“Common sense in an uncommon degree is what the world calls wisdom.”

— Samuel Coleridge

Dear Investors,

After an astounding 2021 we had mentioned in our Dec’21 newsletter that “The returns going forward are likely to be more reasonable given the higher base effect that has got established now” - 2022 has indeed toed the line to perfection to what we had anticipated. During 2022 after all the volatility in the market due to various geo-political & economic issues, new highs being made on the headline Index etc., Nifty delivered a flattish ~ 4% return at the end of the year. Against this, the broader base of the market remained impacted with the benchmark NSE Small Cap index delivering -14% return during 2022 – the situation has been worse off with individual stocks in general coming off by 20-50% as well.

Amidst all this, we at Equitree have reasonably navigated this volatility delivering a modest 4% return during 2022. Our performance is summarized hereunder:

Our Performance :

We believe that after 2 consecutive years of high returns delivered on the portfolio, this year has been a year of consolidation for our portfolio. Despite this, we outperformed the benchmark by a significant yardstick. We strongly believe that our stocks are at an inflection point and should witness significant wealth creation in the coming years.

We are glad to share that we have consistently been amongst the top 10% performing funds* across all strategies on a 3 year basis, all of which got endorsed in receiving a 4* rating from CRISIL in association with PMS Bazaar – a platform which tracks data of over 300+ PMS schemes.

*Data from PMS Bazaar

“ Baniya Budhi, the uncommon common sense to investing ” – secret recipe for our success

“ Heads I win; tails, I don’t lose much. ” – Monish Pabrai, The Dhando Investor

We are often asked about our consistent performance in a ‘supposedly’ high risk genre of micro / small cap investing. We believe the cornerstone of our success has been the ‘uncommon common sense approach’ that we bring to our investing. We have been keen observers of the primal traits of the hugely successful Baniya community and learn from their experiences to implement with respect to our investing – being part of the same community helps naturally (I guess!).

We are trying to summarize some of these traits hereunder :

-

Sharp eye for the detail

Amidst large number of products that a Baniya generally stocks, he knows exactly what is kept where and how much – and all this without even any bar codes at work for inventory management. Similarly, even after sitting in one corner of the store, he always knows what’s happening at which counter. It is this acute and sharp eye for detail which helps him manage his store efficiently and profitably. Likewise, we at Equitree try to get into the finer details of the businesses we invest in – right from understanding the macro-opportunities to sales cycles to unit level economics etc. It is this eye for detail which helps us separate wheat from the chaff and help us reduce accidents while investing in the micro / small cap genre. -

Importance to cash flow – profits will automatically fall in place

In the age old system, no Baniya ever kept any detailed record of P&L and Balance Sheets – simple system of cash collection everyday as reduced by payables used to be the cash taken home – and this cash taken home would be the profit. This ‘cash taken home’ would automatically get adjusted for any new expansion that he needs to provide for. Amazing simplicity in managing business against all the new age jargons! Taking a cue from this age old formula for sustainability, we also pay as much heed to the cashflows earned as against the reported profits. In fact, we have had some of our best investments where companies were reporting lower profits due to higher write offs but cash flows were very strong – these eventually have led to multi baggers being created. -

Being debt averse

Generally, the Baniya community is very debt averse – even if it were to be for scaling their own business. This could be due to the fact that they work on very small margins and understand that in a downturn, interest cost can eat deep into the capital and pose survival risks. We at Equitree are also equally debt averse – most of our companies are debt free and / or have a very negligible debt. At a portfolio level, our debt/equity ratio stands at a mere 0.3x! -

Acute sense of costing

Given the low margins that this community works on, they are very frugal. They are conscious that cost saved is profit earned. One of the biggest example of this could be the difference in fortunes of Big Bazaar and Dmart. Big Bazaar played on high street rented premises and vendor credits and Dmart played on company owned (no rent) premises and cash discounts to increase the business profits – all of us know which format has been more successful! Similarly analyzing cost structures and sustainability of margins is something that we at Equitree keenly look at to assess longevity of business moats. This helps us immensely in assigning the right valuations when looking at companies. We have seen enough instances where a seemingly high margin business has lost its entire competitive edge as business scales up and / or as competitive pressures eroded the margins – leading to value destruction in these companies. -

Save for a rainy day

As the saying goes, this community is known for their savings as well which they deploy at the right time to make best use of opportunities – whether it is buying inventory at throw away prices or building assets in a downturn. We try to implement this in our own deployment strategy – as a fund manager we have been very comfortable in taking cash calls and have been holding as much as 10-25% in cash depending on our sense of volatility in the market. We generally never look to deploy our investors’ money in a hurry or in a single block. Likewise, our staggered approach to investing has helped us turn adversity caused in the market due to external volatility and / or temporary setbacks in a company’s performance, into opportunities. Some of our biggest multi baggers have been in companies where we increased our positions in these stocks during a downward phase in the company’s performance – the long term structural story remaining intact.

Our outlook for 2023

“ In the world of the blind, the one-eyed man is king. ” – Desiderius Erasmus

2023 has started on an interesting note – while the global markets seem to be oversold leading to some bottom fishing pushing up these markets, India has seen continuous selling by FIIs leaving Nifty down by 1% in the first 2 weeks. In this light, we enlist a few trends to watch out for in 2023:

-

Pause of burning issues of 2022 and a slowing world economy

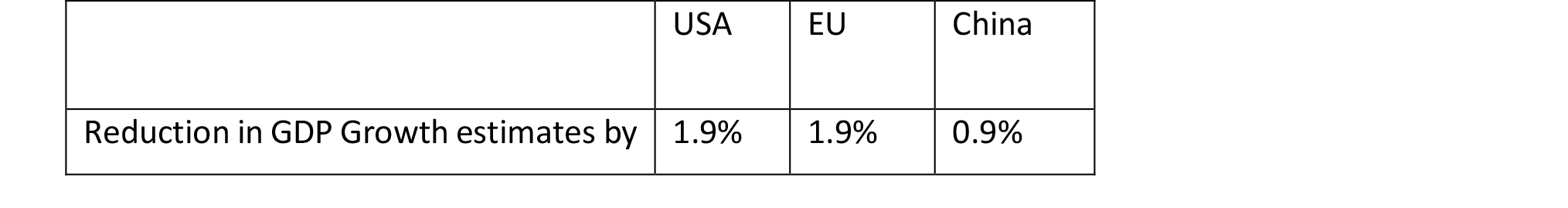

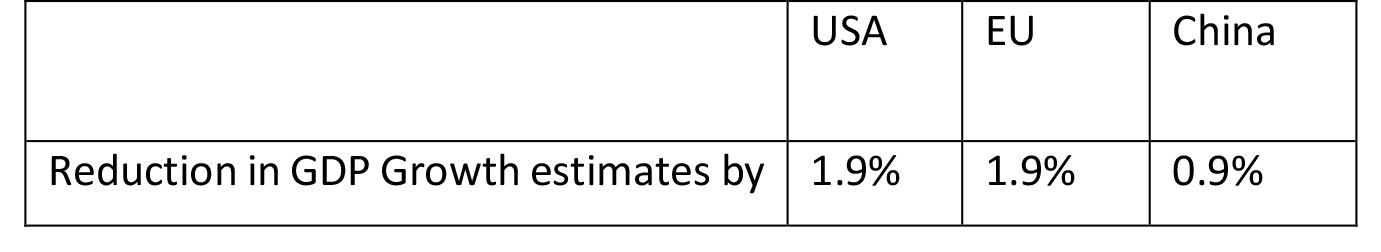

2022 was plagued by rising commodity prices, high inflation, and rising interest rates. Since the last quarter most of these have started showing stability and a downward trend (except interest rates, of course). India being a large consumer of commodities, should benefit from the lower commodity pricing. Lowering inflation should also lead to a pause in rising interest rates – which should eventually be good for global equities. However, on the other side one will also be grappling with a slowing world economy. The impact of the continuous rising interest rates is yet to be seen in its full efficacy. We are already seeing World Bank reducing the GDP growth rates for most economies. Amidst all this, India’s export story will be challenged – signing of FTAs with major economies should help in reducing this impact to some extent. The China+1 and Europe+1 story is also likely to see stronger foothold. It will be interesting to see this tug of war plays out. While the macros will play out themselves, we reiterate that one needs to be watchful for specific opportunities where companies are stepping up to the occasion to gain more market share.

Amidst all this, India’s export story will be challenged – signing of FTAs with major economies should help in reducing this impact to some extent. The China+1 and Europe+1 story is also likely to see stronger foothold. It will be interesting to see this tug of war plays out. While the macros will play out themselves, we reiterate that one needs to be watchful for specific opportunities where companies are stepping up to the occasion to gain more market share.

-

India to continue with growth – increasing capital expenditure and robust domestic economy

There is a global consensus that India is likely to emerge as one of the fastest growing economy even amidst all the global doom. We are experiencing one of the largest private and public capital expenditures in the past decade or so which should bring in a multiplier effect on the economy. Various initiatives introduced by the government like PLI, reduced income tax on new manufacturing entities, Make-in-India etc. are working towards changing the face of Indian economy from a service led economy to a manufacturing driven one, which should eventually result in increasing domestic consumption too. -

Flight of capital from equity to high yield fixed income

With the rising interest rates, the fixed deposit rate has inched up to 7-7.5% now. This kind of high risk free rate of return as against projected 12-14% return from equities is certainly bound to bring about some capital out of the equity markets thereby creating potential liquidity issues. We saw this capital reallocation being done by FIIs last year already which was more than absorbed by DIIs on the back of continuously increasing SIPs. However, we need to wait and watch the impact if this SIP flow gets challenged for the alternates in the high yielding fixed income. -

Increased importance of Value Investing

We have spoken about this in our past newsletters as well that as interest rate rise, the high PE stocks tend to take a beating. We have all seen this happening across sectors in the obscenely valued new age tech stocks, IT, FMCG, Pharma etc. We strongly believe that as the higher interest rate regime continues for a while, one should see increased interest in the “deep value investing” genre. -

Small / Micro cap likely to do better than their larger peers

Increasing commodity prices played more havoc on the small and mid-cap companies as compared to their larger peers due to economies of scale. As these margin issues settle down, we should see a much higher and faster recovery in the small / micro cap companies as compared to the large caps. Further, during the last year while the larger cap still held on, the broader base of the market saw corrections ranging from 20-60% from its 52 week high and seems oversold. As the business visibility improves and value investing takes the center stage, we expect the small / micro cap to do much better than the large caps. -

Addressing the elephant in the room – Budget 2023

As we approach 1st Feb, it becomes imperative to talk about the budget – an event which often becomes a non-event. As this year is the last actual budget before the union elections, we expect the budget to be more populous and focused towards – infrastructure and agriculture. In-spite of the commodity shock in FY23, the government should manage to maintain their fiscal deficit target of 6.4%, thanks to the robust collections on import duty, GST and income tax. We expect this trend to continue and lend the government some cushioning to spend money on sectors that will have a multiplier effect.

Overall we expect 2023 to be driven much more by the right stock picking for wealth creation rather than a broad based momentum run up in the market. We believe it would be extremely important to do a bottom-up investing and be in the right place.

A quick update on our portfolio

“ The big money is not in the buying and selling, it’s in the waiting. ” – Charlie Munger

Our portfolio is largely structured to leverage the opportunities in the Indian infrastructure plays – Metro, Railways, Defense, Agri Equipment; niche export plays – apparel exports, auto ancillaries, consumer plays – niche media play, logistics etc which are directly linked to the economic growth of the country.

As investors scurry to find pockets of value in the market – our portfolio continues to trade at an average valuation of ~13x (FY24E). Given the business visibility that we are seeing in our portfolio companies we are expecting an average growth of ~36% for our portfolio companies in the upcoming FY24.

Having said that, we expect to see some impact of the high-cost inventory linger in the Q3 numbers even as commodity prices have begun to cool off. Q3 might also see exports dip slightly. Our portfolio should report flattish growth for the quarter, expected to be ~8%. We expect this to normalize by Q4 and pave way for the expected growth in FY24.

We strongly recommend our investors to use the current softness in the market (which may extend briefly as Q3 numbers pour in) to build up on the portfolio from the next 15-18 months perspective and reap benefits as the growth unfolds. We strongly believe in the strength of our portfolio companies and that they are positioned to benefit from many macro triggers ranging from the FTA, a populous budget, revival of the automotive industry, revival of capex cycle and improved domestic consumption. We expect these positives to aid our portfolio to generate an IRR of 25% over the next 2-3 years as we continue to stick to our core competencies and invest like a Baniya.

On that note, we wish you a Happy New Year and Happy Investing!

Please feel free to reach out to us at pawan.b@equitreecapital.com / skabra@equitreecapital.com with your comments/ suggestions/ feedback etc.

Warm regards.

TEAM EQUITREE