“In the short run, the market is a voting machine. In the long run, it is a weighing machine.”

— Benjamin Graham

Dear Investors,

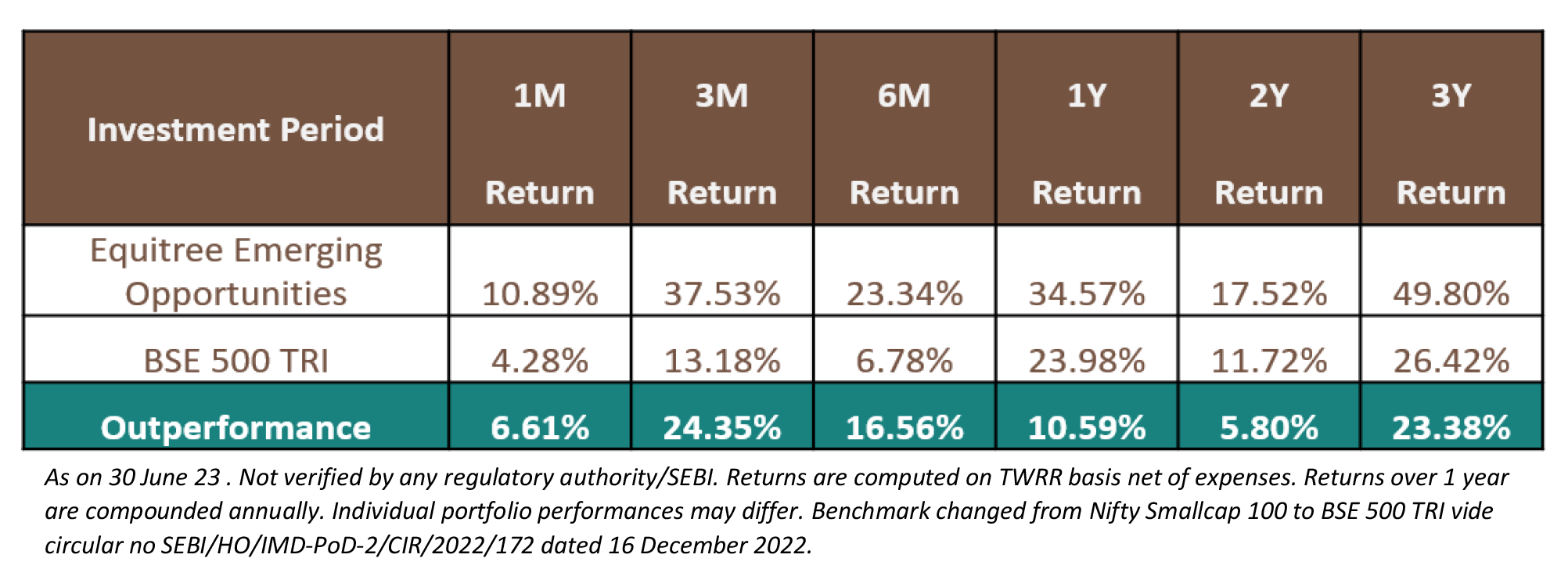

The last quarter has been an exciting quarter for the markets and for us. We’re excited to inform you that for the quarter ended June 23, Equitree has emerged as the BEST performing PMS across all marketcaps and categories with 38% returns!

We expected the markets to see a turnaround after the downturn in March as discussed in our last newsletter, and had mentioned that the downside volatility was a great time to build portfolios and buy into strong businesses. We benefited from sitting on cash and increasing allocations in our portfolio companies during this time. Our performance is summarized hereunder:

After the stellar performance of the market during the last quarter with new highs being created and more particularly the small-caps delivering ~ 25% returns from 1st April till date, the biggest questions on everyone’s mind would be – is it a bubble getting created again? Should we cash out completely? Is there still opportunity to invest – more particularly the Small Caps?

This Market Has Much More Steam Left – Still Time To Build Cautiously Rather Than Thinking Exit

“Periods of depression invariably follow periods of over optimism, when fear replaces hope as the controlling emotion.”

– Edwin Lefevre

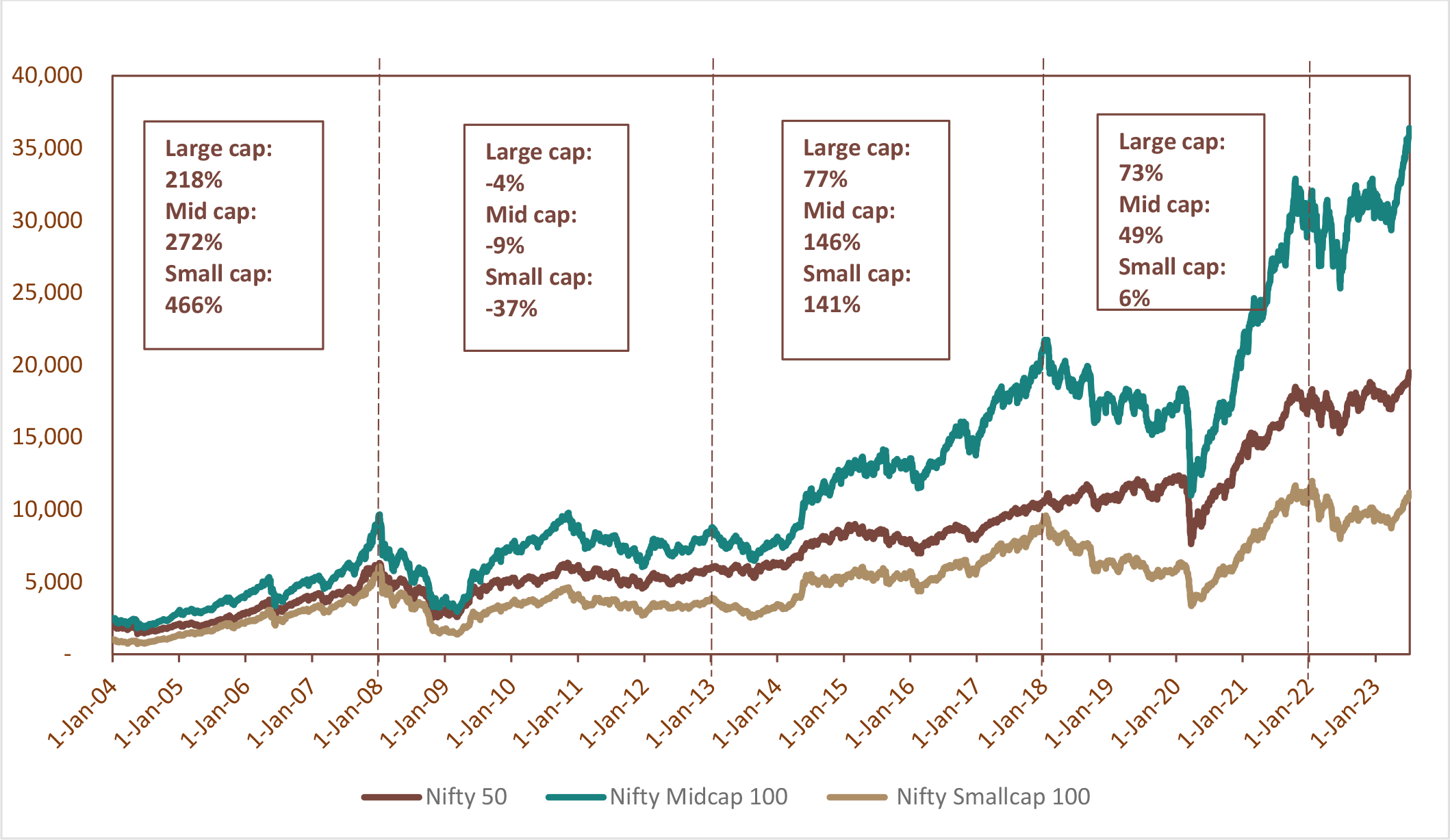

Historically small caps have known to deliver superior returns over large caps. Over the last 20 years since these indices were constituted, Nifty has given absolute return of 911%, while the NSE SmallCap100 has given absolute return of 1012%. We tried breaking up the returns in blocks of 5 years to get a better perspective of cycles:

As can be seen from the above, during the years when the markets have done well, Small Caps tend to do better than the Nifty (2004-07 and 2013-18) and likewise suffer also the most when the tide turns (2008-2013).

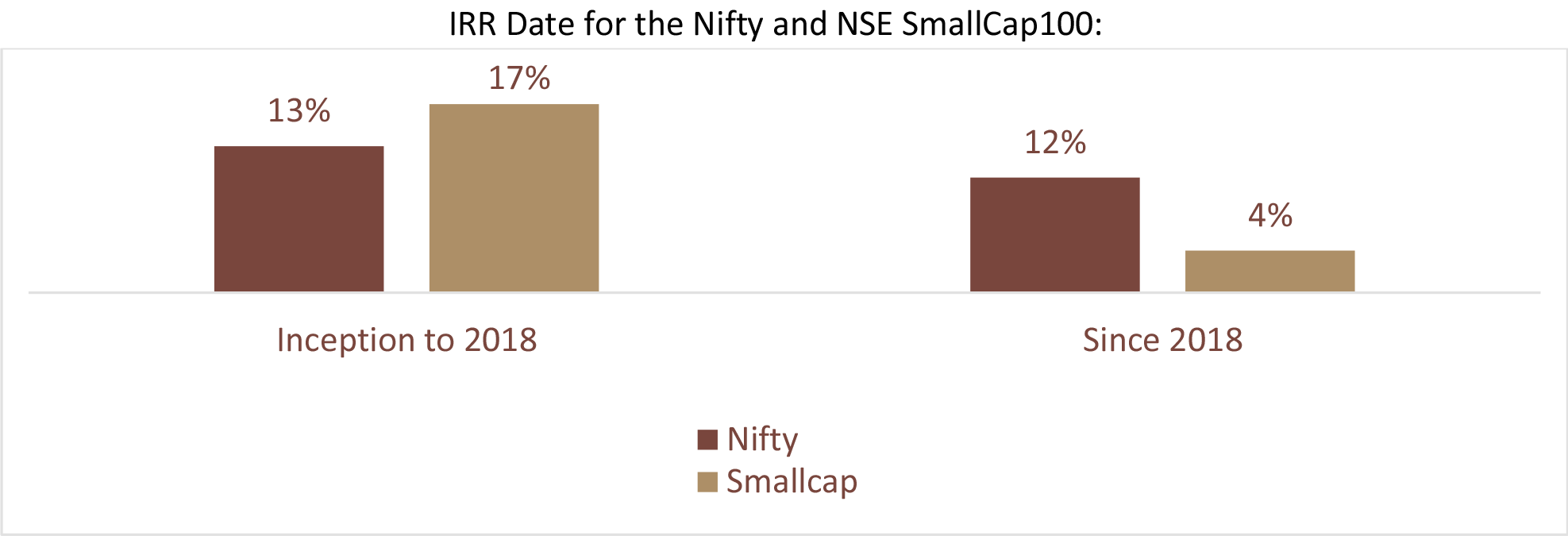

While one may be enthralled with the returns from Small Cap index over the last 3 years (32% IRR against a modest 21% of Nifty), however, when one looks at a 5 year block the small cap index is lagging far too behind with the Nifty as shown hereunder:

We strongly believe that we should see a mean reversion where the Small Cap index returns should not only catch up Nifty but should exceed the same – this may happen either by Nifty correcting substantially or the Small Cap Index delivering better returns from hereon. We tend to believe the latter is more likely to happen – still leaving enough upside in the broader markets.

We tried ratifying our belief by looking at various other parameter shared hereunder:

-

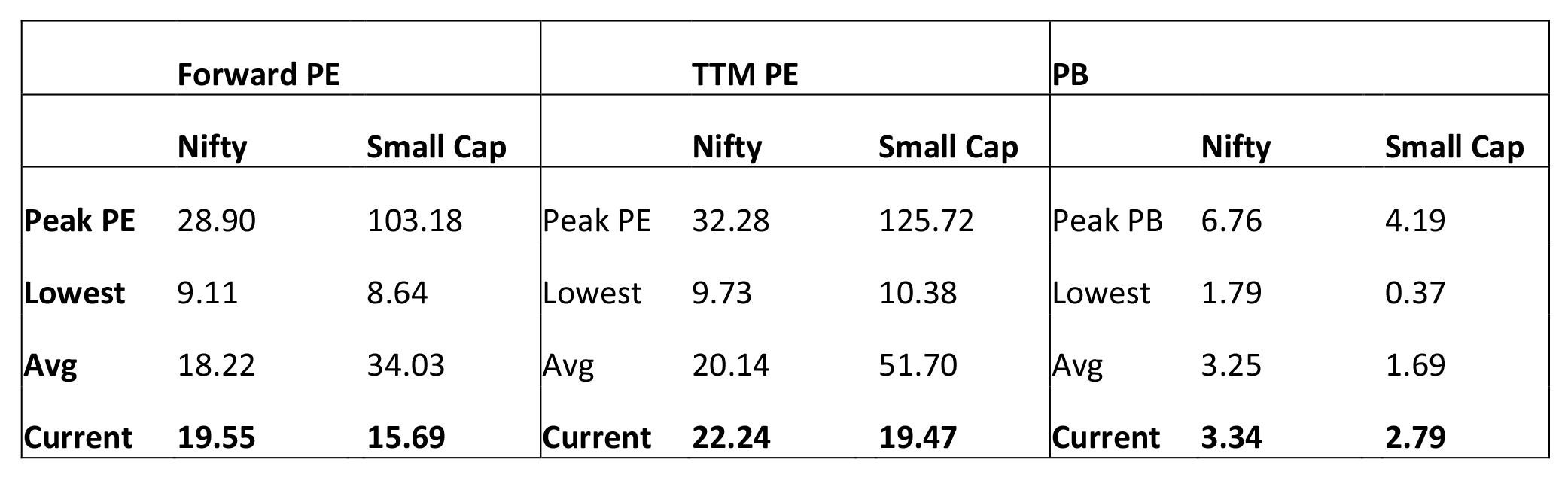

Valuations still not showing any bubble

Despite the headline indices making new highs, however, the current valuations are just around the long term averages and way off the peaks made earlier.On the contrary, Small Cap index valuation (even after the run up) is still way below the average valuation at which it has traded historically! Our portfolio is currently trading at an average PE (FY24E) of 15.3x with an expectation of ~47% PAT growth in FY24E – leaving enough upside potential despite the recent run up in the last quarter, which largely has just been catching up on the lost time to some extent

-

Correlation of Nifty and Small Cap Index

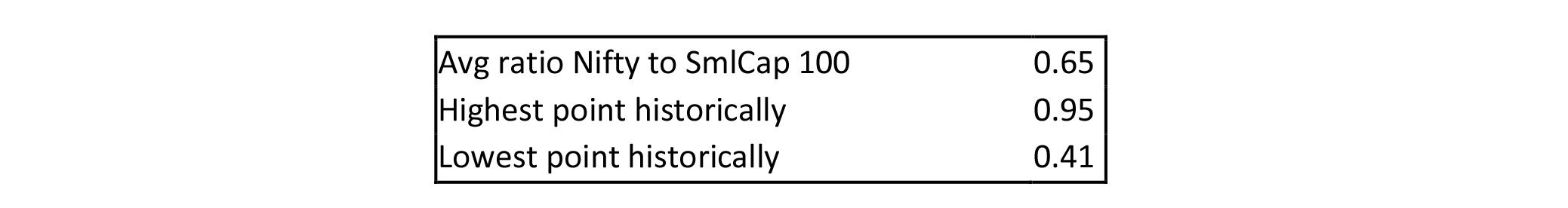

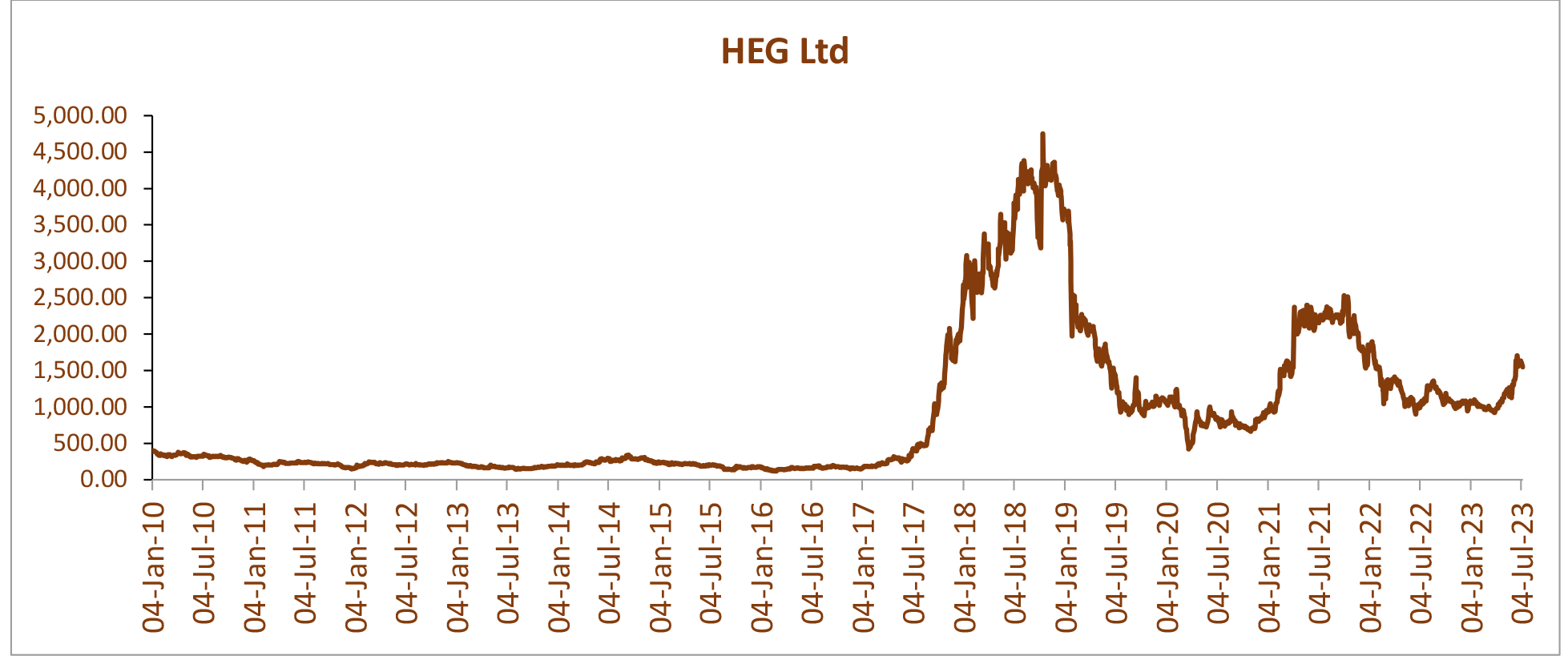

We looked at the Nifty and NSE SmallCap100 data from 2005 and found the following correlation: Normally after touching 0.65 markets turn irrational, and can go either way - back to 0.5 levels or can continue to be overly optimistic. The same holds true below 0.5 too - markets turn irrational and can go down to 0.41 but they will rebound eventually. Currently we are at 0.58 levels and we believe unless there is a trigger, we should not see a significant rebound till we touch that 0.65 ratio - which was last touched in Dec 21 post which there was some correction. During March 23, the ratio was at 0.51 which is the lowest it has been since 2020 December, causing a sharp turnaround. The last 5 years were a period of depression and pessimism for the small-cap space, while this quarter that has changed to optimism, we are still to see the markets turn over-optimistic.

Normally after touching 0.65 markets turn irrational, and can go either way - back to 0.5 levels or can continue to be overly optimistic. The same holds true below 0.5 too - markets turn irrational and can go down to 0.41 but they will rebound eventually. Currently we are at 0.58 levels and we believe unless there is a trigger, we should not see a significant rebound till we touch that 0.65 ratio - which was last touched in Dec 21 post which there was some correction. During March 23, the ratio was at 0.51 which is the lowest it has been since 2020 December, causing a sharp turnaround. The last 5 years were a period of depression and pessimism for the small-cap space, while this quarter that has changed to optimism, we are still to see the markets turn over-optimistic.

Then Why Are Some Small Cap MFs Stopping To Take Fresh Inflow?

As one would have read, a couple of Small Cap Mutual Funds announced that they have stopped taking fresh inflow which would have naturally created some anxiety in investors mind.

One needs to understand a couple of things here:

- These funds have stopped taking Lump Sum allocation only – SIPs in these funds are allowed to continue the way it has been

- Second, given the recent performance of these funds investors have flooded them with large allocations making it necessary for these funds to deploy this cash (MFs are obliged not to take cash positions) in the same stocks in their portfolio.

- Mutual Funds typically have about 60-70 stocks in their portfolio universe and adding a new stock can take longer time / bandwidth which further necessitates them to keep buying more of the same.

- This impetus in buying their own portfolio companies has had a runaway effect on prices of some of their portfolio companies – in turn stretching valuations of these companies as well.

It is for this primary reason that some of these funds have stopped taking fresh lump sum allocations and not otherwise.

We believe this anomaly may give rise to some volatility in the market as investors look to book profit in stocks which have seen a quick run up. The key will be to stay disciplined while entering and not budge on reasonability of valuation. It is this volatility which gets perceived as risk of investing in the current market.

This brings us to a question we are often asked – how risky & volatile small-cap investing is.

Volatility vs Risk

“There are many kinds of risks … But volatility may be the least relevant of them all.” – Howard Marks

The definition of volatility is the tendency of something to change quickly and unpredictably. Which put simply would mean volatility includes both situations; when prices correct and rise, rapidly and erratically.

This movement can be caused due to variable causes, ranging from sentiments to domestic indicators, global causes and liquidity. Most academics refer to volatility as a risk to consider while investing. But is price movement really a risk?

Risk refers to the potential financial loss inherent in any investment decision, or put simply risk is the probability of permanent capital loss. In our experience, permanent capital loss takes place due to shortcomings in the business and/or industry and not due to market movements. While in the short-term volatility might feel like a risk, over a longer period cycles of downside volatility are opportunities.

Small-Cap Investing: How Risky Is It Really?

“Volatility is not synonymous of risk but – for those who truly understand it – of wealth.” – Francois Rochon

A statement we hear quite often is that small-cap investing is a risky proposition. But is it really risky?

There are broadly two types of risks: Systematic Risk and Unsystematic Risk. Systematic risk is broadly external factors beyond the company’s control that affect more than just the company, they affect the entire market or industry. Unsystematic risk is one that is company specific risk, which affects a said organization or sector.

Unsystematic or company specific risk is something that can be avoided by thorough due-diligence, research and understanding how companies and industries work. Like Warren Buffet famously said, “risk comes from not knowing what you’re doing”, one of the biggest risks in the investing world is not knowing your businesses well enough. Conversely systematic risks can’t always be provided for or planned against and are difficult to anticipate.

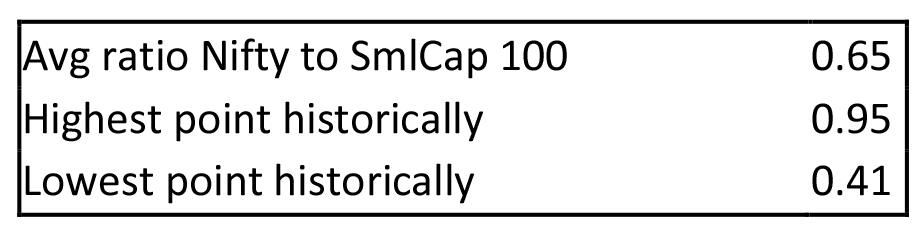

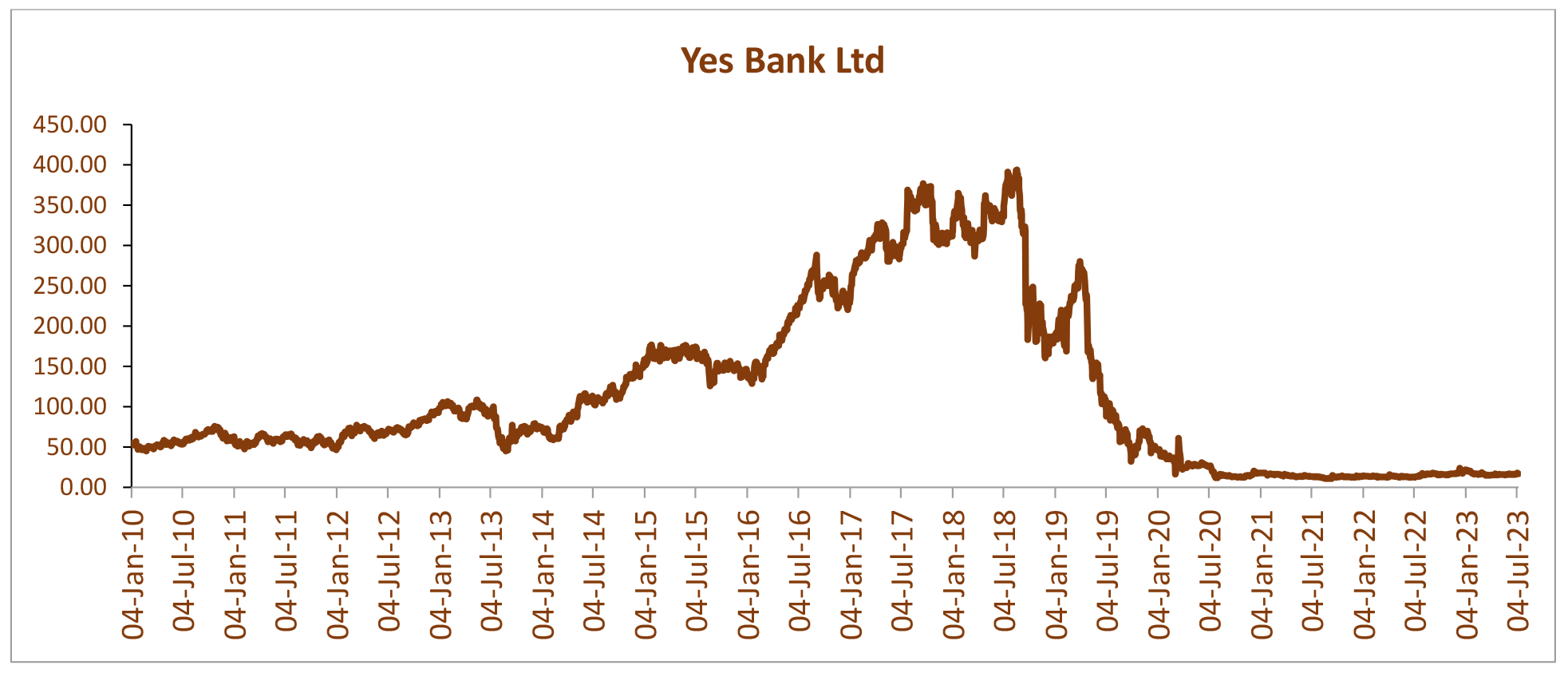

But are these risks only specific to small-caps? History suggests otherwise. We’ve seen large reputed organizations fall prey to both these risks, for example when Yes Bank crumbled due to its poor corporate governance standards (unsystematic risk) or when HEG/Graphite corrected substantially due to a change in the steel-graphite cycle (systematic risk).

Large caps are not immune to risks, they are just less volatile, because they are normally well covered by brokers, traded into by institutions and have adequate float. The lack of information available on small-caps, the lack of discovery, the lack of free-float and the untested managements of small-caps is what leads to excessive volatility, but this is also what leads to superior returns.

The volatility in the small-cap space is not a symptom of risk, but a symptom of lack of awareness of what the value of the company should be. It is this volatility that allows long-term, patient and wellresearched investors to generate wealth out of small cap investing. Simply put, small caps don’t generate superior returns because they are riskier, but they do so because they are more volatile.

We are constantly looking for pockets of value and as an organization look to gain from the volatility presented by implementing staggered buying.

We do expect bouts of volatility and corrections, but continue to believe strongly in the long term India story and remain upbeat about our investments. Like they say – this is India’s decade and the biggest risk will be to not participate in this opportunity.

Please feel free to reach out to us at pawan.b@equitreecapital.com / skabra@equitreecapital.com with your comments/ suggestions/ feedback etc.

Warm regards.

TEAM EQUITREE