“ You make most of your money in a bear market, you just don’t realize it at the time. ”

— Shelby Cullom Davis

Dear Investors,

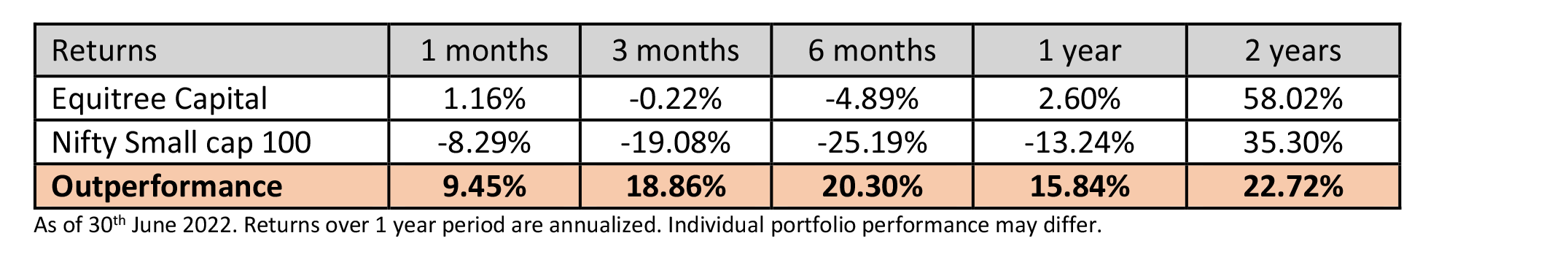

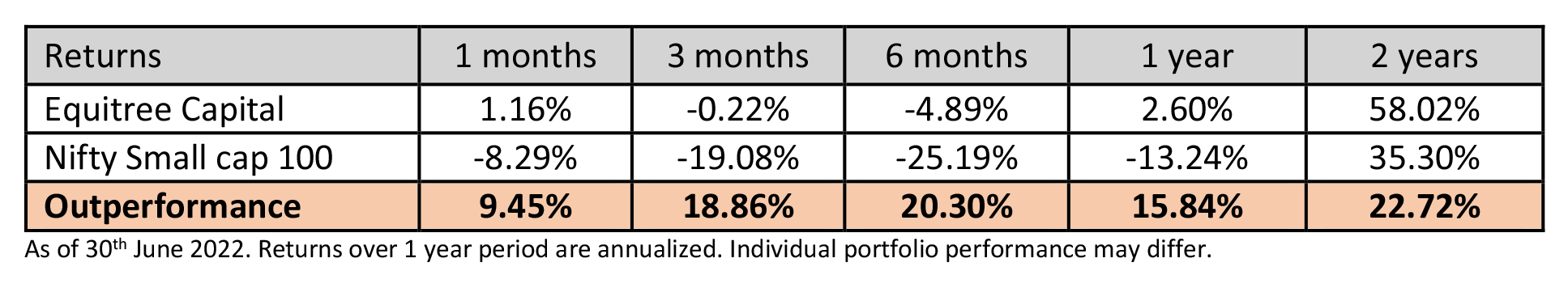

The market volatility due to macro-economic factors has led to Nifty 50 / Nifty Small Cap 100 declining by 13% / 29% respectively from their October 2021/January 2022 peak. We are glad to report that despite heightened volatility in the market, we have been able to hold on to our portfolio quite well – consistently generating an alpha of ~ 20% over the last 2 years.

In the current context of global economic uncertainties where various variables like rising inflation, increasing interest rates, fear of recession hitting global markets, currency depreciation to record levels, it is only natural for fear to creep into the investors’ mind. We take this opportunity to share some of our views on these variables hereunder :

Is inflation really bad for the economy / markets?

The biggest concern that lies in front of global leaders and investors alike is the record inflation levels globally. Developed economies of US and UK have reported the highest annual increase in inflation over last 40 years of 8.6% and 9.1% respectively. We have seen a good cool off in commodity prices over the last fortnight, however, the prices still remain at significantly alleviated level from their lows causing the central bankers to expedite the interest rate hikes and squeeze liquidity in their effort to tame inflation.

-

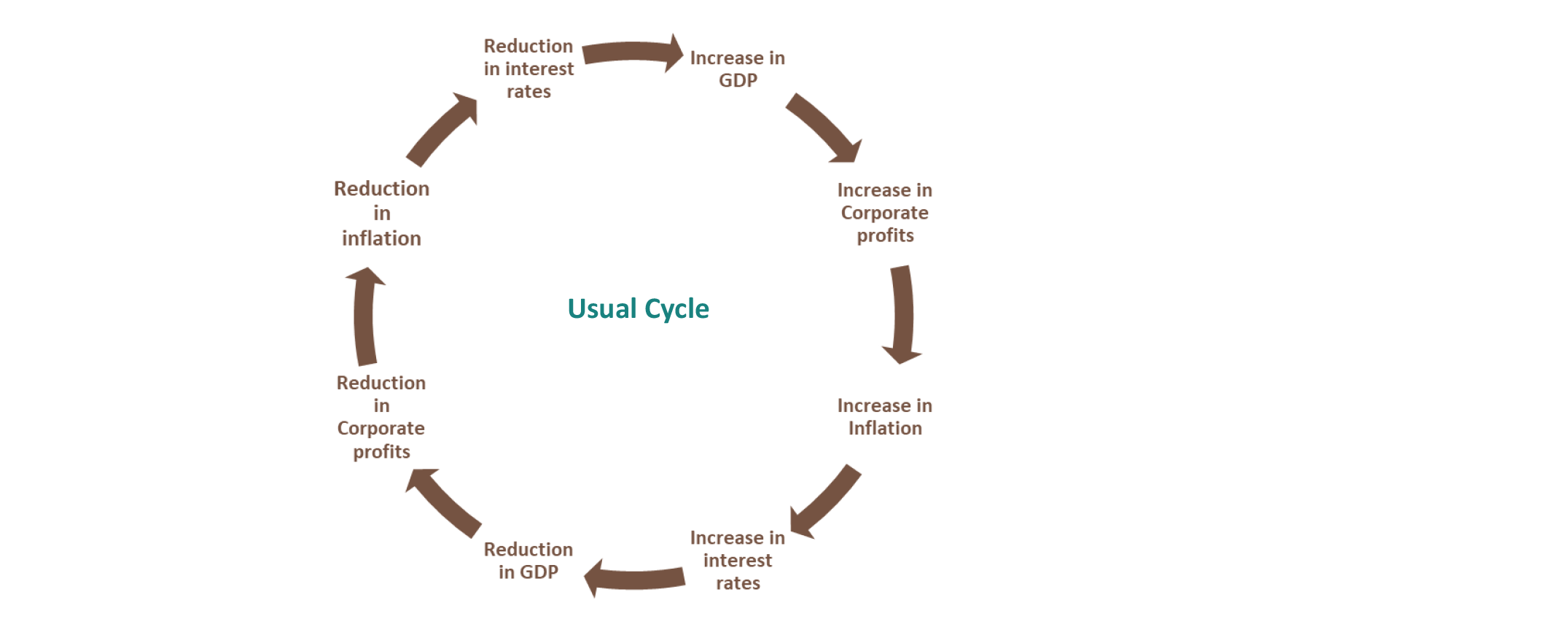

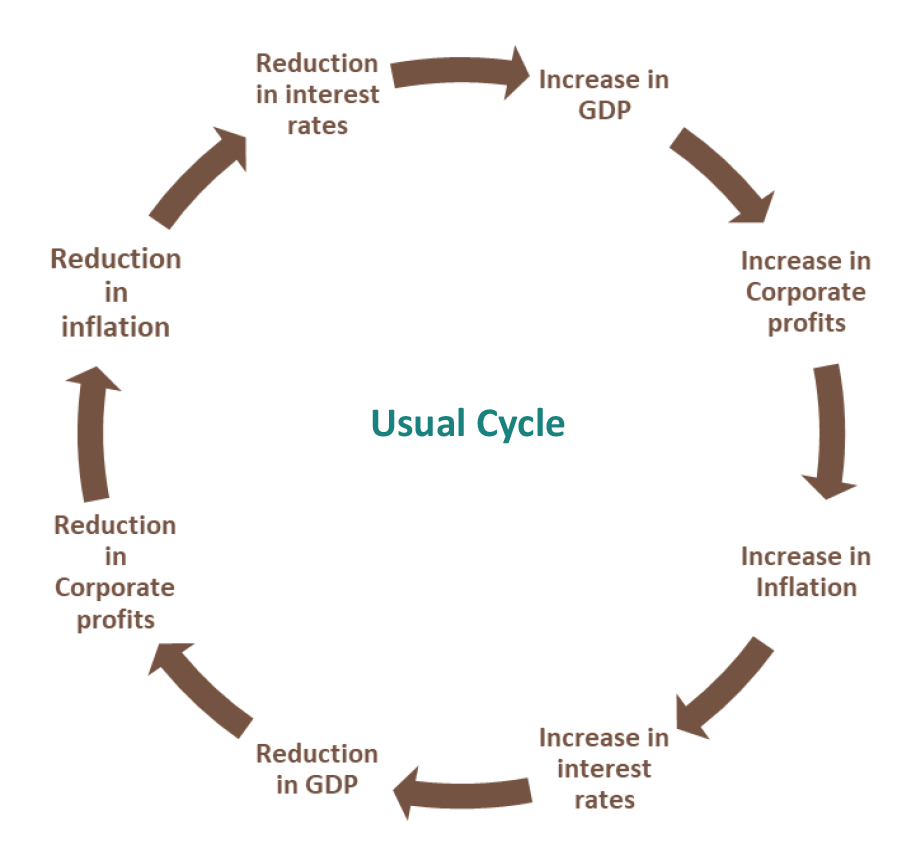

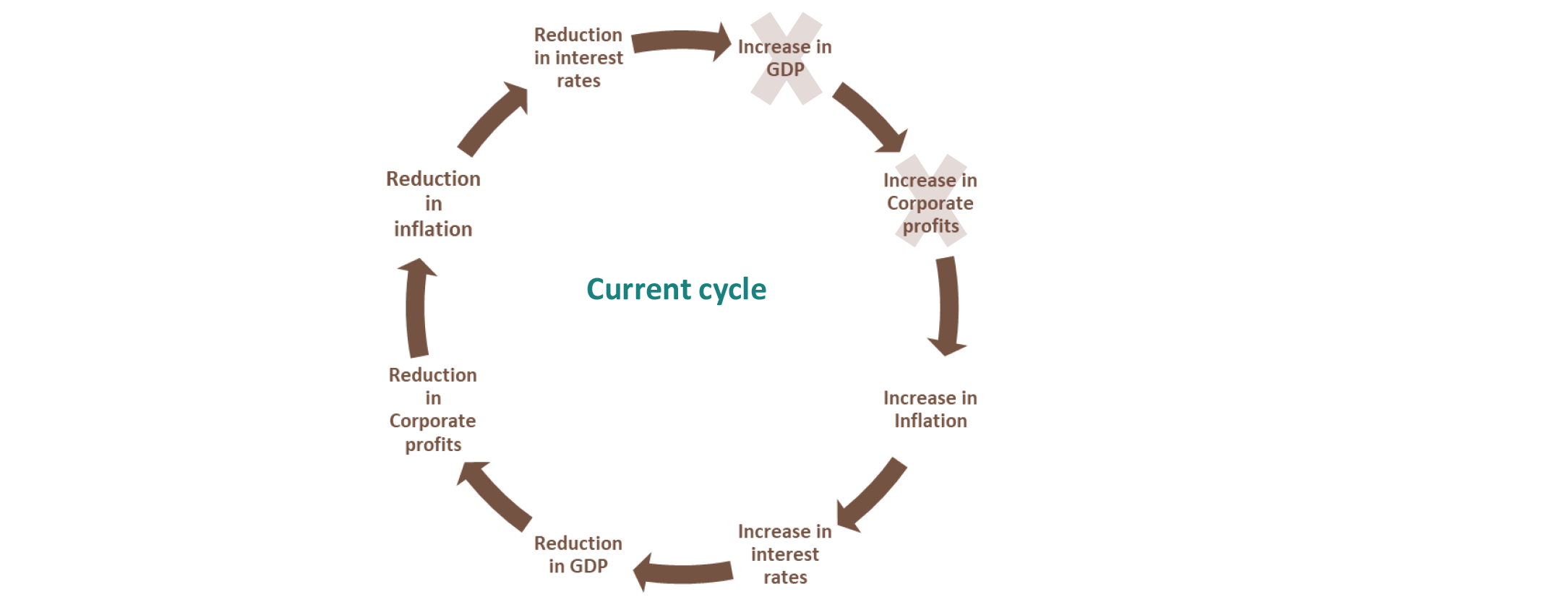

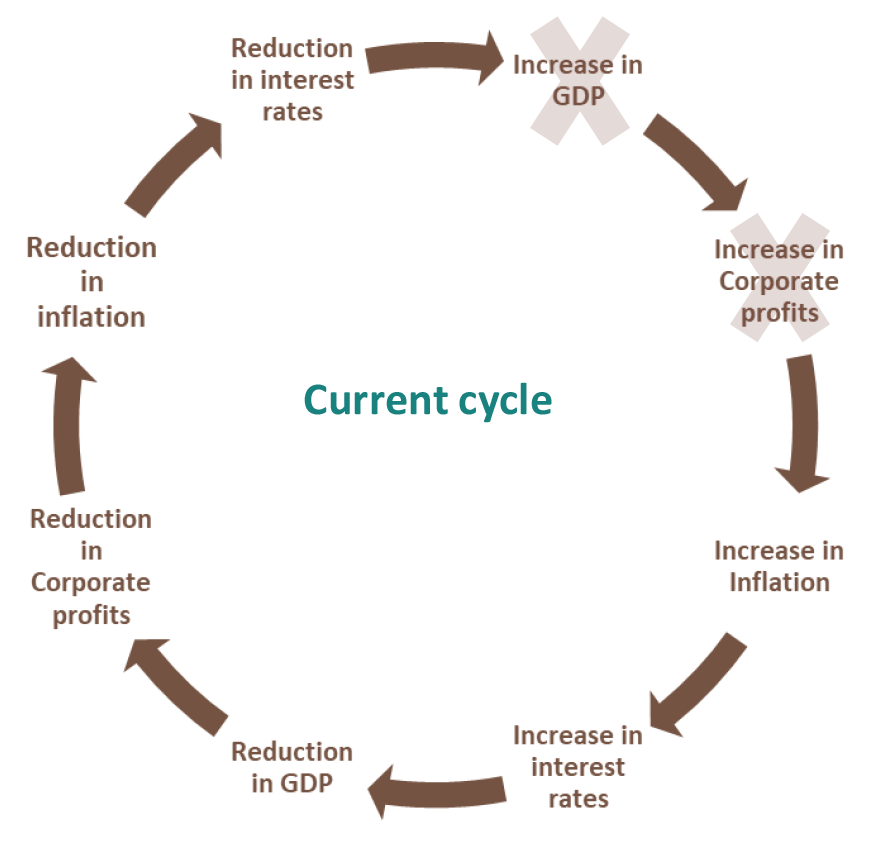

Before we proceed, first let us try and understand how all the variables are interlinked.

- Inflation causes a rise in prices of goods and services which adversely impacts consumer sentiments as things become expensive to consume. This prompts the Central Bankers to raise interest rates to squeeze liquidity from the market and in turn curb consumption to soften the prices. Corporate sector due to lower demand outlook and high interest rates delay their capacity expansion plans and look to reduce costs by inter alia, laying off employees / reducing wages.

- All this results in lower demand which helps in cooling down prices and inflation is also controlled, but the GDP growth slows down as consumption and manufacturing activity slows down.

- To revive the demand, Central Banks reduce interest rates. Due to the lower interest rates, consumers and corporate sentiments improve. Consumers start borrowing and spending on discretionary items thereby increasing the demand.

- Due to improvement in demand outlook corporates also undertake capacity expansion plans by borrowing at lower rates and increasing their workforce. Due to increased manufacturing and consumption activity, GDP and corporate profit increases. This in turn results in moderate inflation as the economic activity picks up. Moderate inflation is beneficial as it helps in increasing corporate profits as well as GDP growth. As the growth continues, inflation further fuels and leads to increasing interest rate cycle again!

-

How does interest rate rise impact the market?

-

Realignment of portfolio from equity to bonds

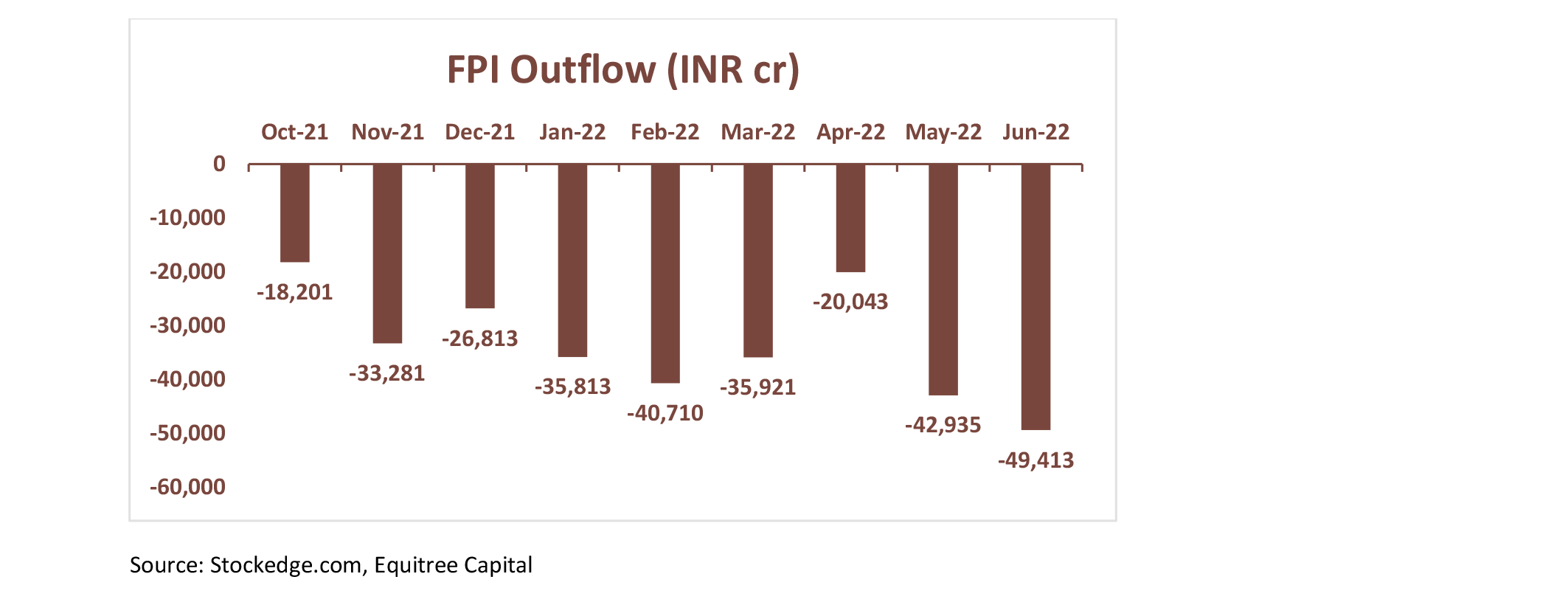

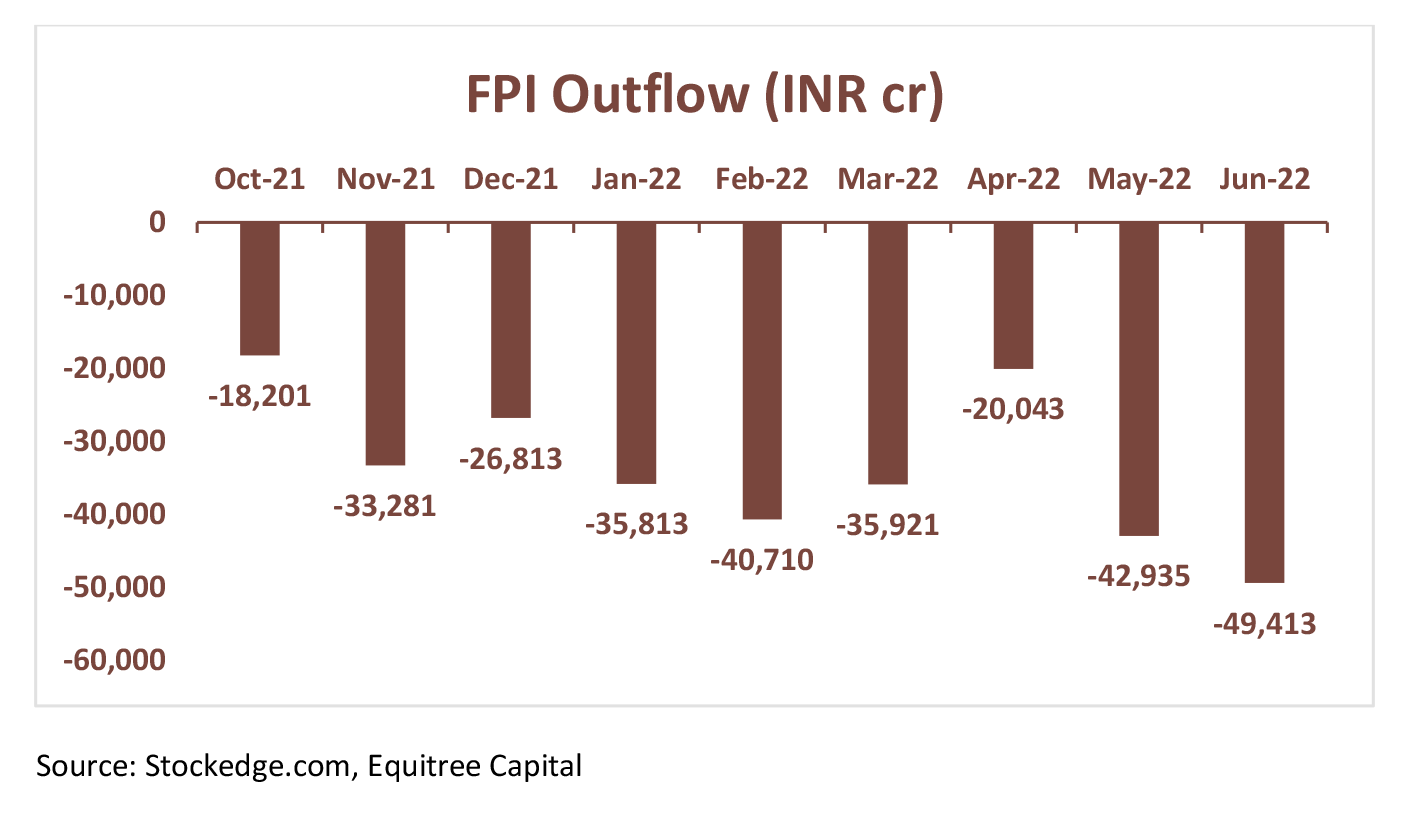

As interest rates rise, investors tend to shift their equity allocation to bond as bond yields become more attractive. With risk free rates going up, money tends to flow out of emerging markets in to safe havens of US treasury leading to a sell off in equity markets – more particularly emerging market. In line with this, we are already experiencing substantial sell off in emerging markets over the last couple of months. FPI’s have withdrawn ~ INR 3 trillion since October 2021 from the Indian market.

-

Money eventually chases growth after initial volatility

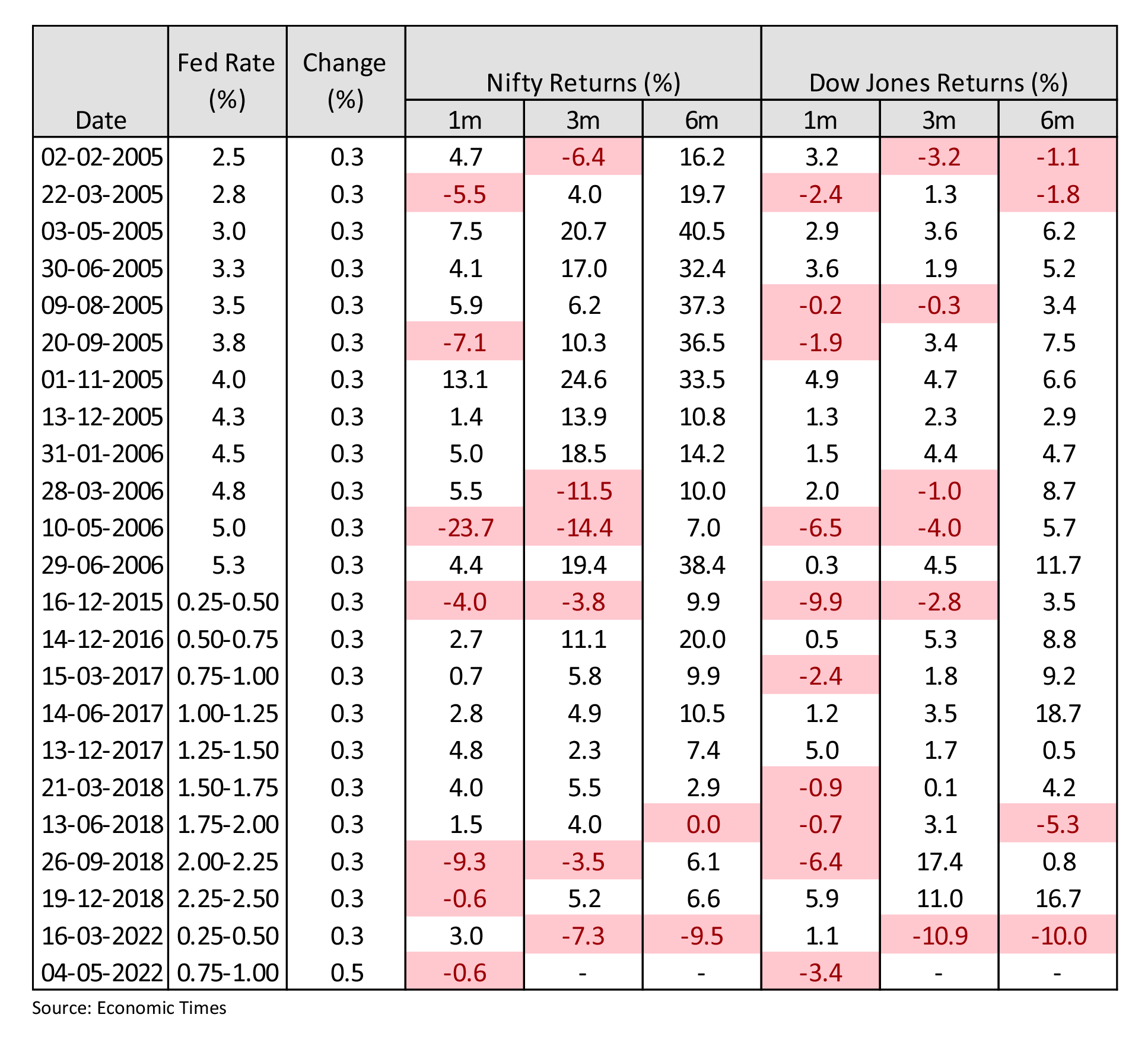

Post the initial sell off and realignment, money eventually tends to chase growth again. There is enough empirical evidence that the market tends to pick up again and post substantial returns after the realignment phase that typically lasts for 6-9 months. Performance of US and Indian Indices

It may be noteworthy here that we have already seen about 9 months of relentless selling by FIIs – giving us some hope that we should be at the far end of this realignment and should see stability coming back sooner than later.

-

Shift from high PE stocks to deep value investing / dividend plays

Interest rates and PE are inversely related – higher interest rate regime generally leads to a de-rating of PE leading to a selloff in high PE stocks. This is because as interest rates rise and cost of capital increases, investors prefer stable and free cash flow generating companies over high growth ones. In this kind of environment, investors interest generally tends to move to dividend plays and / or deep value investing – i.e. investing in companies where valuations are below their “intrinsic” value as they tend to withstand this volatility better. We have again experienced this happening in India as well as in the US specially in the new age tech and loss-making companies.

-

Realignment of portfolio from equity to bonds

“ History doesn’t repeat itself, but it does rhyme ” – Mark Twain

-

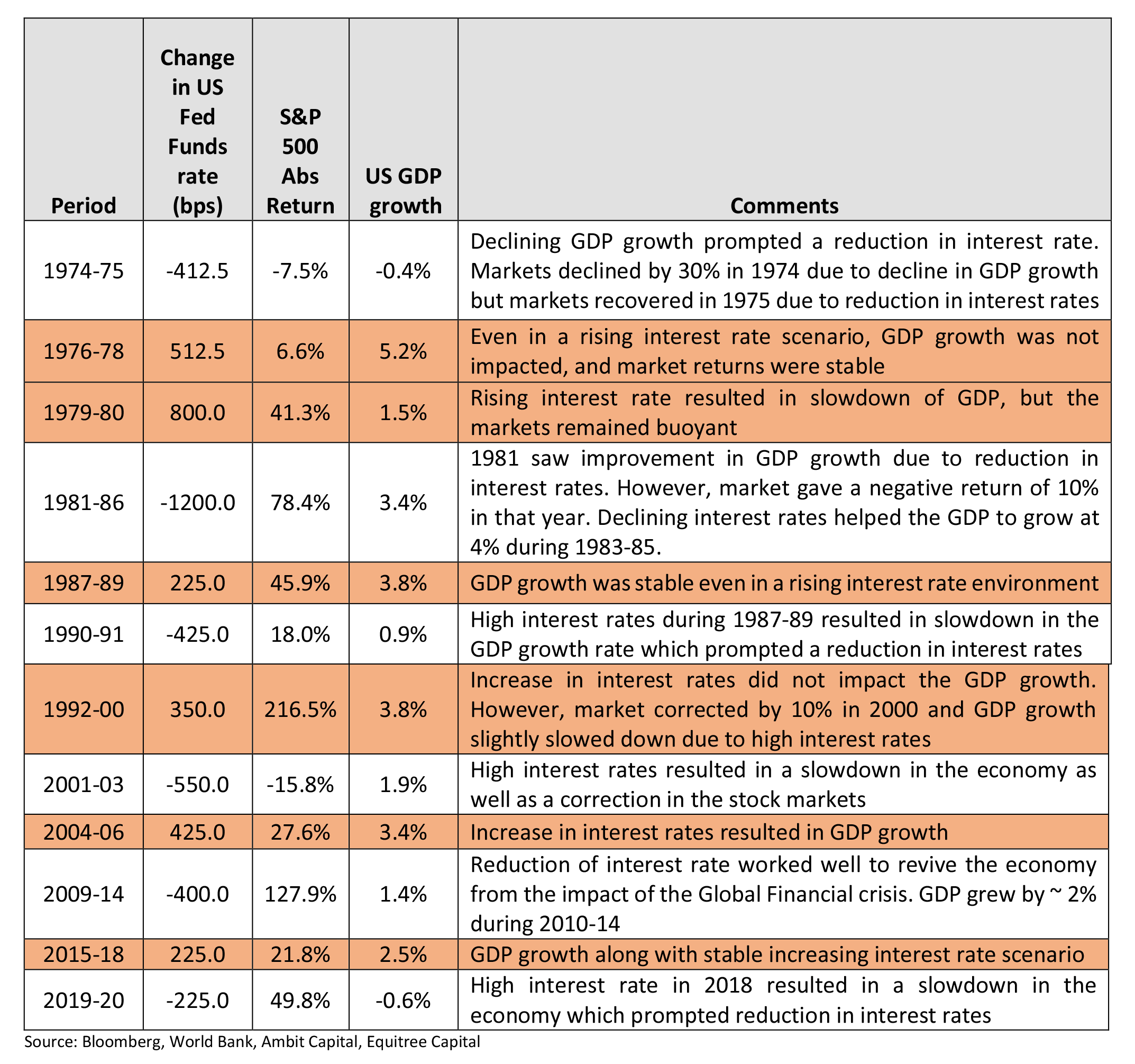

Rising interest rates generally does good to the market

-

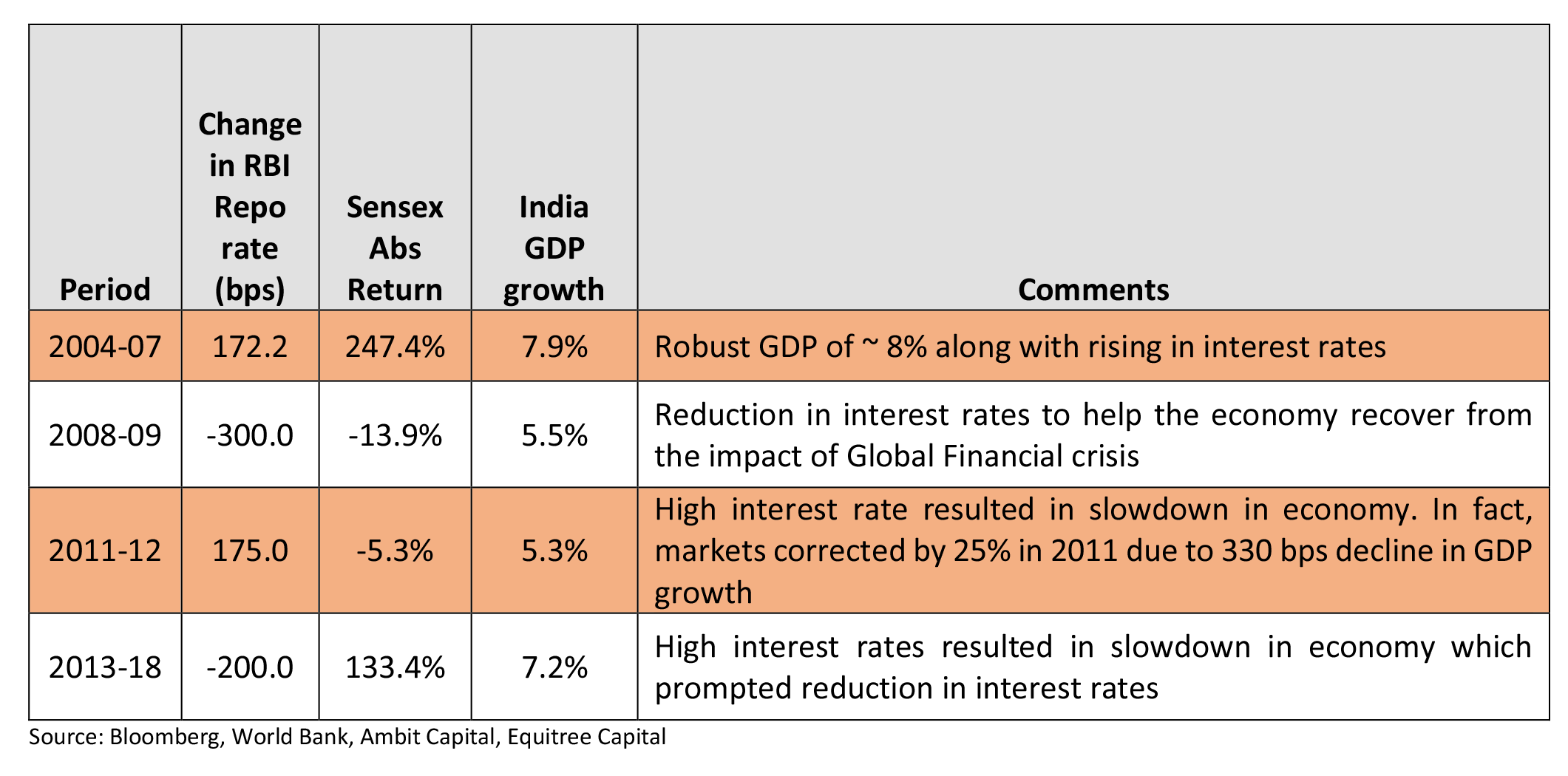

We have gone back 40 years to understand the impact of changing interest rate cycle on the economy as well the markets :

- From the above it can be seen that inflation to an extent is beneficial as it helps in increasing corporate profits which in turn increases demand and the overall GDP. However, inflation beyond a level is not beneficial as it reduces consumption and results in economic slowdown.

-

We have seen similar trends in India as well.

-

We have gone back 40 years to understand the impact of changing interest rate cycle on the economy as well the markets :

-

Current cycle is not like the usual cycle

- Over the last few years, developed economies did not see a significant growth in GDPs. This coupled with the pandemic prompted the Central Banks to provide monetary stimulus to its citizens to keep the economy afloat.

- The fiscal stimulus provided by the US government did not result in GDP growth, it only helped in maintaining the GDP and in fact prevented a possible recession in the US. On the contrary, a good chunk of the free cash distributed found its way in to financial assets such as new age tech companies and cryptos which resulted in obscene valuations of those assets / companies.

-

Unlike typical economic cycle, high inflation today is not come about due to increased demand / growth in GDP rather is more supply chain driven issue due to :

- Sanctions imposed by the US on oil producing countries such as Venezuela and Iran resulted in decrease in global oil supply.

- Tariff wars with China resulted in shortage of supplies to US as the US was not able replace the Chinese supplies.

- Covid resulted in shutting down of factories as well as disruption of global trade.

- Russia-Ukraine crisis further worsened the supply chains which were slowly getting back on track post the pandemic. Food and energy prices currently are the major contributors to the inflation.

- Channeling of stimulus into financials assets also resulted in speculation in commodities and other assets which also increased inflation.

-

How can this be corrected?

- With Fed’s dot plot indicating interest rate rising to 3.75-4% over the next 12 months, financial / speculative assets have seen a good correction over the last couple of months – metals correcting by around 20-30%, agri commodities correcting around 10-15%, crude correcting by around 10%. We feel that even while monetary policies do their bit, however, they alone may not be enough to curb inflation. Raising interest rates beyond a point may more likely lead to demand destruction and potentially a recession, defeating the very purpose of infusing money to save the economy in the first place. In fact, the US Fed Chair Powell in his recent testimony to the Congress has accepted that raising interest rates will not help in reducing the fuel and food prices and rate hikes may result in demand slowdown.

- We feel that the onus is on the politicians now to come together to resolve the supply chain issues that have been disrupted due to variety of reasons. Curbing inflation is also important politically given the upcoming midterm election in the US.

-

Some of the potential steps in addressing the supply chains issues could be

- Removal of tariffs imposed on China by the US

- Removal of sanctions imposed on Iran and Venezuela by the US

- Increase in crude production by OPEC

- Increasing sourcing of raw materials from Asian countries etc.

-

Indian economy shows a lot of resilience – silver lining in global chaos

- India’s GDP surpassed its pre-pandemic(2019-20) level by 1.5 per cent and the recovery remains robust in 2022-23 so far. The inflation print for May was lower than the previous month after seven months of continuous rise.

- Inflation in India today is not as bad as what it is in the US. This is partly because our government did not print money to keep the economy afloat during the pandemic. Also, India is largely independent (except for crude) when it comes to producing basic commodities which helped India deal with supply related issues in a better way.

-

A large part of the inflation that India is facing is on account of the increased crude prices globally and shortage of commodities induced by the Russia-Ukraine crisis (food and fuel prices constitute 60% of the CPI).

“75 per cent of the increase in our inflation projection, compared to what we had made in April, is attributed to food inflation...primarily the food inflation spike is linked to external factors, namely, the war in Europe.” – RBI Governor Shaktikanta Das in an interaction with press on 8th June 2022. - We feel that current elevated levels of crude oil are not sustainable as it will lead to demand destruction, which will reduce the demand for oil as well thereby cooling down the prices. Similarly, as mentioned above, any increase in supply of oil shall also result is reduction of prices. Either way, India will benefit from reduction in oil prices as it will help us in curbing the imported inflation.

-

A life time opportunity for Indian manufacturing!

- As mentioned above, increasing sourcing of raw materials from Asian countries by the Developed nations is likely to benefit India as well. Export opportunities for domestic as well as global players will open as countries look to diversify their supply chains.

- One can argue that a slowdown in the developed countries can hamper the export demand. It can very well happen that the overall demand may not increase for a while, but Indian players can possibly increase their share in the pie by replacing existing suppliers (similar to China + 1 theme that played out in chemicals). India’s share in global merchandise exports is only 1.8% (which is the 10-year average).

- In addition to above, Indian government has also set an ambitious target of achieving USD 1 trillion export (current exports stood at USD 0.4 trillion). The government has taken multiple steps such as a) introduction of PLI schemes b) reduction in tax rates c) Make in India initiatives d) Free trade agreements etc. to increase the domestic manufacturing. All the above tailwinds can help India increase its export share as well as creation of necessary infrastructure and required capacities.

While the government is doing its bit, it will be interesting to see how the Indian entrepreneurs rise up to the occasion to grab their share in the global export opportunity. Challenges notwithstanding, we believe that Indian entrepreneurs have tasted success in sectors like pharma, chemicals, home textiles and are yearning to make the most of this opportunity. We are already seeing companies in auto ancillary, apparels, footwear, engineering amongst others making global inroads and looking to scale up significantly.

-

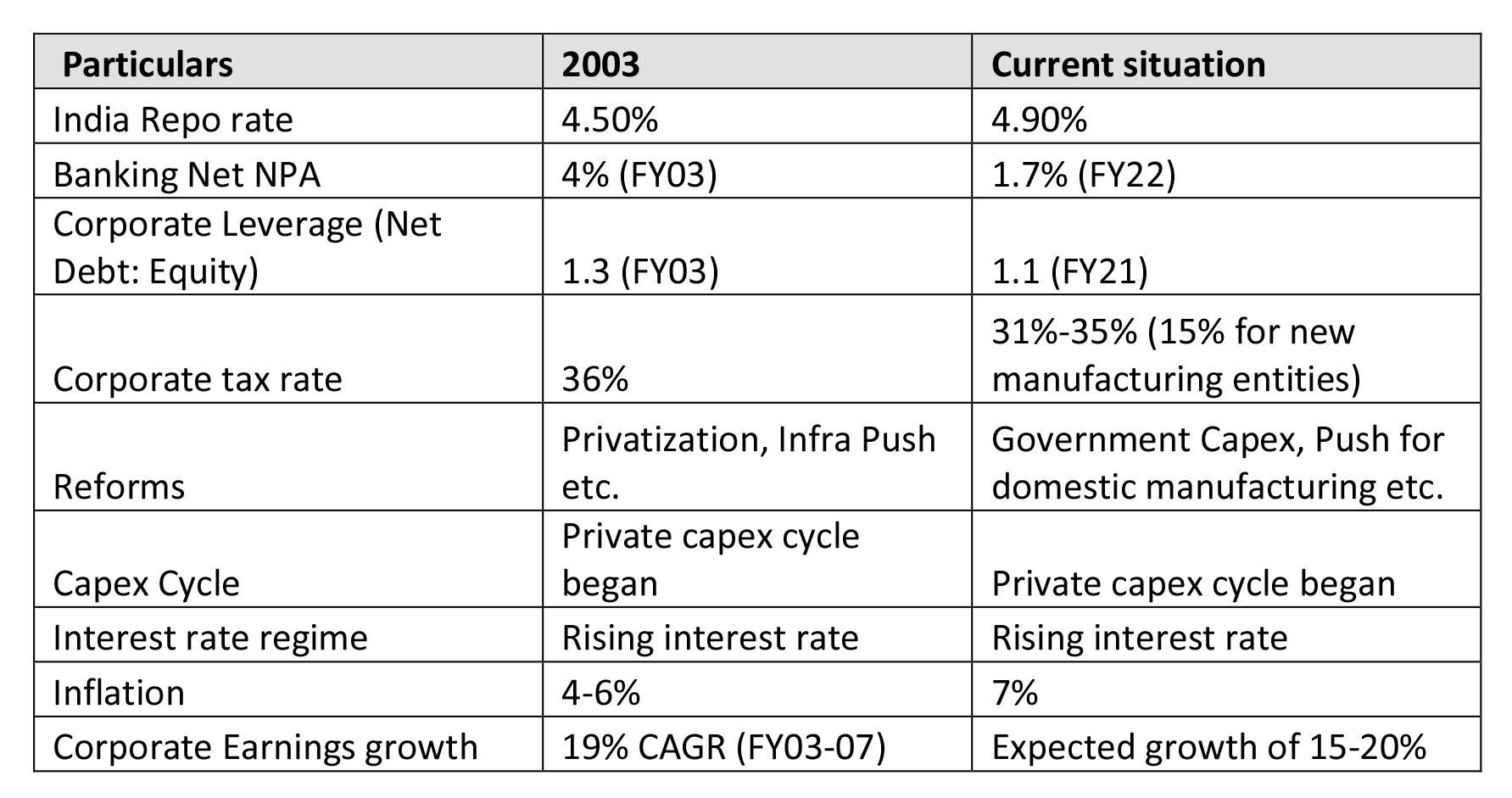

2003-07 deja vu - Stage set for a manufacturing / private capex driven bull run

-

While the market volatility and supply chains issues are expected to normalize in the near term. We feel that the current situation reminds us of the bull run that we saw in India during 2003-07 as well as the manufacturing driven bull run in Japan during 1970s.

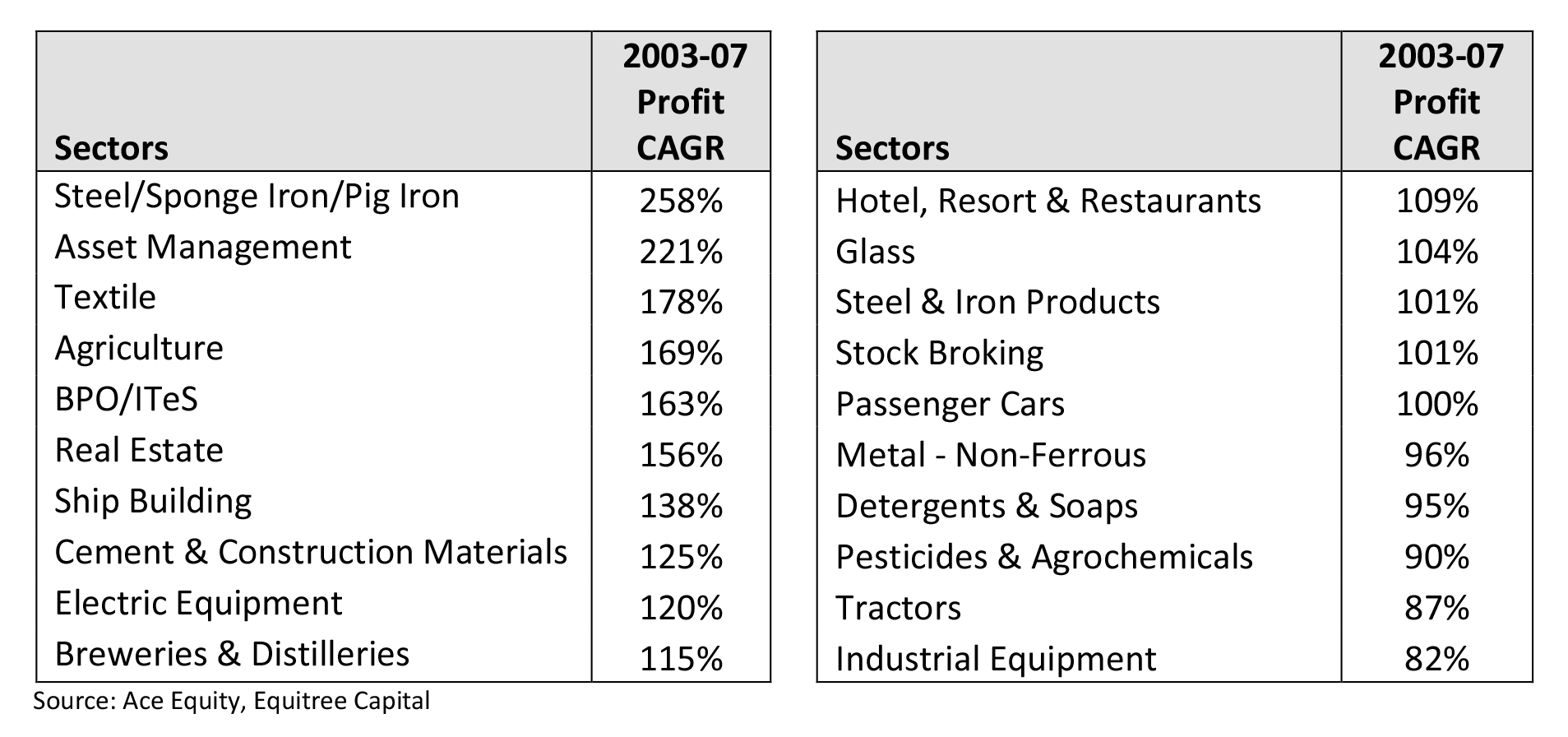

It is interesting to note that the bull run during this period was led by the real economy sectors – manufacturing, engineering et al which outperformed the median profit growth of 41% during 2003-07 period

- We expect capital goods, infrastructure, and manufacturing themes to play out once again in the coming yearsfueled by domestic and global players setting up capacitiesto cater to the global demand as countries look to diversify their supply chains.

- Having said that, investors will have to follow a bottom-up approach to look for companies that are best placed to ride the up cycle that is expected in the coming years.

- To emphasize this further, we would like to highlight that even though the textile industry is currently facing headwinds (and is expected to face headwinds going forward as well) due to increase in cotton prices and slowdown in demand in the export markets – one of our portfolio company (which is a leading manufacturer and exporter of knitted garments for infants and children) has mitigated the elevated prices by increasing prices, operating leverage and cost control measures. Company has a robust order book and is in a position where it has been rejecting orders due to high demand and unavailability of skilled labour. The Company has invested INR 20 crs to build a hostel for housing its labour, in order to address their labour bottleneck. They are on course to start production in their second shift within a few months.

-

While the market volatility and supply chains issues are expected to normalize in the near term. We feel that the current situation reminds us of the bull run that we saw in India during 2003-07 as well as the manufacturing driven bull run in Japan during 1970s.

With value investing coming back in vogue, we believe that our kind of investment style where we are focused on “deep value investing” should do extremely well in this kind of environment. Our continuous focus on manufacturing, engineering, infrastructure space – the very sectors which are likely to see high growth – puts us in extremely good stride from an investment perspective. We continue to be upbeat on our portfolio companies and some of the opportunities that we are currently exploring. Short term volatility notwithstanding, we strongly believe this is a fantastic opportunity to build portfolio of “real economy” companies for significant wealth creation over the next couple of years.

As always, please feel free to reach out to us at pawan.b@equitreecapital.com / skabra@equitreecapital.com with your comments/ suggestions/ feedback etc.

Warm regards.

TEAM EQUITREE