“ Money is always eager and ready to work for anyone who is ready to employ it. ”

— Idowu Koyenikan

Dear Investors,

The unprecedented liquidity fueled by the global banks and the better than expected recovery in the economy continued to keep the markets buoyant during the December quarter as well, resultantly Nifty continued its upward journey delivering another 24% returns during the quarter. We are happy to share that our portfolio has once again outperformed the broader indices and has delivered 28.80% returns during the quarter. Cumulatively, our portfolio has delivered staggering 86% returns from April till Dec’20 (kindly note that individual performance may differ).

Our conviction in the quality of the businesses that we have been holding on seem to be paying off as most of the companies surprised us positively with September quarter earnings while giving a very strong visibility for the near future – resultantly, some of our portfolio companies have risen 3-4x from the nadirs of March’20.

PEAK 50000 CAPTURED – TIME FOR SMALL CAP INVESTING IS EVEN MORE IMMINENT NOW

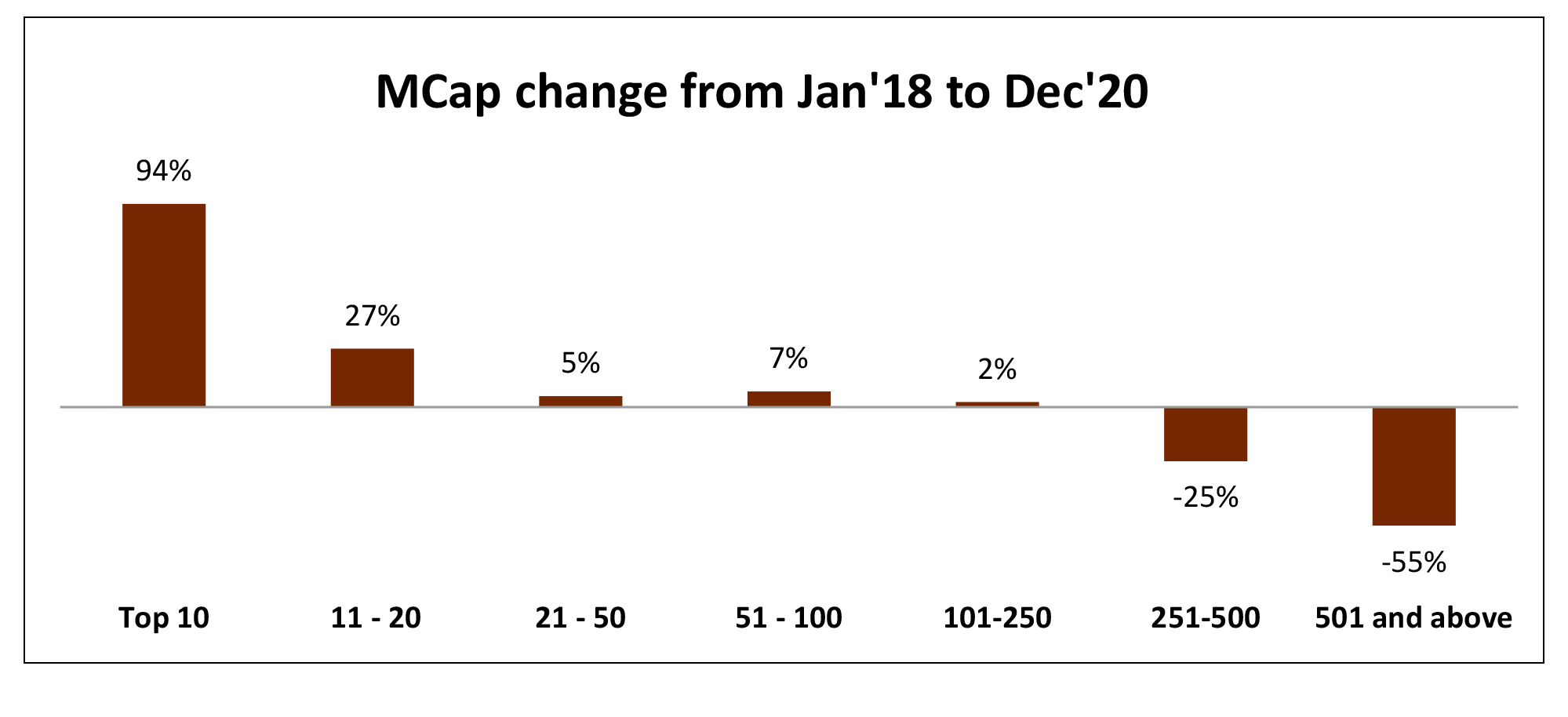

Post the fall of 2018, the top 20 companies have significantly increased by market capitalization as the fear intensified and investors rushed to the safe havens of large caps.

As the economic fear recedes, there has been a renewed interest in the small and mid cap companies driving a much broad based rally in the market over the last couple of months.

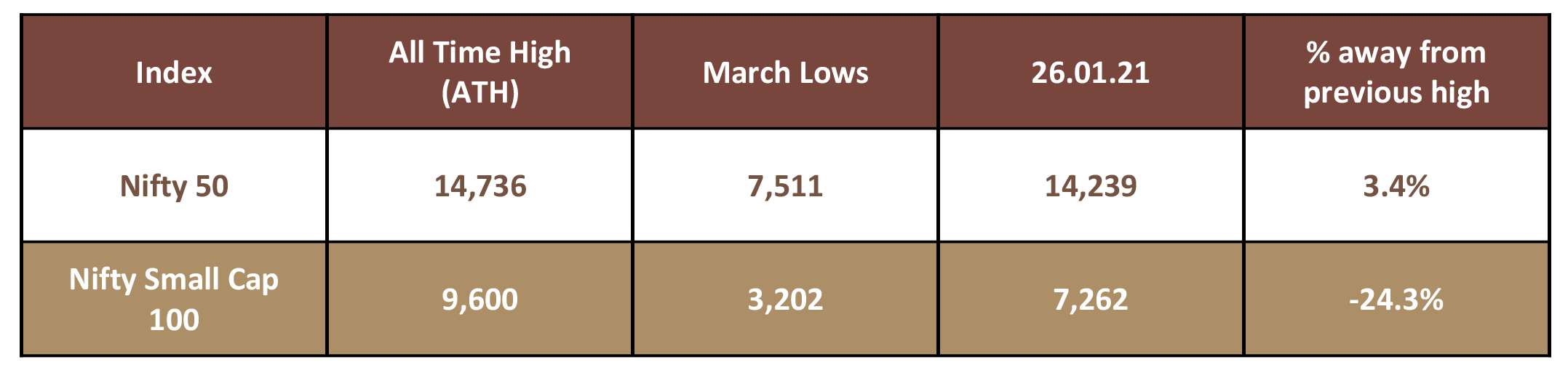

Despite the recent run up in the small cap companies, they are still a distant afar from their 2018 highs. Infact, even after the recent run-up most of them continue to trade significantly below their all-time highs.

As seen from the above chart, leaving aside the top 250 companies, the broader base of small / mid-sized companies are still way off their previous highs leaving a significant catch up opportunity to be encashed.

Small Cap Index itself is still a distant 24% away from its previous high while the Nifty 50 made a new all time high recently.

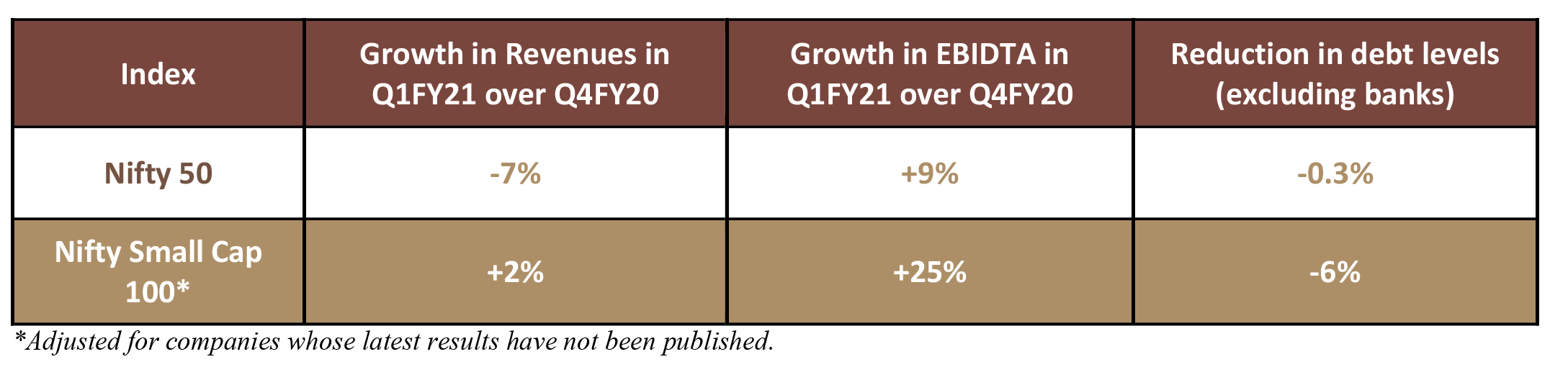

Better financial performance and growth should also continue to attract higher investor interest to Small Cap companies going forward :

Since most of the big guys are trading at significantly high valuations, we believe, the value stocks should now lead the next leg of rally, most of which fall under the mid and small cap category.

TRENDS TO WATCH OUT FOR :

- China +1 strategy

- The world’s frustration with China is set to benefit countries like India, Vietnam and Thailand. Global companies are now looking at India as a manufacturing/sourcing hub post the outbreak of Covid-19 to reduce dependence on China. Various sectors like chemicals, pharma, textiles, auto ancillary, electronic manufacturing amongst others are seeing a structural shift in demand for Indian made products – both in domestic markets as well as in international markets due to restrictions on imports from China.

- IT Services

- With the world working and operating from home due to the outbreak of Covid-19, the importance of having a robust IT system in place has increased. This has resulted in increased offshoring and outsourcing by US and European Firms. Hiring activity index grew by 71% in the Apr-Dec 2020 period for the IT Services sector as per Naukri hiring index for Dec 2020. Strong growth and hiring momentum in Indian IT services will lead to higher employment generation and therefore better growth impetus.

- Private capex making a come back

- The GOI announced the Product Linked Incentive Scheme with a total allocation of ~Rs 2 trillion spread over 5 years under the Atmanirbhar Bharat Programme to boost India’s share in global export and reduce dependence on imports. The PLI scheme along with the reduction in the corporate tax rate in Sept 19 should help make India a meaningful contributor in the global supply chain. Riding on this opportunity, increasing number of listed companies have been announcing significant capex in expansion of their capacity as these companies get themselves ready to become part of the global supply chain.

- Governments push for infrastructure spending

- The government had announced plans to invest Rs1000bn over FY20-25 in the areas of energy, roads, water, sanitation, Metros, railways and irrigation etc. NHAI has given orders for ~1330km and expects another 4500km ordering in current year. L&T has seen 36% increase in order inflow in 3Q21. Government’s thrust on the creation of infrastructure with a combination of revival in private capex will accelerate the growth momentum in the economy.

- Our on ground checks suggest that there has been a significant change in the government’s stance with respect to the spending on infrastructure segment – where projects were languishing for want of funds, government has now not only fast tracked execution but has also extended fiscal benefits to the companies involved in terms of lowering the billing cycle, faster payment turnaround, reducing the guarantee’s required etc. Collectively all this has resulted in a much lower working capital requirement and a faster execution at the ground level.

- Move to renewable / Gas based economy – solar/gas

- To reduce the import bill and protect the environment; the GOI is committed to increase the share of natural gas in the energy mix from 6% to 15%. The GOI has also set an ambitious target of achieving 20% ethanol blending with petrol by 2030. Renewable energy is also gaining increasing focus with various schemes launched to promote the same.

- Continued domestic consumption story

- The recovery in Indian economy coupled with government and private expenditure will boost employment at the bottom of the pyramid and increase disposable income which will boost demand in the economy. Also, the Indian economy crossing per capita income of $2,000 is seen as an inflection point as experienced in China which saw exponential growth since 2006.

- Agri based businesses

- Rural economy is leading the way for recovery post lockdown. Bountiful monsoon, good sowing season, lower cases and remunerative crop prices have led to acceleration in agricultural activity. With the recent agri reforms and government schemes to improve agri productivity, companies focused on the rural economy are expected to flourish going forward as well.

We strongly believe that these structural trends will present significant investment opportunities across the entire value chain catering to these segments and unleash a multi year earnings growth visibility for these companies.

RISKS NOTWITHSTANDING

While we remain elated about the prospects of a multi year growth Indian story, nevertheless, we are also cognizant of challenges / risks which could present intermittent road blocks :

- A pause on government spending – Modi regime been very focused and disciplined in maintaining the fiscal deficit in line with the Fiscal Responsibility and Budget Management Act (FRBM Act) 2003 – this even at the cost of slowing down of the economy over the last couple of years. However, the adversity caused by the pandemic has forced the government to scale up spending as the only solution to recoup the economy overlooking the fiscal deficit for now. All eyes are on the Budget 2021 now where the expectations are running high. However, if the government gets back to maintaining the fiscal discipline and move back to target 3-4% fiscal deficit, it will again lead to slowing down of government expenditure which could turn out to be very negative for the nascent recovery that we have seen in the economy.

-

Liquidity – A large part of the recent run up in the markets has been due to the unprecedented liquidity infused in the global market

and a negative / low interest rate regime globally. You can read more about the same in our June 2020 quarter update.

Foreign institutional investors have continued to be net buyers as the US dollar index continues its downward trajectory and the low interest rate regime continues to make available cheap capital – in turn pushing the equity valuations higher.

The US 10-Y Treasury yield hit 1% for the first time since March. Any continuous increase in the yield will divert the flow of funds from emerging equity markets back to the treasury bonds which may challenge the equity market valuations. - New strain of virus – A new strain of coronavirus emerged in Britain which is said to be up to 70% more contagious. India has also reported 71 cases of this new strain. This has forced several countries including India to ban flights from UK. UK and other European countries have started to announce stricter lockdowns to contain the spread of this transmission. While the existing vaccines have claimed that they are good to address the new strain as well, however, any surge in the cases further and associated extended lockdowns in global economy may hamper the sentiments and global economic recovery further.

OUR PORTFOLIO

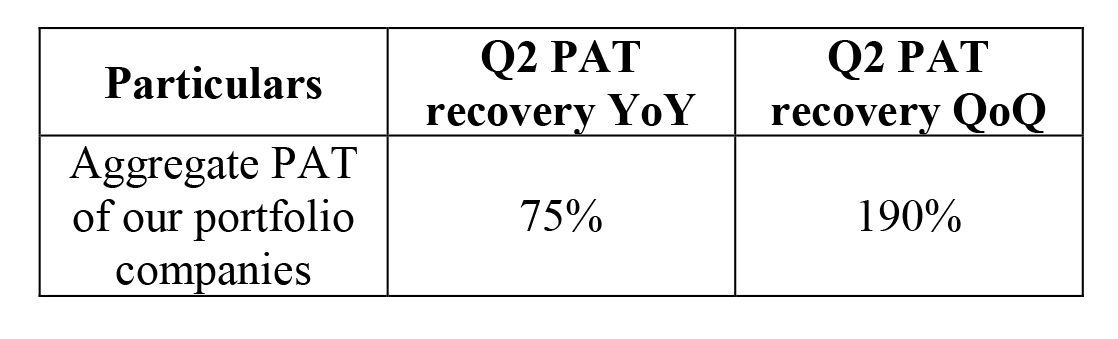

Given that the financial year started with the onset of pandemic with no clarity of when and how the situation would come back to normalcy, we had budgeted a dismal performance from most of our portfolio companies for FY 21. Accordingly we had budgeted for 30-35% drop in profits for FY 21 and normalcy (assuming FY 20 was a normal year) returning in FY 22.

However, despite Q1FY21 being a washout quarter, for H1FY21 we have already witnessed 70% recovery and expect the next two quarters of the fiscal to be much better and close the year in line with FY20.

Based on the business visibility, we have revised our estimates upwards post the strong performance and are expecting a flattish to marginal de-growth for FY21 and return to the growth trajectory in FY22 .

Further, our portfolio TTM PE stands at ~14x (which includes the pandemic impacted Jun’20 quarter as well) despite the sharp rally in the market which gives us comfort to add some more of our own stocks in expectation of a phenomenal growth in profits in the coming quarters.

We are hopeful of an even better year in terms of our performance compared to 2020.

Please feel free to reach out to us at pawan.b@equitreecapital.com / skabra@equitreecapital.com with your comments / suggestions / queries etc.

Wishing everyone a happy and a healthy 2021!

Warm regards.

TEAM EQUITREE