“ The less prudence with which others conduct their affairs, the greater the prudence with which we should conduct our own affairs. ”

— Warren Buffet

Dear Investors,

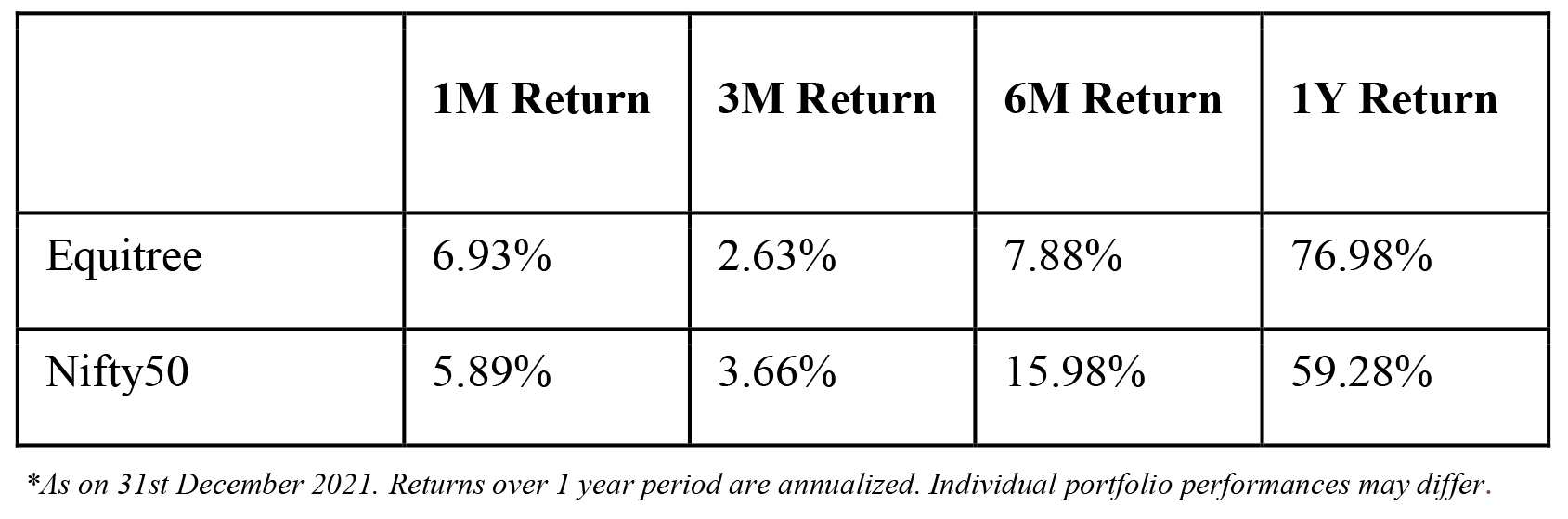

2021 has been an astounding year for us! Glad to share that Equitree was ranked 12th amongst the top performing PMS’s in India across categories!!

Despite all the volatility that we observed since 2018 for variety of reasons, it is reassuring that our conviction in our portfolio companies paid off handsomely – putting us in the top performer league! It would be worthwhile to share here that these returns have come from the same portfolio that we have been holding for the last 3 years with almost negligible churn whereas most other fund managers have reshuffled their portfolio’s substantially during and after the fall in 2020. This to us is the biggest testament of our “private equity approach to public market investing” where we know and understand the businesses that we invest in really well and have the deep conviction to hold from longer term perspective rather than doing momentum investing.

In the same breadth, we sincerely thank all our investors and well-wishers who stood by us like a rock and supported us over the years. Without their backing, our conviction alone would have only been half good. We highly appreciate the trust and confidence shown by all our investors in us and yearn to keep up the good work.

Where do we go from here?

“ Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble. ” – Warren Buffett

After the dream run that one saw over the last couple of years, anxieties are only normal to creep in as to will this run continue. Indeed a 77% yearly return is not something that one budgets for nor does one expect. The returns going forward are likely to be more reasonable given the higher base effect that has got established now. Nevertheless, as the India story plays out (something that we have been repeatedly discussing in our earlier newsletters) we strongly believe that this market has more legs to run longer albeit the intermittent corrections – aka “snakes and ladders” as discussed in our Sept’21 newsletter. We believe that given our deep focus on investing in businesses, generating 20-25% IRR (compounded return) over the next couple of years should be eminently achievable as these businesses achieve similar growth during the same period.

India: will we see a repeat of dream run in the markets from 2003-2007!

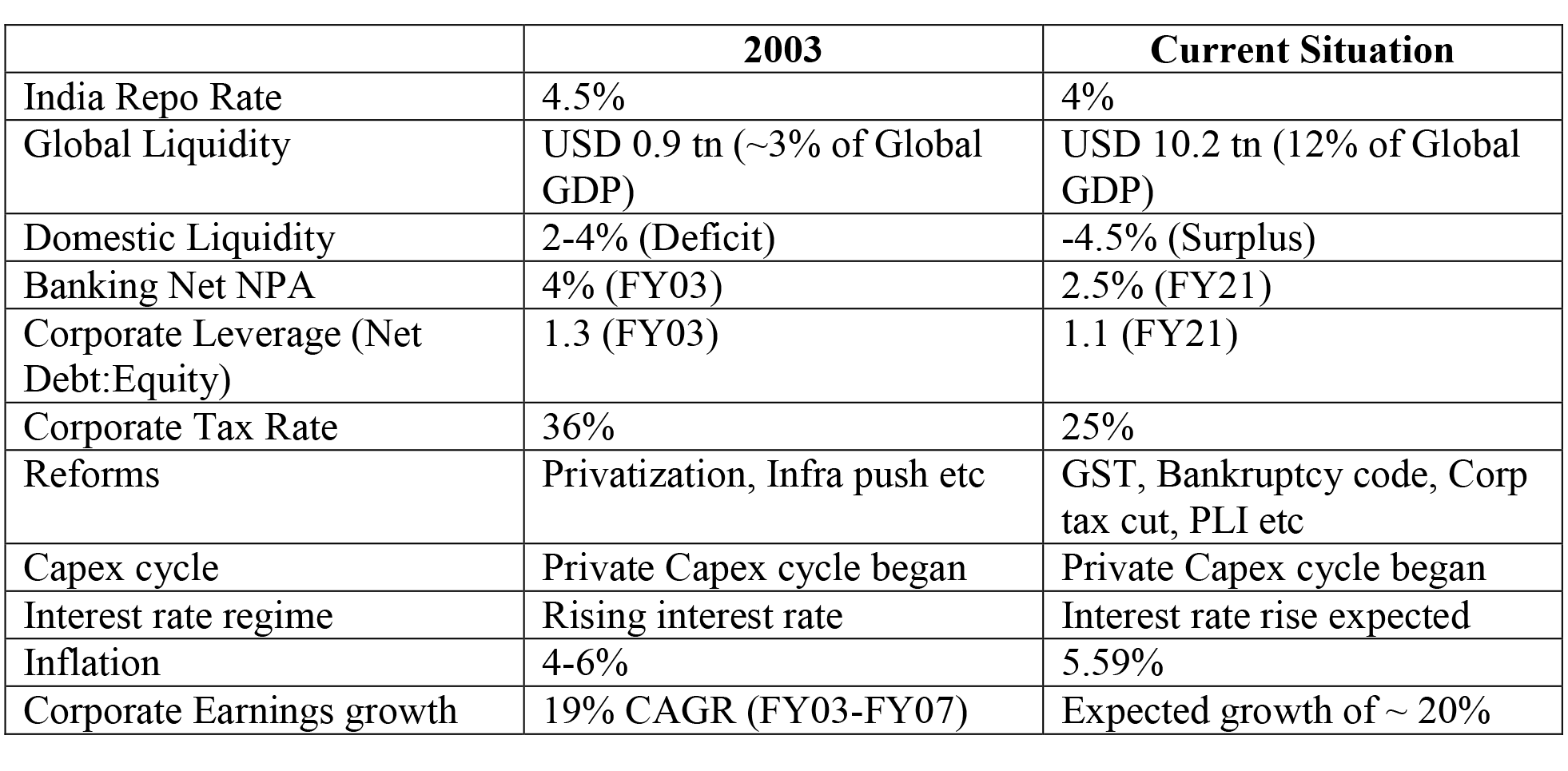

As we speak of the Indian opportunity in the making, we looked at some of the macro data and found an uncanny similarity between 2003 and now:

India balance sheet appears to be far stronger today than in 2003 – with corporate earnings looking at a very strong growth trajectory. As the economy starts to do well, rising inflation will naturally come along, necessitating a rising interest rate regime too – a glimpse of what we saw recently with the US Fed announcing a definitive plan to increase interest rate and taper the balance sheet. Despite all this, it was the corporate earnings growth which led to a mega bull run in the markets from 2003-2007 :

Fed Interest Rates

As seen above, the 2003-2007 period saw the fed take substantial rate hikes, with the interest rate crossing 5% in 2007 from 1.25% in 2003. A total increase of ~420%. During this period the Indian Indices gave stellar returns of 465% between April 2003 and March 2007, mainly supported by the favorable business environment and strong corporate earnings growth. We believe the current scenario has some semblance to the situation in 2003 and one should use the “sentiments” driven corrections in the market to build up the portfolio.

Returns of Nifty from 2003-2007 :

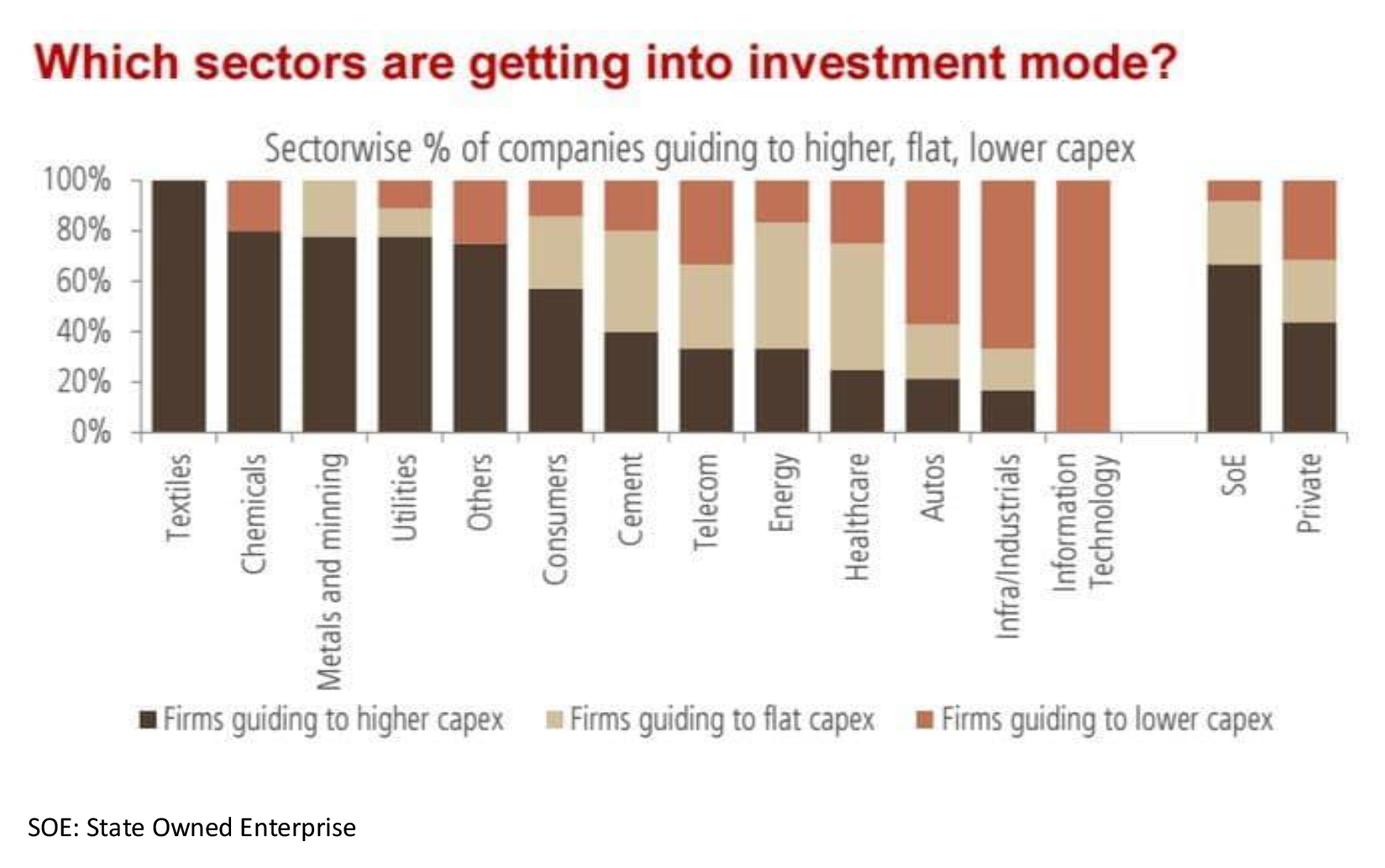

The Capex Cycle – endorsement from the ground :

We spoke about beginning of the capex cycle in our June’21 newsletter. Since then we have been talking to entrepreneurs across diverse businesses and are seeing actual traction on the ground. Promoters of many of our own portfolio companies are now talking about expansion plans. Interestingly, most of these capex are being funded from internal accruals as against bank credit, which was the primary source of capex funding back in 2003 – another positive similarity between 2003 cycle and now.

Large part of our focus domain sectors like textiles, chemicals, metals and utilities are indeed the ones which are guiding for capex. We expect these to deliver high growth over the next 2-3 years.

All put together, we strongly believe that this capex cycle is sowing the seeds of a vibrant economy and a multi-year growth story.

Markets yet to give its due share to value investing

Valuations for “new age tech unicorns” going public are close to being bizarre according to us. The EBITDA negative companies Paytm and Zomato have market-caps of ~INR 58000cr and ~INR 70000 cr respectively.

New-age companies cornered one-third of the total US$17.5bn of funds raised through IPOs in 2021, total start-up funding surged by 3x to US$39bn as 40+ companies became unicorns – which is more than the unicorns created in the last decade.

On the other hand, many cash-generating companies still continue to be valued at higher single digit / lower double digit multiples.

Interestingly a large number of HNIs as well as retail investors have been making a bee line to invest in to these new age tech businesses as the greed for the hunt of next “unicorn” aspirant is running high – inadvertently assuming much higher survival risk itself in some of these businesses. While on the other hand the same investors continue to question sustainability of cash generation of the old economy businesses which have been around for decades and / or develop a cold feet with a bit of correction in the stock prices of such businesses without any significant change in the underlying business!

We believe this anomaly should normalize at some point in time with either cash-burning companies correcting or cash-generating companies catching up as the investors start giving “value investing” its due share.

In this backdrop, it is interesting to share that our portfolio companies are hugely cash-generating businesses with sturdy balance sheets and reasonable valuations – and this gives us the comfort and confidence that they should out-perform the market going forward.

Things to watch out for over the next quarter :

“ Markets are constantly in a state of uncertainty and flux and money is made by discounting the obvious and betting on the unexpected. ” – George Soros

-

Budget – more likely to be a non-event

Government finances remain to be in good shape, tax revenues have been better than expected, growing 65% till November. Hikes taken in excise duty in petrol paid off – November monthly excise collection increased by 48% and overall expenditure has been prudent. Government’s fiscal math seems to be in a comfortable place before the budget. We believe the budget 2022 will be rendered a non-event with continuation of more of the same – focus on infrastructure, agriculture and healthcare. The only thing to watch out will be governments pace of spending – any likely slowdown in that will negatively impact a fledgling economy. -

Election season is back

We believe instead of the budget, outcome of the upcoming state elections in Goa, Manipur, Punjab, Uttarakhand and mainly UP will set the direction of the market as they will set the tone for the general elections of 2024. A coalition government could very well undo the probusiness environment created by the NDA and cause some degree of confusion. -

Rising commodity prices

Rising raw material / commodity prices have been squeezing margins for businesses. While we are seeing volume growth, however, higher raw material prices are driving profitability lower. Early Q3 results for companies are showing a mixed bag primarily driven by this factor. We believe that this should be a transitionary phenomena caused more by supply chain constraints due to covid and should get corrected shortly as the supply chain resumes normalcy. Delay in correction of commodity prices would have a negative impact and may challenge the anticipated growth in earnings. -

Continuous selling by FIIs

Since Oct’21, FIIs have been relentlessly selling in the markets and till date cumulatively have sold stocks worth whopping ~ Rs. 138,000 crore! This has been broadly absorbed by DIIs and domestic liquidity from retail investors – still keeping India as one of the best emerging market in the world with just about 6% drawdown in the broad based indices over the last 3 months. If this selling continues unabated and should the liquidity dry out with DIIs / retail investors, one could see sharp corrections in the market like the one witnessed over the last week of Jan’22 where market saw a sharp correction of around 6%! Will be interesting to see how the market behaves if the FIIs turn buyers after such a sell off.

Interestingly, while the benchmark indices (Nifty) show only ~ 6% correction, the broader base of the market has a different story to tell with a large number of stocks coming off anywhere from 20-40% since their recent 52 week high – this includes a bunch of recently listed “new age tech” companies as well.

Volatility notwithstanding, we believe the time of easy money has gone and the time for smart money is back.It is time to be more company specific while investing– and at that ground up level there are ample amount of lucrative opportunities in the small and mid-cap space which are poised for a staggering growth and are likely to do extremely well on the markets as well.A case in point is our recent investment in a kids apparel manufacturer (we spoke about it in our last newsletter) which is up about 43% since our investment in the last 3 months where the market has been on a downward slide.

We once again invite you to go through our recent update on our portfolio companies to get a perspective on some of the businesses that we are holding on.

As always, please feel free to reach out to us at pawan.b@equitreecapital.com / skabra@equitreecapital.com with your comments / suggestions / queries etc.

Warm regards.

TEAM EQUITREE