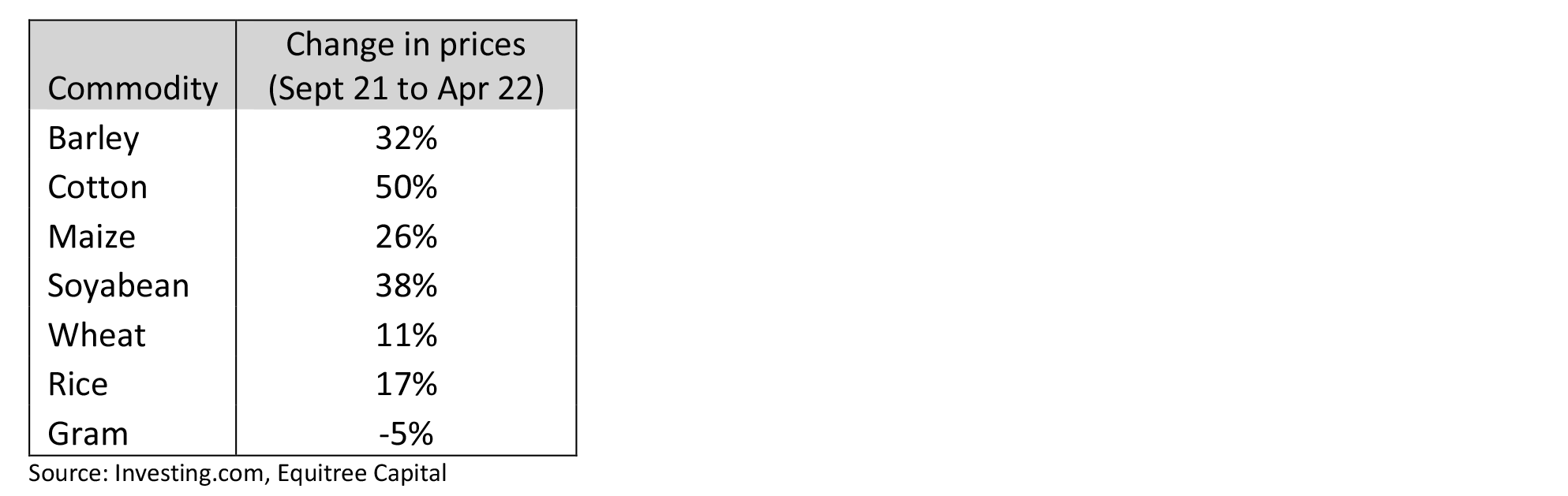

Russia and Ukraine are among the biggest exporters of raw materials. Due to the war, supply of commodities such as wheat, copper, nickel, ammonium nitrate has been disrupted and the resultant surge in prices of commodities has delivered another blow to the global economy that was already reeling from the impact of Covid-19 and rising inflation, forcing companies to adopt varied strategies to manage the situation.

Sectors such as steel, FMCG, cement, automobiles and textiles are facing higher input prices due to the conflict. Major steel companies have increased prices by 10-15% in the last two months. FMCG players are also expected to hike their prices by a similar quantum soon.

Businesses are experiencing short-term margin squeezes as they’re only being able to pass on price hikes to consumers in a staggered manner. Cyclical sectors like consumer durables and automobiles are feeling the pain due to the longer lag in passing on prices. Even if the companies are able to pass on the costs to consumers, demand may be impacted thereby affecting the post-covid recovery.

We expect to see impact of increasing raw material prices and margin squeeze in some of our portfolio companies too in Q4. We are continuously reviewing the situation and will check if we need to rationalize our growth projections for the portfolio companies after seeing Q4 results and getting a better understanding of the companies’ ability to pass through the raw material price hikes.

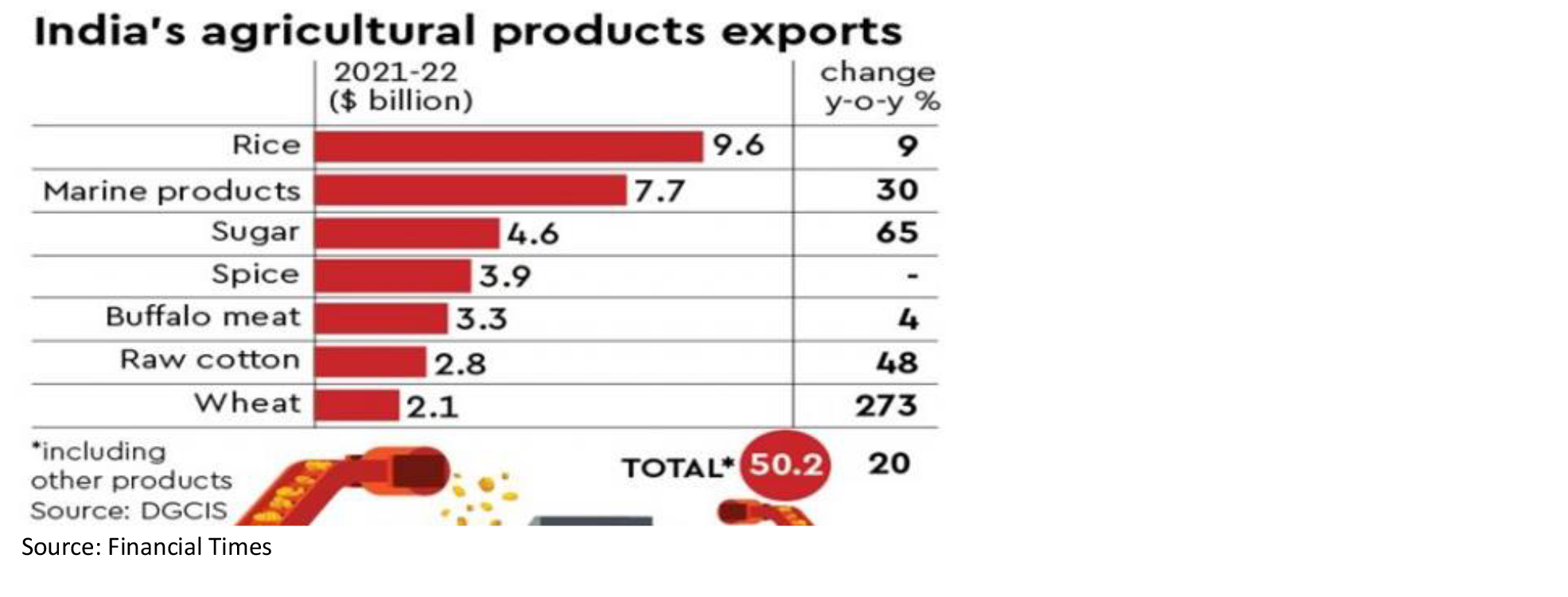

AMIDST THE CRISIS INDIA GETS READY TO SUPPLY TO THE WORLD

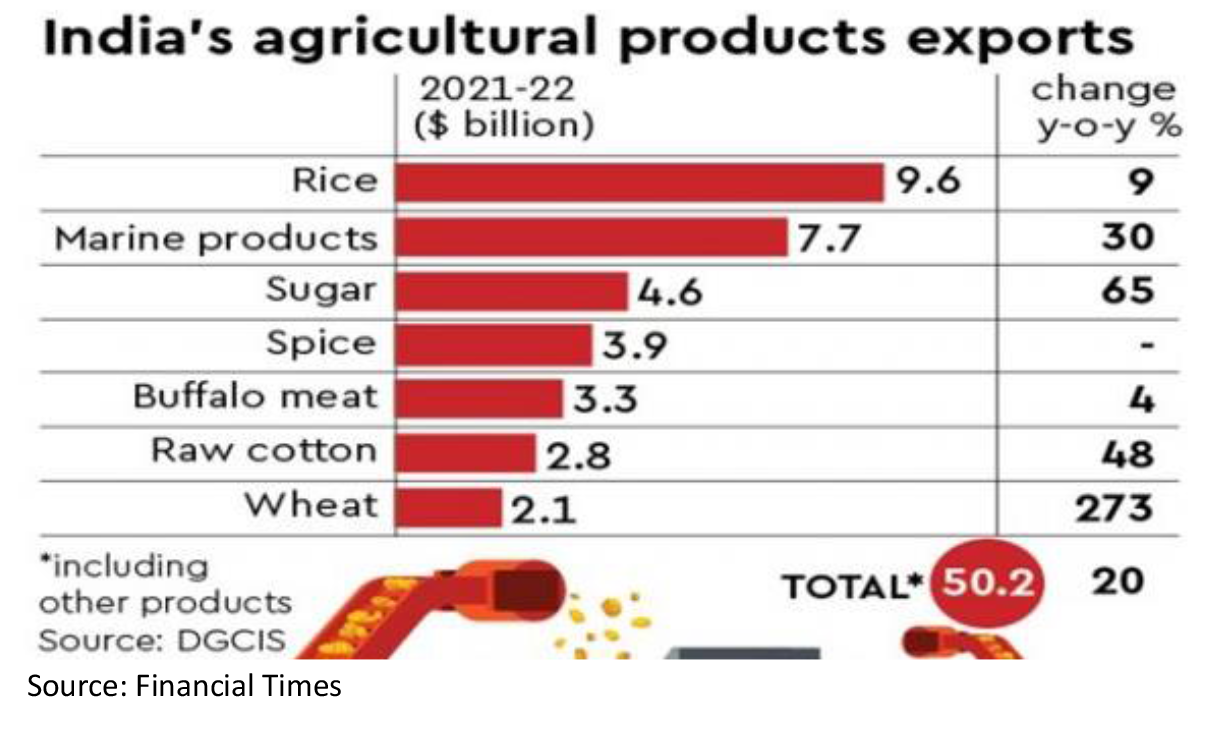

India has been attracting increased global attention as the world starts looking for China+1 sourcing. The global supply chain constraints caused due to the ongoing war has further accentuated India’s position as a global supplier of finished goods. For e.g., India being the second largest wheat producer after China, hasincreased its exports and is benefiting from the rise in prices of wheat which is in short supply due to the war.

India achieved its highest monthly value of merchandise export in March 2022, an increase of 14%/88% over March 2021/2020.

India’s growing importance in the global matrix is also evident from the long list of dignitaries rushing to meet the Indian Prime Minister and other administrators. We believe that all of this should open up doors for Indian manufacturing / agri exports creating massive opportunities for Indian entrepreneurs over the next few years. Signing of Free Trade Agreements with UAE, Australia and the much spoken about UK FTA (expected to happen soon) further endorses the Indian export opportunities.

Our on ground checks and conversations with entrepreneurs suggest that the Indian government is proactively working with their foreign counterparts in getting business opportunities for Indian entrepreneurs which were hitherto unheard of. Likewise, the government is working at great speed to remove any obstacles coming in way of making Indian exports competitive – for e.g. recently, within a week of industry representation, government swiftly removed custom duty on imported cotton to soothe the apparel industry which was reeling under increased cotton prices making their apparels less competitive in global markets.

We strongly believe that India’s vision of achieving USD 1 trillion in exports by 2030 would open up tremendous opportunities across diverse industries over the next couple of years.

“ The best chance to deploy capital is when things are going down. ” – Warren Buffett

Rather than trying to star gaze as to when does the war end or what happens in the next Covid wave or how many bps does the next interest rate hike come with, this time we are making an effort to take a deep dive on Auto Industry which has been under tremendous pressure for the last decade. Taking a cue from Mr. Buffet’s statement, we believe that the current disruption presents an interesting opportunity to look at some credible businesses in the auto industry which are available at very reasonable valuations.

INDIAN AUTO SECTOR: BUMPY RIDE TO STABILIZE SOON?

-

Sector gasping for growth for over 10 years now

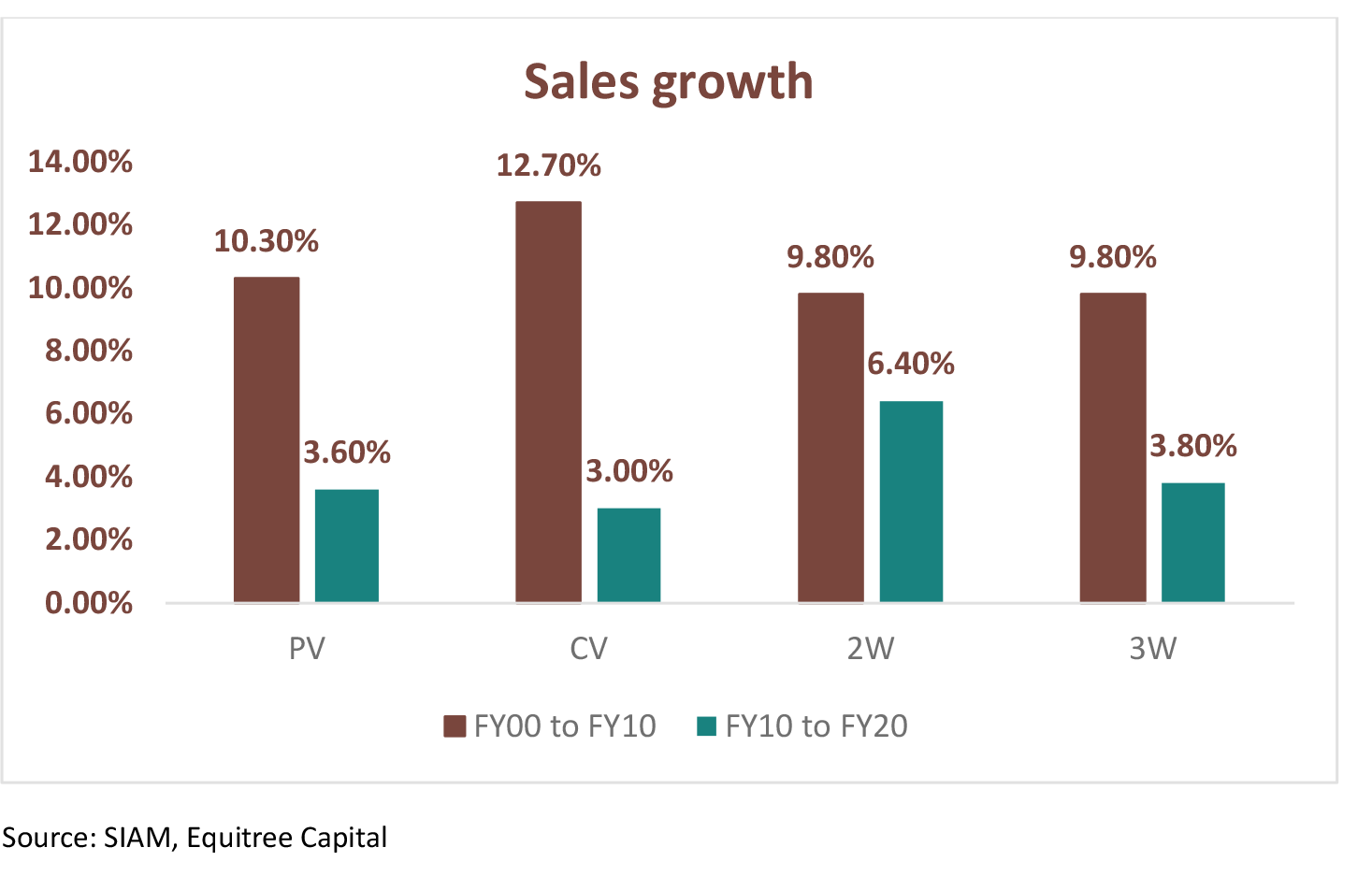

Automobile industry in India is going through a long-term structural slowdown as the growth rates across all major segments has witnessed a decline in the last decade. The fortunes of the automobile industry are closely linked with the growth rate of the economy.

The fortunes of the automobile industry are closely linked with the growth rate of the economy.

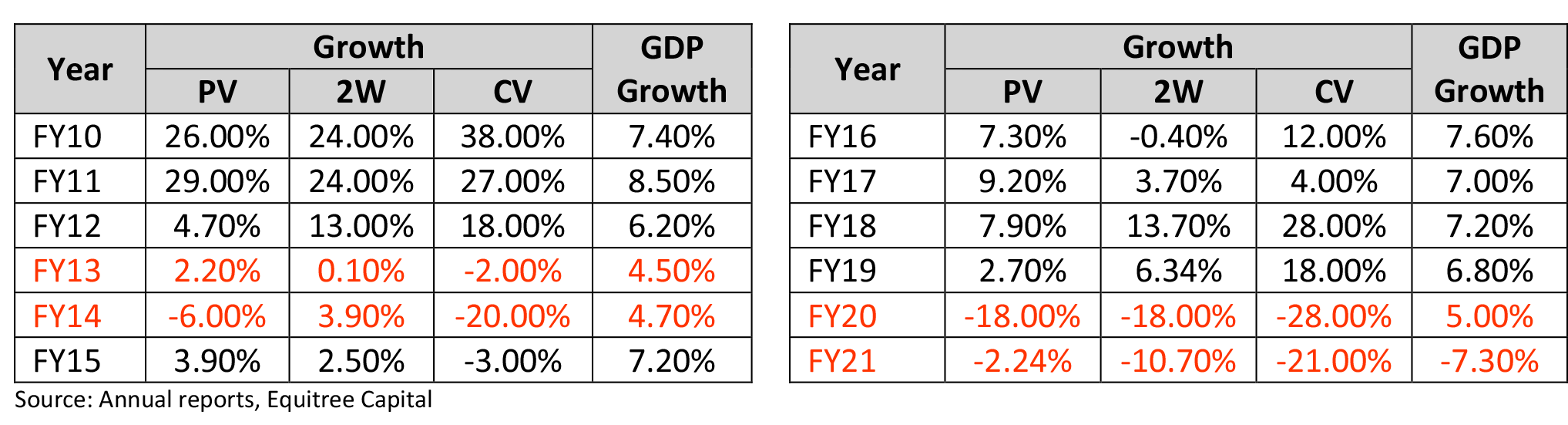

- FY10-11: All the segments recorded growth in FY10 and FY11 due to government measures announced to aid recovery from the Global financial crisis of 2008. Also, good monsoon coupled with robust performance of industrial and services sectors boosted sales.

- FY12-14: High interest rates and high fuel prices coupled with inflation dampened the business sentiments resulting in a slowdown. Consumer durable purchase decisions were pushed back.

- FY15-18: Customer sentiments improved due to appointment of a stable government. Government placed a lot of emphasis on manufacturing and introduced favorable policy decisions along with focus on ease of doing business, fiscal stability and managing inflation. FY17 saw a slight slowdown due to increase in NPAs, Demonetization and low capex.

- FY19-21: In FY19, PV sales were impacted due to BSVI transition, hike in interest rate, high fuel price, higher insurance costs. FY20 saw an economic slowdown globally as well as in India due to protectionist measures introduced by various countries. FY21 was a Covid impacted year.

-

Current headwinds:

-

Semiconductor shortage

The semiconductor shortage started in early 2020 and was expected to largely recover by March 2022. However, the ongoing Russia-Ukraine conflict has further delayed the recovery. Ukraine produces more than 50% of neon gas which is required for manufacturing semiconductor. Also Russian is a major player in palladium which is used in after sales servicing of autos. Based on our discussion with industry participants, inventory levels of both the above materials are sufficiently available as of now, but extension of the conflict can result in some shortages in the supplies. This has led to elongated waiting for the customers for their new cars. -

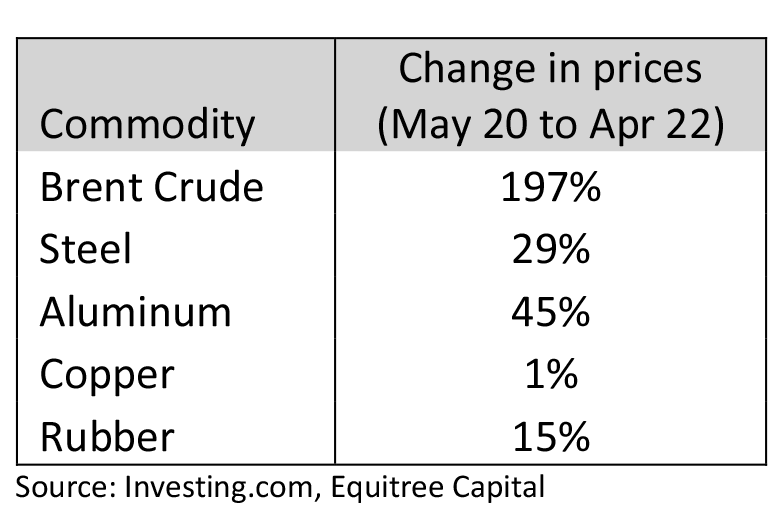

Increase in raw material costs

Due to rise in commodity costs, OEMs have been forced to hike prices in the past one year. The Russia-Ukraine crisis has further worsened the matter with major OEMs suggesting that further price hikes will be required to offset the inflation in the commodity prices.

-

Regulatory hurdles

Transition from BS IV to BV VI and mandatory upfront third-party insurance has resulted in increase in cost of ownership across all segments. The expected increase in interest rates will further increase the cost of ownership. Change in axle load norms has resulted in an increase in load carrying capacity of trucks which has decreased the demand for new trucks. Overall due to various regulatory changes, raw material inflation, the prices of vehicles have gone up by 10-36%. This coupled with the high fuel prices have increased the running cost of the vehicles as well.While the above issues persist, demand has been strong for passenger vehicles due to growing need for personal mobility brought about by the pandemic. Similarly, the commercial vehicle cycle is expected to revive as the economic growth turns robust. It is important to note that the rural demand has not picked up yet and will be a key monitorable factor for the overall recovery.

-

Semiconductor shortage

-

How Long Before the Industry Accelerates?

We are beginning to see green shoots in the industry, and the fact that majority of the industry headwinds are supply side issues reconfirms our belief that this sector is on the verge of acceleration, all it needs is a clear road.-

Revival of rural economy

Spike in the agri commodity prices due to the Russia-Ukraine war has come as a silver lining for the rural economy as the farmers are getting higher realizations for their produce leaving higher disposable income in their hands. We believe that this eventually should translate into higher expenditure as well with auto sector also benefiting at large as the demand comes back. -

Pent up demand for PV

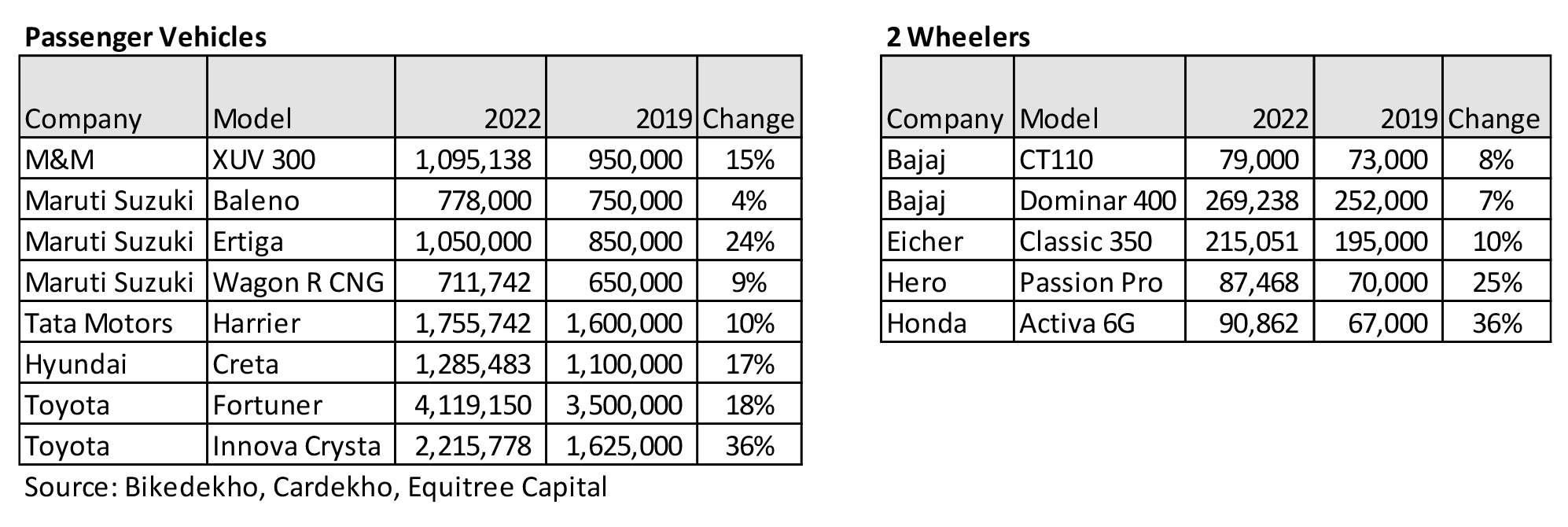

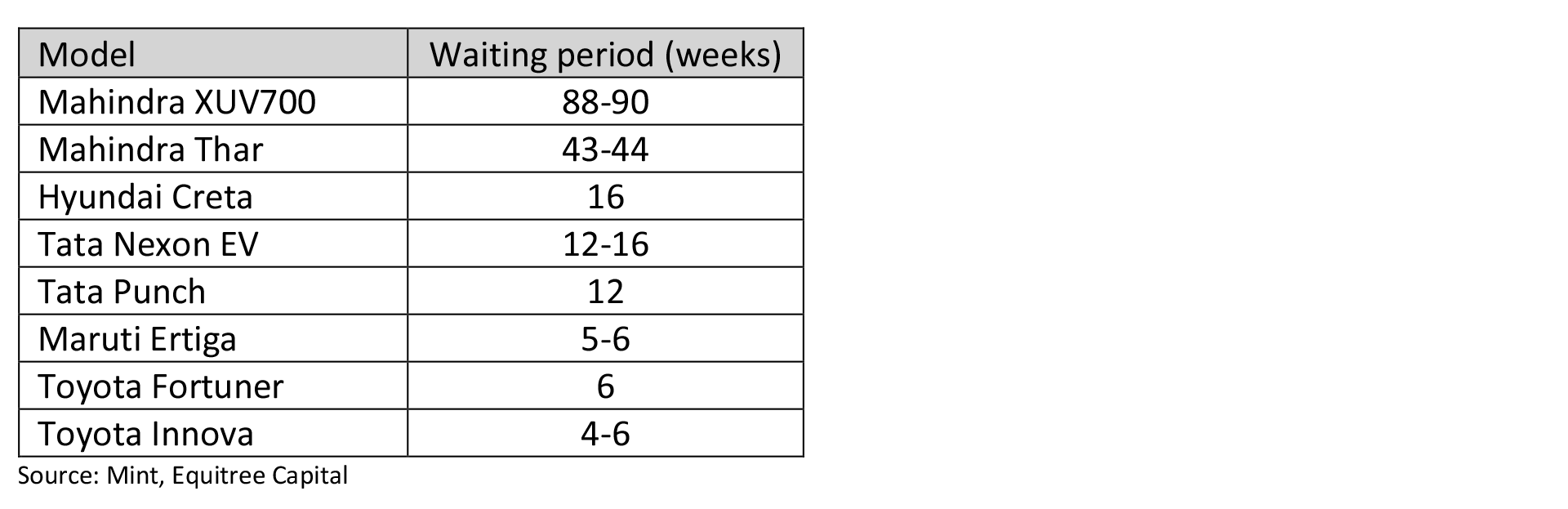

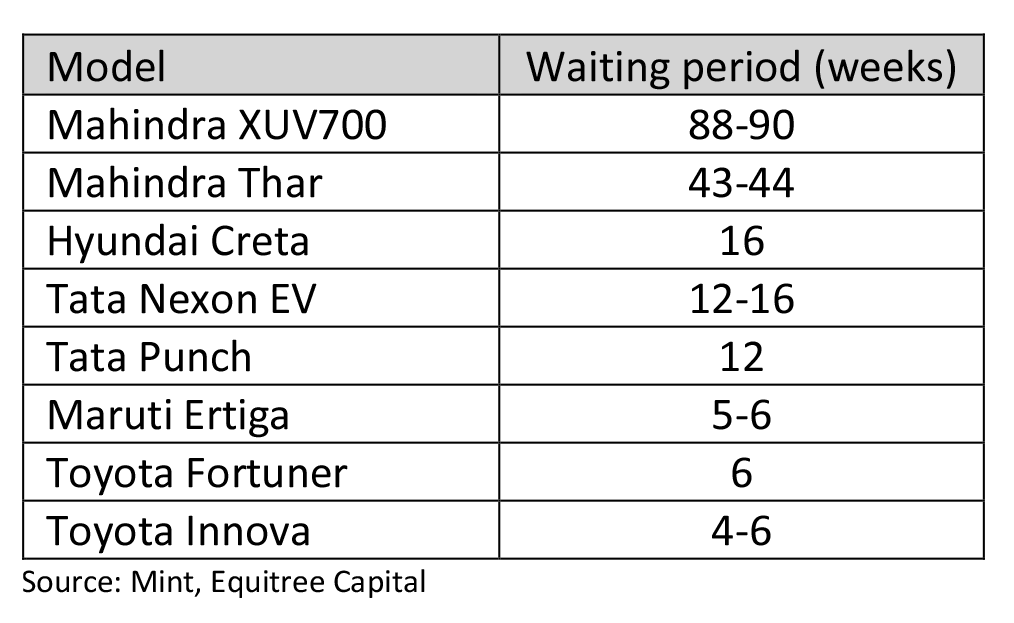

As per a CNBC TV18 article1, the prices of used cars have shot up, with pre-owned vehicles being sold at a premium of 7-10 percent over 2020. On the OLX Auto platform, the average selling price of used cars was 21 percent higher at Rs 4.84 lakh in January 2022 compared to Rs 3.99 lakh in January 2021, Amit Kumar, Chief Executive of OLX Auto, said. Mahindra First Choice Wheels has been witnessing 100 percent year-on-year growth in the past few months, with the total number of used cars sold in the fourth quarter being equal to the overall volumes sold last fiscal, as per Ashutosh Pandey, Chief Executive and Managing Director, Mahindra First Choice Wheels. "We are seeing very good demand side parameters in terms of inquiries and bookings. But due to supply-side issues, a lot of bookings have turned pending," Shashank Srivastava, executive director at Maruti Suzuki, told ET. The market leader was sitting on 270,000 pending bookings, more than twice the usual, he said. Waiting periods have sky-rocketed! From the above it is visible that the demand for cars is not a challenge. The only challenge that remains is the supply of semiconductors and commodity inflation.

From the above it is visible that the demand for cars is not a challenge. The only challenge that remains is the supply of semiconductors and commodity inflation.

-

Economic revival

With the increased capital expenditure outlined in the budget, demand for commercial vehicles is expected to pick up as the projects pick up pace. The demand will be further boosted by the replacement demand as the fleet owners would now be looking to replace their ageing trucks. While we are seeing early signs of recovery, the industry is largely dependent on commodities, the prices of which are linked to the stabilization of the Russia-Ukraine crisis. We believe the industry might continue to remain under pressure for a few quarters, but these quarters might also lend an opportunity to investors with a longer-term horizon. -

Export opportunity

Major PV and 2W OEMs have seen their exports surge this year mainly on account of demand from Latin America, Africa, and South-East Asia. This has provided some reprieve to the OEMs in an otherwise dull year. In addition to above, global players are also looking at India for sourcing parts and components as part of their China+1 strategy - for e.g., Case New Holland Industrial, the world's fourth largest tractor maker, aims to triple sourcing of parts and components from India in value terms to over USD 300 million in the next three years.

-

Revival of rural economy

-

Industry is at an inflection point

Currently market cap of entire auto sector contributes 5.5% of the total market cap – which is in line with its long term averages. However, historically, this tends to move up to 9-10% of the total market cap as the economic growth comes about. Given India’s ambition to become a USD 5 trillion economy, India’s GDP growth will have to grow by more than 7%. We believe this should lead to cumulative contribution of auto industry regaining ~ 9% of the total market cap thereby creating substantial value over 3–5-year period.

-

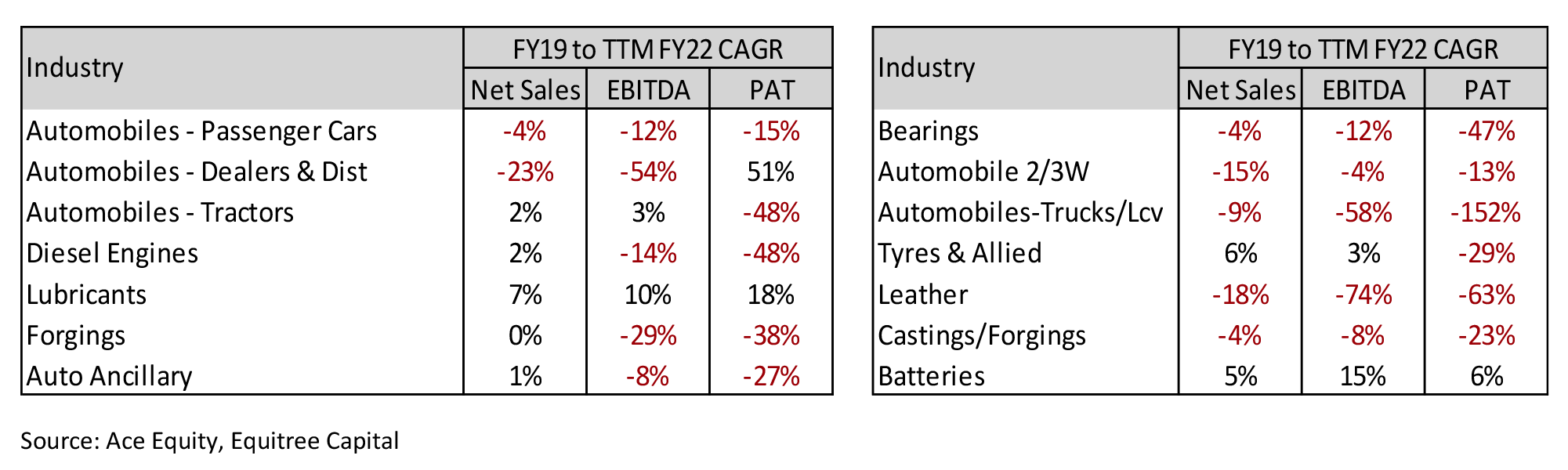

Find the diamonds in the rough

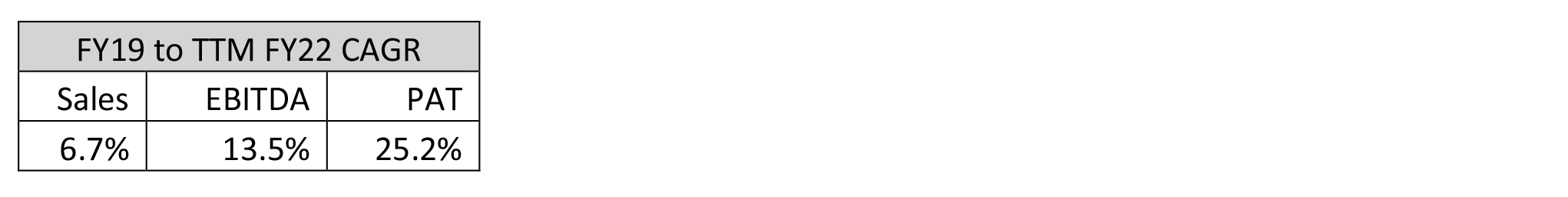

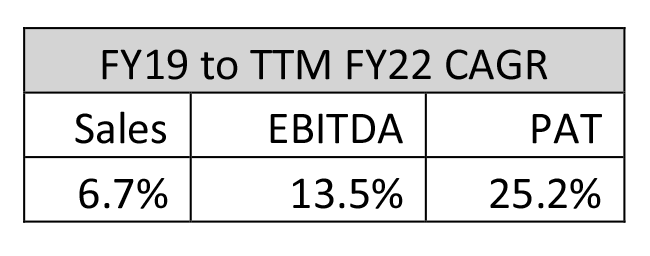

The last 3 years have been tough for the auto sector due to variety of reasons with various sub sectors of the industry showing a degrowth.However, there are always some pockets of opportunity that would be available and needs to be identified. We as a bottom-up investor always look for companies that have managed to not only keep their head above the water during the downturn but have delivered supernormal growth. Companies like these, which manage to outperform on the downside end up firing on all cylinders once the cycle picks up. We have walked the talk having identified and invested in one such auto ancillary company. The company is a market leader in its chosen category of products in the country. Additionally, they have also expanded their product profile through organic expansions and multiple JVs with foreign partners. The company has been around for almost 6 decades and has well reputed customers like Volvo, Tata Motors, BMW, Mercedes Benz etc. Performance of Investee Company

This investment has already become a mulit-bagger for us delivering 2-4x2 returns for the investors on this investment. As evident from the table above, the increase in stock price is backed by strong business performance and not by market sentiments. We have been tracking this Company since the last 5 years and invested at an average valuation of 7-8x PE. Even at the current valuation of 12x PE, we feel that the stock is trading at attractive levels given the potential of the Company as well as the sector.

This investment has already become a mulit-bagger for us delivering 2-4x2 returns for the investors on this investment. As evident from the table above, the increase in stock price is backed by strong business performance and not by market sentiments. We have been tracking this Company since the last 5 years and invested at an average valuation of 7-8x PE. Even at the current valuation of 12x PE, we feel that the stock is trading at attractive levels given the potential of the Company as well as the sector.

We continue to keenly look for businesses that are expected to outperform over the next 3-5 years. We feel that time is ripe to look at fundamentally strong companies early on through bottom up investing approach.

As always, please feel free to reach out to us at pawan.b@equitreecapital.com / skabra@equitreecapital.com with your comments/ suggestions/ feedback etc.

Warm regards.

TEAM EQUITREE