“Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.”

— Peter Lynch

Dear Investors,

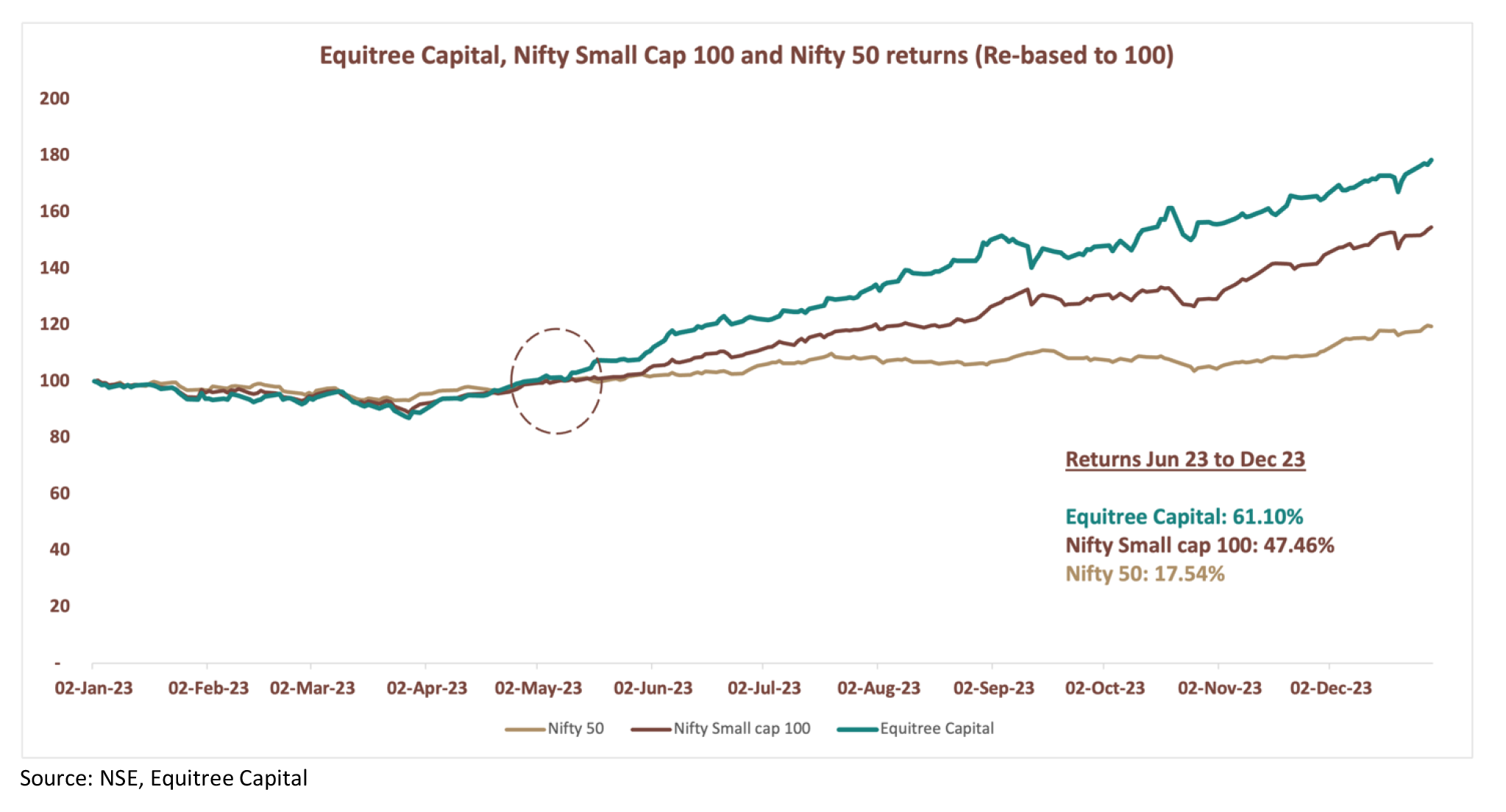

CY2023 has played out to perfection as mentioned in our June 2023 newsletter that Small Caps were slated for a significant outperformance to Nifty. Extract of the same is reproduced below:

“We strongly believe that we should see a mean reversion where the Small Cap index returns should not only catch-up Nifty but should exceed the same – this may happen either by Nifty correcting substantially or the Small Cap Index delivering better returns from hereon. We tend to believe the latter is more likely to happen – still leaving enough upside in the broader markets.”

Our performance:

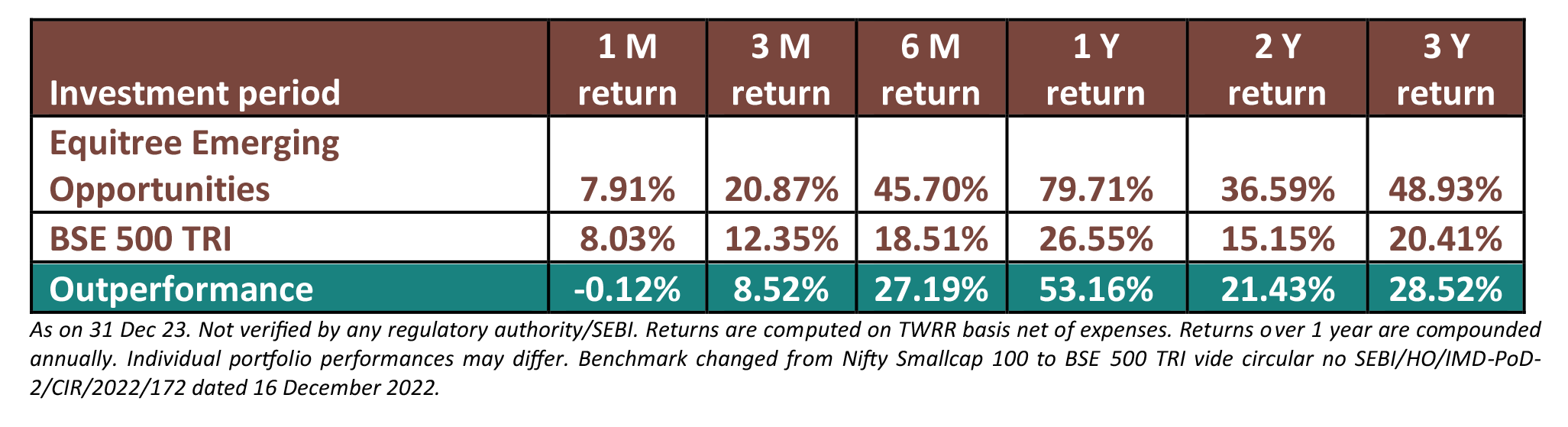

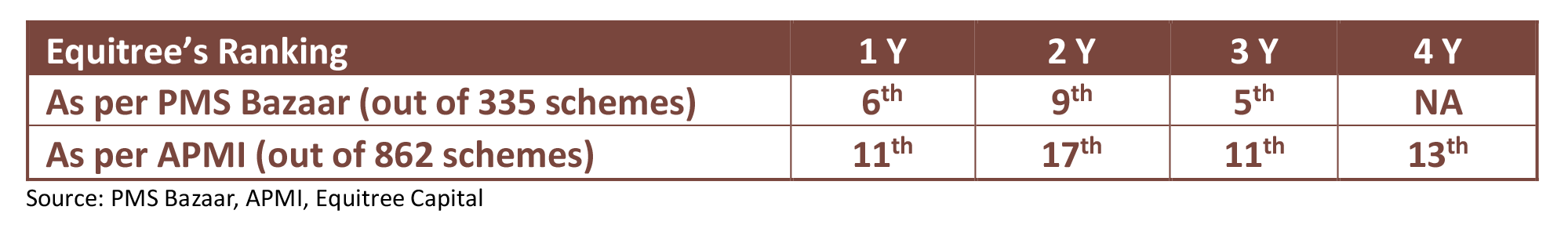

In this backdrop, we are glad to share that Equitree emerged one of the BEST PERFORMING PMS in India across all strategies for yet another year, delivering ~ 80% return in CY2023:.

It is now 4th year in a row that Equitree has been amongst the top performing PMS’s in India consistently across all strategies:

Despite the recent rise in small cap stocks in general and our portfolio in particular, we still remain very comfortable with the business visibility and valuation of our portfolio. The median valuation of our portfolio is 11x FY25 (more on this hereunder) and is expected to show a median profit growth of 30% in FY25. This leaves significant upside still to happen in our portfolio companies!

Small Caps: Just the Beginning or End of the Road?

There has been increased media frenzy on how Small Caps have become extremely expensive and vulnerable with more and more people recommending shifting to Large Caps instead. We take this opportunity to reflect upon some of facts and share our perspective on the same hereunder:

-

Breaking the valuation labyrinth – our genre of companies still trading at reasonable valuations

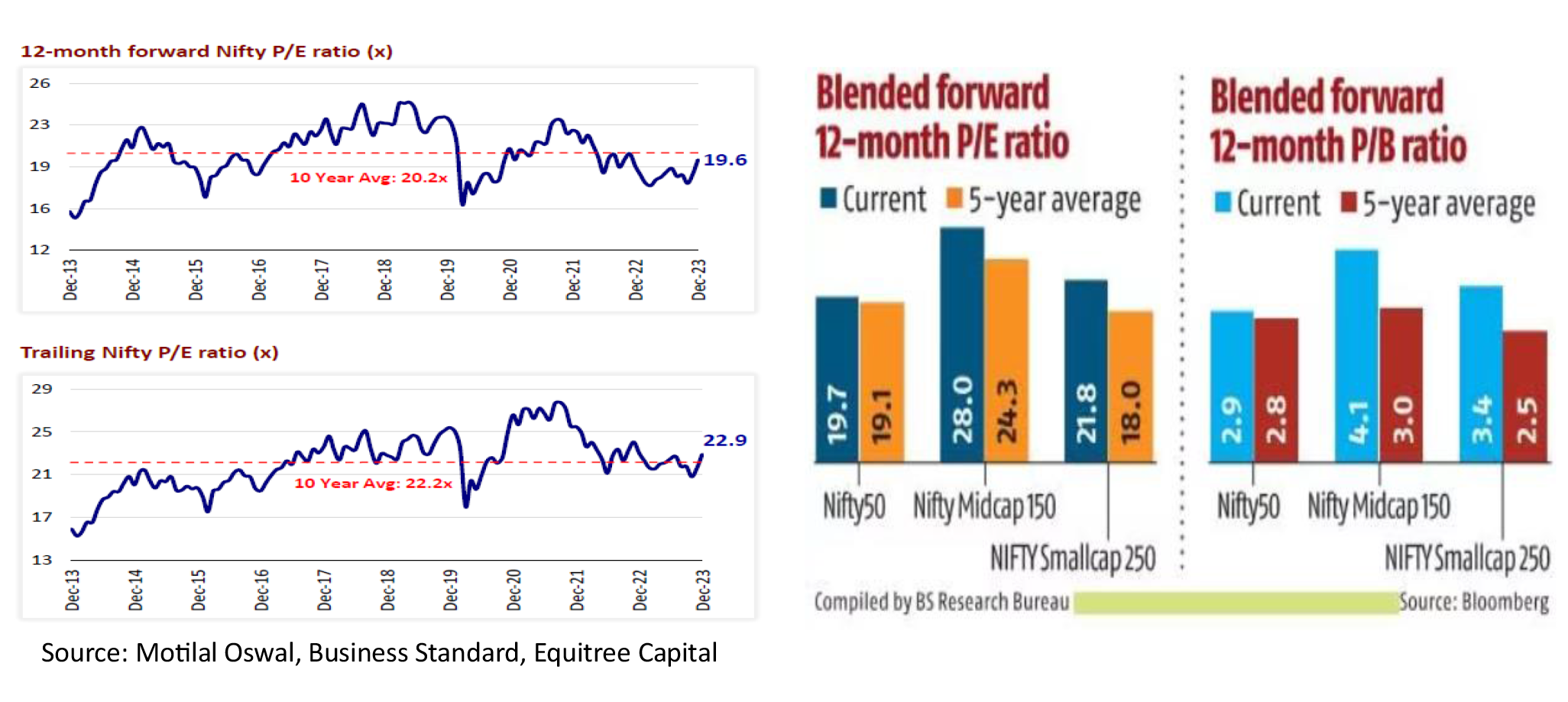

With the markets creating new high on the headline index there has been increased noise on the valuations being rich across the board with media reports suggesting that large cap companies are better poised in terms of valuations now than the small caps, primarily because of the run up in Small Cap companies. However, one needs to understand this in right context. We present hereunder valuation of large caps and Small Caps as shown in different media:

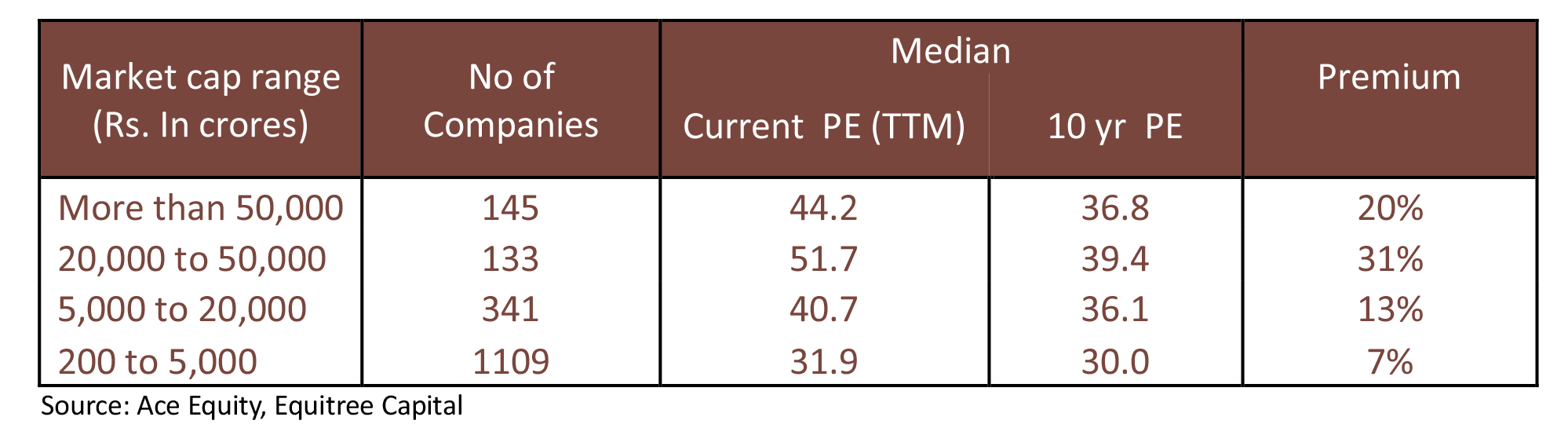

As can be seen from above, the consensus seems to be that Nifty currently trades at 12-month forward P/E of ~ 19.6x which is below its 10-year average of 20.2x and marginally higher than its 5-year average of 19.1x. Likewise Nifty Small Cap 250 index seems to be trading at 21.8x currently which is higher than its 5-year average of 18x. In our opinion, 5-year average may not be a right indicator of valuation matrix to begin with as it includes the black swan event of Covid making the averages quite erratic. Further, while one looks at the benchmark index as a lighthouse to get a sense of valuations, however, that itself has limitations due to smaller representation of companies which could again present very erratic outcomes. We analyzed broad base of companies based on their market cap to get a better sense of where we stand vis-à-vis 10-year valuation. The result is summarized here:

It is interesting to note that the larger Small Caps / Mid Caps / Large Caps (market cap with more than Rs. 20000cr) is trading at 20%-30% premium to their 10yr averages! The Small Caps – more particularly our focus genre of companies in the market cap range of Rs. 200-5000cr is trading at a mere 7% premium to its 10yr average PE multiple!! It is this genre where we still continue to find enough and more opportunities. While at that, there is indeed exuberance in some pockets of the market which we discuss hereunder.

-

Exuberance indeed – but only in certain pockets

We have seen massive liquidity chasing stocks in certain pockets of the market which has led to exuberance in these pockets. These include:

-

SME Exchange:

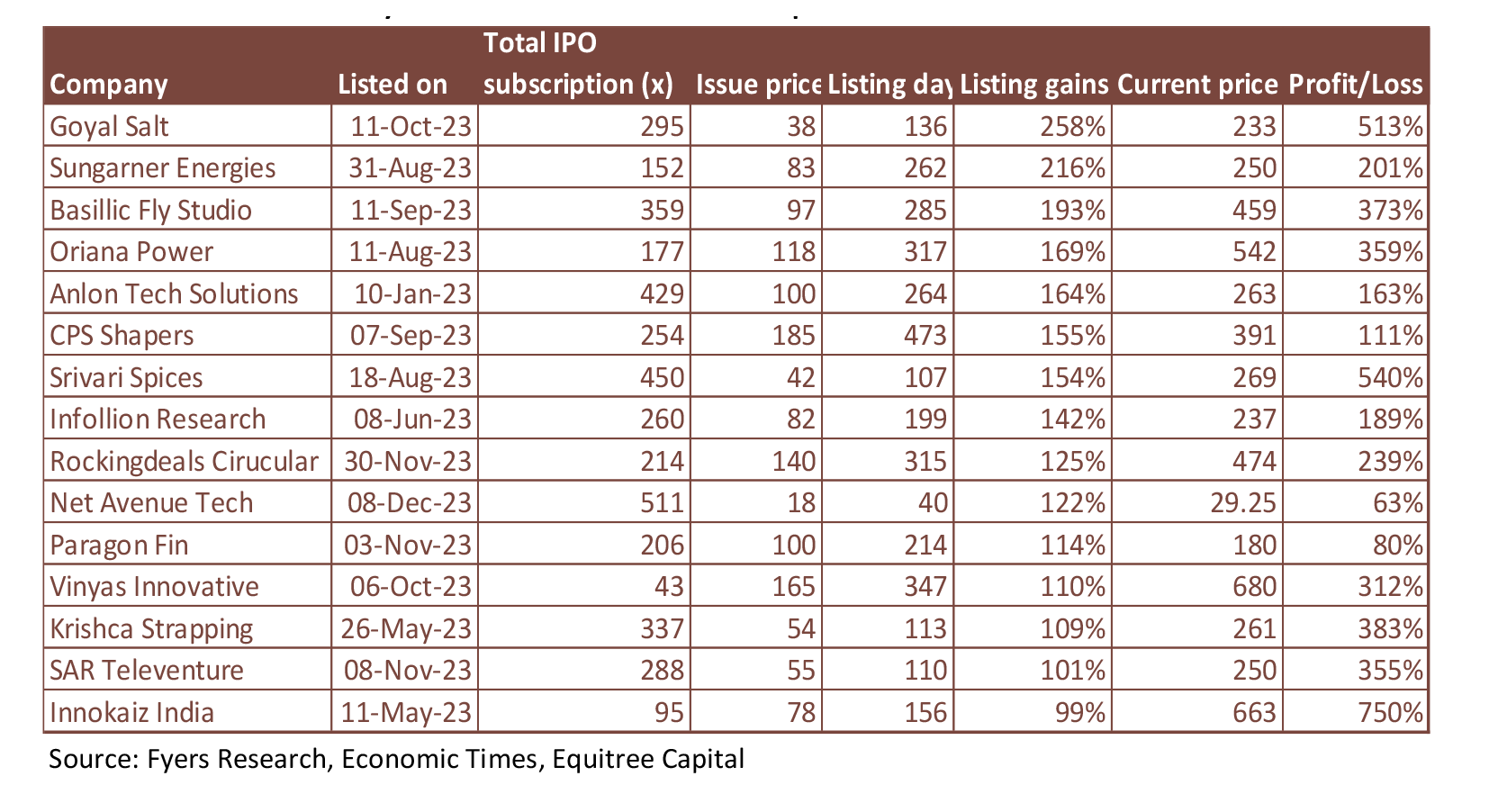

Over the last year, SME Exchange has seen over 164 IPOs which were looking to raise Rs. 4,425cr cumulatively received bids worth Rs. 280,000cr! We share a sample of some of the IPOs recently conducted and their performance:For relatively smaller companies with limited existential history and paltry profits, this kind of exuberance is surely unnerving. We have seen stocks going up 3-10x over the last year in this segment without any substantial change in fundamentals – just future promises being sold. We are very wary of money being made so easily luring a lot of retail investors in this genre of investing – a perfect recipe for an accident in the making.

-

Larger Small Caps / Mid Caps:

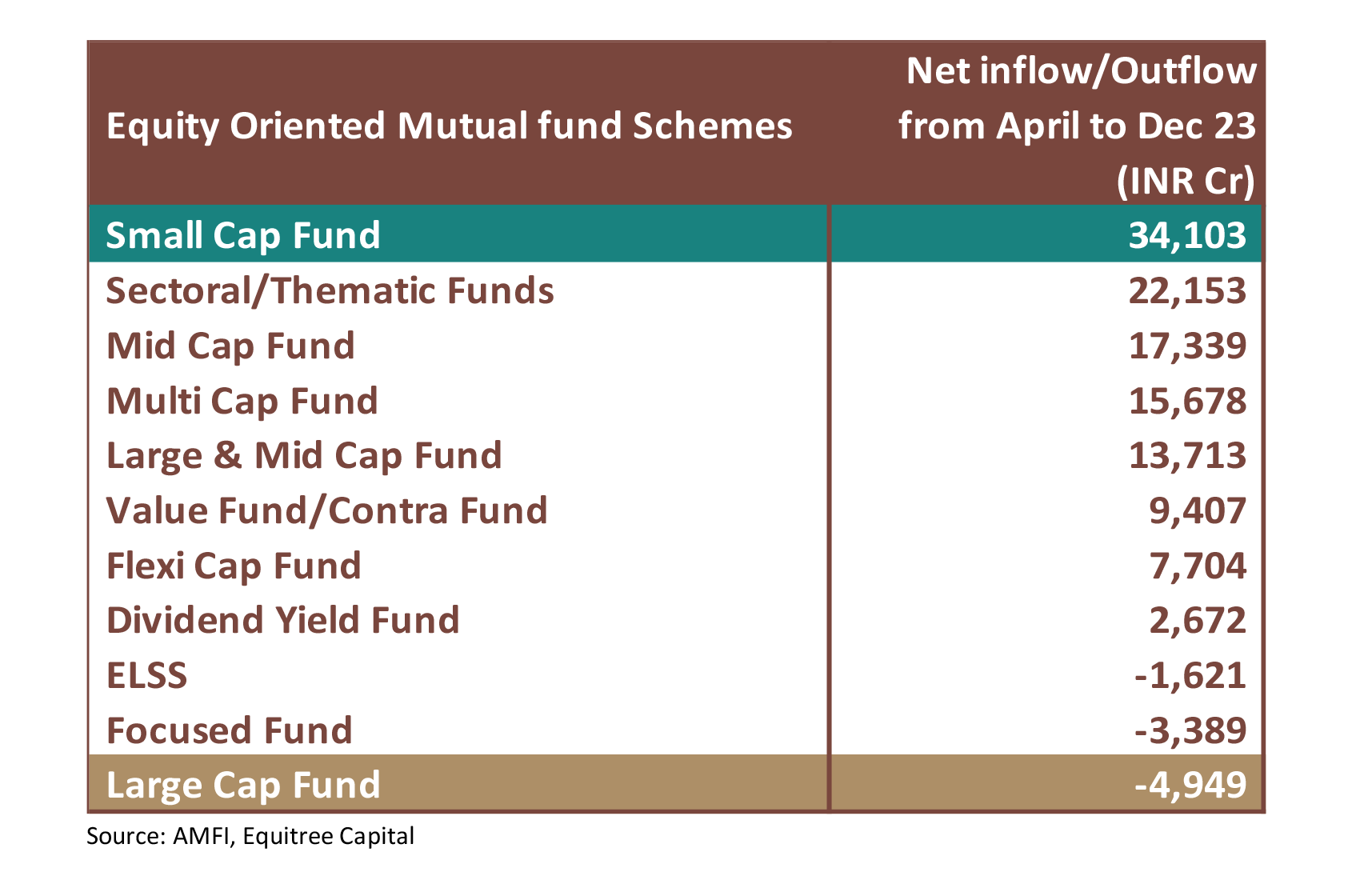

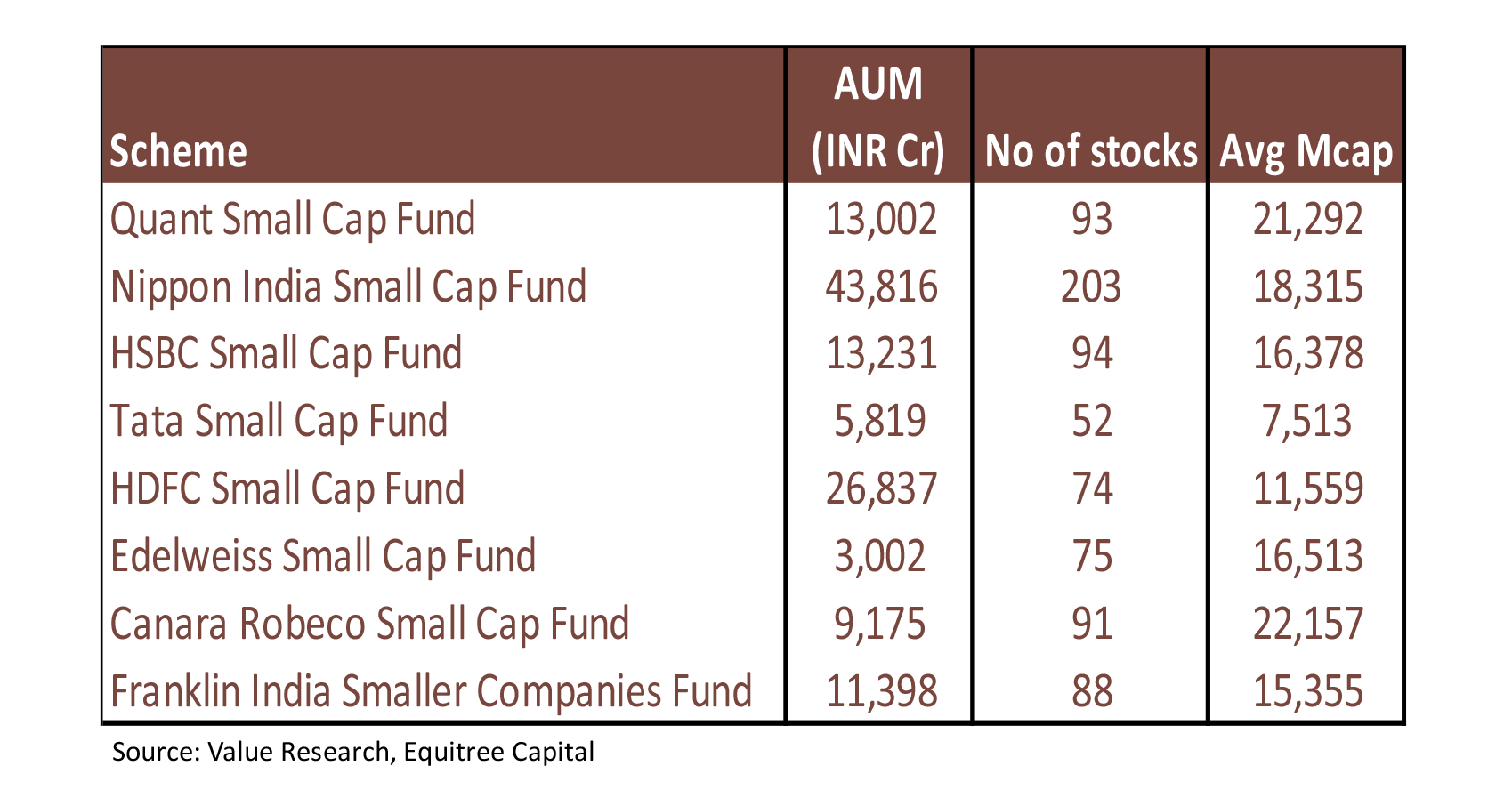

With SIPs seeing a record of Rs. 17,610cr for the month of Dec’23, we have seen increased participation from retail investors. Overall SIPs have seen a staggering 23% growth from Rs. 149,437cr in CY22 to Rs. 183,741cr in CY23. Interestingly, a major chunk of this has found its way to Small Cap, Mid Cap, Value / Contra Fund as shown hereunder:Likewise, Small Cap focused PMS’s have also seen major traction during the last year and have seen assets swelling substantially. A close analysis of these “Small Cap” Mutual funds suggest that most of these are focused on relatively larger small caps / mid-caps with an average market cap of focused companies ranging from Rs. 4000cr-20000cr. Needless to say that this excess liquidity has gone in to chasing the same stocks which most of these funds / PMS’s are already invested in with little new additions. It is these stocks again where one has seen significant re-rating of companies driving the valuations to levels where future gains will be curtailed. It's worth highlighting that at Equitree, our average market cap is positioned at Rs.1,700cr, markedly below the target range of these Small Cap Mutual Funds / PMSs. The median institutional holding in our portfolio companies is just 3.6%, indicating that these entities are still in the early stages of attracting significant institutional investment, thereby shielding them from the current market's liquidity-driven fervor. We anticipate that as our companies evolve and mature, they will attract increased attention from larger investors, potentially leading to a revaluation of our portfolio.

Needless to say that this excess liquidity has gone in to chasing the same stocks which most of these funds / PMS’s are already invested in with little new additions. It is these stocks again where one has seen significant re-rating of companies driving the valuations to levels where future gains will be curtailed. It's worth highlighting that at Equitree, our average market cap is positioned at Rs.1,700cr, markedly below the target range of these Small Cap Mutual Funds / PMSs. The median institutional holding in our portfolio companies is just 3.6%, indicating that these entities are still in the early stages of attracting significant institutional investment, thereby shielding them from the current market's liquidity-driven fervor. We anticipate that as our companies evolve and mature, they will attract increased attention from larger investors, potentially leading to a revaluation of our portfolio.

-

Margin funding touching all time high:

Margin funding where brokers / NBFC’s fund investors for buying of shares against ~ 25% margin contribution has been on rise reaching Rs. 54,537cr as of Jan’24, significantly higher from Rs. 29,500cr last Jan and Rs. 7,100cr in Feb’20! This only shows the kind of exuberance from the recent upside in the market leading people to leverage and invest more in hope of making faster money – this kind of greed can never be sustainable in the long run.

-

SME Exchange:

-

Liquidity is here to stay

Despite the continuous doubts being raised on sustainability of domestic inflows in the markets, we have seen the SIPs only increasing month after month. We believe that there have been structural changes on the ground ensuring this increased participation and strongly feel that this is going to only get better in times to come. We enumerate some of these changes:

-

Newgen moving away from parallel economy

As the Millennials and GenZ take over reins of family wealth from the Baby Boomers and GenX, there has been an increased affinity to move away from parallel economy. This shift of wealth to formal economy has led to increased participation in financial assets with a large chunk finding its way to the capital markets. -

Increasing education and awareness

“Mutual Funds Sahi hai” has become a kind of clarion call in recent times! The effort taken by the regulators in creating mass awareness as well as availability of multiple educational platforms has ensured rise of a more informed investor class who is ready to navigate volatility of capital markets and yet not just keep his calm but also increase participation in such scenarios. This has been a striking contrast from the past where the retail investors would generally be the first ones to lose confidence and sell off at the slightest of volatility. -

A Shift from Traditional Investment

The headline Nifty 50 index has delivered returns of 15% CAGR over the past two decades and significantly outperforms real estate's modest returns of 9% and even gold's 11.2% during the same period (Source: Statista, NSE). This consistent higher returns from equity markets has ensured reallocation amongst asset classes in favor of financial assets. The fact that financial assets are much easier to handle and liquidate has been a strong driving factor for the shift of household savings to capital markets. -

Improved Regulatory landscape and Ease

The e-KYC system has had a transformative impact on market access. As of April 2023, the cumulative number of Aadhaar e-KYC transactions surpassed 14.95 billion, expanding market reach, even in remote areas thereby making is very easy for retail investors to participate in capital markets. Simultaneously, the Securities and Exchange Board of India (SEBI) has played a pivotal role in implementing crucial regulatory reforms to ensure market fairness. Measures like banning brokers from using client securities for their own loans, limiting exposure on stock leverage, linking F&O exposure to stringent margins, proactive steps to curb insider trading etc. have gone a long way to safeguard investor assets and inspire confidence in market participants.

All this is at the retail level alone.

One also needs to understand that FIIs have been continuous sellers in the Indian markets for the last 3 years in a row selling to the tune of Rs. 387,639cr cumulatively and have further sold stocks worth Rs. 23,583cr until 20th Jan’24 itself. As India emerges as one of the fastest growing economy in the world and we see interest rate reversals coming about in later part of the year, we believe that we will also see buying coming about by the FIIs. This should further add to the liquidity and buoyancy in the markets.

-

Newgen moving away from parallel economy

-

Corporate earnings in a buoyant mode – remember 2003-07?

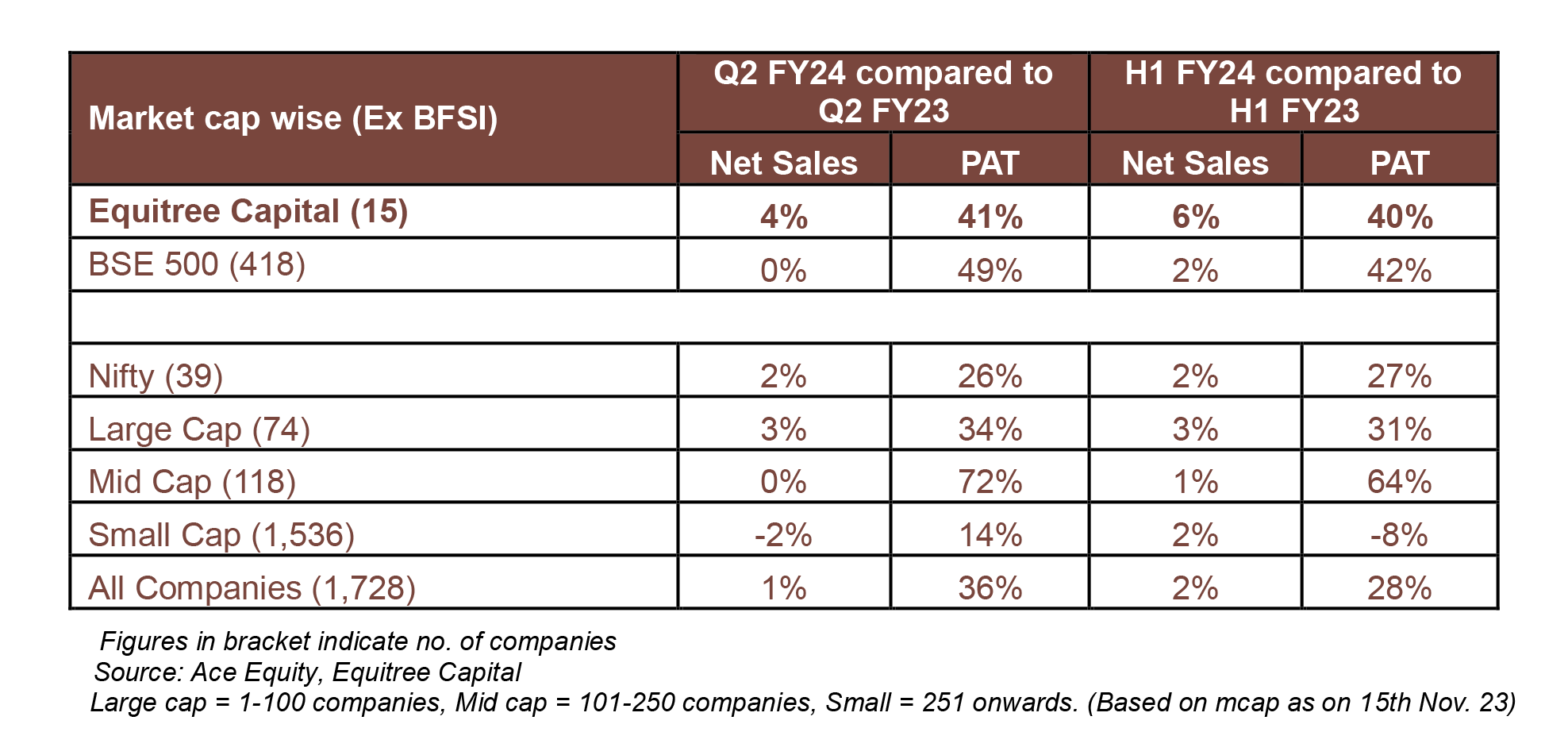

In our newsletter for Jun'22 quarter end, we had spoken about expected buoyancy in corporate profits leading to significant wealth creation in capital markets similar to 2003-07 era. We are glad to share that even this prediction is playing out to perfection as reflected in Q2 / H1 FY24 reported numbers:

We expect this growth trend to continue further albeit on a lower growth rate given the higher base now. Nevertheless, we should see corporate profits delivering CAGR growth of ~ 18-20% over the next couple of years which should continue to fuel the markets further.

-

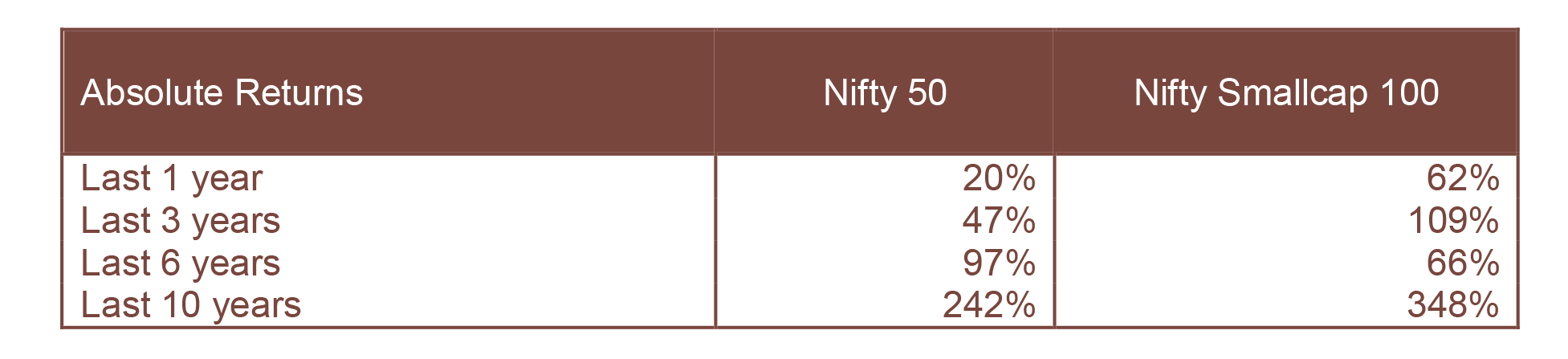

While Small Caps have surely outperformed the Nifty in recent times, their 6-year performance still trails behind the Nifty.

This year, the Small Cap Index has risen by 62%, significantly outshining the Nifty's 20% gain. Despite this, Small Caps have displayed a robust performance over the past three years. However, it's worth noting that such short-term gains often overshadow longer-term performance.

A closer look reveals that 57% of Small Caps’ gains in the last three years occurred in the previous year, and 94% of the six-year returns accumulated in the last year alone, amounting to a modest 5-6% annual return in the preceding five years. Even with this year’s stellar performance, Small Caps have not surpassed the six-year returns of Large Caps, as illustrated below.

Our perspective is that the underperformance observed cannot be rectified by a mere 1-2 years of outperforming trends. Despite volatility, we foresee the Small Caps outperforming in the next 2-3 years as part of a mean reversion over a decade, ultimately leading to their long-term outperformance.

Our conviction in small cap stocks has been bolstered by robust investor interest in sectors like Engineering, Manufacturing, Infrastructure, Capital Goods, Railways, and Defense, which are underrepresented among Large Caps. These sectors, which are also our core investment focus, have substantial growth potential ahead.

“A market downturn doesn’t bother us. It is an opportunity to increase our ownership of great companies with great management at good prices.” – Warren Buffett

Outlook on CY24

In 2024, we foresee a shift from sector-led rallies to selective stock picking driving wealth creation. While 2023 saw a general uptick across sectors, this may lead to a more cautious approach in the new year. Even as IT, Chemicals, and Textiles have not led the charge, we expect individual companies within these sectors to become key wealth generators in 2024.

2024 is starting on the backdrop of good returns. After these kind of returns it wouldn’t be out of context for the market to take a breather before it moves ahead, and this may call for a time correction and / or an absolute correction. We believe that a 5-7% correction in the headline indices is not out of context and with that small caps may also see a drawdown of around 20-25% in the worst scenario.

Markets have factored in a lot of positives already right from expected reduction in interest rates, growth in corporate earnings, a stable government coming back post elections, normalization of geo-political issues et al. Any negative surprises in any of these may bring in huge volatility during the year.

We believe that if such an opportunity arises, one should be ready to lap it up and build a portfolio of high-quality businesses to create wealth from a mid to long term perspective.

How are we positioned in the current market?

Given the low base of last year coupled with margin recovery in most business on account of raw material stabilization, as expected, we saw a very good growth in PAT for Q2 FY24. In fact, the buoyancy in businesses in some of our portfolio companies have positively surprised us, far exceeding our expectations! This has led us to revise our profit estimates upwards for these companies.

The most comforting fact was outperformance of our core portfolio companies which fired during Q2 reporting an aggregate growth of 41% in PAT (our top 15 holdings which constitute about 87% of the portfolio ex-cash).

True to our core principles of deep value investing we have completely exited from a couple of our investment as their valuations ran up beyond our comfort zone and have added a new company as well in the core portfolio. We will continue to monitor the portfolio and book partial / complete profits wherever we see the valuations running ahead of our comfort zone.

For now, we remain super excited about the near term business visibility of our portfolio companies and given the undemanding valuations and very low institutional holding in most of them, believe that there is still significant upside yet to happen in our portfolio.

We continue to cautiously build up on our portfolio companies and look forward to leverage the volatility to add more, should one arise!

For any inquiries or feedback, please contact us at pawan.b@equitreecapital.com or skabra@equitreecapital.com.

Follow our LinkedIn page for ongoing updates on our performance and market insights!

Warm regards.

TEAM EQUITREE